Passive income with Crypto

Thinking of gains and losses in Crypto, erratic prices and chaotic markets definitely come to mind. However, Crypto trading is not the only way to make money on the Blockchain. One of the many appealing features of the Cryptocurrency market is the ability to earn passive income. Traders can profit from their Crypto holdings in a variety of ways, each bearing certain opportunities and necessity for technical knowledge and trusted broker.

You can earn additional income on your assets without actively participating in trading. In the traditional financial realm, the concept is similar to compounding interest or reinvesting dividends, or earning rent on investment properties.

It is feasible to make passive income using Cryptocurrency, but the final gains may vary depending on the strategy used and the amount of Cryptocurrency available to begin with. Because of the volatility of digital assets, different passive income earning methods will yield varying results. Those investors and traders who own Crypto, on the other hand, have a number of options for generating income with it.

Copy Trading of Cryptocurrencies

Newbies who use Copy Trading feature, or experienced traders love Cryptocurrencies for their volatile nature: once you master the logic (or just follow someone who did it), you can profit from their price moves.

Trading experience and intuition are key to successful trade when it comes to Crypto as much as to any other asset. The long-term gains will be well worth it if you put in the time and effort to learn and perfect the necessary discipline and market expertise. Copy Trading, on the other hand, significantly simplified things allowing beginners to borrow the experience of professional traders.

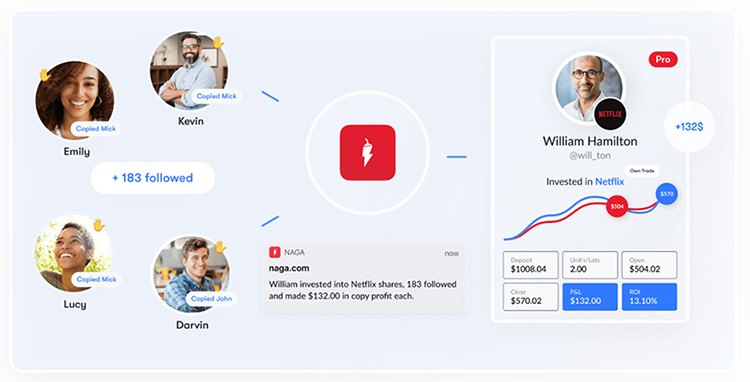

Like any other social networking platform, you may use the tool to follow experts and automatically duplicate their trading decisions. Profits are yours to keep, and you may learn from experienced traders by analyzing their tactics and developing your own strategies.

For passive income with Crypto you just fund your account, subscribe to professional traders and market experts and then their moves are automatically copied as yours. Usually, the feature is available for Crypto trading as well as for any other instruments broker offers.

NAGA Markets, a trustful broker originated from Germany, is in the market to introduce users to all possible benefits of Copy Trading. NAGA Autocopy is an innovative feature available for Crypto trading as well that lets you automatically copy leading traders on the platform and learn from their experience.

Moreover, it offers a wide choice of trade instruments and educational materials to make trading more effective and secure. Among more than 950 instruments are Bitcoin and Ethereum, so you can trade the most famous Cryptocurrencies with the highest level of security: it is guaranteed by several reputable regulative bodies, those rules NAGA has to follow such as FCA and CySEC. Moreover, the broker issues its own NAGA coin (NGC), traded for the price of $0.89 with a total market cap of more than $70 million.

AvaTrade gives the opportunity to trade not only the most popular Cryptocurrencies such as Bitcoin, Ethereum, Ripple, or Litecoin but also more exotic kinds. And even trading these relatively new assets, traders can be assured of their safety, since the broker is regulated by six of the most recognized regulatory bodies in the world, including ASIC and CySEC.

With AvaTrade users have access to a comprehensive range of tradable assets, including Forex pairs, equities, commodities, Cryptocurrencies, available on a variety of trading platforms for both manual and automated trading, across multiple device types.

AvaTrade also offers AvaCopy, which allows you to generate passive income with Crypto or any other platform instrument by automatically following the actions of more experienced traders. The combination of AvaTrade’s global reputation and technologically advanced systems provides traders with the peace of mind that their trades and capital are in the hands of some top traders in the world.

Crypto Staking

Staking allows Cryptocurrency owners to put their assets to work and earn passive income without having to sell them. It can be compared to placing money in a high-yield savings account in the Crypto world. When you put money in a savings account, the bank usually takes it and lends it out to others. You get a share of the interest gained by lending in exchange for putting your money in the bank – although a very small portion.

When you stake your digital assets, you lock up your money in order to participate in running the Blockchain and maintaining its security. In exchange, you will receive an incentive based on percentage yields. These profits are generally significantly higher than any bank’s interest rate.

Staking has become a successful tactic to benefit from cryptocurrency without having to trade coins. According to Staking Rewards, the total value of cryptocurrencies staked exceeded $280 billion in April 2022.

How does staking work?

Staking is largely possible due to the proof-of-stake consensus mechanism, which is used by some Blockchain networks to select trustworthy contributors and verify new data blocks being added to the network.

It makes it unappealing to act dishonestly in the network by requiring these participants – known as validators or “stakers” – to purchase and lock away a certain amount of tokens. If the Blockchain were to be tampered with in any manner, the native coin connected with it would most certainly lose value, and the perpetrator(s) would lose money.

The stake is the validator’s “skin in the game,” which ensures that they perform honestly and in the best interests of the network. Validators receive benefits in the native Crypto coins in exchange for their commitment. The greater their input, the more likely they are to suggest a new block and reap the benefits. After all, the more skin in the game you have, the more likely you are to be truthful.

The stake does not need to be entirely made up of one person’s coins. Validators typically operate a staking pool and generate funds from a group of token holders via delegation (acting on behalf of others), decreasing the entrance barrier to staking for more users.

To hold validators in line, simple infractions like as remaining offline for extended periods of time might result in them being suspended from the consensus process and having their funds taken away. The latter is referred to as “slashing,” and it has occurred on several Blockchain networks, including Polkadot and Ethereum.

Crypto Yield farming

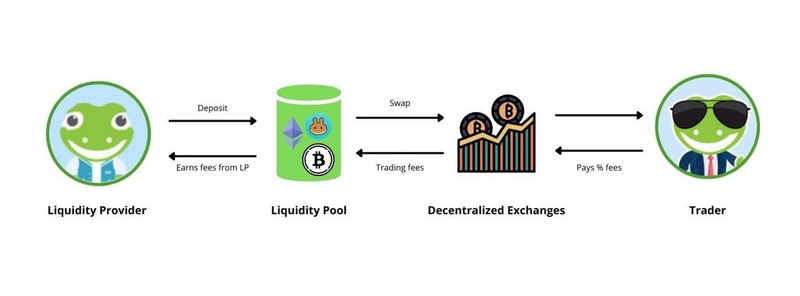

Yield farming is another way to make passive Crypto income that is decentralized, or DeFi. The dynamic operations of decentralized exchanges, which are essentially trading platforms where users rely on a combination of smart contracts (programmable and self-executing computer contracts) and investors for the liquidity required to execute trades, make this possible.

Traders do not compete with brokers or other traders. Instead, they trade against funds deposited by investors (known as liquidity providers) in special smart contracts known as liquidity pools. Liquidity providers, in turn, receive a proportional share of the pool’s trading fees.

Crypto lending

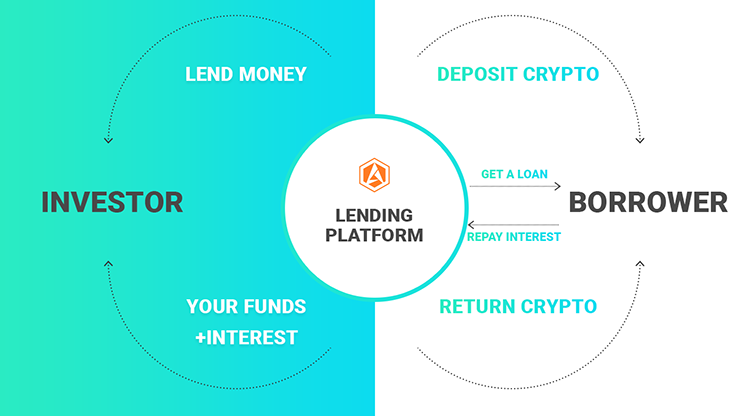

Crypto lending is a simple option that enables you to lend your assets out only with little risk. On the other hand, you may immediately obtain low-interest digital assets if you borrow them. Using digital assets to take out and give loans is typically more clear, efficient, and affordable, making it a viable choice for both sides in a loan.

Taking Crypto from one user and lending it to another for a fee is how Crypto lending works. From platform to platform, the actual technique of administering the debt varies. Crypto loan services are available on both centralized and decentralized platforms, but the fundamental concepts are the same.

You don’t have to be a borrower to participate. By depositing your Cryptocurrency in a platform pool or with a broker that manages your funds, you can receive a passive income and earn interest. There is usually little chance of losing your assets, depending on the stability of the smart contract you utilize. This could be because the borrower put up collateral or because the loan is managed by a CeFi (centralized finance) platforms.

How does Crypto lending work?

The lender, the borrower, and a DeFi (Decentralized Finance) platform, Crypto broker or Crypto exchange are often involved in lending. Before borrowing any Cryptocurrency, the borrower must usually put up some form of collateral. You can also employ no-collateral fast loans. You might have a smart contract minting stablecoins on the opposite side of the loan, or a platform giving out funds from another user. Other lenders deposit their Crypto into a pool managed, for example, by a Crypto lending platform which then oversees the entire process and pays users a portion of the interest.

Best Forex brokers for earning passive Crypto income

If you’re like most Cryptocurrency enthusiasts, you’ve probably realized that Cryptocurrency trading and investing can be tremendously rewarding, but also quite time-consuming and stressful, due to the ongoing need to check your portfolio, seize opportunities, and manage your positions.

But what if you just want to create passive income without having to worry about being on top of the market 24/7? Fortunately, there are now a plethora of options for doing so, Crypto Copy Trading, Crypto lending, and Staking on the top of a very long list.

Brokers our experts list below support Crypto trading, Copy Trading and other ways to make a passive income with digital assets, plenty of other trading instruments, low minimum deposit requirements, tight spreads and low commissions. Traders can use a wide range of trading strategies when dealing with these brokers, and diversify their portfolio even with only Crypto trading, just by choosing different coin types.

AvaTrade Crypto income

AvaTrade is one of the most popular Forex brokers in the world, offering very competitive trading conditions. It gives the opportunity to trade and Copy Trade not only the most popular Cryptocurrencies such as Bitcoin, Ethereum, Ripple, or Litecoin but also more exotic kinds. And even trading these relatively new assets, traders can be assured of their safety, since the broker is regulated by six of the most recognized regulatory bodies in the world, including ASIC and CySEC.

AvaTrade also offers AvaCopy, which allows you to generate passive income by automatically following the actions of more experienced traders. The combination of AvaTrade’s global reputation and technologically advanced systems provides traders with the peace of mind that their trades and capital are in the hands of some top traders in the world.

NAGA Markets Crypto income

NAGA Markets is a trustful broker that originated from Germany, with a great range of trading instruments and a very competitive, but friendly environment. By registering, you benefit from over 950 markets, including Crypto CFDs, ETFs, Forex, commodities, a wide range of professional tools, and educational materials for traders of any level.

Together with more than a million users, you can trade and invest, learn from them and automatically copy the best traders or become a trading pro yourself. As one, you’ll get a chance to earn extra income and a largely reduced commission. Or as a trading newbie, you can highly benefit from auto-copying the most successful traders in real-time: make money and learn at the same time. Copying is available for Crypto as for any other financial instruments NAGA provides.

Another point that speaks for the credibility of these regulated international brokers is that they give you an opportunity to try out their platforms and tools before you actually start trading: opening a demo account with each of them is completely free. You can register with several of them just to see how suitable and user-friendly they are for your trading needs.

Moreover, it is a great strategy to manage risks by diversifying a trading portfolio. It will help compare trading platforms to pick the best one for you, but also make the most of the benefits you receive. You can also trade on your own with some brokers while using the Copy Trading feature with others. It will inspire you to keep trading and improve your chances of earning some passive income.

Passive income with Crypto - FAQ