Forex market for beginners: an expert guide on currency trading

Every day, around $5 trillion in FX transactions are made, averaging $220 billion every hour. Institutions, corporations, governments, and currency speculators make up the majority of the market; speculation accounts for around 90% of trading activity, with the US dollar, euro, and yen accounting for the majority of it.

Those who participate in the active exchange of foreign currencies, frequently for the aim of financial benefit or gain, are referred to as Forex traders. Some of them can be speculators looking to buy or sell a currency with the intention of benefitting from the currency’s price movement, or hedgers looking to safeguard their accounts in the case of a negative move against their own currency positions.

An individual trader using a retail platform, a bank trader using an institutional console, or hedgers who are either managing their own risk or outsourcing that role to a bank or money manager are all examples of Forex traders.

The foreign exchange market, also known as Forex (FX), is a decentralized market that allows anyone to buy and sell different currencies. Instead of using a centralized exchange, this is done over the counter (OTC).

You’ve probably previously participated in the foreign exchange market without realizing it by ordering imported goods like apparel or shoes, or, more evidently, by exchanging foreign money while on vacation. Forex traders are drawn to it for a variety of reasons, including:

- Market open 24/7;

- Wide variety of instruments to trade;

- Minimal transaction costs;

- Board market capacity;

This article aims to provide a solid foundation for the foreign exchange market, whether you are totally new to forex trading or looking to expand on your previous expertise.

The essence of the Forex market

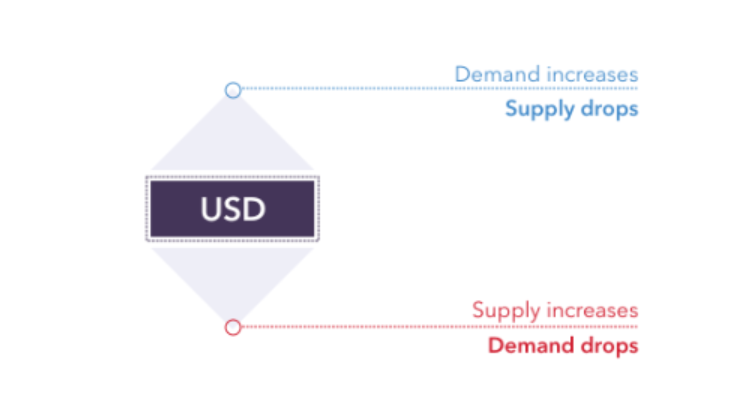

In a nutshell, the Forex market is driven by supply and demand, just like any other. To provide a simple example, if there is a high demand for the US dollar among European residents holding euros, they will convert their euros to dollars. The dollar will appreciate in value, while the euro will depreciate. Keep in mind that this transaction solely affects the EUR/USD currency combination and will not cause the USD to devalue against the Japanese Yen, for example.

Forex trading in a pair does give the trader or investor a little more flexibility by allowing them to execute their trade against the currency they feel is most appropriate.

Again taking the euro as an example, let’s imagine that a trader believes the European economy is on the upswing and wants to go long on the local currency. However, this imaginable trader is bullish on the US economy but pessimistic about the UK economy. In this case, he does not have to buy the euro against the US dollar (execute a long EUR/USD trade); instead, he can buy the Euro against the British Pound (open EUR/GBP trade).

This gives the investor or trader a little more leeway, allowing them to avoid ‘going short’ the US dollar in order to buy the euro and instead buy the euro while shorting the British pound.

In actuality, the example above is just one of many variables that can influence the Forex market. Other factors compound Fundamental analysis including broad macroeconomic events like a new president’s election, as well as country-specific factors like the current interest rate, GDP, unemployment, inflation, and the debt-to-GDP ratio, to name a few. Top traders utilize an economic calendar to keep track of these and other key data announcements that have the potential to impact the market.

Longer-term, interest rates from the connected economy are a primary driver of Forex values, as they can have a direct impact on holding a currency long or short.

How does Forex market work?

Forex trading, unlike stock or commodity trading, takes place directly between two parties in an OTC market. The currency market is controlled by a global network of banks based in London, New York, Sydney, and Tokyo, which are all located in separate time zones. You can trade Forex 24 hours a day because there is no central place.

The FX market is divided into three categories:

- Forward Forex market – A contract to purchase or sell a defined amount of a currency at a given price, to be settled at a future date or within a range of future dates.

- Futures Forex market – A contract to purchase or sell a specific amount of a given currency at a specific price and date in the future. A futures contract, unlike a forwards deal, is legally binding.

- Spot Forex market – The physical exchange of a currency pair that occurs at the precise moment the trade is settled – i.e. “on the spot” – or within a short period of time.

Most Forex brokers divide currency pairings into the following categories to keep things organized:

- Major pairs: Seven currencies account for 80% of worldwide Forex trade. EUR/USD, USD/JPY, GBP/USD, USD/CHF, USD/CAD, and AUD/USD are among the most popular currency pairs.

- Minor pairs: These are less commonly traded and often pit major currencies against each other rather than the US dollar. EUR/GBP, EUR/CHF, and GBP/JPY are all included.

- Exotics: A major currency vs a currency from a developing or emerging economy. USD/PLN (US dollar vs. Polish zloty), GBP/MXN (Sterling vs. Mexican peso), EUR/CZK (Euro vs. Czech koruna).

- Pairs from different regions: Region-based pairings, such as Scandinavia and Australasia. EUR/NOK (Euro vs. Norwegian krone), AUD/NZD (Australian dollar vs. New Zealand dollar), and AUD/SGD (Australian dollar vs. Singapore dollar).

Why Forex trading is so popular

The Forex market allows major organizations, governments, and retail traders to exchange one currency for another, and the so-called “interbank market”, where liquidity providers trade among themselves, is the “core” of the FX market.

The ability to trade currencies around the clock is one of the advantages of entering the Forex market. Before turning over to the US, the European and UK institutions come online as the Asian trading day draws to a conclusion. When the US session closes and the Asian session begins the next day, the trading day is complete.

The supply of liquidity 24 hours a day, 7 days a week makes this market even more appealing to traders. Because there are so many willing buyers and sellers of foreign exchange, traders can quickly open and close positions.

Some of the advantages of Forex over other markets are:

- Low transaction costs: Forex brokers typically profit from the spread as long as the trade is opened and concluded before any overnight funding fees are imposed. As a result, when compared to a market like equities, where a commission is charged, forex trading is more cost-effective.

- Low spreads: Due to their liquidity, major FX pairs have extremely low bid/ask spreads. When it comes to trading, the spread is the first obstacle to overcome when the market moves in your favor. Any extra pips that go in your favor are pure profit.

- More profit opportunities: Forex trading allows traders to speculate on currencies rising and falling. Furthermore, traders have a wide range of Forex pairs to choose from when looking for better trades.

- Leverage trading: Leverage used in Forex indicates that a trader does not have to pay the full cost of the trade, but only a portion of it: a solid chance to increase final profits.

Though constant currencies’ volatility may seem like something wary and unreliable, you’d be glad to know that this market is actually one of the safest to trade on thanks to the number of heavily regulated Forex brokers. There are ones that hold multiple licenses from the strictest financial authorities around the world: FCA and CySEC (European Economic Union), ASIC (Australia), MAS (Singapore), FSA (Japan), and several overs.

Moreover, these brokers often support Social trading (the ability to automatically copy moves of expert traders, earning passive income and learning from the best at the same time), which you can fund with Forex bonuses (though they are subject to geographical availability). With some of these brokers, you can get up to $5000 on your initial account top-up, get seasonal or other deposit bonuses, and try out new trading platforms without risking your own money.

Forex market terms and concepts

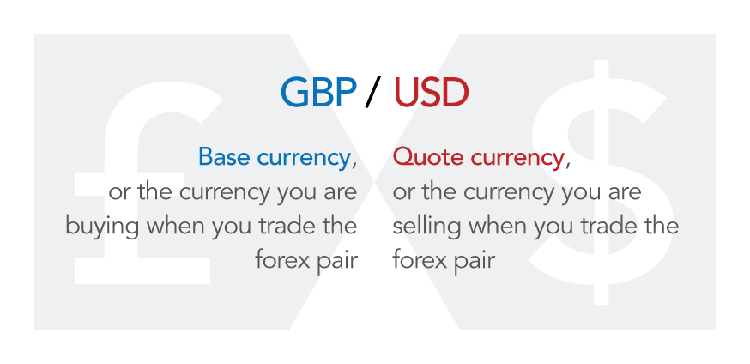

The first currency specified in a Forex pair is known as the “base currency”, while the second currency is known as the “quote currency”. The price of a Forex pair is equal to how much one unit of the base currency is worth in the quote currency. Forex trading always includes selling one currency in order to buy another, which is why it is quoted in pairs.

Each currency in the pair is represented by a three-letter code, which usually consists of two letters for the location and one for the currency. GBP/USD, for example, is a currency pair in which the Great British pound is bought and the US dollar is sold.

GBP is the base currency in the picture above, whereas USD is the quote currency. When the GBP/USD exchange rate is 1.28365, one pound is worth 1.28365 dollars.

If the pound gains value against the dollar, a single pound will be worth more dollars, and the price of the pair will climb. If it falls, the price of the pair will fall as well. You can buy a pair if you believe the base currency is likely to strengthen against the quote currency (“going long”). You can sell the pair if you believe it will weaken (“going short”).

How to trade Forex on demo accounts

One of the most significant challenges of learning a new market or learning to trade is that it can be a costly endeavor, and the risk of financial loss is often present when trading with real money on a platform.

Whenever one buys or sells a Forex pair, they are open to certain risks. Many Forex brokers, on the other hand, provide demo accounts so that new traders or prospective customers can get a feel for the market, the platform, and the dynamics of Forex trading before depositing real money.

A demo account can provide a realistic virtual environment in which a rookie trader can test strategies and manage trades with fictitious funds. This is a great place to learn about the mechanics of Forex trading, such as how to open positions, put stops, and scale out of trades.

What does move the Forex market?

The Forex market is made up of currencies from all around the world, making it difficult to predict exchange rates due to the numerous factors that might influence price changes. However, Forex, like most financial markets, is primarily driven by supply and demand dynamics, and it is critical to understand the factors that influence price movements.

Central banks

Central banks regulate nations’ money supply and can announce policies that have a big impact on the price of their currency. Quantitative easing, for example, entails infusing more money into an economy, which might lower the value of its currency.

Global News

Commercial banks and other investors like to put their money into economies with a bright future. As a result, if positive news about a particular location reaches the markets, it will promote investment and raise demand for that region’s currency.

The discrepancy between supply and demand will lead the currency’s price to rise unless there is a simultaneous increase in supply. Similarly, bad news can lead to a drop in investment and a drop in the value of a currency. This is why currencies tend to follow the region’s perceived economic health, and keeping up with market news can help to make successful trading decisions.

Market environment

Market sentiment, which is typically influenced by news, can also have a significant impact on currency pricing. If traders believe a currency is heading in a specific way, they will trade in that direction and may persuade others to do the same, raising or lowering demand.

Economic data

Economic data is crucial to currency price movements for two reasons: it provides insight into how a country’s economy is going and it predicts what its central bank will do next.

Assume that inflation in the Eurozone has climbed above the 2% target set by the European Central Bank (ECB). Increasing European interest rates is the ECB’s major policy tool for combating growing inflation, therefore speculators may start buying the euro in anticipation of higher rates. With more traders clamoring for euros, the EUR/USD could surge in value.

Credit scores

Investors will strive to acquire the best possible return from a market while minimizing their risk. They may consider credit ratings in addition to interest rates and economic statistics when determining where to invest.

The credit rating of a country is an independent assessment of its ability to repay its debts. A country with a high credit rating is considered to be a safer investment destination than one with a poor credit rating. When credit ratings are upgraded and reduced, this is typically brought to light. A country’s currency may appreciate in value if its credit rating is increased, and vice versa.

Top trusted Forex brokers

You can trade Forex in a variety of ways, but they all work the same way: you buy one currency while selling another. Many Forex transactions have traditionally been conducted through Forex brokers, but with the rise of online trading, you may now take advantage of currency price swings through derivatives such as CFDs.

CFDs are leveraged products that allow you to open a position for a fraction of the trade’s full value. You don’t own the asset, but you do take a bet on whether the market will rise or decline in value.

Yet, however, you decide to participate in the Forex market, choosing a reliable intermediary is one of the main success keys. As we mentioned above, the global FX market houses some of the most trusted players – truly client-oriented brokers that comply with multiple regulators around the world, and have gained millions of clients through decades of their existence.

Plus500 CFDs trading

Plus500 has been in business for over a decade, offering CFDs for currency pairings, commodities, stocks, Indices, and Crypto as well as a trading guide and all the tools necessary to make trading more efficient and secure.

Plus500’s customers have access to a web terminal for PCs and laptops, as well as a mobile app for Android and iOS. There are two sorts of accounts available: real and demo. The second will provide an excellent opportunity for new brokers to practice, test their trading techniques, and get valuable experience in real market situations while remaining fully risk-free.

Plus500 is regulated by the UK Financial Conduct Authority, the Australian Securities and Investments Commission, the Cyprus Securities and Exchange Commission, and the Financial Markets Authority in New Zealand, making it one of the most well-known players in the Forex market. It is also a licensed financial services provider in South Africa, holding a license from the Financial Sector Conduct Authority.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

OANDA Forex trading

OANDA – a respectable US-based broker with millions of clients worldwide and a long history of operations – has acquired a superb reputation among users over the course of more than two decades of existence, while also cooperating with a plethora of global regulators.

The broker is a fantastic choice for beginner traders because it offers demo accounts as well as thorough training resources and market insights, and there is no minimum deposit requirement. There are Forex bonuses of up to $1000 on your first deposit, as well as minimal commissions and spreads, a wide range of trading instruments including Forex, Indices, Commodities, and Crypto including Bitcoin and Ether, and advanced trading platforms and mobile apps.

NAGA Markets Forex trading

NAGA Markets is a fully licensed and regulated broker that offers more than 950 trading products and assets. Its clients can trade commodities, Cryptos, Forex, and conduct trades on futures, precious metals, ETFs, indices, and CFDs.

NAGA is licensed by several of the world’s most authoritative regulators and doctrines, including the FCA, CySEC, MiFID II, and MiFIR, allowing users to trade with little risk, even if they are novice to trading.

It is now possible to trade it on desktop and mobile versions of MT4, as well as on the broker’s own NAGA Trader platforms (Mobile app and web version). Overall, a great combination of platform features enables clients to trade, copy trades and communicate – this is a modern social trading platform offered by NAGA.

HF Markets Forex trading

HF Markets is a broker with representative brunches around the world that offers the most diverse range of trading instruments, including currency pairs, commodities, cryptocurrency, stocks, indices, metals, energies, bonds, and CFDs, and most notably – Forex Gold trading with competitive low spreads and no hidden fees.

Clients of HF Markets can select a trading account that meets their needs, such as Micro, Premium, Zero Spread, Demo, or Islamic. There is also a significant feature accessible – the Copy Trading HFcopy which allows you to mirror transactions from multiple traders at the same time.

All transactions take place across multiple platforms. You can use MT4, MetaTrader 4 Web Terminal, or dedicated mobile trading apps for Apple and iOS devices.

In terms of regulation, the broker is governed by CySEC and the FCA (Europe), the FSCA (South Africa), the DIFC (Dubai), and the SFSA (South Africa).

AvaTrade Forex trading

AvaTrade is a broker noted for offering advantageous terms for all types of assets such as currency pairs, commodities, indices, stocks, CFDs, Cryptocurrencies, and many others. Trading platforms available include MT4, MT5, Proprietary, AvaSocial, AvaTradeGo, AvaOptions, and WebTrader. If you are a frequent trader who does not want to be tethered to a computer, AvaTrade mobile trading is for you.

AvaTrade, in particular, offers a wide choice of automated trading platforms and tools that novice traders can utilize to boost the profitability of their transactions. One of them is Ava Replicate Trading – AvaSocial, which allows you to copy the performance of successful traders you select and profit in the same way they do.

A comprehensive regulatory framework can be added to AvaTrade’s benefits. It holds MiFID, ASIC, FSA and FFA, FSB, IIROC, and FSCA licenses. AvaTrade has various offices in most regions of the world, in addition to its cross-continent regulatory coverage.

XM Group Forex trading

XM Group is a regulated online broker offering over 1000 trading instruments, including more than 55 currency pairings, cross rates, metals, commodities, and equities, all of which may be traded on the MT4/MT5 platforms. The broker also provides a user-friendly mobile app through which you can trade on worldwide markets with a single login on a demo or live account.

Furthermore, XM offers clients a VPS service, allowing them to fully enjoy all of the benefits of trading without having to worry about other issues that can impede rapid and high-quality transactions, such as Internet connection speed, computer problems, and power outages.

One of the several benefits of XM Group is that there are no fees for deposits or withdrawals: the broker bears the entire expense of payment system commissions. Clients can select the most profitable trading account with negative balance protection, good leverage, and tight spreads from the following options: Micro, Standard, XM Ultra Low, and Shares.

XG Group accepts clients from more than 150 countries around the world thanks to being credited by such reputable regulators as CySEC, IFSC, DFSA, and ASIC.

Forex market for beginners - FAQ