Introduction to Forex trading risk management

Leave traditional markets, go online and risk can quickly spiral out of control, owing in part to the speed with which transactions can be completed. In reality, the speed of the transaction, the rapid gratification, and the adrenaline rush of generating a profit in under 60 seconds can all spark a gambling inclination in many traders. As a result, people may regard online trading as a sort of gambling rather than a professional business requiring suitable speculative skills.

Speculating as a trader is not the same thing as gambling: risk management makes all the difference. To put it another way, when you speculate, you have some control over your risk, however, when you gamble, you don’t.

Risk management entails detecting, assessing, accepting, and/or managing the uncertainty associated with trading decisions. Considering Forex trading implies incurring financial risks, risk management is critical to currency trading success.

When carrying out open positions, prudent Forex traders use recognized risk management approaches to assist them with the market’s inherent volatility, deal with uncertainty, and minimize their market exposure.

Some traders who lose money trading Forex do so because they don’t use effective risk management tactics, while inexperience and a lack of market understanding can also play a role in their losses. Risk management is usually one of the most critical aspects of a successful trader’s trading strategy.

What are the risks of Forex trading

Implementing a system of rules and steps to ensure that any unfavorable impact of a forex deal is manageable is referred to as forex risk management. Because it is not a good idea to start trading and then try to limit your risk as you go, an effective strategy involves solid planning from start to completion.

- Interest rate risk

The hazard associated with a quick increase or drop in interest rates, which impacts volatility, is known as interest rate risk. Interest rate fluctuations affect FX prices because, depending on the direction of the rate shift, the level of expenditure and investment across an economy will increase or drop.

- Exchange rate risk

Fluctuations in the prices at which you can purchase or sell currencies are carrying exchange rate risks. If you’re on international Forex markets, you’re at a higher risk, though you can also be exposed indirectly through stocks and commodities.

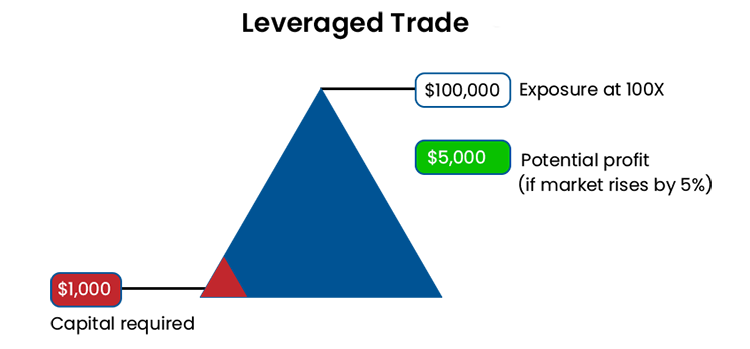

- Leverage risk

In trading on margin, the risk of losses being multiplied is known as leverage risk. Since the initial investment is less than the value of the FX deal, it’s crucial to know how much money you’re risking.

- Liquidity risk

The risk of not being able to buy or sell an asset quickly enough to avoid a loss is known as liquidity risk. Despite the fact that Forex is normally a liquid market, there are times when it is not — depending on the currency and government rules on foreign exchange.

Best trading risk management strategies

So, the first rule of risk management is to figure out how likely your trade is to succeed. To do so, you’ll need a solid understanding of both Fundamental and Technical analysis. You’ll need to know the nature of the market you’re trading, as well as where the psychological price trigger points are likely to be, which a price chart may help you determine.

Once you’ve decided to take the trade, the next major consideration is how you’ll limit or manage the risk. Remember that if you can measure the risk, you can control it for the most part. So let’s go over several risk management tactics that definitely work.

Understand the market

If you’re new to trading, you’ll want to learn everything you can about it. In reality, no matter how much experience you have in the Forex market, you may always learn something new.

The good news is that there are a variety of educational resources available, such as Forex articles, videos, webinars, and other materials provided by client-focused brokers.

On a very basic level, you should know that the Forex market is made up of currencies from all around the world, including GBP, USD, JPY, AUD, CHF, and ZAR. The forces of supply and demand are the primary drivers of the Forex market, often known as foreign exchange or FX.

Forex trading functions similarly to any other exchange in which you purchase an asset with a currency. In the case of Forex, the market price for a pair indicates how much of one currency you will need to purchase another.

Have a trading strategy

By acting as your own decision-making tool, a good trading strategy can make your market vision so much clearer. It might also assist you in keeping your cool in the tumultuous currency market. The goal of the strategy is to provide answers to key questions including what, when, why, and how much to trade.

It is critical that your Forex trading strategy is exclusive to you. It’s pointless to duplicate someone else’s strategy because they’re likely to have distinct aims, attitudes, and ideas unless, of course, you want to get some passive income with Social trading, by following and automatically copying deals of market experts. They will almost probably devote a varied amount of time and money to trading as well.

Another tool you may use to keep track of everything that happens while trading is a trading diary. This can include anything from your entry and exit positions to your mental condition at the time.

Define a risk-reward ratio

Every trade you make should be worth the risk you’re taking with your capital. In an ideal world, your profits should exceed your losses, allowing you to profit in the long run even if you lose on individual trades. To assess the worth of a deal, you should determine your risk-reward ratio as part of your Forex trading strategy.

Compare the amount of money you’re risking on an FX deal to the possible reward to find the ratio. The risk-reward ratio is 1:3 if the maximum potential loss (risk) on a deal is $200 and the maximum potential gain is $600. So, if you placed ten trades with this ratio and three of them were profitable, you may have made $400 despite only being correct 30% of the time.

Grasp the concept of leverage

You will be trading on leverage when you predict Forex price swings with derivatives like spot FX contracts. This allows you to gain complete market exposure for a small initial deposit (margin).

Assume you decide to trade the GBP/USD pair at 1.22485, with a buy price of 1.22490 and a selling price of 1.22480. You believe the pound will appreciate against the US dollar, so you purchase a regular GBP/USD contract at 1.22490.

Buying a single standard GBP/USD contract in this situation is the same as exchanging £100,000 for $122,490. You decide to purchase three contracts for a total investment of $367,470 (£300,000). If, for example, margin requirements for this currency pair are 5%, your first investment would be only $18,373.50 (£15,000).

Turn on limits and stops

Since the Forex market is so volatile, it’s vital to decide on your trade’s entry and exit points before you initiate a position. You can accomplish this by employing a variety of stops and limits:

- If the market moves against you, stop orders will automatically close your position.

- Limit orders will track your profit objective and close your trade when the price reaches the level you specify.

Get into the psychology of trading

The FX market’s volatility may also play havoc with your emotions, and if there’s one factor that influences the success of every deal you make, it’s you. Panic, temptation, temptation, confusion, and worry are all emotions that can either urge you to trade or obscure your judgment. In any case, allowing your emotions to influence your decision-making could negatively impact the outcome of your trades.

Follow financial news

Making forecasts about currency pair price fluctuations can be challenging due to the numerous factors that might cause the market to vary. Keep up with the industry news, maintaining a focus on banking system actions and statements, political events, and market sentiments to avoid being taken off guard.

Start trading with a demo account

Demo accounts provided by brokers under regulations of the world’s strictest financial authorities aim to replicate the experience of real trading as precisely as possible, allowing you to gain a sense of how the Forex market operates. The key difference between a demo and a live account is that with a demo, you won’t lose any real money, allowing you to gain trading confidence while remaining risk-free.

Top safest Forex brokers

Every trade you make carries risk, but as long as you can assess it, you can manage it. Just keep in mind that risk can be amplified by utilizing too much leverage in relation to your trading capital, as well as by a lack of liquidity in the market. Taking some risk is the only way to create good returns with a disciplined approach and strong trading habits.

Our recommended and reviewed forex brokers have been servicing customers for decades and meet the demanding criteria of the world’s strictest lending institutions. Despite the fact that some of them have geographical restrictions, you may still open an account with these reputable brokers from anywhere by using free VPS or VPN services. They have the best selection of currency pairs as well as other financial instruments such as stocks, commodities including gold, and Cryptocurrencies, as well as some of the best trading conditions, such as Forex bonuses of up to $ 5,000 even on initial deposits (subject to geographic availability), Copy trading, negative balance protection, and swap-free Islamic accounts.

Plus500 currency pairs CFDs trading

Plus500 is one of the most popular CFD brokers around the world. The company provides a huge number of CFDs for different trading assets, including currency pairs, indices, commodities, Cryptocurrencies (availability subject to regulations), stocks, options, and ETFs.

On an unlimited trading demo account, beginner traders can work out their strategies, try unfamiliar instruments, and practice before advancing to the next level. Professional traders can also benefit from this by using the demo to practice new strategies.

The trading terminal of the broker is available in a web version for PCs and laptops, as well as an Android and iOS mobile app. Bank transfers, credit and debit cards, and e-wallets are also accepted for deposits and withdrawals.

CySEC, FCA, ASIC, MAS, and other authorities fully regulate and license the broker, allowing it to accept clients from all over the world.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

eToro FX trading

eToro is a well-known brokerage company all over the world, and it is probably the most popular in Europe, with favorable trading conditions such as the availability of over 2,000 financial instruments, including CFDs, stocks, and 59 Cryptocurrencies, as well as the ability to use CopyTrader – Social trading tool, which allows you to automatically copy deals of other eToro users. Simply sign up for the trader and enter the amount you want to put into the portfolio.

The working terminal is easy to use and supports both the web version and the Android and iOS mobile apps. Furthermore, two account kinds will allow you to choose the best scenario for you.

The broker also upholds its credentials. It is regulated by organizations such as the FCA (UK), ASIC (Australia), and CySEC (Cyprus/Europe), which has helped it earn the trust of millions of traders worldwide.

NAGA Markets FX trading

NAGA Markets is the broker registered by the FCA, CySEC, MiFID II, and MiFIR that provides over 950 trading items on a single multi-currency account and a demo account with a virtual balance of $ 100,000.

Desktops include the MT4, MT5, NAGA Web App, and iOS and Android mobile apps. Imitate Trading is available for both beginners and experienced traders, allowing you to trade and invest, learn from them, duplicate the best traders, or become a trading pro yourself.

Clients can fund their trading accounts by bank transfers, credit cards, electronic payment systems such as Giropay, Skrill, Neteller, Paysafe Card, and Klarna, as well as cryptocurrency (Bitcoin, Ethereum, Dash, Litecoin, Bitcoin Cash, and NAGA Coin).

AvaTrade FX trading

AvaTrade unites over 20000 private traders from 150 countries. The broker now operates regional offices in France, Australia, Japan, and Italy, with its headquarters in Dublin, Ireland. All rules are followed by the broker, who is regulated by MiFID, ASIC, Japan FSA and FFA, FSB, IIROC, and FSCA.

Traders can purchase and sell 1250 instruments across multiple trading platforms, including MT4, MT5, Proprietary, AvaSocial, AvaTradeGo, AvaOptions, and WebTrader. AvaTrade mobile trading is for you if you are an active trader who does not want to be tied to a computer.

HF Markets FX trading

HF Markets – formerly known as HotForex in some regions – is a well-known broker that provides a number of accounts for a variety of purposes, including Micro, Premium, Fixed, VIP, and Zero Spread accounts. Forex Gold Trading offers the most competitive spreads and no hidden commissions, allowing you to trade in over a thousand different trading products.

The well-known financial terminals MT4 and MT5 are available for Windows, iOS, macOS, and Android in desktop, web, and mobile versions. The addition of a VPS service and the HFcopy trading platform will also be beneficial. The latter will assist beginners by emulating professionals, while experienced traders will be rewarded for their efforts.

HF Markets is regulated in the EU and operates in full conformity with CySEC, as well as in the UK under the supervision of the FCA and in Dubai under a DFSA license.

It may appear to be a lot, but the good news is that you are not limited to choosing just one broker. Most of the reputable Forex brokers we mentioned above provide demo accounts, allowing you to test them out and determine if their platforms are right for you. It will allow you to experiment with different trading strategies and make use of advanced features that are currently available on the market.

It could also be an important part of your portfolio diversification strategy: You can trade freely with one broker while supporting Social trading with another, generating some passive money.

Forex risk management - FAQ