Exness trading accounts: Standard and Pro options

Founded in 2008, Exness has established itself as a reputable company in the financial industry by providing a wide range of services tailored to traders interested in diverse financial markets, encompassing currencies, commodities, indices, and Cryptocurrencies.

The company operates under the regulations of esteemed authorities, including the FCA, CySEC, FSCA, FSC, and FSA. These regulatory bodies play a vital role in ensuring the safety of funds and the provision of fair trading conditions to safeguard the interests of traders.

Exness stands out for its provision of highly regarded trading platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), as well as the Exness Web terminal and mobile app. Renowned for their intuitive interfaces, advanced charting tools, and automated trading capabilities, these platforms empower traders to make informed decisions and execute trades efficiently.

Acknowledging the significance of customer support in the trading experience, Exness offers assistance through various communication channels, including live chat, email, and phone. Their commitment to efficient and timely customer support ensures prompt resolution of issues and satisfactory addressing of inquiries.

Furthermore, Exness recognizes the importance of education and equips traders with valuable knowledge and skills through a range of educational materials and resources. These resources encompass webinars, tutorials, trading guides, and market analysis, enabling traders to enhance their understanding, make informed decisions, and develop effective trading strategies.

In addition to the above, Exness offers a selection of account types to cater to diverse trading needs. Traders can choose from Standard and Pro accounts, each featuring distinct characteristics such as spreads, commissions, and minimum deposit requirements. This flexibility allows traders to select an account that aligns with their individual preferences and trading goals.

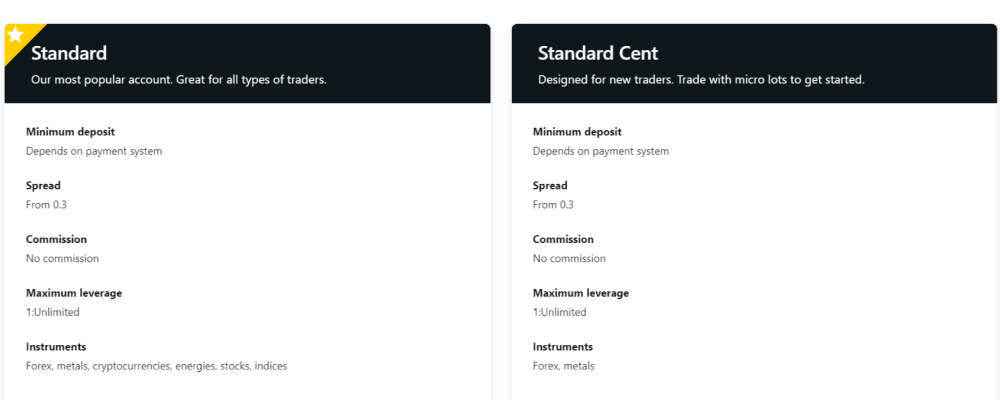

Exness Standard accounts: Standard and Standard Cent

Exness offers two types of standard accounts: Standard and Standard Cent. These accounts are designed to provide traders with a range of features and options to suit their trading needs. Let’s take a closer look at the features of these accounts.

Exness Standard account

The Exness Standard Account provides a range of features to cater to traders’ needs. The minimum deposit required varies based on the chosen payment system, and multiple payment methods are available. Traders can enjoy tight spreads starting from 0.3 pips, which helps reduce trading costs and potentially increase profitability. With this account, there are no commissions charged on trades, allowing for commission-free trading.

The Standard Account offers maximum leverage of 1:Unlimited, giving traders the opportunity to amplify their trading positions. It provides access to a diverse range of trading instruments, including forex currency pairs, metals, cryptocurrencies, energies, stocks, and indices. This broad selection allows traders to diversify their portfolios and explore different markets.

For those who prefer smaller positions, the Standard Account has a minimum lot size of 0.01. During regular trading hours (7:00 – 20:59 GMT+0), the maximum lot size is 200, while it reduces to 20 during off-peak hours (21:00 – 6:59 GMT+0). Traders can open multiple positions without any limitations, offering flexibility in managing their trading strategies.

Hedged positions do not require additional margin allocation, as the hedged margin requirement for the Standard Account is 0%. To ensure sufficient margin for maintaining open positions, a margin call level of 60% serves as a notification to traders. The account has a stop-out level of 0%, meaning positions will not be automatically closed due to margin requirements unless specifically chosen by the trader or in certain cases involving stocks.

The Standard Account utilizes market execution, ensuring that trades are executed at the best available market prices. Additionally, Exness offers a swap-free option for this account type. Traders can hold positions overnight without incurring swap charges, which is particularly beneficial for those with religious beliefs or those who prefer to avoid overnight interest charges.

Exness Standard Cent account

The Exness Standard Cent Account is a trading account that offers a range of features and options to enhance the trading experience. It has a minimum deposit requirement that varies depending on the chosen payment system, similar to the Standard account. Traders using this account can benefit from competitive trading conditions with spreads starting from as low as 0.3 pips. There are no commissions charged on trades, making the cost of trading transparent.

With a maximum leverage of 1:Unlimited, traders have the flexibility to employ different trading strategies. The account provides access to a variety of trading instruments, including forex currency pairs and metals, expanding trading opportunities. Traders can engage in trading with smaller position sizes, as the account has a minimum lot size of 0.01. Additionally, there is a maximum lot size limit of 200 to ensure responsible trading and risk management.

The account allows traders to open up to 1000 positions simultaneously, enabling them to diversify their portfolio. It has a 0% hedged margin requirement, providing flexibility for hedging strategies. Traders will be notified when the margin level reaches the margin call level of 60%, prompting them to take necessary action. The account also has a 0% stop-out level, meaning positions will not be automatically closed due to margin requirements, giving traders more control.

Orders are executed using market execution, ensuring efficient order processing. For those who require a swap-free option, the account offers this feature, accommodating specific trading preferences or religious considerations.

Overall, the Exness Standard Cent Account caters to traders seeking competitive conditions, flexibility, and a diverse range of trading options to suit their individual needs.

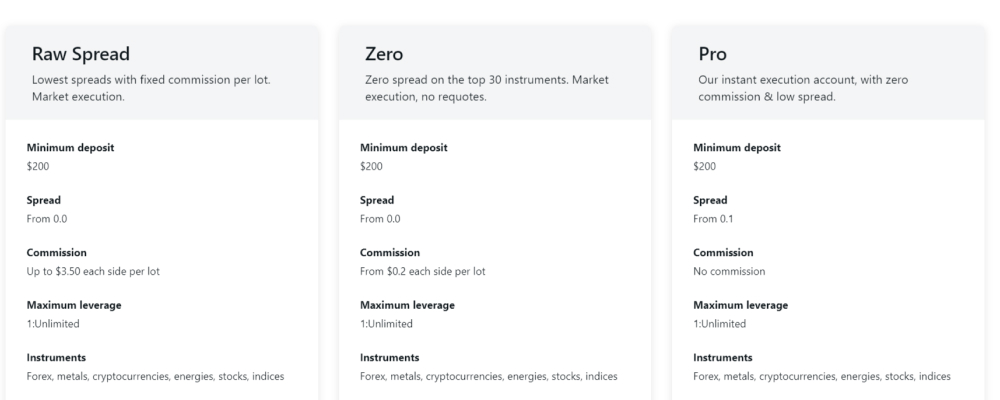

Exness Pro accounts: Raw Spread, Zero, and Pro

Exness Pro Accounts are specifically designed to meet the needs of professional traders and institutional clients. These accounts offer a range of advanced features and competitive trading conditions to enhance the trading experience for experienced individuals and organizations in the financial markets.

Exness Raw Spread account

The Raw Spread account is designed for traders who want tight spreads and flexibility in their trading positions. To open this account, a minimum deposit of $200 is required. This account offers spreads starting from 0.0 pips, ensuring competitive pricing.

Traders using the Raw Spread account are charged a commission of up to $3.50 per lot on each side. However, they benefit from a maximum leverage of 1:Unlimited, giving them ample room to manage their positions effectively.

This account allows trading in a wide range of instruments, including currency pairs, metals, Сryptocurrencies, energies, stocks, and indices. The minimum lot size is 0.01, and traders can trade up to 200 lots during the period of 7:00 to 20:59 GMT+0. During the remaining hours, from 21:00 to 6:59 GMT+0, the maximum lot size is 20 lots.

One of the advantages of the Raw Spread account is that traders have the freedom to open an unlimited number of positions without any hedged margin requirement. In the event of a margin call, the account has a 30% threshold. The stop-out level is set at 0%, although there may be variations for stocks.

Order execution in the Raw Spread account is performed at the market price, ensuring fast and accurate execution. Additionally, a swap-free option is available for traders who require it, accommodating those with specific religious or cultural requirements.

Exness Zero Pro account

The Zero account shares similarities with the Raw Spread account. It requires a minimum deposit of $200 and offers spreads starting from 0.0 pips, ensuring competitive pricing. However, the commission structure differs, as traders using the Zero account pay a commission of $0.2 per lot on each side.

Similar to the Raw Spread account, the Zero account provides a maximum leverage of 1:Unlimited, granting traders flexibility in their trading positions. It supports trading in various instruments, including currency pairs, metals, Cryptocurrencies, energies, stocks, and indices.

The minimum and maximum lot sizes, the maximum number of positions, hedged margin requirement, margin call threshold, stop-out level, order execution at the market price, and availability of swap-free options remain unchanged from the Raw Spread account. These features provide traders with consistent trading conditions and options tailored to their needs.

Exness Pro account

The Pro account, similar to the previous two accounts, requires a minimum deposit of $200. However, it offers spreads starting from 0.1 pips, slightly higher than the Raw Spread and Zero accounts. A notable difference is that there is no commission charged for trading on the Pro account, setting it apart from the other two options.

The Pro account maintains the same features as the other accounts, including maximum leverage, supported instruments (forex, metals, cryptocurrencies, energies, stocks, and indices), lot sizes, number of positions, hedged margin requirement, margin call threshold, stop out level, order execution at the market price, and swap-free availability.

Traders opting for the Pro account can benefit from a commission-free trading structure while enjoying the same trading conditions, flexibility, and options as offered by the Raw Spread and Zero accounts.

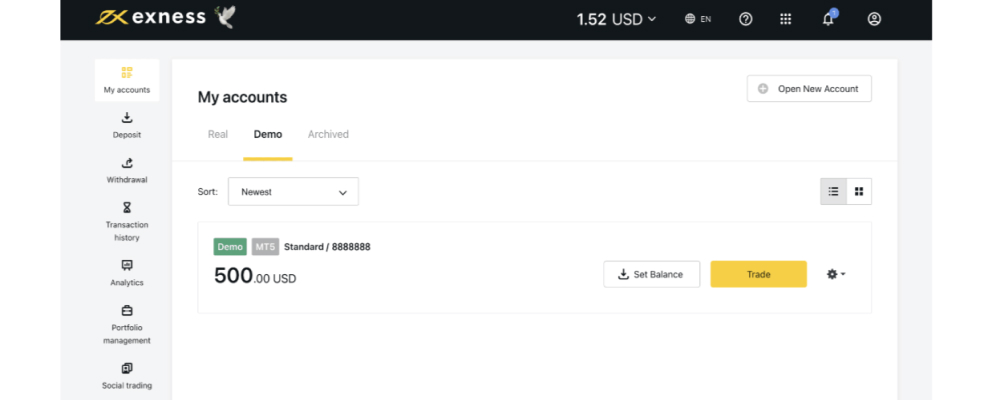

Exness demo account

Exness also offers demo accounts for traders to practice their trading strategies without risking real money. A demo account with Exness allows you to simulate real trading conditions using virtual funds. It’s a risk-free environment where you can explore the features of the trading platform, test different trading strategies, and familiarize yourself with the markets. It is particularly useful for beginners who are new to trading and want to gain experience before investing real money.

With an Exness demo account, you can typically practice trading for an unlimited period. However, the virtual funds provided are not withdrawable or transferable to a live trading account.

Exness deposits and withdrawals

Exness offers a range of convenient deposit and withdrawal options to cater to its users’ needs. Users can choose from flexible payment methods in local currencies, including popular payment systems, e-wallets, and crypto-wallets.

When it comes to deposits, Exness allows a minimum amount of $10 for most options. Bitcoin deposits require a minimum of $50. The processing speed for deposits is generally within 30 minutes, except for Bitcoin and certain Cryptocurrencies, which may take up to 24 hours.

For withdrawals, the minimum amount varies depending on the method chosen. Bank card withdrawals have a minimum of $3, while most other options have a minimum of $10. The processing time for withdrawals is typically within 24 hours for all options.

Here is an overview of the deposit and withdrawal options on Exness:

Deposit options:

- Bitcoin: Minimum amount of $50, processed within 24 hours.

- Bank Card: Minimum amount of $10, processed within 30 minutes.

- Skrill: Minimum amount of $10, processed within 30 minutes.

- Neteller: Minimum amount of $10, processed within 30 minutes.

- Perfect Money: Minimum amount of $10, processed within 30 minutes.

- SticPay: Minimum amount of $10, processed within 30 minutes.

- USD Coin (USDC ERC20): Minimum amount of $10, processed within 24 hours.

- USD Coin (USDC TRC20): Minimum amount of $10, processed within 24 hours.

- Tether (USDT ERC20): Minimum amount of $10, processed within 24 hours.

- Tether (USDT TRC20): Minimum amount of $10, processed within 24 hours.

Withdrawal options:

- Bitcoin: Minimum amount of $50, processed within 24 hours.

- Bank Card: Minimum amount of $3, processed within 24 hours.

- Skrill: Minimum amount of $10, processed within 24 hours.

- Neteller: Minimum amount of $4, processed within 24 hours.

- Perfect Money: Minimum amount of $2, processed within 24 hours.

- SticPay: Minimum amount of $1, processed within 24 hours.

- USD Coin (USDC ERC20): Minimum amount of $100, processed within 24 hours.

- USD Coin (USDC TRC20): Minimum amount of $10, processed within 24 hours.

- Tether (USDT ERC20): Minimum amount of $100, processed within 24 hours.

- Tether (USDT TRC20): Minimum amount of $10, processed within 24 hours.

Exness trading accounts summary

Exness offers a range of trading accounts to cater to different traders’ needs. The Standard Accounts, including Standard and Standard Cent, provide tight spreads starting from 0.3 pips, no commissions on trades, and maximum leverage of 1:Unlimited. Traders can access various trading instruments and open multiple positions without limitations. The Standard Cent Account allows for smaller position sizes and simultaneous opening of up to 1000 positions.

For professional traders, Exness offers Pro Accounts such as Raw Spread, Zero, and Pro. The Raw Spread Account requires a minimum deposit of $200 and offers spreads starting from 0.0 pips. Traders are charged a commission of up to $3.50 per lot, but they can open unlimited positions without a hedged margin requirement. The Zero Account has a similar structure but with a commission of $0.2 per lot. The Pro Account, with spreads starting from 0.1 pips, stands out as it doesn’t charge any commissions.

Exness also provides a demo account for traders to practice without risking real money. The demo account simulates real trading conditions and is suitable for beginners to gain experience and test strategies.

Overall, Exness offers a variety of trading accounts with competitive conditions, flexibility in position sizes, access to multiple instruments, and options for both retail and professional traders. Click our special button to sign up with Exness.

Related articles:

Discover the power of Exness Social Trading, where you can effortlessly track and adopt the strategies of talented traders from around the globe. Whether you’re seeking to enhance your trading game, simply choose a strategy that resonates with you, fund your account, and unlock the potential for profitable trades. Dive into an insightful expert review to unveil the array of Exness Social Trading account types, advantageous trading conditions, transparent commissions, and complimentary VPS services, and even explore the exciting opportunity of becoming a strategy provider yourself.

Get a comprehensive overview of Exness trading platforms provided by market experts at TopForex.trade. Discover essential details about the broker’s primary platform, Web, MT4, and MT5 terminals, as well as their mobile app. Gain insights into technical requirements, charting capabilities, signal options, and additional features catering to both Fundamental and Technical analysis.

An in-depth exploration of Exness trading markets and instruments reveals a diverse range of investment opportunities. These include engaging in stock and index trading, participating in currency pair and commodity transactions, and speculating on Cryptocurrencies. Exness offers various advantages such as leveraged trading, minimal commissions, low spreads, an extensive selection of instruments, and effective risk management tools.

Exness trading accounts - FAQ