Understanding Social trading with HFcopy of HF Markets

With the rise of technology and the increasing accessibility of financial markets, Social trading (sometimes, Copy trading) has emerged as a popular trend among traders and investors. Social trading, at its core, is a concept that allows traders to connect and share their investment strategies, insights, and trades with others in a community-like setting. It brings together experienced traders and those just starting out, offering a unique opportunity to learn from others and potentially replicate their success.

The benefits of social trading are numerous. For beginners, it provides a valuable learning experience, allowing them to observe and follow the trades of more experienced traders. This can help them gain insights into market trends, strategies, and risk management techniques. Additionally, social trading offers a sense of community and support, as traders can engage with each other, ask questions, and seek advice.

HF Markets, also known as HotForex, is a well-established and globally recognized online Forex and CFD broker. It provides traders with a wide range of financial instruments, including currencies, commodities, indices, and stocks. With a strong reputation for its reliable trading services and innovative platforms, HF Markets has attracted a large community of traders from around the world.

The broker was founded in 2010 and has since grown to become one of the leading online brokers in the industry. It is regulated by multiple financial authorities, including the Financial Conduct Authority (FCA) in the United Kingdom and the Cyprus Securities and Exchange Commission (CySEC). The broker is known for its emphasis on transparency, security, and client satisfaction.

In recent years, HF Markets has expanded its offerings to include Social trading by introducing HFcopy, a feature that allows traders to connect with each other and share their trading activities. To optimize your trading experience, we will explore strategies for developing a Social trading strategy, analyzing market trends, and engaging with other traders. Additionally, we will highlight common mistakes to avoid, such as ignoring market news, following too many traders, and not adjusting your strategy based on market changes.

Benefits of Social trading with HFcopy of HF Markets

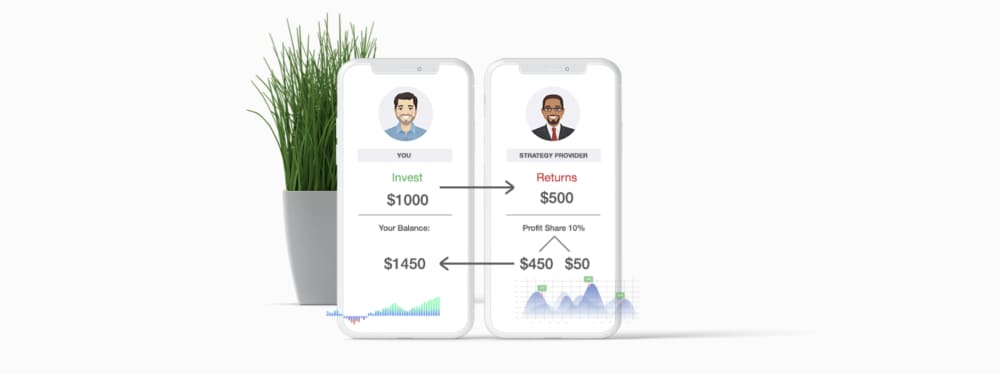

In the context of HF Markets, Social trading enables traders to connect with each other on the platform, observe the trades of others, and automatically copy the trades of selected traders. This feature opens up a world of opportunities for both experienced and novice traders, as they can learn from successful traders, gain insights into market trends, and potentially replicate their performance.

Social trading offers several benefits for traders on the HF Markets platform. Some of the key advantages include:

Learning from experienced traders

Novice traders can observe and learn from the strategies and trading activities of experienced traders. By following successful traders, they can gain insights into their decision-making process, risk management techniques, and overall trading approach.

Access to a diverse community

Social trading provides access to a diverse community of traders from various backgrounds and experience levels. This allows for the exchange of ideas, discussions on market trends, and the opportunity to engage with like-minded individuals.

Time-saving and convenience

By copying the trades of successful traders, social trading eliminates the need for extensive market research and analysis. This can be particularly beneficial for traders with limited time or those who are new to the trading world.

Potential for profitability

By following and replicating the trades of successful traders, social trading offers the potential to generate profits. However, it is important to note that trading involves risks, and past performance is not indicative of future results.

Key features of Social trading in HF Markets

HF Markets offers a range of features that enhance the social trading experience. Some of the key features include:

Trade replication

One of the main features of social trading is the ability to replicate the trades of selected traders. This means that traders can automatically execute the same trades as the traders they choose to follow. This feature allows novice traders to benefit from the expertise of experienced traders and potentially improve their own trading results.

Profile and performance evaluation

Traders on the HF Markets social trading platform have their own profiles, where they can showcase their trading performance, strategies, and other relevant information. This allows other traders to evaluate their track record and make informed decisions about whom to follow.

Social interaction

The social trading platform provided by HF Markets enables traders to interact with each other, share trading ideas, and discuss market trends. This social interaction creates a supportive community where traders can learn from each other and exchange valuable insights.

Risk management tools

To ensure responsible trading, HF Markets incorporates risk management tools into its social trading platform. Traders can set limits on the amount of capital they are willing to risk, implement stop-loss orders, and customize their risk preferences to align with their trading strategies.

Optimizing your HFcopy trading experience

Optimizing your HF Markets social trading experience is essential to maximize your potential for success. In this section, we will explore strategies and techniques to enhance your social trading journey. We will discuss the importance of developing a social trading strategy, analyzing market trends, and engaging with other traders.

A well-defined social trading strategy is crucial for achieving consistent results. Consider the following steps when developing your strategy:

- Set clear goals

Define your trading goals and objectives. Are you looking to generate short-term profits or focus on long-term investment growth? Understanding your goals will help you tailor your social trading strategy accordingly.

- Determine risk tolerance

Evaluate your risk tolerance and set appropriate risk management parameters. Consider factors such as the percentage of capital you are willing to risk per trade and the maximum drawdown you are comfortable with.

- Selecting traders to follow

Based on your goals and risk tolerance, choose traders to follow whose strategies align with your own. Consider their trading style, performance, and risk management techniques. Remember to diversify your portfolio by following traders with varying trading approaches.

- Monitor and evaluate

Regularly monitor the performance of the traders you are following and evaluate their suitability for your portfolio. If a trader’s performance deviates significantly from your expectations or their strategy changes, consider adjusting your allocation or replacing them with a more suitable trader.

- Utilize HF Markets research and tools

Take advantage of the research and analysis tools provided by HF Markets. These resources can offer valuable insights, market commentary, and technical analysis reports to aid your decision-making process.

Common mistakes to avoid in HF Markets Social trading

While HF Markets’ Social trading offers numerous benefits, it is important to be aware of common mistakes that traders often make. By avoiding these pitfalls, you can improve your social trading experience and minimize potential losses.

Ignoring market news

One of the biggest mistakes traders make in social trading is ignoring market news and economic events. Staying informed about market developments is crucial for making informed trading decisions. By neglecting to keep up with the latest news, you may miss important market-moving events that can significantly impact your trades. Stay updated with economic indicators, central bank decisions, geopolitical events, and other relevant news that can affect the assets you are trading.

Following too many traders

In the excitement of social trading, it can be tempting to follow numerous traders in the hope of finding the next big winner. However, following too many traders can lead to information overload and confusion. It is important to be selective and follow a manageable number of traders whose strategies align with your goals and risk tolerance. Quality over quantity is key when it comes to selecting traders to follow.

Not adjusting strategy based on market changes

The markets are dynamic and constantly evolving. Failing to adjust your trading strategy based on market changes can lead to poor performance. It is crucial to regularly review and adapt your strategy to align with current market conditions. Monitor the performance of the traders you follow, analyze market trends, and adjust your portfolio allocation accordingly. Flexibility and adaptability are key traits for successful social trading.

Neglecting risk management

Risk management is a fundamental aspect of trading, and it is equally important in social trading. Neglecting proper risk management techniques can expose you to unnecessary risks and potential losses. Set appropriate risk limits, implement stop-loss orders, and diversify your portfolio to manage risk effectively. Remember that not all trades will be successful, and it is essential to protect your capital.

Lack of due diligence

Trusting blindly in the performance of others without conducting your own due diligence is a common mistake in social trading. While it is important to follow successful traders, it is equally important to understand their trading strategies and the rationale behind their trades. Conduct thorough research, analyze their performance history, and evaluate their risk management techniques. By doing your due diligence, you can make informed decisions and increase your chances of success.

By avoiding these common mistakes, you can enhance your social trading experience and increase your chances of success. Remember to stay informed, be selective with whom you follow, adapt your strategy to market conditions, prioritize risk management, conduct due diligence, and align with your own risk tolerance.

Navigating the future of HF Markets Social trading

Looking ahead, the future of HF Markets’ Social trading appears promising. As technology continues to advance, Social trading platforms are likely to become more sophisticated, offering improved features and enhanced user experiences. Traders can expect more robust tools for analysis, greater connectivity, and increased integration with other platforms and services.

To stay ahead in the evolving world of Social trading, it is essential to continue learning and adapting. Stay updated with market trends, explore new strategies, and engage with the social trading community. As you gain experience and refine your skills, you can unlock the full potential of HF Markets Social trading and potentially achieve your trading goals.

In conclusion, understanding HF Markets Social trading opens up a world of opportunities for traders. By leveraging the power of Copy trading, you can learn from experienced traders, share insights, and potentially improve your trading results. However, it is important to approach social trading with caution, avoiding common mistakes and conducting proper due diligence.

So, embrace the world of HF Markets Social trading, develop a sound strategy, analyze market trends, engage with the community, and navigate your way towards trading success. Start now by opening a trading account with the broker by clicking the link below:

Related articles:

Social trading with HFcopy of HF Markets - FAQ