OANDA

OANDA review: the online broker you can trust

OANDA is a US-originated, founded in 1996, truly “all about currency” broker providing services from currency conversion and supply of Forex data services for businesses to offering an established global online brokerage to traders on multiple CFD markets.

OANDA accepts clients from more than 100 countries. By registering, traders get access to multiple financial markets, gaining the ability to trade CFDs for Forex pairs and indices, commodities, metals, and Cryptocurrencies like Bitcoin and Ethereum. OANDA trading platforms and mobile apps are equipped with a wide range of professional trading tools and educational materials for traders of any level.

OANDA offers six account types: Standard, Core, Swap-free, Premium, Premium Core, and Demo, which makes the broker a fine fit for both new and seasoned trades. Moreover, there is no minimum deposit to open an account with OANDA.

As reliability is key when it comes to trading, OANDA has a base to prove a point. It’s regulated by several of the most authoritative regulators in the world: IIROC, RFED, CFTC, FCA, MAS, ASIC, and others.

OANDA should be the broker of your choice because:

OANDA regulations and safety

Since 1996, OANDA has been in the CFD trading business. It is a well-capitalized, established online broker with several trading platforms. For important enterprises, such as tax agencies, accounting firms, and financial institutions, OANDA is the authorized source of currency data.

These institutions aside, OANDA aims to make trading simple and accessible for its clients. To make investment services available to users in different jurisdictions, the broker complies with multiple authoritative regulations around the world.

Some of OANDA regulations are:

- The US: Retail Foreign Exchange Dealer (RFED), Commodity Futures Trading Commission (CFTC), and a Forex dealer member of the National Futures Association (NFA), #0325821;

- Singapore: Monetary Authority of Singapore (MAS), License No: CMS 100122-4;

- Canada: Investment Industry Regulatory Organization of Canada (IIROC);

- Europe: Financial Conduct Authority (FCA), No: 542574;

- Japan: Financial Services Agency (FSA), #2137 and Financial Futures Association #1571

- Australia: Australian Securities and Investment Commission (ASIC), ABN 26 152 088 349

OANDA is required to file financial reports with regulators in the territories in which it operates, as well as to employ international professional accountant agencies to audit its financial statements. Regularly, the broker compiles and submits financial information to regulators.

Also, according to financial regulars, OANDA is obliged to keep capital reserves at certain levels, though the broker’s capital reserves substantially exceed these levels.

OANDA trading instruments

OANDA strives to provide competitive spreads across its full range of Forex and CFD markets, including indices, commodities, Cryptocurrencies, and metals with around 100 instruments in total.

- Forex: more than 48 currency pairs;

- Metals: Gold, Silver, and Copper;

- Commodities: Oil, Natural Gas, Copper, Wheat, and others;

- Cryptocurrencies: pairs of BTC/USD, ETH/USD, LTC/USD, BCH/USD, BNB/USD, ADA/USD, LINK/USD, DOGE/USD, DOT/USD, EOS/USD, XLM/USD, XTZ/USD, UNI/USD, AVAX/USD, KSM/USD, GLMR/USD, SOL/USD, and MATIC/USD.

- Indices: US Wall St 30, France 40, UK 100, Germany 30, and others, 18 indices in total;

OANDA trading platforms and tools

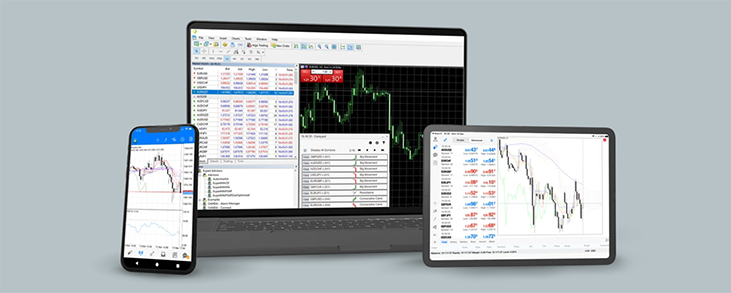

OANDA lets you choose between fully customizable OANDA Trade web-based and desktop platforms and speculation on the Forex markets using MT4. Also, the broker provides apps for mobiles and tablets. With the mobile version, you can access more than 50 technical tools, including 32 overlay indicators, 11 drawing tools, and 9 chart types with OANDA apps for iOS and Android.

Aside from a variety of trading platforms, OANDA offers:

- Advanced Charts

Leading indicators and drawing tools include trade-through charts and 65+ technical indicators. You can analyze market trends using drawing tools such as Pitchforks, Gann Fans, Elliott Waves, and more.

- Technical analysis

Technical analysis is a web-based charting application accessible on the OANDA Trade platform. Continuous intraday market scanning, performance statistics, market volatility analysis, and more.

- Economic overlay

Keep your finger on the trading pulse. Receive updates on important economic announcements and events directly from your OANDA Trade platform. Global economic overview, customizable view, reference results, and more. Also available on OANDA demo accounts.

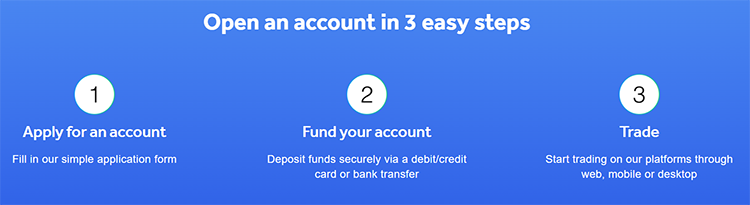

How to start trading with OANDA

With OANDA’s user-friendly, intuitive platform, you can start trading in just a few easy steps.

Step 1: Fill out a simple application form and verify your identity.

Step 2: Fund your account by depositing funds securely via a debit or credit card or bank transfer.

Step 3: Now you can start trading on platforms through the web, mobile, or desktop with more than 100 financial instruments.

OANDA minimum deposit

There is no minimum deposit requirement to open an account with OANDA. However, as soon as you are up to making the first deal, your account needs a sufficient balance for a trade. The deposit amount defines your trading conditions, especially when it comes to trading with leverage.

Usually, the leverage amount is written as 1:20, 1:30, 1:100, or any other. It means that for each deposited $1 of yours the broker allows opening a position for $20, $30, or $100 respectively.

To explain better, let’s illustrate it with an example of an OANDA Pro account with a leverage of 1:100.

If you deposited $600, you would be able to trade amounts up to $60,000 on the market.

or,

If you deposit $2000, then you can make deals worth up to $200,000.

As you see, the more money you deposit, the wider your trading opportunities. Moreover, a bigger deposit gives you more trading flexibility and mitigates risks; for example, with a $2000 deposit, you can trade the same worth of deals with lower leverage, staying more secure in terms of market volatility.

OANDA fees and commissions

OANDA charges several types of fees, and those amounts are among the smallest in the industry. Another good thing here is that the mathematics behind these charges is really clear, so let’s break it down by type.

- No deposit fees;

- Withdrawal fees depend on the method you use:

Debit/credit card: You can make one free withdrawal to your credit or debit card per calendar month.

Bank transfer: Withdrawals made by bank transfer will incur a fee, depending on your trading currency.

- Financing fees apply for positions kept open over time.

- An inactivity fee applies as a monthly charge that is levied on an account if there has been no trading activity for 12 months.

- Currency conversion fees:

When you make a deal with an instrument in a currency other than your account currency, the realized profit or loss, as well as any associated adjustments, will be converted to your account currency at the broker’s current currency exchange rate. This rate is derived by adding a 0.5% markup or mark-down to the midpoint price (buy + sell price divided in half) at the time of conversion (depending on whether a debit or credit is to be applied to your account).

OANDA Deposits and withdrawals

It is simple to deposit and withdraw funds to and from your trading account. You can deposit, withdraw, and transfer funds from your ‘My Funds’ page.

You can fund your account using several different methods, including:

- Funding: Visa, Mastercard, Skrill, Neteller, Wise, and various Alternate Payment Methods

Withdrawal: Visa, Mastercard, Skrill, Neteller, Wise, and Bank/Wire Transfer

Also, you can withdraw funds from your account via a number of the same payment methods as for deposits.

OANDA broker summary

OANDA, a reputable US-originated broker with millions of clients around the world and a long history of operations, for more than two decades of work, earned itself a stellar reputation among users, compiling with a slew of global regulators at the same time.

The broker is an excellent choice for new traders since there are demo accounts available together with detailed educational materials and market insights, and there is no minimum deposit requirement. With minimal commissions and spreads, a variety of trading instruments, including Forex, Indices, Commodities, and Crypto, including Bitcoin and Ethereum, advanced trading platforms, and mobile apps.

Disclaimer: The OANDA Group has multiple subsidiaries that are licensed to offer products to clients around the globe. The OANDA subsidiary with which a client contracts depends on their country of residence. Each subsidiary provides different products via different platforms, so clients will experience OANDA differently depending on their country of residence.

CFDs are not available to residents in the United States. Spreadbetting is only available to residents in the UK.

More about OANDA:

An overview of OANDA trading platforms: a customizable Web Terminal, the popular MT4, and a full-fledged mobile app. A detailed analysis of their technical capabilities and advantages, as well as a comparison of powerful trading tools including charts, indicators, tech analysis apps, economic overlays, and spread calculators.

Discover the power of mobile trading with the OANDA app. Explore its features, from real-time market data to comprehensive charting tools. Get answers to FAQs and learn why this app is a game-changer for traders on the go.

OANDA overall scores

This review was created for you to learn more about OANDA and decide on how well it suits your needs and values. We scored it using our own criteria and methodology to present you with a full, informative report. However, some info is clearer in numbers! Please, see OANDA final scores in areas that our experts consider high-priority.

OANDA fees and commissions

OANDA charges several types of fees, those amounts are among the smallest in the industry. Another good thing here - the mathematics behind these charges is really clear.