XTB

XTB: leading European FX and CFDs broker

XTB is a leading online FX and CFDs broker that was established in 2002 and is regulated by several financial authorities, including the UK’s Financial Conduct Authority (FCA) and the Polish Financial Supervision Authority (KNF). With its headquarters in Warsaw, Poland, XTB has a presence in over 10 countries, including the UK, Germany, Spain, France, and Turkey, and is one of the largest brokers in Europe.

XTB offers a wide range of financial instruments, including Forex, indices, commodities, Cryptocurrencies, and stocks, and provides traders with access to advanced trading platforms such as xStation 5 and MT4.

XTB also offers competitive pricing with tight spreads and low commissions, making it an attractive option for traders. The broker provides excellent customer service through various channels, including phone, email, and live chat. Additionally, XTB offers a range of educational resources, including webinars, tutorials, and trading guides, to help traders improve their skills and knowledge.

Why should XTB be the broker of your choice? Here are a few reasons:

XTB regulations and security

XTB is a regulated broker that is authorized and licensed by multiple financial authorities, including:

- UK Financial Conduct Authority (FRN 522157);

- Polish Financial Supervision Authority (KNF);

- Financial Services Commission in Belize (FSC) with license No.: 000302/438;

- Cyprus Securities and Exchange Commission (CySEC) with CIF Licence number 169/12.

The broker is required to adhere to strict regulations and guidelines set forth by these authorities, which include maintaining a certain level of capital, segregating client funds, and providing regular financial reports.

In addition to its regulatory compliance, XTB prioritizes the security of clients’ personal data and funds. The broker uses advanced encryption technology to protect clients’ personal and financial information, and all client funds are held in segregated accounts with top-tier banks. XTB also offers two-factor authentication for added security and provides clients with protection under the Financial Services Compensation Scheme (FSCS) in the UK, which provides up to £85,000 in compensation in the event of the broker’s insolvency.

XTB offered trading instruments

XTB offers a wide range of trading instruments in various markets, including currency pairs, indices, commodities, Cryptocurrencies, and stocks.

XTB currency pairs trading

Overall, XTB’s currency trading conditions are competitive, and the broker provides a range of features and tools to support traders in making wise decisions.

There are around 50 currency pairs offered by the broker, including all majors, minors, and exotics, which you can trade with tight spreads as low as 0.1 pips for major currency pairs.

For currency trading, XTB offers leverage up to 1:500 allowing traders to amplify their gains. However, it’s important to note that high leverage can also increase risk. To help with that, XTB provides a range of trading tools to support Forex traders, including economic calendars, market news, and analysis, as well as access to Autochartist, a powerful pattern recognition tool.

More about your personal Forex trading conditions with XTB you can find here.

XTB indices trading

XTB provides access to over 20 indices from all over the world, including the S&P 500, NASDAQ, DAX 30, FTSE 100, US500, US2000, RUS50, SPA35, DE30, and more with spreads as low as 0.2 points for major indices.

Maximum leverage is also 1:500, and XTB provides traders with access to advanced trading platforms such as xStation 5 and MT4, which offer powerful charting and analysis tools, as well as a range of order types to execute trades.

XTB commodities trading

XTB allows trading in popular commodities like precious energies, metals, and agricultural products: oil, gas, gold, silver, aluminum, cocoa, corn, coffee, and more.

Trading of indices is available with leverage 1:500 with competitive spreads and transparent rollovers visible directly on the chart.

XTB stocks CFDs trading

XTB offers a wide range of stock CFDs from various markets, including Europe, the US, Asia, and Australia. There are over 2100 stocks available to trade, including blue-chip stocks such as Apple, Amazon, and Google, as well as smaller-cap stocks.

The fees and spreads for stocks CFDs trading on XTB are competitive. There are zero trading commissions and no hidden fees, and the spreads for major stocks start from as low as 0.1 pips. XTB also offers a transparent pricing model, which means that traders can see the bid and ask prices of each stock in real time.

XTB offers leverage of up to 1:10 for stocks CFDs trading, which means that traders can open larger positions than their initial investment. However, it’s worth noting that leverage can increase both profits and losses, so it should be used with caution.

Check out XTB’s full list of available CFDs for stocks.

XTB ETF CFDs trading

XTB offers a wide range of ETF CFDs from various markets, including Europe, the US, and Asia. There are over 60 ETFs available to trade, covering different asset classes, such as equity, fixed income, and commodities with maximum leverage of 1:10.

The fees and spreads for ETF CFDs trading on XTB are competitive: spreads for major ETFs start from as low as 0.08 pips. XTB also shows the bid and ask prices of each ETF in real time.

XTB Crypto CFDs trading

XTB offers a wide range of cryptocurrencies for trading, including Bitcoin, Ethereum, Ripple, Litecoin, and more. There are over a dozen Crypto CFDs available to trade, covering both major and minor coins. The list of available coins depends on your location, so check yours here.

The benefits of trading Crypto CFDs with XTB include:

- Trading opportunity on the weekend as the market opened 24/7;

- Low trading costs, spreads starting from 0.22%;

- Safe and transparent account, FSC supervision, safe and quick deposits, and withdrawals;

- Maximum leverage is 1:5.

XTB trading platforms

XTB offers two trading platforms for its clients: MetaTrader 4 (MT4) and their original xStation 5 platform (together with the mobile app).

MT4 is a widely popular trading terminal that is known for its advanced charting tools, technical indicators, and automated trading capabilities. It is preferred by traders who want to develop and use custom indicators and Expert Advisors (EA) to automate their trading strategies. MT4 is available for desktop, web, and mobile devices and supports trading in multiple asset classes.

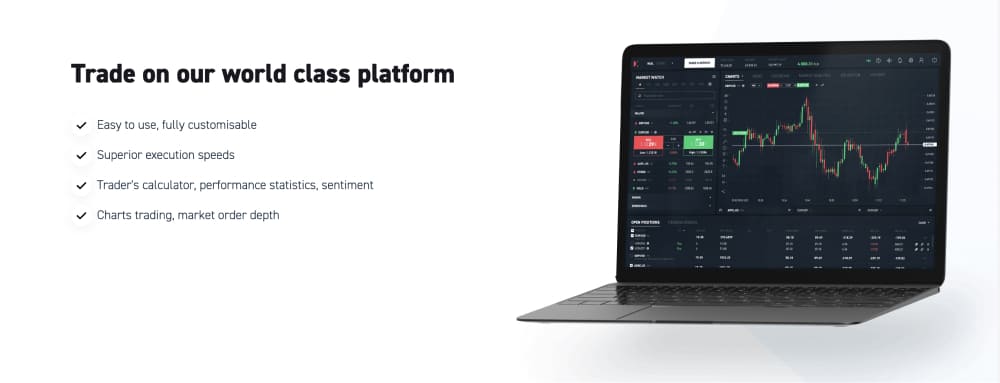

On the other hand, xStation 5 is XTB’s proprietary trading platform, which is a user-friendly platform that is designed for traders of all levels. It offers advanced charting tools, price alerts, and news feeds, making it a comprehensive platform for traders who want to analyze the markets and make informed trading decisions.

xStation 5 also features a customizable interface, allowing traders to personalize their trading environment according to their preferences. It is available for desktop, web, and mobile devices.

Both trading platforms offer features such as one-click trading, multiple order types, and risk management tools, which make trading easier and more efficient for traders. Additionally, XTB provides a demo account option, which enables traders to practice and test their trading strategies on both platforms before depositing any real money.

XTB trading account types

Besides the free demo account option mentioned above, XTM offers Standard and Swap Free account types.

They have similar trading conditions:

- No minimum deposit is required to set up an account;

- Free account management;

- Forex, commodities, indices, Cryptos, stock CFDs, and ETF CFDs are available for trading, more than 2100 in total;

- 1:500 of maximum leverage;

- Available automated trading;

Two major differences between them are:

- Minimum spreads: 0.5 for Standard account, and 0.7 for Swap Free;

- Swap Free account is well, obviously, swap-free. Meanwhile, there are swaps on the Standard account.

Also, XTB offers swap-free Islamic accounts for traders from UAE, Saudi Arabia, Kuwait, Oman, Qatar, Jordan, Bahrain, Lebanon, Egypt, Algeria, Morocco, Tunisia, and Malaysia.

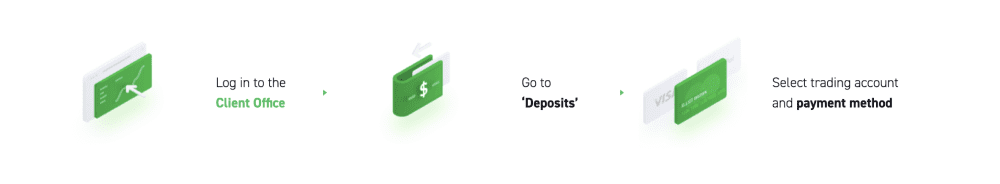

XTB funds deposits and withdrawals

XTB offers multiple options for depositing and withdrawing funds from a trading account. The following methods are available:

- Bank transfers

Clients can deposit and withdraw funds through bank transfers. The processing time for deposits and withdrawals can take up to 3-5 business days, depending on the banks involved.

- Credit/debit cards

Clients can deposit funds through Visa or Mastercard credit/debit cards. The processing time for deposits is instant, and the fees for deposits are free. However, withdrawals can take up to 24 hours to process, and the fees for withdrawals vary depending on the card issuer.

- E-wallets

Clients can deposit funds through e-wallets such as PayPal, Skrill, and Neteller. The processing time for deposits is instant, and the fees for deposits are free. Withdrawals can take up to 24 hours to process, and the fees for withdrawals vary depending on the e-wallet service provider.

It is important to note that XTB only accepts funds from accounts that have the same name as the trading account holder to comply with anti-money laundering regulations. Additionally, clients may be required to provide additional documentation to verify their identity and address when making deposits or withdrawals.

XTB trading fees and commissions

XTB’s trading fees and commissions are competitive with industry standards, as it charges trading fees and commissions that vary depending on the trading instrument and account type.

The Standard account type trades with slightly wider spreads but does not incur any execution commission fees (save for equity and ETF CFD trades).

Traders with Pro accounts pay a commission on each trade made, but they also trade using market spreads. These conditions depend on clients’ locations, so make sure you check the XTB website for personal trading conditions.

XTB educational resources for FX trading

XTB offers a wide range of educational resources for traders of all levels, including beginners, intermediates, and advanced traders. The broker’s educational resources are designed to help traders improve their trading skills, gain market knowledge, and develop profitable trading strategies. There are:

- Webinars

XTB offers a variety of live webinars that cover various trading topics, including fundamental analysis, technical analysis, and trading psychology. The webinars are conducted by experienced traders and market analysts, providing traders with insights into the latest market trends and trading strategies.

- Trading Academy

The XTB Trading Academy is an online educational platform that offers a variety of trading courses, video tutorials, and eBooks. The courses cover a range of topics, including forex trading, indices trading, and Cryptocurrencies trading. The platform is designed to cater to traders of all levels, providing a comprehensive learning experience for traders.

- Market Analysis

XTB provides regular market analysis through its website, which includes daily market commentary, technical analysis, and market news. The analysis is provided by experienced market analysts, providing traders with insights into the latest market trends and potential trading opportunities.

- Economic Calendar

The XTB economic calendar is a valuable resource for traders, providing information on upcoming economic events and news releases. The calendar provides traders with important data, including the time and date of the event, the expected impact on the market, and the previous and forecasted values.

Overall, XTB’s educational resources are comprehensive and designed to provide traders with valuable market knowledge and trading skills. The broker’s live webinars, trading academy, market analysis, and economic calendar are all excellent resources that can help traders make informed trading decisions.

XTB broker review: conclusion

All in all, XTB is a reputable broker that offers a wide range of trading instruments and platforms to its clients. With its global presence and regulatory compliance, XTB provides a safe and secure environment for traders to trade in financial markets.

XTB’s trading platforms, including the xStation 5 and MT4, are intuitive and user-friendly, making it easy for both beginner and experienced traders to trade. The broker’s range of account types and deposit/withdrawal options also gives traders much-needed flexibility and convenience.

Overall, XTB is a trusted FX and CFDs market player that provides clients with a comprehensive trading experience. With its excellent customer support and educational resources, XTB is an ideal choice for traders looking to start their trading journey or expand their portfolio.

More about XTB:

This comprehensive review provides an in-depth look at the various markets available for trading with XTB, including currency pairs, commodities, stocks, indices, ETFs, and cryptocurrencies. XTB offers leveraged trading options, minimal commissions, low spreads, and a diverse range of instruments to trade, along with advanced risk management tools to help traders manage their positions effectively.

Discover everything about XTB’s trading platforms with the help of TopForex.trade market experts. The review covers everything you need to know about the broker’s xStation desktop and web platform, MT4 terminal, and mobile app. You’ll learn about technical capabilities and additional features. Moreover, you’ll find out how to optimize your trading experience with XTB, including on-the-go with the mobile app.

TopForex.trade provides an in-depth overview of XTB’s account types, including features, fees, and benefits, to help traders make an informed decision about which account type is best suited for their trading goals.

XTB overall scores

This review was created for you to learn more about XTB and decide on how well it suits your needs and values. We scored it using our own criteria and methodology to present you with a full, informative report. However, some info is clearer in numbers! Please, see XTB final scores in areas that our experts consider high-priority.