Chip development company Socionext Inc. rose 15% since its Tokyo public offering, dispelling traders’ and investors’ pessimism about global semiconductor stocks.

Shares of a Yokohama-based company held prior to listing by Panasonic Holdings Corp., Fujitsu Ltd., and Development Bank of Japan Inc. closed the first session at 4200 yen. They were sold for 3650 yen each, the highest price for the IPO, which was raised to 66.8 billion yen ($456 million) due to strong investor interest.

Semiconductor listings in Tokyo usually perform well in the first session. Socionext was able to lure buyers even in a weak IPO market in Japan, where revenue this year has fallen by 80% compared to last year. This rise is at odds with a slump in chip-related stocks that wiped out more than $240 billion of the sector’s global market value this week after US-imposed restrictions on China’s access to technology.

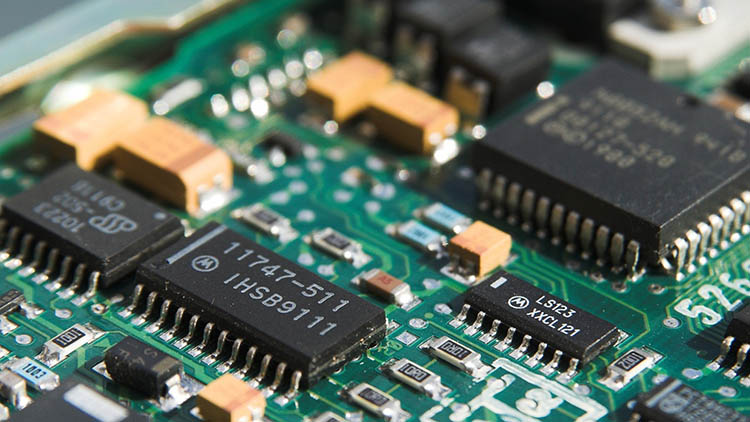

Socionext develops customized systems-on-chips for customers in the consumer, automotive and industrial sectors. Silicon processors from Apple Inc. and the Snapdragon line from Qualcomm Inc. are mass-market logic processors often referred to as the brains of electronic devices. Customers are increasingly looking for specialized chips for specific applications, and Socionext competes with Taiwan’s Faraday Technology Corp., Alchip Technologies Ltd., and Global Unichip Corp. to meet this demand.

Learn how to trade stocks and popular assets with Top Forex brokers in Japan

The company was created by combining the SoC divisions of Fujitsu Semiconductor Ltd. and Panasonic in 2015.

It is the fourth semiconductor company to go public in Japan in the past two years and the largest of the country’s nine semiconductor companies in the past decade. Only one of them, RS Technologies Co., did not close the first session above the IPO price.

Listed companies in Tokyo over the past two years, after raising over $100 million, are up an average of 28% on the first day.

Demand for Socionext’s IPO was strong as only long-term funds closed the deal. The company is a major chipmaker looking to expand into the fast-growing automotive technology industry, with growing sales in the segment and a better-valued stock than its peers.

Subscribe for our newsletter

Get Forex brokers reviews, market insights, expert analytics and education material right into your inbox for free!