The NAGA Group AG (XETRA: N4G, ISIN: DE000A161NR7), a financial technology company, and Key Way Group Ltd., operating under the CAPEX.com brand, have finalized plans for a merger.

The merger will occur through a non-cash capital increase proposed to The NAGA Group AG’s Annual General Meeting. Key Way Group’s parent company will contribute all its shares in exchange for new shares in The NAGA Group AG, resulting in Key Way Group shareholders holding a majority stake. Mr. Octavian Patrascu, the managing partner of Key Way Group, will become Chairman of the Management Board of The NAGA Group AG.

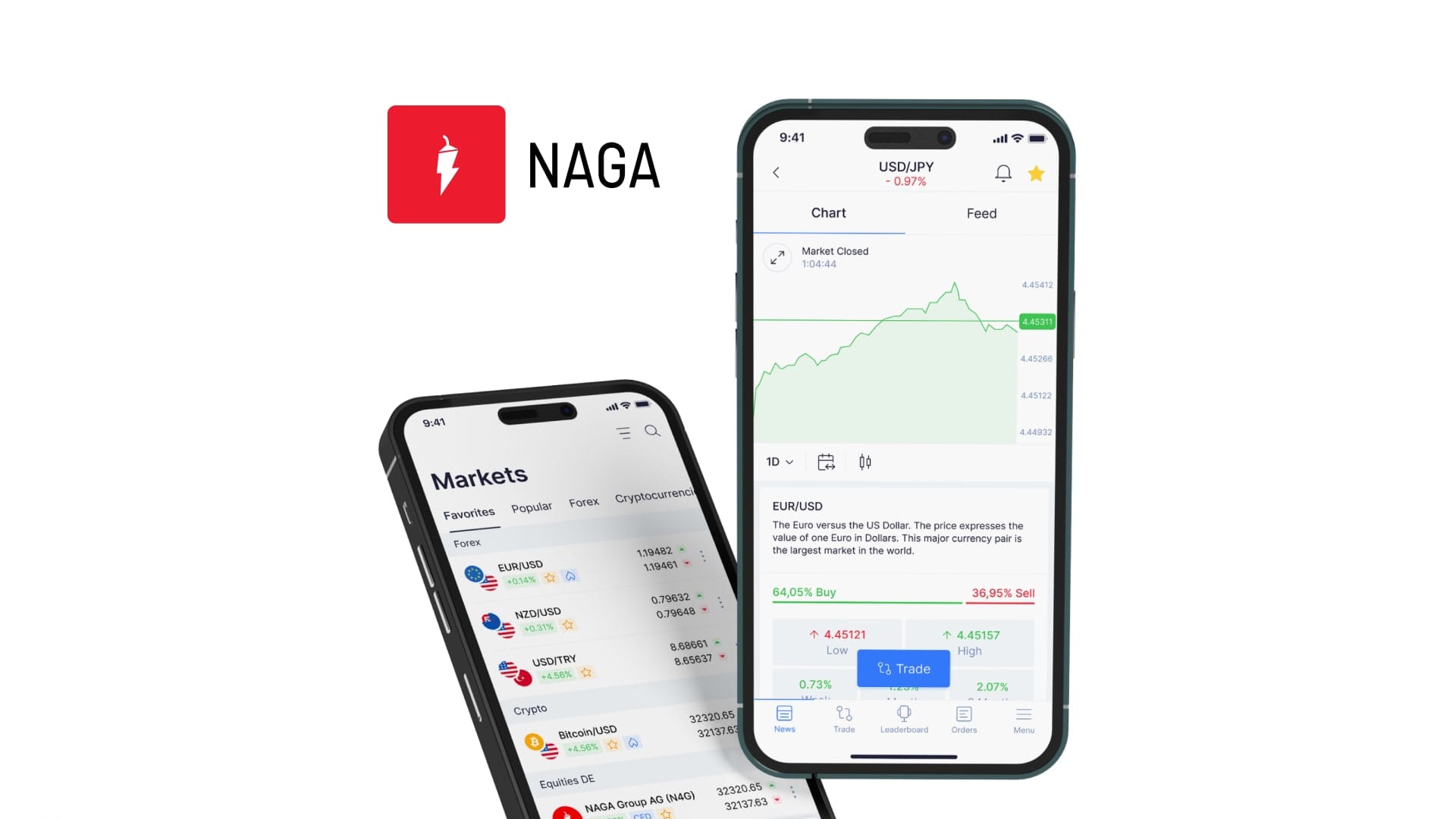

Learn how to trade currency pairs, commodities, stocks, and other popular assets with the Top trusted broker NAGA

Additionally, 20% of the increased share capital will be offered as share options. Alongside the merger, a zero coupon convertible bond worth up to EUR 8.2 million will be issued, with a subscription offer expected to start in December 2023. Major shareholders of The NAGA Group AG will waive their subscription rights in favor of Key Way Group shareholders. The completion of the transaction is subject to regulatory approval.

The merger is projected to result in combined sales of approximately USD 90 million and EBITDA of around USD 6.5 million for the financial year.