BlackBull Markets

A review of BlackBull Forex broker: unveiling excellence

In the vast landscape of online trading, finding a broker that aligns with your financial goals and trading preferences is paramount. BlackBull Forex broker emerges as a distinguished player in this realm, offering a blend of reliability, innovation, and customer-centric services that set it apart from the crowd.

BlackBull Forex broker: trading experts review

BlackBull prides itself on transparency, a quality often elusive in the financial markets. The company is committed to fostering trust with its clients through clear communication, fair practices, and adherence to regulatory standards. This commitment translates into an environment where traders can operate with confidence, knowing that their interests are prioritized.

In an era where speed and precision can make or break a trade, BlackBull Forex Broker leverages cutting-edge technology. The platform’s robust infrastructure ensures quick order execution and minimal slippage, providing traders with a competitive edge in the dynamic Forex market. The user-friendly interface makes it accessible to both novice and experienced traders.

BlackBull stands out by offering a diverse range of trading instruments beyond the standard currency pairs. Traders can explore opportunities in commodities, indices, and Cryptocurrencies, diversifying their portfolios with ease. This broad spectrum of options caters to the varied preferences of the trading community.

The broker’s commitment to low latency and high liquidity positions it favorably in the market. With a network of top-tier liquidity providers, BlackBull ensures that traders can execute orders promptly, even during peak trading hours. This emphasis on efficiency minimizes the risk of slippage and enhances overall trading performance.

Recognizing the importance of empowering its clients, BlackBull provides an array of educational resources. From webinars and tutorials to market analysis and research tools, the broker equips traders with the knowledge needed to make informed decisions. This commitment to education reflects a genuine interest in the success of their clients.

A standout feature of BlackBull is its customer support. The dedicated support team is responsive and knowledgeable, ensuring that traders receive timely assistance. Whether it’s a technical query or guidance on market trends, the broker’s support services contribute to a positive trading experience.

BlackBull Markets safety and regulations

Safety is a paramount concern when choosing a Forex broker, and BlackBull addresses this concern head-on with a robust commitment to regulatory compliance and client security.

BlackBull operates under the oversight of reputable financial authorities, providing traders with a solid regulatory framework. The company complies with stringent standards, assuring clients that their funds are handled with the utmost care. Regulatory adherence is a testament to the broker’s commitment to ethical business practices.

- The Company is authorized and regulated by the Financial Services Authority in Seychelles (FSA) under license number SD045 for the provision of investment services.

Another standout feature of BlackBull is its dedication to the security of client funds. The broker employs advanced encryption protocols to safeguard financial transactions and personal information. Additionally, client funds are held in segregated accounts with reputable financial institutions, ensuring that they are distinct from the company’s operational funds. This separation of funds adds an extra layer of protection for traders.

BlackBull Markets trading instruments

BlackBull stands out by offering a diverse range of trading instruments, allowing traders to explore various markets and diversify their portfolios. Here is a list of some key trading instruments available on the BlackBull platform:

- Currency Pairs (Forex)

The Forex market is the cornerstone of BlackBull’s offerings. It includes major, minor, and exotic currency pairs, providing traders with ample opportunities to capitalize on global currency fluctuations.

- Commodities

BlackBull extends its offerings beyond currencies to include commodities such as gold, silver, oil, and other precious metals. Trading commodities allows investors to diversify their portfolios and hedge against inflation or geopolitical uncertainties.

- Indices

Traders can engage in index trading with BlackBull, allowing them to speculate on the performance of global stock markets. Popular indices such as the S&P 500, Dow Jones, and FTSE are available, offering exposure to broader market trends.

- Cryptocurrencies

Embracing the digital era, BlackBull provides access to the cryptocurrency market. Bitcoin, Ethereum, Litecoin, and other leading cryptocurrencies are tradable assets, allowing traders to capitalize on the volatility of the crypto space.

- Shares (Equities)

BlackBull facilitates stock trading by offering a selection of shares from prominent global companies. Traders can diversify their portfolios by investing in individual stocks and benefiting from potential capital appreciation and dividends.

- Futures

BlackBull allows traders to engage in futures trading, enabling speculation on the future price movements of commodities, currencies, or indices. Futures contracts provide a standardized way to manage exposure to various assets.

As you can see, BlackBull’s extensive range of trading instruments caters to the diverse preferences of traders. Whether one is interested in traditional Forex pairs, commodities, indices, or emerging digital assets, BlackBull provides a comprehensive suite of instruments for a well-rounded trading experience. Traders can craft diverse and dynamic portfolios, adapting to the ever-changing landscape of global financial markets.

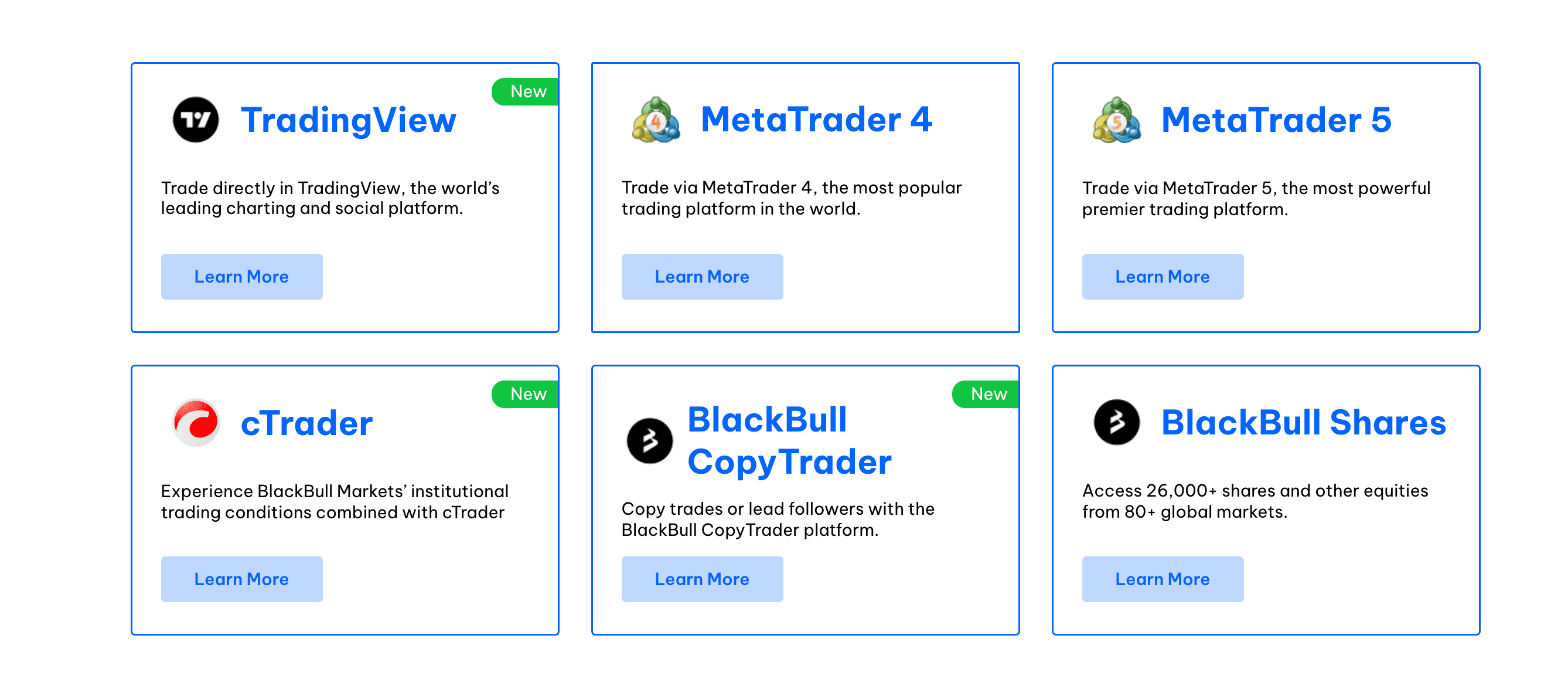

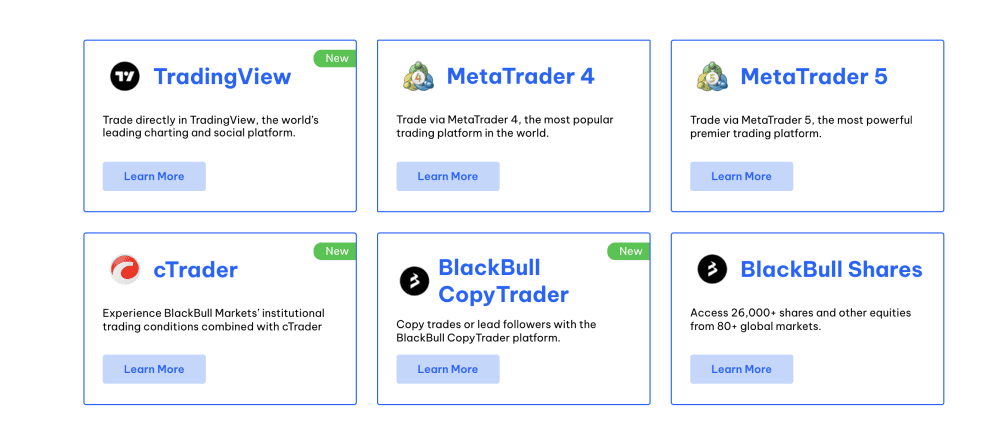

BlackBull Markets trading platforms

The broker recognizes the importance of a reliable and user-friendly trading platform. Here are the key trading platforms offered by BlackBull, along with a brief description of the advantages of each:

- MetaTrader 4 (MT4) and its advantages

Proven performance: MetaTrader 4 is a time-tested platform known for its stability and reliability in the Forex industry.

User-Friendly interface: MT4’s intuitive design makes it suitable for both novice and experienced traders, offering easy navigation and efficient order execution.

Customizable charts: Traders can customize charts and use a wide range of technical analysis tools to enhance their decision-making process.

- MetaTrader 5 (MT5) and its advantages

Expanded asset classes: MT5 goes beyond the Forex market, allowing traders to access a broader range of instruments, including stocks and commodities.

Advanced technical analysis: MT5 offers more advanced charting tools and timeframes, catering to traders who require in-depth technical analysis capabilities.

Integrated economic calendar: The platform includes an economic calendar, keeping traders informed about upcoming economic events that may impact the markets.

- cTrader and its advantages

Level II pricing: Traders on cTrader have access to Level II pricing, offering insights into market depth and order book data.

Algorithmic trading: cTrader supports algorithmic trading strategies, allowing traders to automate their trading through the use of expert advisors.

- BlackBull Web Trader and its advantages

No download required: The Web Trader platform is accessible directly from a web browser, eliminating the need for software downloads.

Cross-device compatibility: Traders can access the platform from various devices, providing flexibility for those who prefer trading on the go.

Real-time quotes and analysis: The Web Trader platform offers real-time quotes and analysis tools, keeping traders informed without the need for additional installations.

- Mobile Trading App and its advantages

On-the-Go trading: BlackBull’s mobile trading apps (compatible with iOS and Android) empower traders to stay connected and execute trades from anywhere.

User-friendly design: The mobile apps feature an intuitive design, making it easy for traders to monitor the markets, manage positions, and execute orders while on the move.

BlackBull provides a versatile array of trading platforms to cater to the diverse needs of its clientele. Whether traders prioritize the familiar interface of MetaTrader, the user-friendly cTrader, the convenience of web trading, or the flexibility of mobile apps, BlackBull ensures that its platform offerings align with the preferences and trading styles of a wide range of traders.

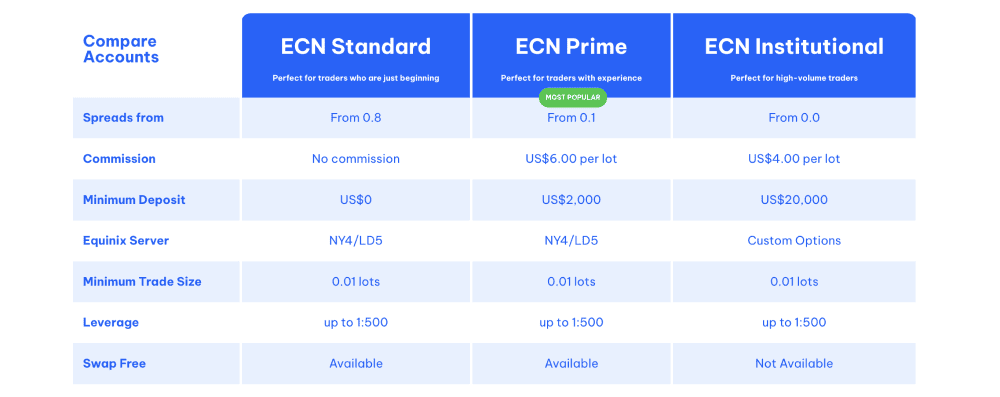

BlackBull Markets trading account types

BlackBull offers a range of trading accounts, each designed to meet the diverse needs and preferences of traders.

- The Standard account

The Standard account is suitable for traders looking for a straightforward and accessible trading experience. It often comes with competitive spreads and allows traders to access a wide range of trading instruments, including Forex pairs, commodities, indices, and more. This account type is well-suited for both beginner and intermediate traders seeking a standard trading environment.

- ECN account (Electronic Communication Network)

The ECN account is tailored for traders who value direct market access, transparency, and rapid order execution. It provides access to interbank liquidity, allowing for tighter spreads and potentially lower trading costs. ECN accounts are favored by more experienced traders who appreciate the benefits of a direct connection to the market.

- VIP account

The VIP account is designed for high-volume traders or institutional clients who require personalized services and enhanced trading conditions. Traders with VIP accounts often enjoy lower spreads, priority customer support, and other exclusive benefits. This account type is ideal for those who demand a premium trading experience with tailored features.

- Islamic account (Swap-Free)

The Islamic account is in compliance with Shariah law, making it suitable for traders who follow Islamic finance principles. It eliminates interest payments (swap) on positions held overnight, ensuring that trading adheres to Islamic financial ethics. The Islamic Account accommodates traders who seek to align their trading activities with their religious beliefs.

- Trading demo account

The demo account is a risk-free environment designed for traders to practice and familiarize themselves with the platform. It allows users to explore the broker’s features, test strategies, and gain confidence in their trading abilities without risking real money. The demo Account is an invaluable tool for both beginners and experienced traders looking to refine their skills.

Choosing the right type of trading account depends on individual preferences, trading strategies, and risk tolerance. BlackBull’s diverse account offerings cater to traders at various skill levels and with different trading goals, ensuring that each client can find an account that aligns with their unique requirements.

BlackBull Markets fund deposits and withdrawals

Efficient and secure transactions are critical aspects of any online trading experience. BlackBull provides a range of options for deposits and withdrawals, offering flexibility and convenience for its clients. Here’s a breakdown of the deposit and withdrawal processes with BlackBull:

BlackBull fund deposits

- Bank transfers: Traders can fund their BlackBull accounts through bank transfers. This method typically involves transferring funds directly from the trader’s bank account to their trading account. Bank transfers are known for their reliability and security.

- Credit/Debit cards: BlackBull accepts deposits via major credit and debit cards such as Visa and Mastercard. This method provides a quick and convenient way for traders to fund their accounts, with transactions processed in real-time.

- E-Wallets: BlackBull supports various e-wallet options, allowing traders to deposit funds through platforms like Neteller, Skrill, or other electronic wallets. E-wallets offer a fast and secure means of transferring funds, and they are often preferred for their ease of use.

- Cryptocurrency deposits: In line with the growing popularity of cryptocurrencies, BlackBull may offer the option to fund accounts with digital currencies like Bitcoin or Ethereum. Cryptocurrency deposits can provide an additional layer of privacy and security for traders who prefer using blockchain-based assets.

BlackBull fund withdrawals

- Bank transfers: Withdrawals to bank accounts are a common method, ensuring that traders receive their funds directly into their bank accounts. The process may take a few business days for the funds to reflect, depending on the banks involved.

- Credit/Debit cards: Profits and withdrawals can be transferred back to the same credit or debit card used for the initial deposit. This method provides a convenient way for traders to access their funds.

- E-Wallet withdrawals: E-wallets can be used for withdrawals, providing a fast and efficient way for traders to receive their funds. This method is often faster compared to traditional bank transfers.

- Cryptocurrency withdrawals: BlackBull may offer the option for traders to withdraw funds in cryptocurrencies for added flexibility. Cryptocurrency withdrawals can provide a swift and decentralized way for traders to access their profits.

Important notes:

- BlackBull may have specific policies regarding the processing time for deposits and withdrawals.

- Verification processes, such as Know Your Customer (KYC) procedures, may be required to ensure the security and legitimacy of transactions.

- Traders should be aware of any fees associated with deposits or withdrawals, as these can vary depending on the chosen method.

When it comes to fund management, BlackBull provides a variety of deposit and withdrawal options, allowing traders to choose methods that align with their preferences and needs. The inclusion of traditional banking methods, credit and debit cards, e-wallets, and even Cryptocurrencies reflects a commitment to offering a diverse and convenient financial experience for their clients.

BlackBull trading fees and commissions

Understanding the fee structure of a Forex broker is crucial for traders to assess the overall cost of trading. BlackBull is transparent about its fee schedule, and here’s an overview of the trading fees and commissions that traders may encounter:

- Trading spreads

The spread is the difference between the buying (ask) and selling (bid) prices of a currency pair. It represents the primary cost of trading with BlackBull. The broker aims to provide competitive spreads, and the specific spread for each currency pair can be found on the broker’s website or trading platform.

- Commission on ECN Accounts

For traders using the ECN (Electronic Communication Network) account, BlackBull may charge a commission per trade. This commission-based model is common for ECN accounts and is in addition to the spread.

- Overnight financing (Swap) fees

Traders who hold positions overnight may incur overnight financing fees, also known as swap fees. The swap fees are associated with the cost of holding positions beyond the close of the trading day.

- VIP account benefits

Traders with VIP accounts may enjoy certain benefits, including potentially lower spreads and priority customer support. The specific advantages and any associated fees or commissions may vary based on the trader’s VIP account level.

Important notes:

- On their official website or trading platform, BlackBull provides a detailed fee schedule that traders should review, as it may vary depending on your location, account type, or trading instrument.

- The fee structure can vary based on the type of account, trading instrument, and market conditions.

- Understanding the total cost of trading, including spreads, commissions, and overnight fees, is essential for effective risk management and strategy planning.

BlackBull CopyTrader review

BlackBull CopyTrader is a feature designed to enhance the Social trading experience, allowing traders to replicate the trades of experienced and successful investors. This innovative tool aims to provide a seamless and accessible way for both novice and experienced traders to benefit from the expertise of others.

Traders can browse through a list of Signal Providers, who are experienced and successful traders willing to share their strategies. Signal Providers have their trading performance and statistics displayed, enabling users to make informed decisions when selecting a provider.

Once a trader selects a Signal Provider, they can choose to replicate the provider’s trades in their own account. The CopyTrader system will automatically mirror the selected Signal Provider’s trades, ensuring that the follower’s account reflects the same positions and proportional gains or losses.

The CopyTrader system operates in real-time, meaning that as the Signal Provider executes trades, those trades are instantly mirrored in the follower’s account. Users have the flexibility to monitor and adjust their settings based on their risk tolerance and trading preferences.

BlackBull CopyTrader benefits

- Access to expertise

CopyTrader provides traders, especially those new to the market, with access to the strategies and decisions of experienced traders. It allows users to learn from the expertise of successful investors without the need for in-depth market knowledge.

- Portfolio diversification

Traders can diversify their portfolios by following multiple Signal Providers with different trading styles and strategies. Diversification helps spread risk and can contribute to a more balanced and resilient investment portfolio.

- Time efficiency

CopyTrader is particularly beneficial for those with limited time for market analysis and trading. By automating the replication of successful trades, users can participate in the markets without the need for constant monitoring.

- Risk management

Users have control over their risk parameters, including the ability to set a maximum amount for copying trades and adjusting the size of each copied position. This allows followers to manage risk according to their individual risk tolerance.

- Transparent performance metrics

The performance metrics of Signal Providers, including historical trades and success rates, are transparently displayed. This transparency helps users make informed decisions when selecting Signal Providers to follow.

Important notes:

- While CopyTrader can offer convenience and potential benefits, users should be aware that all trading involves risk, and past performance is not indicative of future results.

- It’s essential for users to carefully review the historical performance and trading style of Signal Providers before deciding to replicate their trades.

CopyTrader serves as a valuable tool for traders looking to leverage the expertise of successful investors and experienced traders. The platform’s transparency, flexibility, and risk management features contribute to a user-friendly social trading experience that caters to traders with varying levels of expertise and time commitments.

BlackBull Markets trading education

BlackBull recognizes the importance of empowering traders with knowledge and skills to navigate the complexities of financial markets. The broker offers a range of educational resources to support novice and experienced traders.

Here is an overview of the trading education that BlackBull provides:

- Webinars and workshops

BlackBull may organize live webinars and workshops conducted by market experts and industry professionals. These sessions cover a variety of topics, including market analysis, trading strategies, risk management, and platform tutorials.

- Educational videos and tutorials

The broker may provide a library of educational videos and tutorials covering different aspects of Forex trading. These resources are designed to offer visual guidance and step-by-step instructions on using the trading platform, implementing strategies, and understanding market dynamics.

- Written guides and articles

BlackBull may offer written guides and articles that cover a wide range of topics, from basic concepts for beginners to advanced strategies for experienced traders. Written materials may include market insights, trading psychology tips, and explanations of key economic indicators.

- Market analysis and research

Traders can benefit from regular market analysis and research reports provided by BlackBull. These reports may cover fundamental analysis, technical analysis, and insights into current market trends, helping traders make informed decisions.

- Demo accounts for practice

BlackBull may offer demo accounts that allow traders to practice trading in a risk-free environment. Demo accounts simulate real market conditions, providing an opportunity for users to test strategies and familiarize themselves with the trading platform.

- Customer support and training

The broker’s customer support team may offer training and assistance to clients who have questions about trading, account management, or the use of trading tools.

- Interactive learning materials

BlackBull may provide interactive learning materials, such as quizzes and interactive charts, to engage traders in the learning process. Interactive tools can enhance understanding and retention of key concepts.

The educational resources provided by BlackBull cater to traders of all experience levels, from beginners to advanced. This inclusivity ensures that traders can find relevant and helpful information regardless of their background.

Also, BlackBull’s educational content focuses on practical knowledge that traders can apply to their trading activities since the broker’s goal is to empower traders with the skills and insights needed to make informed decisions in dynamic financial markets.

BlackBull Markets integrated trading tools

BlackBull is committed to providing traders with a comprehensive set of tools to enhance their trading experience. These integrated trading tools are designed to assist traders in making informed decisions, conducting thorough analyses, and executing trades with efficiency.

- Advanced charting software

BlackBull’s trading platform likely includes advanced charting software with a wide range of Technical analysis tools. Traders can utilize features such as trendlines, indicators, and oscillators to conduct in-depth analysis of price movements and identify potential trading opportunities.

- Economic calendar

An economic calendar is often integrated into the trading platform, providing real-time updates on economic events, news releases, and key indicators. Traders can stay informed about events that may impact the financial markets and make timely decisions based on economic data.

- Risk management tools

BlackBull may offer risk management tools within its platform, allowing traders to set stop-loss and take-profit orders to manage their risk. These tools help traders implement risk-reward ratios and maintain disciplined risk management strategies.

- Algorithmic trading (Expert Advisors)

The trading platform may support algorithmic trading through the use of Expert Advisors (EAs).

Traders can automate their trading strategies, allowing for the execution of predefined rules and conditions without constant manual intervention.

- Market sentiment indicators

BlackBull may provide market sentiment indicators, offering insights into the positioning of traders in the market. Understanding market sentiment can be valuable for contrarian trading strategies and risk assessment.

- Technical and Fundamental analysis tools

The platform likely includes a combination of technical and fundamental analysis tools to cater to different trading styles. Traders can access a variety of indicators, overlays, and fundamental data to form a comprehensive view of the market.

- Social trading integration

BlackBull’s platform may integrate social trading features, allowing traders to connect with and replicate the trades of successful investors. Social trading tools enhance collaboration and knowledge-sharing within the trading community.

- Real-time news feeds

Traders can access real-time news feeds and market commentary directly from the trading platform.

Up-to-date news helps traders stay informed about geopolitical events, economic developments, and other factors influencing market movements.

- Account analytics and performance tracking

The platform may include tools for tracking account performance and providing traders with insights into their trading history, profitability, and key performance metrics.

The broker’s integrated trading tools are designed to empower traders with the resources they need for successful trading. The platform’s commitment to providing a robust set of features enhances the overall trading experience and supports traders in their pursuit of financial goals.

BlackBull integrated VPS service

The VPS service is supplied by partner BeeksFX, a provider dedicated to hosting finance servers, and usually it costs around $30 per month. The VPS servers are located in New York, London, and Japan, close to the relevant exchanges to maximize execution speed and reliability.

BlackBull Markets offers free VPS services to its clients.

The only requirements are that a client must have a BlackBull Markets account, a minimum of a $2000 deposit, and 20 lots traded across Forex pairs or metals per month.

Forex trading with BlackBull: a holistic review of features, fees, and trading tools

BlackBull Markets emerges as a comprehensive and trader-centric platform, offering a robust suite of features to cater to the diverse needs of both novice and experienced traders. From a commitment to regulatory compliance and client fund security to a diverse range of trading instruments and advanced trading platforms, BlackBull demonstrates a dedication to providing a secure and rewarding trading environment.

The broker’s emphasis on education and integration of powerful trading tools, including the innovative CopyTrader feature, further enhances the overall trading experience. Traders can access a wealth of resources, from webinars and tutorials to market analysis and social trading, empowering them with the knowledge and tools needed for success.

BlackBull’s commitment to transparency, evident in its fee structure and the availability of demo accounts, aligns with its goal of fostering a trustworthy relationship with its clients. The integration of VPS services adds an extra layer of convenience for traders seeking low-latency and uninterrupted trading operations.

For those looking to embark on a rewarding trading journey, BlackBull Markets invites you to explore the world of financial markets with confidence. Take advantage of their offerings by opening an account today through the link below.

Embark on your trading journey with a broker that prioritizes your success and offers the tools and support needed to navigate the dynamic world of Forex and CFD trading.

More about BlackBull:

Dive into the expansive world of financial markets with BlackBull’s diverse range of trading instruments. From currency pairs and commodities to equities and Cryptocurrencies, this comprehensive guide explores the multifaceted landscape of trading possibilities offered by BlackBull. Discover the features, benefits, and strategic advantages each instrument presents, empowering traders to navigate and thrive in the dynamic realm of finance.

Explore a diverse array of trading platforms with BlackBull, from the popular MT4 and MT5 to the innovative cTrader and TradingView. Dive into the world of stocks with BlackBull Shares, leverage the expertise of others with CopyTrader, and trade on-the-go with the BlackBull Trade app. Discover a comprehensive suite of platforms tailored to meet the needs of both novice and experienced traders.

Discover the next level of trading excellence with BlackBull’s mobile and web trading app. This revolutionary platform seamlessly blends accessibility and advanced tools, offering traders an unparalleled experience. Dive into the flexibility of web and mobile applications, enjoy 24/7 dedicated support, and leverage opportunities at 1:500. From intuitive order placement to advanced charting tools, BlackBull provides a feature-rich environment for both novice and experienced traders. Learn how to harness the power of this game-changing platform for a dynamic and rewarding trading journey.

BlackBull Markets overall scores

This review was created for you to learn more about BlackBull Markets and decide on how well it suits your needs and values. We scored it using our own criteria and methodology to present you with a full, informative report. However, some info is clearer in numbers! Please, see BlackBull Markets final scores in areas that our experts consider high-priority.