eToro trading markets review

eToro is one of the most well-known brokerage companies in the world which gives you an opportunity to trade and invest in over 2000 different assets, including currencies, commodities, indices, as well as real stocks, and Cryptos, on the best terms available: minimum trading costs and low minimum deposits.

The company is licensed by reputable regulatory bodies such as FCA (UK), ASIC (Australia), and CySEC (Cyprus/Europe), that’s why millions of customers worldwide trust the broker with their funds.

The eToro platform is intuitive and does not require additional downloads. Among its website sections, you can find training, information about the company, trading conditions, as well as eToro trading markets, which we will analyze in detail in this article.

eToro trading markets

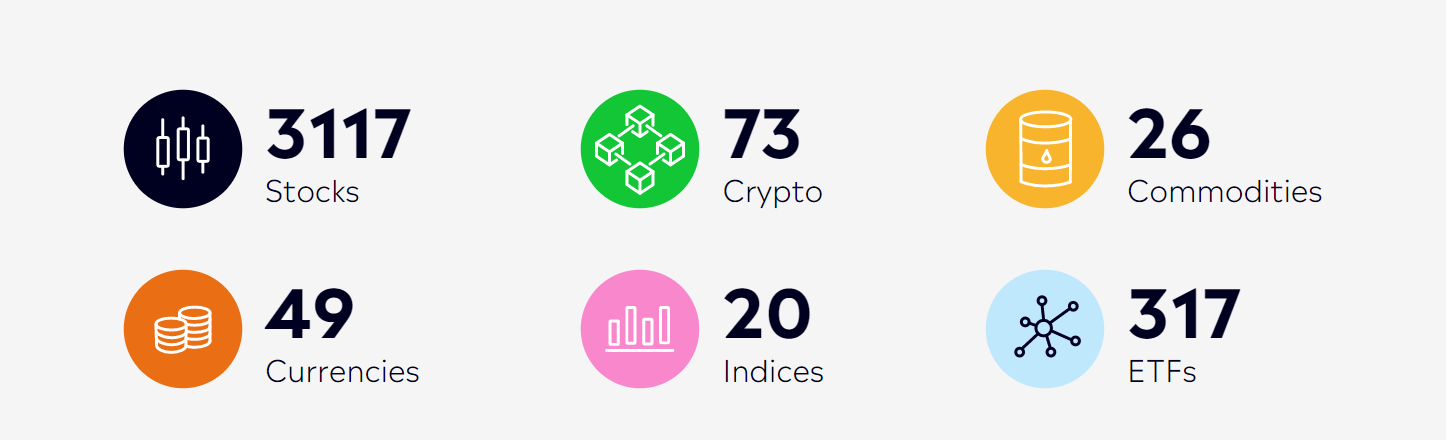

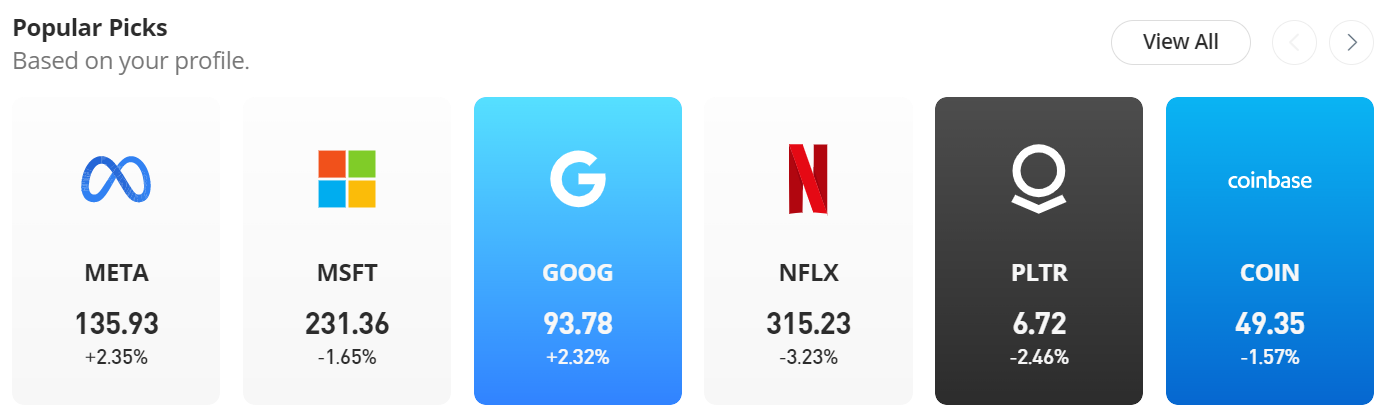

On the company’s home page, you can find eToro trading markets, among which, a trader is free to choose commodities, currency pairs, stocks, ETFs, indices, and Cryptocurrencies. Underlying assets are traded through CFDs, the broker also offers direct trading in stocks, ETFs, and Crypto.

Trading stocks and ETFs with eToro

eToro provides traders with real-time access to the world’s leading exchanges and also offers its clients trading in 3118 stocks and 300 ETFs of a variety of popular and lesser-known companies from technology to healthcare sectors.

Some stocks are purchased on the exchange in the name of the client (unless leveraged), while others are traded through CFDs, which do not involve physical ownership of the security. The CFD rate follows the price of the underlying asset but may differ slightly at certain points in time.

In addition, on the broker’s page, you can find info about leading stocks, promising stocks based on top community analysts, as well as entire stock portfolios.

Clients can also invest in fractional shares. A fractional share is a portion of the share capital that is less than one full one. Fractional shares allow you to buy shares based on the dollar amount you wish to invest.

Besides, CFDs on stocks and ETFs can be traded using leverage up to x5. This leverage does not automatically increase your position size by x5 but it simply means that you can enter a position size up to 5 times the margin balance (your deposit 100 x 5 leverage = $500 to work with).

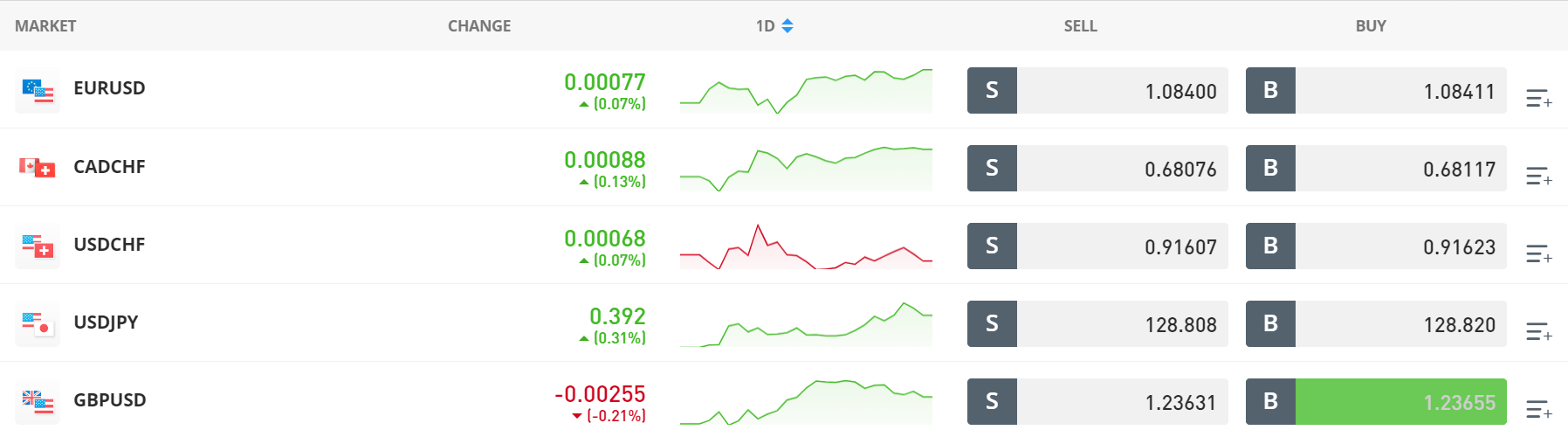

Trading currency pairs with eToro

In terms of trading currency pairs, eToro has 49, which include majors, minors, and exotics. The minimum spread when trading CFD currency pairs starts from 1 pip; it is also possible to use leverage up to x30 for major currency pairs such as EUR/USD, x20 for non-major currency pairs such as EUR/NZD (or up to 1:400 as a Professional Client).

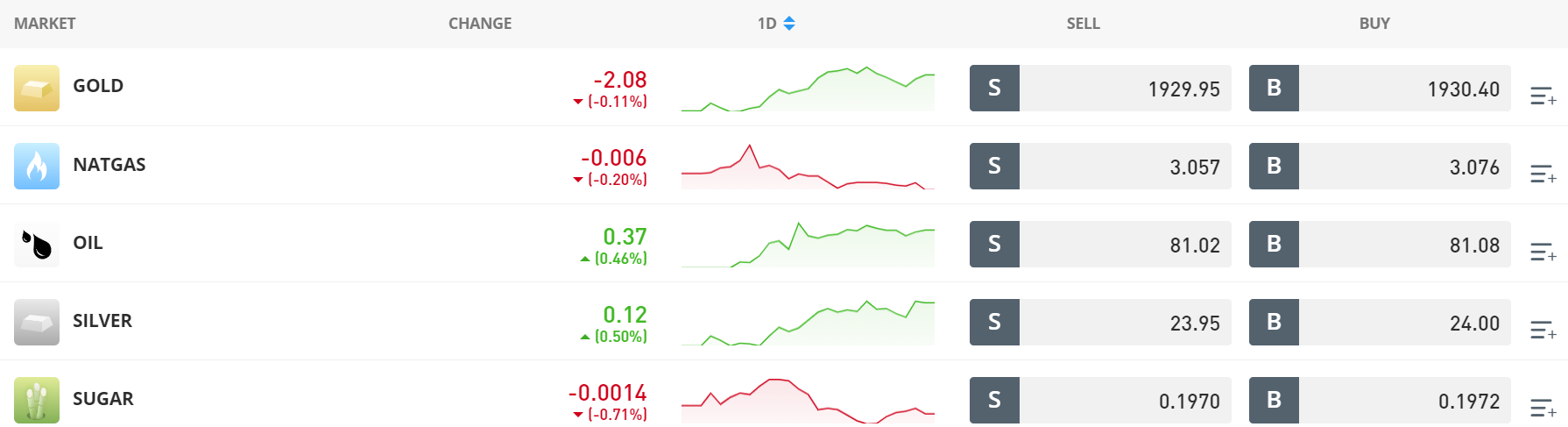

Trading commodities with eToro

eToro has made trading commodities fast and convenient via CFDs with flexible leverage and high liquidity. Clients can trade by choosing the amount to invest, not limited to units such as a whole barrel of oil or an ounce of gold.

Among commodities, customers can find oil, gold, platinum, sugar, and many others (26 offers in total). Commodity spreads start at 2 pips. Besides when trading commodities with eToro, you can use leverage up to x10 on most commodities and up to x20 on gold.

Commodity markets are open most of the week, which means you can trade on your own schedule. In addition, commodities tend to have a low correlation with traditional asset classes such as stocks and bonds. For example, gold, considered a safe-haven asset, often rises in price during periods of economic uncertainty when stocks fall. This means that commodities can add diversification to a portfolio and potentially help traders and investors reduce the overall risk of a portfolio.

To start trading commodity CFDs, a trader chooses the commodity they want to trade and then adjusts the details by selecting:

- Buy or sell. You would choose to buy if you think the price of the item will rise. This is called a “long position”. You choose to sell if you think the price of an item will fall. This is called “shorting”.

- The amount of money or the number of units you wish to trade.

- Leverage.

- Stop loss or take profit.

The trader then opens a position. The position remains open until the client either close it, or it is closed by a stop-loss or take-profit order, or until the contract expires.

In addition, there are other ways to trade commodities on eToro, such as exchange-traded funds (ETFs).

There are a number of ETFs on eToro that track the prices of commodities such as:

- SPDR Gold ETF (ticker: GLD) tracks the price of gold.

- iShares Silver Trust ETF (ticker: SLV) tracks the price of silver.

- Teucrium Corn Fund ETF (ticker: CORN) tracks corn prices.

- The Teucrium Wheat Fund ETF (ticker: WEAT) tracks wheat prices.

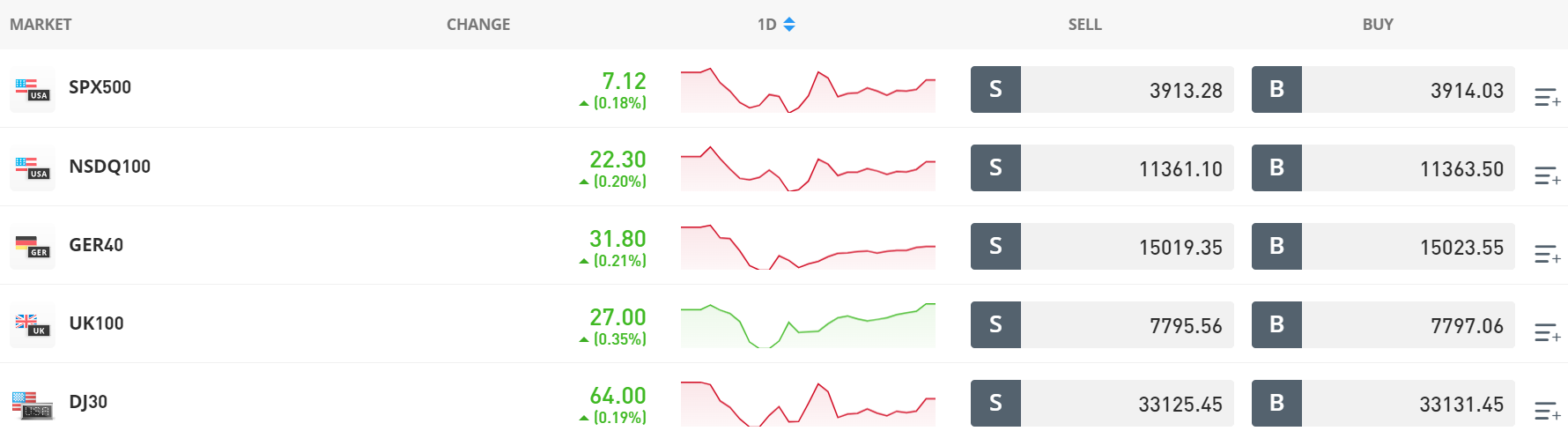

Trading indices with eToro

Traders can also invest in the overall movement of the stock market with the flexibility to manage risk as they see fit with the help of indices. There are 20 index CFDs available on the eToro platform which include some of the most popular indices to trade like the Dow Jones Industrial Average, S&P 500, FTSE 100, DAX 30, and Nikkei 225 to name a few.

In terms of leverage, eToro currently offers leverage of up to x20 on selected stock indices.

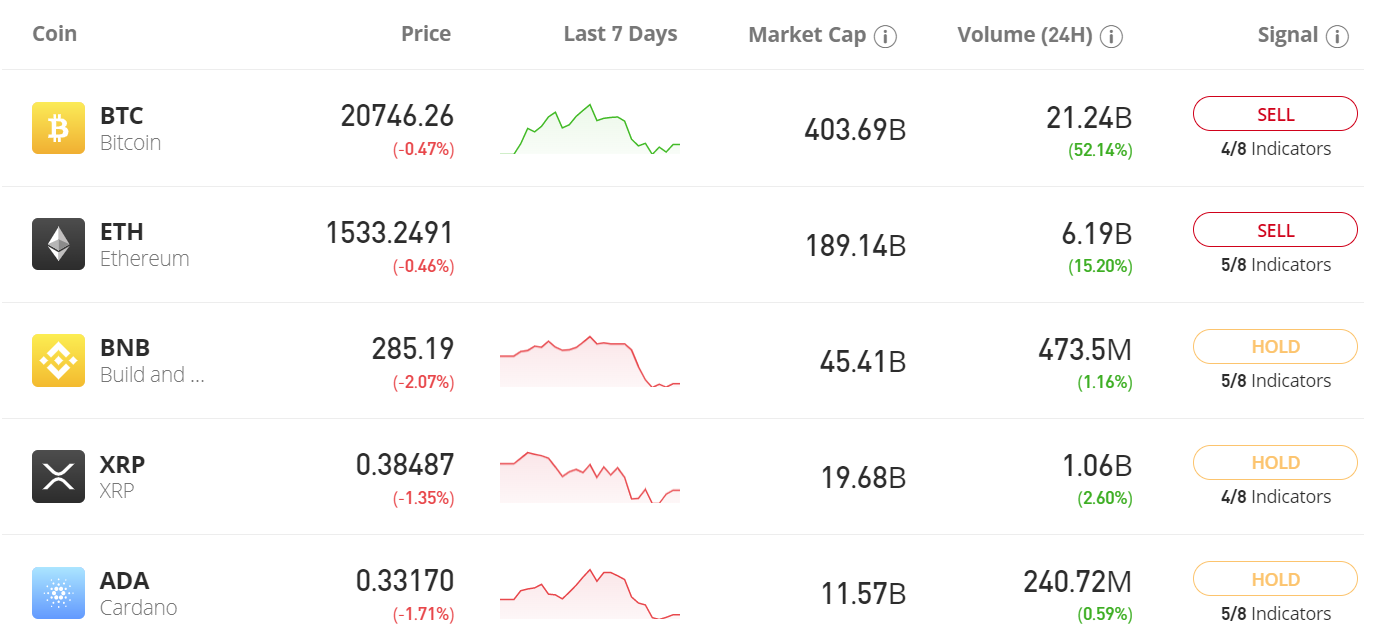

Cryptocurrency trading with eToro

eToro is known for its range of leading Crypto assets and Crypto crosses. eToro offers the ultimate Crypto solution: trading platform, wallet, and exchange in one, with the security of a regulated financial technology leader you can trust.

There are 73 Cryptocurrencies available to traders, including Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Ripple, Dash, Litecoin, Cardano, Doge, and dozens of other coins that you have probably never heard of.

Moreover, you are not only trading Cryptocurrencies against the US dollar, as is typical with most brokers. Instead, you are offered fiat, commodity, and Crypto crosses such as gold/BTC or Stellar/euro.

If you want to trade Cryptocurrency directly, you need to buy the underlying asset. The purchase of the underlying asset involves the exchange of traditional currency (i.e. US dollars) for Cryptoasset tokens (coins) such as Bitcoin, Litecoin, or XRP. When you buy Crypto in this way, eToro buys the tokens on your behalf and registers them in a separate account in your name.

The main advantage of this approach is that you fully own the Crypto asset. You can transfer tokens to your wallet, exchange them for others, send them to other people or pay for goods and services with them.

Summing up the eToro trading markets

eToro can rightfully be called one of the best platforms offering to trade in Crypto assets, stocks, ETFs, and CFDs on various commodities, indices, and much more, so every trader or investor will be satisfied with this broker.

If we talk about the conditions of trading through the eToro broker, then we can note the availability of using leverage, low spreads, and minimal commissions. It is also very convenient that all the functionality of the broker is available on the official eToro website without the need to install additional software.

Over the years, the eToro broker has established itself in the online trading community as one of the most respected brokers in the industry, regulated by such reputable organizations as the FCA (UK), ASIC (Australia), and CySEC (Cyprus/Europe). Click the button and try trading popular assets on favorable terms with eToro.

Risk disclaimer: eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Related articles:

- Social Trading: PAMM, MAM and Copy trading of Forex, stocks, commodities, Gold, and Cryptocurrencies

eToro trading markets - FAQ