Exploring the advanced trading tools of NAGA Markets

NAGA, also known as NAGA Markets, is a reputable online brokerage firm that specializes in multi-asset trading. Established in 2015, NAGA has quickly gained recognition in the financial industry for its innovative and user-friendly trading platform. The broker is headquartered in Cyprus and is regulated by the Cyprus Securities and Exchange Commission (CySEC), ensuring compliance with rigorous financial regulations.

NAGA offers a wide range of financial instruments for trading, including forex currency pairs, stocks, indices, cryptocurrencies, and commodities. One of the standout features of NAGA is its social trading platform, which allows users to engage in Social trading, automatically copy the trades of experienced traders, and interact within a vibrant trading community.

In addition to its Social trading capabilities, NAGA provides traders with advanced charting tools, educational resources through the NAGA Academy, and various risk management features. This combination of features and services makes NAGA a popular choice among both novice and experienced traders looking for a comprehensive trading experience. It’s worth noting that the availability of services and features may vary based on the user’s location and regulatory restrictions. Traders should always perform due diligence and consider their specific trading needs when selecting a broker like NAGA.

In this article, we will delve into some of the advanced trading features that make NAGA Markets stand out in the competitive world of online trading.

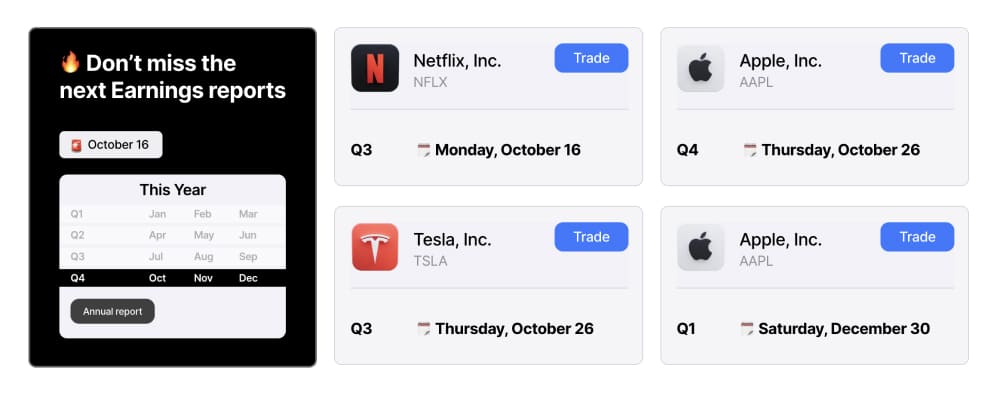

Social trading with NAGA Markets

NAGA Markets has revolutionized online trading by introducing the concept of Social trading. This feature allows users to follow and copy the trades of experienced traders, creating a unique and engaging community of traders. NAGA Social Trading operates on the principle that success leaves traces, and by following the strategies of skilled traders, newcomers can learn, adapt, and potentially profit from their insights.

- NAGA leaderboard: NAGA Social Trading features a Leaderboard, which displays a list of the top-performing traders on the platform. Users can assess the traders’ performance metrics, including their historical returns, risk levels, and trading styles. This transparency empowers users to make informed decisions when selecting traders to follow.

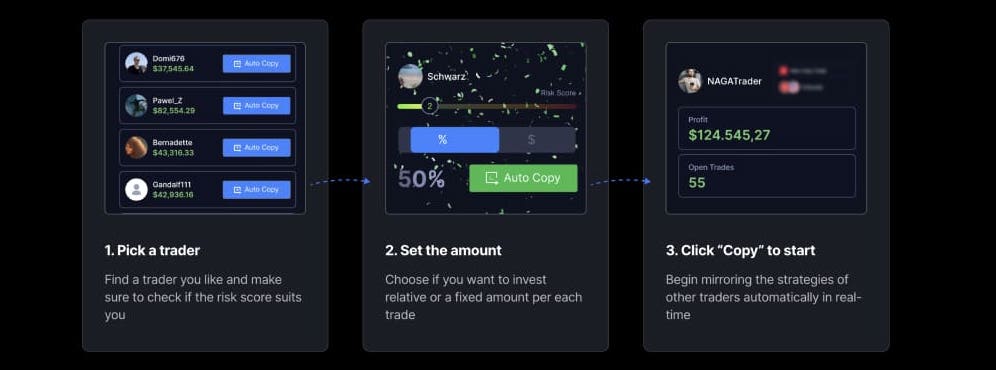

- Auto-Copying: To facilitate ease of use, NAGA Markets offers an Auto-Copy feature. With Auto-Copy, users can allocate a portion of their trading capital to automatically mimic the trades executed by the traders they follow. This hands-off approach enables users to benefit from the expertise of others while managing their portfolios effectively.

- Community interaction: NAGA Social Trading goes beyond merely copying trades. It fosters community interaction through features like live chat, comments, and likes on traders’ profiles and posts. This social aspect creates a collaborative and supportive environment for traders to exchange ideas and insights.

- Performance Analysis: Users can conduct an in-depth analysis of each trader’s historical performance, allowing them to assess factors such as risk-adjusted returns, trading frequency, and portfolio composition. This information helps users make informed decisions about whom to follow.

- Diversification: Social trading on NAGA Markets enables users to diversify their portfolios by following multiple traders with different strategies. This diversification can reduce risk and potentially improve overall portfolio performance.

NAGA Autocopy feature

NAGA Autocopy is an advanced feature that allows users to automate their trading strategies based on the actions of selected top-performing traders. Users can set their risk preferences and allocate funds to be automatically invested in the trades of their chosen traders. NAGA Autocopy ensures that users can benefit from the expertise of others while maintaining control over their investment parameters. This feature empowers traders to diversify their portfolios and reduce the time and effort required for active trading.

NAGA Academy of Forex education

Education is a cornerstone of success in trading, and NAGA Markets recognizes this by offering the NAGA Academy. This feature provides a wealth of educational resources, including webinars, video tutorials, and articles, to help traders improve their skills and understanding of the financial markets. Whether you are a novice or an experienced trader, the NAGA Academy can enhance your knowledge and keep you updated on market trends and analysis.

Here’s a closer look at what the NAGA Academy offers:

- Comprehensive educational material

The NAGA Academy provides a wide range of educational material, including articles, video tutorials, webinars, and more. These resources cover various topics, such as market analysis, trading strategies, risk management, and trading psychology.

- User-Friendly Learning

The platform’s educational content is presented in a user-friendly and accessible manner, making it easy for traders to navigate and find the information they need. Whether you’re new to trading or an experienced trader, you can find relevant and engaging material to enhance your knowledge.

- Live webinars

NAGA Markets frequently hosts live webinars conducted by industry experts. These webinars cover a variety of trading-related subjects, providing traders with the opportunity to learn from professionals in real time. Webinars also offer a chance for participants to ask questions and engage with the presenters.

- Educational articles

The NAGA Academy offers a library of informative articles that cover a wide array of trading topics. These articles provide in-depth insights into market analysis techniques, trading strategies, and timely market updates.

- Video tutorials

Visual learners will appreciate the platform’s video tutorials. These videos break down complex trading concepts into easy-to-understand visuals, making it simpler for traders to grasp important ideas and strategies.

- Interactive quizzes and assessments

To reinforce learning, the NAGA Academy often includes quizzes and assessments that allow traders to test their knowledge. These interactive features help traders gauge their understanding and identify areas for improvement.

- Access for all

The NAGA Academy is not limited to NAGA Markets account holders. It’s open to anyone interested in learning about trading, even if they haven’t yet registered for an account. This inclusivity reflects NAGA Markets’ commitment to educating and empowering traders worldwide.

NAGA advanced charting tools

NAGA Markets offers a robust set of advanced charting tools that empower traders to make informed and precise trading decisions. These tools are designed to provide traders with comprehensive insights into price movements, trends, and technical indicators, enhancing their ability to analyze and trade the financial markets effectively.

- Customizable charts

NAGA Markets’ trading platform provides customizable charts, allowing traders to tailor their charts to their specific preferences. Traders can adjust the chart’s timeframes, choose different chart types (candlestick, bar, line), and apply various technical indicators and drawing tools to suit their analysis style.

- Technical indicators

The platform offers a wide range of technical indicators, including moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), Bollinger Bands, and more. Traders can overlay multiple indicators on their charts to gain deeper insights into market dynamics and potential trading opportunities.

- Multiple timeframes

NAGA Markets allows traders to view price data on different timeframes, from minutes to days or even months. This feature enables traders to zoom in for short-term analysis or zoom out for longer-term trend assessment, ensuring they have a holistic view of market movements.

- Drawing tools

Traders can make use of drawing tools such as trendlines, support, and resistance lines, and Fibonacci retracements to mark key price levels and patterns on their charts. These tools aid in identifying potential entry and exit points for trades.

- Real-time data

The platform provides real-time data updates, ensuring that traders have access to the most current market information. This is crucial for making timely and accurate trading decisions.

- Multi-Asset charting

NAGA Markets offers multi-asset charting, allowing traders to analyze different asset classes, including forex, stocks, indices, cryptocurrencies, and commodities, all on the same platform. This versatility enables traders to diversify their portfolios and capitalize on various market opportunities.

- User-friendly interface

The charting tools are integrated into a user-friendly interface, making it easy for traders of all skill levels to navigate and analyze charts effectively. Whether you’re a beginner or an experienced trader, you can seamlessly access and utilize these advanced charting features.

- Advanced analysis

With access to these advanced charting tools, traders can perform in-depth technical analysis, and identify trends, potential reversals, and key support/resistance levels. This analysis forms the foundation of their trading strategies, helping them make informed decisions and manage risk effectively.

As you can see, NAGA Markets’ advanced charting tools provide traders with the essential capabilities needed to analyze financial markets comprehensively. These tools, from customizable charts and technical indicators to real-time data and multi-asset charting, empower traders to conduct thorough technical analysis and develop effective trading strategies. Whether you’re a day trader, swing trader, or long-term investor, these advanced charting features enhance your ability to navigate the markets with precision and confidence.

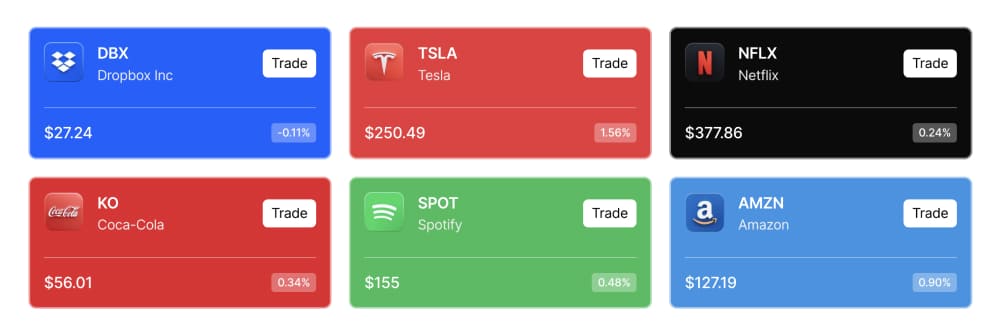

NAGA multiple asset classes

NAGA Markets distinguishes itself by providing traders access to a diverse array of asset classes, making it a one-stop platform for comprehensive trading. Here’s a closer look at the key asset classes available on NAGA:

NAGA Forex (Foreign Exchange) trading

NAGA Markets offers a broad selection of forex currency pairs, allowing traders to engage in the largest and most liquid financial market in the world. Whether you’re interested in major, minor, or exotic currency pairs, you can trade them on the platform. Forex trading enables participants to speculate on the exchange rate between two currencies, providing opportunities for profit in both rising and falling markets.

NAGA stocks trading

NAGA Markets provides access to a wide range of global stocks, allowing traders to invest in the shares of prominent companies across various industries and markets. With this asset class, traders can build diversified portfolios and capitalize on the growth potential of individual stocks.

NAGA Indices

Traders can also trade indices on NAGA, which represent the performance of a group of stocks from a particular stock exchange or sector. Indices are used to gauge the overall health and direction of a specific market or industry. NAGA offers a selection of major indices from around the world, including the S&P 500, FTSE 100, and Germany 30 (DAX).

Cryptocurrencies trading

Cryptocurrency enthusiasts will find a compelling range of digital assets to trade on NAGA. This includes popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and many others. The crypto market operates 24/7, providing traders with flexibility and opportunities for both short-term and long-term trading strategies.

NAGA commodities trading

NAGA Markets also offers commodities trading, allowing traders to speculate on the price movements of physical goods like gold, oil, silver, and agricultural products. Commodities provide diversification opportunities and can act as a hedge against inflation and economic uncertainties.

The availability of these diverse asset classes on a single platform sets NAGA Markets apart, making it convenient for traders to explore different markets and asset types without the need for multiple accounts or platforms. This versatility enables traders to adapt to changing market conditions and take advantage of various trading opportunities.

Furthermore, NAGA’s user-friendly interface and integrated tools for technical analysis and risk management make it easier for traders to navigate and analyze these asset classes effectively. Whether you’re interested in currency trading, stocks, indices, cryptocurrencies, or commodities, NAGA Markets provides a comprehensive and seamless trading experience to cater to your specific financial interests and goals.

NAGA risk management features

Effective risk management is essential in trading, and NAGA Markets provides several risk management features to help traders protect their capital. These include stop-loss and take-profit orders, as well as advanced risk settings for NAGA Autocopy users. These tools enable traders to define their risk tolerance and automatically exit trades to limit potential losses or secure profits. Here are the risk management features available on the platform:

- Stop-Loss orders

One of the fundamental risk management tools, stop-loss orders, allows traders to set predetermined price levels at which their positions will automatically be closed to limit potential losses. NAGA Markets enables traders to customize their stop-loss orders, tailoring them to their risk tolerance and trading strategies.

- Take-Profit orders

In addition to stop-loss orders, NAGA Markets offers take-profit orders. These orders allow traders to specify price levels at which their positions will be automatically closed to secure profits. Take-profit orders help traders lock in gains and prevent emotional decision-making.

- Trailing stop

NAGA Markets’ trailing stop feature is a dynamic stop-loss order that adjusts itself as the market moves in favor of the trader. This tool allows traders to capture potential profits while also protecting against sudden reversals. Trailing stops automatically move in the direction of the trade, helping traders optimize their exits.

- Negative balance protection

NAGA Markets provides negative balance protection to its clients. This means that even in highly volatile markets or extreme price movements, traders cannot lose more than their account balance. This feature offers peace of mind to traders, ensuring they do not end up owing the broker more than their initial investment.

- Risk settings for NAGA Autocopy

For traders using the NAGA Autocopy feature, risk management is paramount. NAGA Markets allows users to customize risk settings when auto-copying other traders. Traders can adjust the allocation of funds and set risk limits to ensure that their portfolio aligns with their risk tolerance.

- Margin requirements

NAGA Markets provides clear information about margin requirements for each asset class. Traders can monitor their margin levels to ensure they have sufficient capital to maintain their positions, reducing the risk of margin calls and forced liquidations.

By integrating these risk management tools into its platform, NAGA Markets empowers traders to proactively manage and mitigate risks associated with trading in financial markets. Whether you’re a conservative trader looking to protect your capital or a more aggressive trader seeking to optimize profits while minimizing losses, NAGA Markets provides the tools and resources needed to implement sound risk management strategies. These features are essential for maintaining long-term success and financial stability in the world of online trading.

From novice to pro: unleashing the power of NAGA Markets advanced trading features

NAGA Markets has established itself as a leading online trading platform, thanks to its innovative and advanced features. Social trading, NAGA Autocopy, the NAGA Academy, advanced charting tools, a wide range of asset classes, and robust risk management features make NAGA Markets a versatile and powerful tool for traders of all levels of expertise. Whether you are a beginner looking to learn from the best or an experienced trader seeking a comprehensive trading platform, NAGA Markets has something to offer. It’s a platform that combines the wisdom of the crowd with cutting-edge technology, making it a compelling choice for anyone interested in the world of online trading.

Related articles:

NAGA, a reputable and regulated Forex and CFDs broker, offers Social trading opportunities. Join the network of professional traders to learn from market experts, automatically copy their trades, and possibly make some money while you sleep.

NAGA trading markets and instruments offer a comprehensive array of investment opportunities. You can invest in real stocks and Cryptocurrencies, and speculate on currency pairs, commodities, futures, and ETF CFDs. With the added benefit of leverage, you can amplify your trading potential. Enjoy the advantage of minimal commissions and low spreads, ensuring cost-effective trading. The platform caters to diverse preferences with its wide range of instruments, making NAGA a prime choice for traders seeking a well-rounded trading experience.

Explore a thorough examination of NAGA Markets’ trading platforms performed by market professionals at TopForex.trade. Acquire a comprehensive understanding of the broker’s main Web and mobile trading application, along with the MT4 and MT5 terminals. This assessment encompasses vital elements such as technical requirements, charting features, signal offerings, and supplementary functionalities.

NAGA Markets advanced FX trading features - FAQ