What is Forex trading with leverage and margin?

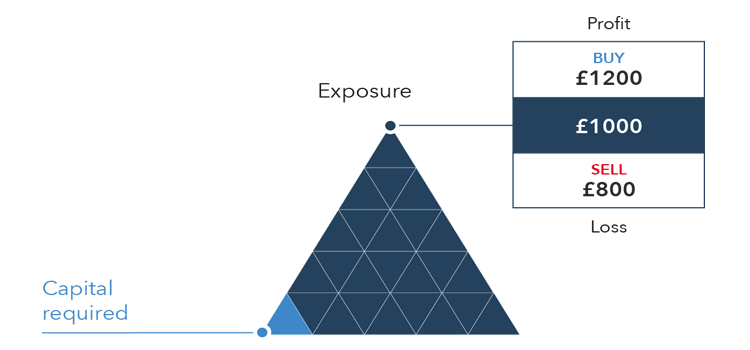

Many people are drawn to Forex trading because of the amount of leverage that brokers offer. Leverage permits traders to get more exposure to financial markets than they would otherwise be able to afford.

Leverage is very much the borrowing of a portion of the funds required to invest in something. Money is typically borrowed from a broker in the case of FX. Forex trading does provide significant leverage in the sense that a trader can build up—and control—a large amount of money for a small initial margin.

When trading Forex on margin, you simply need to pay a proportion of the whole position value as a deposit. Margin requirements vary by broker but typically begin at roughly 3.3% for the most often traded currency pairs like EUR/USD, USD/JPY, and GBP/USD.

How to trade Forex with leverage?

Leverage in the foreign currency markets is commonly as high as 100:1. This means that traders can use up to $100000 in value to open a deal for every $1000 in their account. And though leverage may be considered a risk factor, experienced traders, understand that if their account is effectively managed, the risk will be controllable as well. Furthermore, because the spot Forex market is so large and liquid, it is much easier to enter and exit a trade at the correct level than in other less liquid markets.

Currency fluctuations on the market are commonly tracked in pips, which is the smallest change in currency price and varies depending on the currency pair. These changes are only fractions of a cent. For example, when a currency pair such as the GBP/USD swings 100 pips from 1.9500 to 1.9600— it is a 1-cent movement in the exchange rate.

This is why currency transactions must be done in huge numbers, allowing minute price fluctuations to be translated into larger profits when multiplied by leverage.

When dealing with a large sum, such as $100000, even slight fluctuations in currency prices might result in huge profits or losses, so be sure to exercise proper caution and pay attention to the risks.

How to calculate trading margin and leverage?

A Forex leverage equation assists traders in determining how much cash is needed to create a new position and manage their trades. It also helps them in avoiding margin calls by estimating the best position size.

The FX leverage formula is as follows:

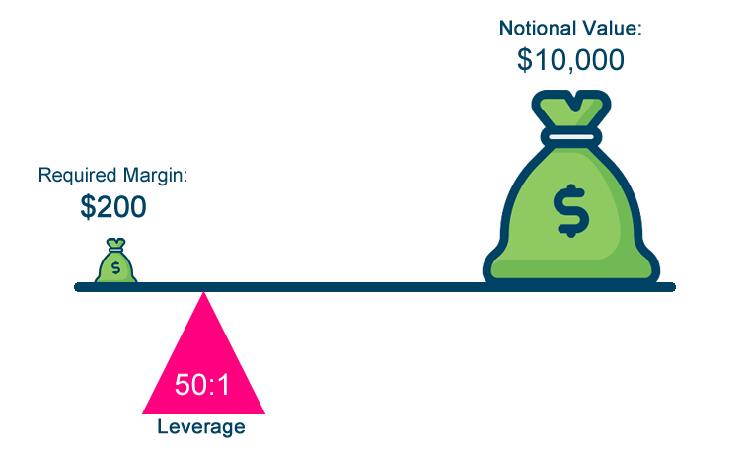

L = A / E, where L is leverage, E is the margin (equity), and A is the asset amount.

To determine the position size, you can also start with the margin amount and apply a leverage ratio. The formula, in this case, would be A = E * L. As a result, dividing the margin amount by the leverage ratio yields the asset size of a trader’s position.

For example, if you are required to deposit 1% of the whole transaction value as margin and wish to trade one standard lot of USD/JPY for $10000, the margin required is $100. As a result, your margin-based leverage is 100:1 (10000/100).

A trader should not, in general, use all of their available margins, only utilizing them when the market situation turns in a favorable direction.

Once the amount of risk in terms of pips is defined, the potential loss of capital may be calculated. As a general rule, this loss should never exceed 3% of trading capital. If a position is leveraged to the point where the possible loss is, say, 30% of trading capital, then the leverage should be lowered. However, traders will have their level of experience and risk parameters, and they may opt to differ from the 3% general rule.

Margin call explained

A margin call occurs when a trader’s usable/free margin is emptied. In other words, the account requires additional funds, which occurs when trading losses drop the usable margin below an allowable level set by the broker.

Margin calls are more likely to occur when traders commit a large amount of their equity to the utilized margin, leaving little room for losses to be absorbed. From the broker’s perspective, this is a crucial tool for properly managing and reducing risk.

Margin calls common reasons

- Holding on to a bad deal for too long, reducing useful margin;

- Over-leveraging your account;

- An underfunded account that forces you to overtrade with insufficient usable margin;

- Continue trading when the price rapidly moves in an unfavorable direction;

When a margin call occurs, a trader’s positions are canceled or closed out. The intent is twofold: the trader no longer has the funds in their account to hold losing positions, and the broker is now liable for their losses. It is critical to understand that leverage trading may result in a trader owing the broker more than what was deposited in certain instances, as he/she may form the misguided impression that their account is well-performing; however, the use of leverage means that the account is less able to absorb major price moves against the trader.

How to avoid a margin call

- Don’t overuse leverage. The safest ratio is considered to be 10:1 or even less, so if you’re not up to “all-in” kind of deals, try to operate near these numbers;

- Use risk management tools provided by your broker;

- To stay in trades, keep a sufficient amount of free margin on the account;

- Trade in smaller increments and treat each trade as if it were one of a thousand inconsequential, minor deals;

How to manage risks when trading with leverage

Leveraged trading is truly a technique to maximize your trading gains, but it does magnify your risks. As a consequence, having an effective risk-management strategy in place is critical when employing leverage in Forex trading. High-leverage Forex brokers usually offer effective risk management tools (like the ones below) to help traders control their risk more efficiently.

Stop-loss order

A Stop-loss order is intended to limit your losses in an unfavorable market by exiting a trade that moves against you at a price specified by the trader. You are effectively stating how much money you are willing to risk on the trade.

Trailing Stop-loss features in the same way as a standard stop-loss does. When the market swings in your favor, the trailing stop-loss goes with it, attempting to capture any price movement in your favor. Regardless of market volatility or gapping, a guaranteed stop-loss order (GSLO) (if provided by the broker) will be executed at the exact price the trader chooses.

Take-profit order

A take-profit order function is always executed at the price you specify. If the market for any product opens at a more favorable price than the target price you set, your order will be executed at a lower price, gratifying you with better market conditions.

Top Forex brokers with the best leverage

Leverage in Forex is a trading solution that allows traders to ‘borrow’ funds to get a larger exposure to the Forex market with a smaller deposit. It provides traders with the opportunity to multiply possible earnings, yet increase potential losses at the same time.

When compared to other leveraged assets, the Forex market has some of the lowest margin rates (and hence the greatest leverage ratios), making it an appealing option for Forex traders who like to trade with leverage. The Forex brokers listed on our website have been serving their clients for decades and adhere to the criteria of the world’s most stringent financial regulators, allowing traders to trade currency pairs as well as other financial instruments such as Cryptocurrency under some of the best trading conditions available (including multiple Forex bonuses, Social trading, or swap-free Islamic accounts).

HF Markets trading with leverage

HF Markets (formerly HotForex) is a multi-asset broker that trades Forex pairs, commodities, equities, indices, and other financial instruments with 7 account types and trading platforms and tight spreads averaging 0.1 pip. The broker provides unconstrained liquidity, allowing any scaled or profile trader to choose between numerous spreads and liquidity providers through automated trading platforms, as well as the performance of any strategy.

The well-known financial terminals MT4 and MT5 are now accessible in desktop, online, and mobile versions for Windows, iOS, MacOS, and Android, with the inclusion of a VPS service and the HFcopy – the original Social trading feature. The latter will help novice traders by imitating pros, while experienced traders will be rewarded for their efforts.

HF Markets is regulated in the EU and fully compliant with CySEC, as well as in the United Kingdom under the supervision of the FCA and in Dubai under a DFSA license.

FXTM trading with leverage

FXTM is the broker that provides more leverage than the majority of its competitors. It is one of the greatest options if you are seeking for CFD and/or Forex deals, with leverage of 1000:1 and some of the industry’s lowest spreads.

It should also be mentioned that FXTM does not reduce leverage for micro accounts – everyone has access to 1000:1 leverage for forex majors, 500:1 leverage for Forex minors, 50:1 leverage for Forex exotics, and 500:1 leverage for spot metals.

The broker is quite competitive, particularly in terms of spreads. Some of the most popular forex pairs have zero spreads, while others have as little as 0.1 pip. This makes it one of the most affordable as well as one of the platforms with the largest earning possibilities through forex trading.

eToro trading with leverage

eToro operates in over 140 countries and is licensed by numerous regulators, including CySEC, the FCA, and ASIC, to mention a few. It has garnered well over 20 million users over the years, providing access to over 2400 financial markets.

In terms of Forex, eToro supports deals on approximately 50 pairs. For training of major currency pairs like EUR/USD, GBP/USD, AUD/USD, and USD/JPY.

It is worth emphasizing that this is true for standard accounts that are open to everyone. Expert traders, on the other hand, can open professional accounts with a leverage ratio of 400:1, though eToro will ask you to pass a test before this option is made available to you.

AvaTrade trading with leverage

AvaTrade is a broker known for providing competitive rates on a diverse variety of assets, including currency pairings, commodities, indices, stocks, CFDs, Cryptocurrencies, and many others. MT4, MT5, Proprietary, AvaSocial, AvaTradeGo, AvaOptions, and WebTrader are among the trading platforms accessible. AvaTrade mobile trading is for you if you are an active trader who does not want to be tied to a computer.

AvaTrade also offers a diverse range of automated trading platforms and tools that beginner traders can use to increase the profitability of their trades. One of them is AvaSocial, Ava’s first Copy Trading tool that allows you to imitate the performance of successful traders you choose and benefit in the same way they do.

AvaTrade is an excellent option for a high leverage broker for market makers because it offers a wide range of platforms and operates in numerous countries across the world. When it comes to leverage, it varies by country, with the maximum leverage ratio for Forex being 400:1, 200:1 for commodities, 20:1 for ETFs, and 10:1 for stocks.

Plus500 CFDs trading with leverage

Plus500 is a well-known CFDs broker that allows users to trade forex with a leverage of 30:1 for retail accounts. The broker is also regulated by top-tier regulators like the FCA, and it provides access to over 70 Forex currency pairs as well as other markets such as shares, commodities, options, indices, ETFs, and Cryptocurrencies (availability subject to regulations).

Plus500 customers can access a web terminal for PCs and laptops, as well as an Android and iOS mobile app. Also, the broker offers demo accounts, which allow traders to practice, test their trading skills, and gain valuable knowledge of real-world market dynamics while remaining fully risk-free.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Forex trading with leverage and margin explained - FAQ