Forex trading with XTB: open an account with a reliable broker

XTB is a top-rated online broker that offers access to a wide range of financial markets, including Forex, indices, commodities, and stocks. With over 18 years of experience in the industry, XTB has established a reputation for providing reliable and transparent trading services to its clients.

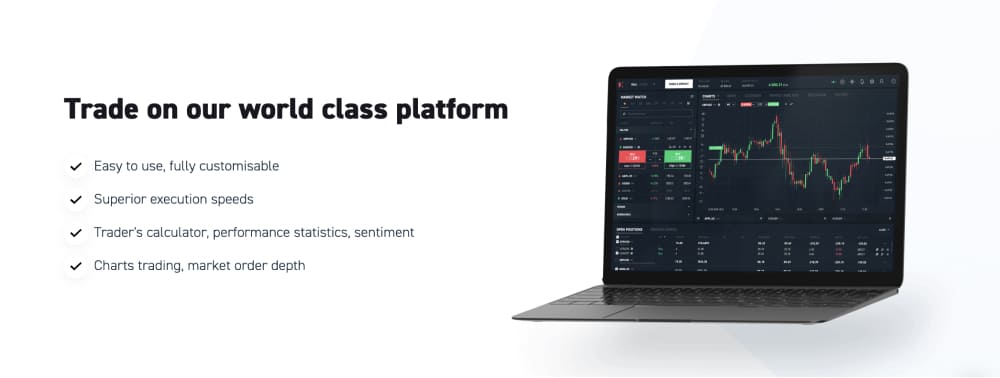

One of the unique features of XTB is its award-winning trading platform, xStation 5. This platform is packed with a range of innovative tools and features that allow traders to make informed trading decisions. The platform offers advanced charting capabilities, real-time market analysis, customizable trading indicators, and much more. The platform is also available in a mobile version, allowing traders to trade on the go.

In addition to its trading platform, XTB offers a range of educational resources to help traders improve their trading skills. These resources include video tutorials, webinars, eBooks, and a comprehensive knowledge base. XTB also offers a free demo account that traders can use to practice their trading skills without risking any real money.

XTB is known for its transparent pricing and competitive spreads. The platform charges a commission on each trade, which varies depending on the type of instrument being traded. The spreads are also competitive with other online trading platforms.

XTB is regulated by several financial regulatory bodies, including the Financial Conduct Authority (FCA) in the UK and the Polish Financial Supervision Authority (KNF) in Poland. This provides traders with the assurance that their funds are safe and secure.

Overall, XTB is a highly reputable online broker that provides traders with a range of trading instruments, advanced trading tools, educational resources, and competitive pricing. Whether you are a beginner trader or an experienced professional, XTB offers a range of features and services that cater to your trading needs.

Choosing the right account type is an essential aspect of online trading, as it can greatly impact a trader’s experience and success. In this article, we will provide an overview of XTB’s account types, including the features, fees, and benefits of each account, to help traders make an informed decision about which account type is best suited for their trading goals.

XTB Demo account review

XTB offers a demo account for traders who want to practice their trading skills and test the platform’s features without risking real money. The XTB demo account is a great tool for traders new to online trading or wanting to try different trading strategies without risking any capital.

The XTB demo account is a replica of the live trading account and offers access to all the features of the trading platform. This includes access to over 1500 trading instruments, including Forex, indices, commodities, and stocks. The demo account also provides real-time market data and price quotes, allowing traders to practice their trading skills in a simulated environment.

Here are particular details of XTB’s demo account:

- Available for 4 weeks from the moment of set up;

- $100000 of virtual funds to trade with;

- 1500+ global CFD markets to trade FX, indices, shares and commodities;

- Powerful platforms including MT4;

- Tight spreads from 0.2 pips;

- 24-hour customer support (Sun – Fri);

Setting up a demo account with XTB is quick and easy. Traders simply need to provide their name, email address, and phone number to create a trading demo account. Once the account is created, traders can log in to the platform and start practicing their trading skills right away.

The XTB demo account provides a realistic trading experience, allowing traders to practice their trading strategies and test different instruments and features of the platform. The platform’s user interface is easy to navigate, and traders can easily switch between different instruments and markets. The demo account also offers access to a range of educational resources, including webinars, video tutorials, and trading guides, which can help traders improve their trading skills.

One limitation of any FX demo account is that it is a simulated trading environment, and traders may not experience the same emotions and psychological factors that come with trading real money.

Overall, the XTB demo account is a great tool for traders who want to practice their trading skills and test the platform’s features without risking real money. The demo account provides a realistic trading environment, and the platform’s user interface is easy to navigate.

XTB Standard trading account

The XTB Standard Trading Account provides access to a range of trading instruments and features, including:

- Over 2200 trading instruments: Forex, commodities, indices, Cryptos, stock CFDs, and ETF CFDs;

- No minimum deposit is required to set up an account;

- Leverage of up to 1:500;

- Competitive spreads are from 0.5;

- Real-time market data and price quotes;

- Access to trading signals and Technical analysis tools;

- Risk management tools, including stop loss and take profit orders;

- Automated trading options;

- Mobile trading capabilities;

XTB charges no fees on deals with Forex, indices, commodities, stock CFDs and ETF CFDs, and Cryptocurrencies. Account setup and management are also free. The platform charges spreads on each trade, which varies depending on the instrument. Yet, they are competitive with other online trading platforms.

To set up a Standard trading account with XTB, follow the link below. You will be asked to provide your personal information, including name, email address, and phone number, and complete the required verification process. Once the account is created, you can fund it and start trading right away.

XTB Swap Free trading account

XTB offers a Swap Free trading account for traders who follow Islamic principles and want to trade without paying or receiving any interest or overnight fees. The account is designed to cater to traders who want to avoid interest-based transactions in compliance with Shariah law.

The XTB Swap Free trading account allows access to all trading instruments available on the platform, including currencies, indices, commodities, and stocks.

Fees policy is the same as for the Standard trading account: there are no additional commissions on making deals with the instruments.

Please, note that the XTB’s Swap Free account is that it is only available to traders who follow Islamic principles and want to avoid interest-based transactions. Additionally, traders may experience differences in execution speed and slippage compared to a standard trading account.

Here is a short summary of XTB’s Swap Free trading account:

- Over 2200 trading instruments: Forex, commodities, indices, Cryptos, stock CFDs, and ETF CFDs;

- No minimum deposit is required to set up an account;

- Leverage of up to 1:500;

- Spreads are from 0.7;

- Real-time market data and price quotes;

- Access to trading signals and Technical analysis tools;

- Risk management tools, including stop loss and take profit orders;

- Automated trading options;

- Mobile trading capabilities;

Start trading with XTB and no swaps you can here.

How to fund your XTB trading account

XTB offers a variety of payment methods that you can use to fund your trading account. Here are the most popular ways to fund your XTB trading account:

- Bank transfer: You can fund your XTB trading account by transferring money directly from your bank account. This method may take a few days to process, depending on your bank’s policies.

- Credit/Debit cards: XTB accepts major credit and debit cards, including Visa, MasterCard, and Maestro. Deposits made using a credit or debit card are usually processed instantly.

- Electronic wallets and payment systems: XTB also accepts electronic wallets, such as PayPal, Skrill, and Neteller. Deposits made using an electronic wallet are usually processed instantly.

- Online bank transfer: XTB accepts online bank transfers from selected banks. This payment method may take a few days to process, depending on your bank’s policies.

Once you have chosen your preferred payment method, simply follow the instructions to complete the transaction. XTB does not charge any deposit fees, but it is advisable to check with your payment provider to confirm if they charge any fees or commissions for the transaction.

Start Forex trading with XTB

In conclusion, XTB offers several account types designed to cater to traders’ needs of each level and belief. Whether you are a beginner or an experienced trader, XTB’s Standard account can suit your trading style with its flexible conditions.

The Swap-Free account is also available for traders who want to trade in compliance with Shariah law. With transparent pricing, reliable trading platforms, and excellent customer support, XTB is an excellent choice for traders looking for a reliable and trustworthy global broker. Follow the link below to benefit from the suitable account type and start your online trading journey now:

Related articles:

TopForex.trade comprehensive review of XTB broker covers everything you need to know, from the broker’s trading platforms, fees and commissions, and account types to educational resources, deposit and withdrawal methods, and customer support. Plus, there are the answers to the most frequently asked questions about the broker to help you make an informed decision before opening an account.

Discover everything about XTB’s trading platforms with the help of TopForex.trade market experts. The review covers everything you need to know about the broker’s xStation desktop and web platform, MT4 terminal, and mobile app, their technical capabilities, and additional features. Moreover, you’ll find out how to optimize your trading experience with XTB, including on-the-go with the mobile app.

Review of XTB account types and their trading conditions - FAQ