Forex trading with Plus500: open an account with a reliable broker

Since its establishment in 2008, Plus500 has emerged as a prominent online broker, specializing in providing CFD trading services for a wide range of assets including shares, currency pairs, precious metals, commodities, oil and gas, and indices.

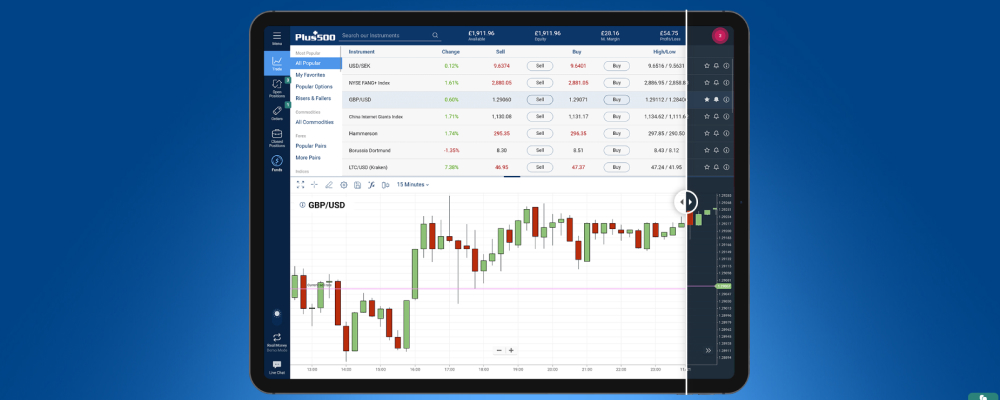

One of the distinguishing features of Plus500 is its convenient accessibility. Traders can access the platform without the need for any software downloads. Plus500 offers Web Trader for both Windows and macOS, as well as mobile versions for smartphones and tablets. The web version boasts a unique design and functionality, offering a comprehensive selection of analysis and forecasting tools. On the platform’s main screen, users can choose from a variety of instruments and indicators, connect to news sources, and utilize the economic calendar.

With a global reach, Plus500 serves traders from various regions and operates under the regulation of multiple authorities. These include the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), the Seychelles Financial Services Authority (SFSA), the Australian Securities and Investments Commission (ASIC) with an Australian Financial Services License (AFSL), the Financial Markets Authority (FMA) in New Zealand, the Monetary Authority of Singapore (MAS), and the Financial Sector Conduct Authority (FSCA) in South Africa.

The platform offers three types of accounts: Retail, Pro, and demo. This article will provide an in-depth review of the different account types offered by Plus500. Whether you’re interested in honing your skills through the demo account or ready to engage in live trading with a real account, Plus500 offers a reliable and feature-rich platform to meet your trading needs.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Plus500 Retail account

With a minimum deposit of $100, Plus500 offers a comprehensive trading experience through its standard retail trading account, which caters to a wide range of traders.

Traders utilizing the Plus500 standard trading account have access to an extensive range of financial instruments across various categories. Crypto СFDs (availability subject to regulations)can be traded with leverage up to 1:2; Indices: up to 1:20; Forex: up to 1:30; Commodities: up to 1:20; Shares: up to 1:5; Options: up to 1:5; ETFs: up to 1:5;

One of the key advantages of the Plus500 standard trading account is the protection it provides to retail traders. Client money protection ensures the segregation of client funds from the company’s operational funds, adding an extra layer of security. Additionally, negative balance protection guarantees that traders cannot lose more than their account balance, protecting them from excessive losses. Transparent execution and pricing, real-time disclosure, product disclosure statement, and financial services guide, recourse to AFCA (Australian Financial Complaints Authority), and margin close-out protection further enhance the trader’s experience, ensuring transparency, accessibility to information, and appropriate safeguards.

It’s important to note that Plus500’s standard trading account operates without inducements, which means there are no incentives or bonuses provided to traders. This policy ensures that traders make decisions based on their own judgment and reduces the risk of potential conflicts of interest.

In summary, Plus500’s standard trading account offers a wide range of leveraged trading opportunities across multiple financial instruments. With robust protections in place and a commitment to transparency, traders can engage in the markets with confidence, knowing that their funds and interests are safeguarded.

Plus500 Professional account

In addition to their standard trading account, Plus500 also offers a Professional account tailored to meet the needs of experienced traders. The Plus500 Professional account provides enhanced leverage options and additional benefits.

Traders utilizing the Plus500 Professional account gain access to a wider range of leveraged trading opportunities across various instrument categories. Crypto СFDs (availability subject to regulations)can be traded with leverage up to 1:2; Indices: up to 1:20; Forex: up to 1:30; Commodities: up to 1:20; Shares: up to 1:5; Options: up to 1:5; ETFs: up to 1:5;

Similar to the standard account, the Plus500 Professional account prioritizes the protection of client funds. Client money protection ensures the segregation of client funds from the company’s operational funds, adding an extra layer of security. Negative balance protection guarantees that traders cannot lose more than their account balance, protecting them from excessive losses. Transparent execution pricing and real-time disclosure ensure that traders have access to transparent information and market data.

It’s important to note that some features differ between the Professional account and the standard account. The Professional account does not require a product disclosure statement and financial services guide or provide recourse to AFCA (Australian Financial Complaints Authority). However, it allows for higher leverage and includes inducements, which may include incentives or bonuses to traders.

All in all, the Plus500 Professional account is designed for experienced traders who seek increased leverage options and additional benefits. With robust protections in place, including client money protection and negative balance protection, traders can engage in the markets with confidence. The Professional account offers a broader range of leveraged trading opportunities, enabling traders to pursue their strategies with greater flexibility.

Plus500 demo account

Plus500 also offers a demo account option for traders who want to practice their trading strategies or get familiar with the platform before investing real money. The Plus500 demo account provides a risk-free environment where traders can trade virtual funds without any financial obligations.

The demo account mirrors the features and functionality of the live trading account, allowing traders to experience the same trading conditions and access to a wide range of financial instruments. Traders can practice trading CFDs on stocks, indices, Forex, commodities, Cryptocurrencies (availability subject to regulations), options, and ETFs, among others.

The demo account operates in real-time market conditions, providing traders with an authentic trading experience. It enables traders to test different trading strategies, explore various financial instruments, and familiarize themselves with the platform’s features, tools, and order execution processes.

By utilizing the demo account, traders can gain valuable hands-on experience and refine their trading skills without the risk of losing real money. It is an excellent resource for beginners who are learning the ropes of trading and for experienced traders who want to experiment with new strategies or fine-tune their existing approaches.

Plus500 trading accounts summary

Plus500 offers two main trading account options: the Standard account and the Professional account. The Standard account has a $100 minimum deposit, accessible to traders in 50+ countries. It provides a wide range of instruments, competitive spreads, leverage up to 1:30, and various protection features. The Professional account is for experienced traders, with enhanced leverage options and additional inducements. Plus500 also offers a demo account for practice trading. Choose the account that suits your needs and level of experience and click our special button to start.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Related articles:

Discover Plus500, the undisputed leader in the world of online CFDs trading, where clients are presented with unparalleled trading tools and an extensive range of trading instruments. At TopForex.trade, our team of experts delves into the diverse asset offerings provided by Plus500, which encompass CFDs on Forex pairs, commodities, indices, ETFs, and numerous other options. In this article, we will unveil how you can access an exceptional selection of over 2800 instruments for trading, along with the opportunity to explore a complimentary demo account and an extensive collection of educational resources aimed at elevating your trading results.

In a comprehensive evaluation of the Plus500 demo account, a professional review explores the platform’s highly coveted CFD trading instruments, an extensive suite of risk management tools, and a variety of indicators. Moreover, the review emphasizes the noteworthy feature of a virtual balance of up to $40000, allowing users to simulate various trading scenarios. Additionally, the review provides user-friendly, step-by-step registration instructions, ensuring a seamless onboarding experience for all users.

Experience the full potential of Plus500’s mobile trading app and stay effortlessly connected to the ever-changing CFD markets wherever you go. Explore its intuitive interface, a diverse range of trading instruments, real-time quotes, and state-of-the-art charting tools. Empower yourself to effortlessly manage your trades from any location using this secure and regulated trading app, trusted by traders worldwide. Enjoy the freedom to seize opportunities and take control of your trading journey with ease through Plus500’s mobile app.

Plus500 trading accounts - FAQ