How to trade multiple assets on BlackBull for portfolio Success

Diversifying your trading portfolio is crucial to managing risk and enhancing potential returns. While traditional investments like stocks and bonds remain popular, incorporating alternative assets and trading instruments can add a layer of diversity that helps safeguard against market volatility. One such avenue for diversification is through BlackBull, a financial services provider known for its comprehensive trading solutions.

BlackBull is one of the leading regulated brokers that offers a wide range of assets for trading and financial services. BlackBull provides access to various markets, including Forex, commodities, indices, and Cryptocurrencies. Traders can benefit from BlackBull’s advanced trading platforms, competitive pricing, and educational resources.

Diversifying your trading portfolio with BlackBull opens up opportunities across various asset classes. By incorporating Forex, commodities, indices, and Cryptocurrencies, you can build a well-rounded portfolio that is resilient to market fluctuations. Remember to stay informed, utilize risk management tools, and continuously reassess your portfolio to ensure it aligns with your financial objectives. BlackBull’s comprehensive suite of services and resources can be instrumental in achieving a diversified and successful trading portfolio.

BlackBull trading portfolio diversification with multiple asset classes

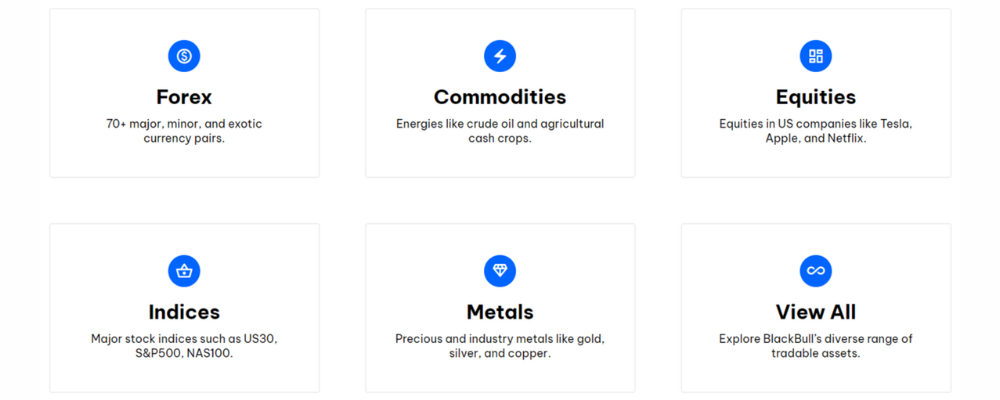

BlackBull offers a diverse range of financial instruments across various asset classes, providing traders with numerous options for portfolio diversification. Here’s a list of instruments available on BlackBull, along with brief explanations on how to use them for diversification:

- Forex pairs (currency trading)

Trade currency pairs like EUR/USD, GBP/JPY, or AUD/JPY. Forex markets are highly liquid, and trading different currency pairs allows you to diversify based on global economic trends. For instance, pairing a major currency with an emerging market currency can offer diversification benefits.

- Commodities

BlackBull provides access to various commodities like gold, silver, oil, and agricultural products. Commodities can act as a hedge against inflation and provide diversification, as their performance is often influenced by different factors compared to traditional securities.

- Indices

Trade global indices like the S&P 500, FTSE 100, or DAX 30. Indices represent the performance of a basket of stocks from a specific region or sector. Including different indices in your portfolio allows you to diversify across multiple industries and geographic regions.

- Cryptocurrencies

Explore digital assets like Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC). Cryptocurrencies are relatively new and can offer uncorrelated returns compared to traditional assets. Including a small allocation to cryptocurrencies can enhance portfolio diversification.

- Stocks

Invest in individual stocks from various sectors and industries. BlackBull provides access to a wide range of global stocks, allowing you to build a diversified stock portfolio. Consider including stocks from different market capitalizations and industries to spread risk.

- Bonds

While BlackBull primarily focuses on leveraged trading, bond-related instruments such as ETFs or CFDs may be available. Bonds can act as a defensive component in a diversified portfolio, providing stability during market downturns.

- Energies

Trade energy commodities like crude oil and natural gas. Energy markets are influenced by geopolitical events and supply-demand dynamics, offering diversification benefits. Including energy commodities in your portfolio can be a way to navigate global economic trends.

- Metals

Diversify with metals like gold, silver, platinum, and palladium. Precious metals are often considered safe-haven assets and can provide a hedge against inflation and economic uncertainty.

- Cryptocurrency crosses

Besides trading individual cryptocurrencies, BlackBull may also offer pairs like BTC/USD or ETH/BTC. Trading cryptocurrency crosses allows you to benefit from the relative performance of different digital assets, adding another layer of diversification.

- Volatility indices

Trade volatility indices such as the VIX. These instruments can be used to hedge against market volatility or as a speculative tool. Including volatility indices in your portfolio can provide insurance during turbulent market conditions.

Remember to conduct thorough research, analyze market trends, and consider your risk tolerance before diversifying your portfolio with different instruments on BlackBull. Additionally, use the risk management tools provided by the platform to protect your investments.

BlackBull trading portfolio diversification strategies

Diversification is a key strategy to manage risk and enhance potential returns in your trading portfolio. Here are some effective strategies you can consider implementing with the capacity of the BlackBull platform:

- Cross-asset diversification

Spread your investments across different asset classes, such as forex, commodities, indices, and cryptocurrencies. This helps reduce the impact of poor performance in one asset class on the overall portfolio.

- Geographic diversification

Trade instruments from different geographic regions. BlackBull provides access to global markets, allowing you to diversify by incorporating assets from various countries. This strategy helps mitigate the risks associated with regional economic downturns.

- Sectoral diversification

Diversify within an asset class by investing in different sectors. For example, within stocks or indices, allocate funds to industries like technology, healthcare, finance, and energy. This reduces exposure to risks specific to a particular sector.

- Market cap diversification

Invest in assets with different market capitalizations. This includes trading large-cap, mid-cap, and small-cap stocks. Diversifying across market caps can provide exposure to different growth trajectories and risk profiles.

- Time-horizon diversification

Consider both short-term and long-term trades. While day trading may be a part of your strategy, having long-term investments can provide stability and help navigate market fluctuations.

- Pairs trading

Engage in pairs trading where you simultaneously go long on one asset and short on another correlated asset. This strategy aims to capitalize on the relative performance between two assets and can be applied to various instruments.

- Risk parity

Allocate funds based on the risk associated with each asset. This strategy involves balancing the risk contribution of each asset class to achieve a more equal distribution of risk in the portfolio.

- Volatility-based allocation

Adjust your allocation based on market volatility. During periods of high volatility, consider reducing exposure to risky assets and increasing exposure to more stable assets, and vice versa.

- Currency hedging

If you have international investments, consider using currency hedging to mitigate the impact of currency fluctuations. BlackBull’s forex trading platform allows you to manage currency risk effectively.

- Staggered entry and exit

Avoid investing all your capital at once. Instead, stagger your entry and exit points for different positions. This can help minimize the impact of short-term market fluctuations and improve the average entry/exit price.

- Systematic rebalancing

Regularly review and rebalance your portfolio. This involves adjusting your asset allocation to maintain your desired risk-return profile. Rebalancing ensures that your portfolio stays aligned with your long-term goals.

Employ derivatives like options or futures for hedging purposes. This can help protect your portfolio from adverse price movements in specific assets.

Remember, the effectiveness of these strategies depends on your financial goals, risk tolerance, and market conditions. It’s crucial to stay informed, continuously reassess your portfolio, and utilize the trading tools provided by BlackBull for risk management.

Open your BlackBull trading account

Diversifying your trading portfolio is a prudent approach to managing risk and optimizing potential returns. BlackBull, with its comprehensive suite of trading instruments and advanced platforms, provides an ideal environment for implementing various diversification strategies.

Diversification not only shields your investments from the volatility of individual markets but also positions you to benefit from global economic trends. Whether you’re a seasoned trader or just starting, BlackBull’s user-friendly interface, educational resources, and risk management tools empower you to navigate the complexities of diverse financial markets.

Take advantage of the opportunity to trade multiple assets with BlackBull, harnessing the potential for enhanced returns and reduced risk. Remember, a well-diversified portfolio is a cornerstone of successful trading. Open your BlackBull account now and embark on a journey towards a more resilient and rewarding investment strategy.

Related articles:

Diversifying your trading portfolio with BlackBull - FAQ