eToro

eToro broker review: unveiling your Social investment network

eToro stands out as a prominent Social trading and investment platform that has garnered substantial recognition within the financial sector. It has redefined the landscape of trading and investing by presenting a distinctive blend of user-friendly functionalities and social engagement.

Fundamentally, eToro strives to democratize trading, making it accessible and enjoyable for individuals at all skill levels. The platform boasts an extensive array of tradable financial instruments, encompassing currency pairs, stocks, Cryptocurrencies, commodities, indices, and more.

A notable distinguishing feature of eToro is its Social trading capability, allowing users to connect with a diverse global community of traders. This fosters a unique environment for learning and collaboration, enabling users to track and replicate the trades of successful investors.

The eToro mobile app extends the platform’s capabilities directly to users’ fingertips, available for download on both iOS and Android devices. The app delivers a seamless on-the-go trading experience with an intuitive interface, simplifying navigation and trade execution through a few taps.

Providing real-time market data, including live quotes, charts, and market depth, eToro’s app keeps users well-informed about the latest market trends. Additionally, advanced trading tools like technical indicators and drawing tools empower users with in-depth analysis of price patterns.

eToro places a high priority on the security and confidentiality of users’ funds and personal information. Rigorous security measures, including two-factor authentication, are in place to safeguard user accounts. The platform is licensed and regulated by reputable financial authorities, ensuring adherence to industry standards and regulations.

Choosing eToro as your broker offers several compelling reasons:

eToro safety and regulations

eToro places a paramount emphasis on regulatory compliance and security measures to ensure a safe and transparent trading environment for its users. The platform is governed by various financial regulatory authorities across different jurisdictions, underscoring its commitment to upholding industry standards. Here are the regulatory details for eToro:

1. UK regulation:

- Regulated by the Financial Conduct Authority (FCA).

- Registered under Company No. 07973792.

- Authorized to offer cryptocurrency services under UK regulations.

2. Europe regulation:

- Regulated by the Cyprus Securities Exchange Commission (CySEC).

- Listed in De Nederlandsche Bank N.V. public register.

- Registered with the French Financial Markets Authority (AMF) as a digital assets services provider.

3. Middle East, Australia, Seychelles, USA, and Gibraltar:

- In the Middle East, licensed and regulated by the Abu Dhabi Global Market (ADGM).

- In Australia, regulated by the Australian Securities & Investments Commission (ASIC).

- In Seychelles, licensed by the Financial Services Authority Seychelles (FSAS).

- In the USA, registered as a Money Services Business (MSB) with FinCEN and holds Money Transmitter Licenses (MTLs).

- In Gibraltar, eToroX is authorized and regulated by the Gibraltar Financial Services Commission (through eToroX is not longer available for retail users).

These regulatory affiliations demonstrate eToro’s commitment to transparency, investor protection, and ethical conduct. By aligning with reputable regulatory bodies in each jurisdiction, eToro aims to instill confidence in its users, assuring them of a secure and compliant trading environment. Additionally, eToro’s adherence to rigorous security measures, such as two-factor authentication, further reinforces its dedication to safeguarding user accounts and personal information.

eToro trading instruments

eToro offers diverse trading instruments and markets, providing users with a comprehensive and versatile platform for their investment needs (CFD Crypto is not allowed under FCA).

eToro currency pairs trading

eToro facilitates the trading of 51 currency pairs, covering majors, minors, and exotics. With a minimum spread starting at 1 pip, users can employ leverage up to 1:30 (or up to 1:400 for Professional Clients).

eToro stocks and ETFs trading

Traders gain real-time access to global exchanges, with eToro offering trading in 4105 stocks and 421 ETFs across various sectors. Some stocks involve direct ownership, while others are traded through CFDs, with low commissions on direct share trading and a minimum investment as low as $10. Fractional shares are available, allowing investment based on the desired dollar amount.

eToro commodities trading

eToro simplifies commodity trading through CFDs, offering flexibility and high liquidity. With a selection of 32 commodities, including oil, gold, platinum, and sugar, users can trade without being limited to whole units. Leverage of up to x10 (and up to x20 on gold) enhances trading opportunities.

eToro indices trading

Traders can invest in overall market movements with 21 available index CFDs, covering popular indices like Dow Jones, S&P 500, FTSE 100, DAX 30, and Nikkei 225. eToro provides leverage of up to x20 on selected stock indices.

eToro Cryptocurrencies trading

eToro is renowned for its comprehensive Cryptocurrency offerings, providing access to 74 Cryptocurrencies, including Bitcoin, Ethereum, Ripple, and many others. The platform allows trading in various Crypto crosses, such as gold/BTC or Stellar/euro.

Users can opt to buy Cryptocurrencies directly. When purchasing the underlying asset, users fully own the Cryptocurrency, allowing for transfers, exchanges, and real-world transactions.

eToro’s user-friendly platform and extensive market coverage make it a preferred choice for traders seeking a one-stop solution for diverse trading instruments, coupled with innovative features and the security of a regulated financial technology leader.

eToro trading platforms

eToro provides a robust and user-friendly trading platform, accompanied by a mobile app, offering a unique set of features designed to enhance the trading experience for its users.

The eToro trading platform features:

- TipRanks Research Tab: Gain valuable insights with the Research Tab, which consolidates the collective knowledge of leading analysts from prominent financial institutions worldwide. This feature allows users to access expert opinions and stay informed about market trends.

- One-Click Trading: Recognizing the repetition in trading habits, eToro introduces One-Click Trading. This innovative feature allows clients to open new positions with a single click, utilizing predefined parameters for efficiency and convenience.

- Stop Loss and Take Profit: Manage positions effectively with Stop Loss and Take Profit functionalities. Clients can predefine price points for closing positions, utilizing Stop Loss to limit losses and Take Profit to secure profits at predetermined levels.

- Trailing Stop Loss: Building on the Stop Loss feature, Trailing Stop Loss enables clients to keep positions open as long as the market moves favorably. This dynamic tool adjusts the stop loss level based on market trends, providing flexibility in risk management.

- ProCharts: For in-depth technical analysis, eToro offers ProCharts, a professional-grade tool that allows users to compare charts from different financial instruments and time frames. This feature enhances analytical capabilities for informed decision-making.

- Offline trading: Acknowledging the 24/7 nature of trading, eToro allows users to place trading and investing orders even during platform maintenance. This ensures uninterrupted access to markets for users worldwide.

- Instrument variety: Trade over 3,000 financial instruments across various asset classes, including stocks, cryptocurrencies, and more.

- Deposit and withdrawal options: eToro offers flexible deposit and withdrawal options, including the innovative eToro Money. This method allows free and instant deposits with no FX conversion fees, along with instant withdrawals. Other options include wire transfers, bank cards, and more.

- Low minimum deposits and unified fees: eToro provides a user-friendly fee structure with low minimum deposits, making it accessible to a wide range of traders.

eToro mobile app

The eToro mobile app is a powerful extension of the platform, providing users with the flexibility to trade on the go. Designed with user convenience in mind, the app offers a seamless and intuitive experience, ensuring that users can manage their investments anytime, anywhere.

The eToro mobile app mirrors the functionality of the desktop platform, allowing users to execute trades, access real-time market data, and utilize a variety of tools for technical analysis. This continuity of features ensures that users can maintain a consistent trading experience across devices.

With the mobile app, users can take advantage of market opportunities and execute trades while away from their desktops. This is especially beneficial for those who prefer to stay connected to the markets and manage their portfolios in real time, providing a level of flexibility that aligns with the dynamic nature of financial markets.

eToro trading accounts

eToro presents a selection of account types to meet the varied needs of its users, each crafted with specific features and advantages:

1. Personal (Retail) account:

- Default choice: The Personal (Retail) account serves as the default option for eToro users.

- Asset diversity: Access a comprehensive array of assets, engage in copy trading, and invest in Smart Portfolios.

- Leverage limitations: While offering asset variety, there are constraints on leverage usage to ensure responsible trading.

- Consumer protection: Account holders benefit from the highest level of consumer protection.

2. Professional account:

- Enhanced leverage: Professional account holders can utilize higher leverage, providing increased market exposure.

- Criteria application: Application for a professional account is restricted to clients meeting specific criteria, ensuring a requisite level of market experience.

3. Corporate account:

- Business focus: Tailored for business purposes, corporate accounts are designated for legal entities.

- Capital utilization: Ideal for those intending to trade using business-owned capital.

- Specialized application: Suited for entities conducting trading activities on behalf of the business.

4. Islamic account:

- Sharia compliance: Crafted for Muslim clients, the Islamic account adheres to Sharia law.

- No overnight fees: eToro refrains from charging or crediting overnight fees on Islamic accounts in line with Sharia principles.

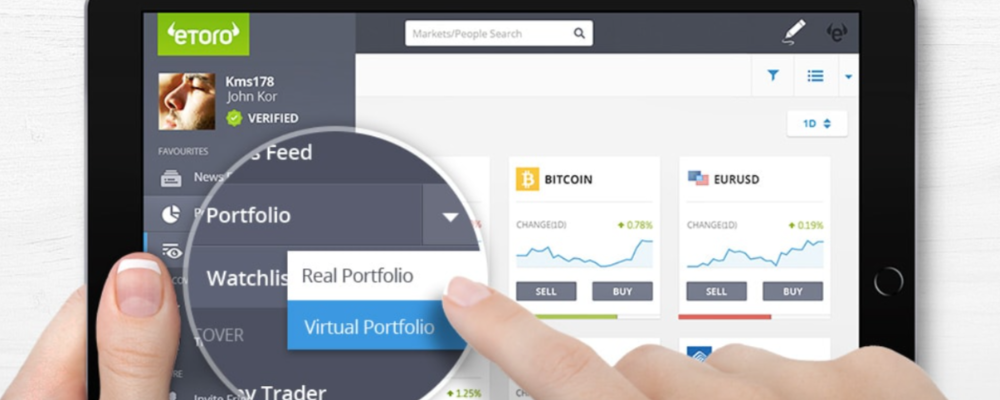

5. Demo account:

- Virtual Portfolio (Demo account): All account types, including the Islamic account, include eToro’s virtual portfolio. This demo account allows users to practice risk-free investing with $100,000 in virtual funds before engaging in live trading.

eToro’s array of account options underscores its commitment to providing personalized solutions, enabling users to select the account type that best aligns with their preferences, goals, and regulatory considerations.

eToro deposits and withdrawals

You can seamlessly manage your funds on eToro using the eToro Money solution, an e-money account managed by a mobile app that enhances the deposit and withdrawal experience on the platform.

Main eToro Money features:

- Seamless integration: eToro Money seamlessly integrates with your eToro trading account, ensuring a smooth and connected experience.

- Free and instant transactions: Enjoy the convenience of free and instant deposits with no conversion fees, allowing you to fund your investment account without delays or additional costs.

- Instant withdrawals: With eToro Money, experience the freedom of instant withdrawals, providing you with quick access to your funds whenever you need them.

- Cost-free: There are no subscription fees or hidden costs associated with eToro Money, making it a cost-effective solution for managing your finances.

- Bank or a Visa debit card account funding: Easily fund your eToro Money directly from your bank or a Visa debit card providing a straightforward and secure process.

With eToro Money, you gain a smart and efficient tool that enhances the deposit and withdrawal experience on the eToro platform. Save time, eliminate unnecessary fees, and manage your funds with ease, empowering you to focus on your investment strategies.

eToro fees and commissions

eToro prioritizes transparency in its fee structure, ensuring traders have a clear understanding of costs associated with stocks, Cryptoassets, and CFDs. Navigate the financial markets confidently, armed with the knowledge to make informed decisions about your trading activities.

Stock and ETF trading:

- Low commission trading: eToro offers low commission trading ($1 for most GEOs) for stocks and ETFs.

- Flexible investment: Invest in stocks with as little as $10, and choose between buying in bulk or fractions.

- No additional fees: Enjoy a fee-free experience with no management fees, rollover fees, ticket fees, or extra broker charges.

- Currency considerations: While USD transactions are fee-free, non-USD deposits and withdrawals may incur FX fees.

- Withdrawal fee: A nominal $5 fee applies to withdrawals.

Crypto trading:

- Transparent fee: A single, transparent fee of 1% is charged for buying or selling Cryptoassets. This fee is incorporated into the market price to reflect the Bid-Ask spread.

CFD trading:

- Competitive spread: Enjoy competitive spreads with currencies starting from 1 pip, commodities from 2 pips, and indices from 0.75 points.

- Overnight fees: CFD positions held overnight may incur fees, relative to the position value. These fees cover market forces and associated maintenance costs.

eToro Social trading: CopyTrader

We could say that eToro’s CopyTrader, which eToro themselves call their most popular feature, is a platform that allows you to copy the trading activity of experienced traders and gain from them.

But the thing is that eToro offers something more than that—it invites you to a community of like-minded people who exchange their experiences and tactics. So, with eToro, CopyTrader is not about just downloading the app and copying the gains of top performers. Rather, it’s like joining a club where the process of online trading becomes a truly social activity.

eToro trading education

eToro has a formidable educational program that includes news and analytics, market guidelines, video tutorials, daily market reviews, and online classes within eToro Academy.

The eToro Academy is a dedicated hub providing a variety of educational materials, including articles, tutorials, and webinars. It covers everything from basic concepts to advanced strategies, serving as a valuable knowledge center for skill enhancement.

Stay informed and make informed decisions with the News and Analysis section. Access real-time market updates, expert insights, and in-depth analyses of financial instruments to stay ahead of trends and make strategic investment choices.

For a deeper understanding of market trends, explore eToro Plus, offering daily, weekly, and quarterly summaries. These comprehensive analyses cover various asset classes, market conditions, and emerging trends, providing traders with the insights needed for successful navigation of the markets.

The Digest & Invest by eToro feature delivers curated, bite-sized market news and analysis. It ensures that traders can quickly grasp essential market developments without feeling overwhelmed, providing a convenient way to stay informed.

Gain insights into global retail investor sentiments with Retail Investor Beat, a quarterly survey exploring factors influencing investment decisions and outlooks. Understanding the trends and preferences of fellow investors contributes to a more well-rounded approach to market participation.

eToro’s commitment to education extends beyond the trading platform, offering a holistic approach through the eToro Academy, news and analysis features, in-depth summaries, curated content, and global investor surveys. These resources empower traders with the knowledge and insights needed to navigate the complexities of financial markets successfully.

eToro Forex trading: summary

Consider exploring eToro—it’s likely you’ll appreciate what this broker has to offer. From CopyTrade to its extensive list of trading instruments and platforms, eToro stands out as a key player in online trading. With a range of tools and perks, it strives to enhance the comfort and potential efficiency of your trades. Whether you’re a novice, an experienced trader, or interested in trying CopyTrade, eToro emerges as an excellent choice among brokers.

Disclaimer:

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

More about eToro:

eToro overall scores

This review was created for you to learn more about eToro and decide on how well it suits your needs and values. We scored it using our own criteria and methodology to present you with a full, informative report. However, some info is clearer in numbers! Please, see eToro final scores in areas that our experts consider high-priority.