Forex trading strategies for beginners: a review of popular tactics

The Forex market is the world’s largest and most liquid financial field. With a daily trading volume of $6.6 trillion, it is more than double that of the New York Stock Exchange, making it an appealing trading venue.

We all know that Forex trading may be challenging to grasp, but choosing the appropriate techniques to trade with is critical for new traders entering the Forex market. For those ready to accept the uncertainty, trading currencies can be a lucrative venture. However, there are quite a few bumps that newcomers should avoid if they wish to succeed in the long run.

That means determining the best trading style!

Continue reading to learn about Forex trading methods that work and what you need to do as a newbie trader to be successful in the market. But first, you must grasp what a Forex trading strategy is and how to select the best one for you.

What is a Forex trading strategy?

A trading strategy is a collection of rules that a trader uses to determine when to initiate a trade, how to manage it, and when to exit it. A trading strategy can be extremely basic or quite sophisticated, depending on the trader.

Traders who use Technical analysis in Forex trading will have an easier time defining their entry/exit indicators, whereas traders who use Fundamental analysis may have a wider range of information on which to base their trading decisions. Regardless, every trader should have a plan in place, as this is the most effective way to create consistency and correctly measure performance.

As we mentioned before, a Forex trading strategy is a well-thought-out plan that helps a trader decide whether to buy or sell a currency pair at a specific point in time.

A typical Forex trading strategy includes the following elements:

- Selection of an analytical framework:

Before you can choose a strategy, you must first choose an analysis method. The majority of traders employ Technical analysis, while others choose Fundamental analysis or a combination of the two. Existing trading tactics, on the other hand, necessitate varied amounts of technical and fundamental investigation. To assess trends, you can use tools like a technical indicator, candles, or patterns.

- Understanding graphs:

You’ll need to know how to read Forex charts and graphs as a beginning part of your trading journey. Then, to keep an eye on the currency market, examine these charts and graphs on a regular basis.

- Finding your own trading indicators:

Finding signals based on the analysis process is critical to your trading plan. Your analysis process will determine the signals that will inform you whether to purchase or sell.

- Evaluation of a trading strategy:

Use the past data to determine how well your selected approach has performed in terms of generating profits. This will assist you in predicting the likelihood of future earnings.

How to choose the best Forex trading strategy?

Only a small minority of traders are able to identify the best Forex strategy right immediately, as the vast majority devotes a large amount of time to testing multiple techniques using a demo trading account and employing funds of 100% Forex bonuses they receive for topping up their real accounts for the first time, ensuring that their testing is conducted in a secure and risk-free environment.

However, even if a trader discovers a technique that produces positive results and feels good, it is doubtful that they will continue with it for a long time. The financial markets are continuously changing, and traders must adapt to keep up, at least using analytical tools provided by reputable brokers.

If you’re a newbie, it’s probably best to adhere to simpler tactics as many novice traders make the mistake of attempting to incorporate too many technical indicators into their strategy, resulting in information overload and contradicting signals. You may always change your approach as you go, based on your backtesting and demo trading experience.

The most popular Forex trading strategies

A successful trading strategy allows you to gain a better understanding of how the Forex market works. Though the market is quite competitive, if you learn to play your cards well, it may be beneficial. To continuously succeed, you must hone your trading abilities and methods. As a newbie, it is best to start trading currencies with modest leverage as this way it is easier to tolerate losses and protect your funds. In this article, we’re going through 9 of the best yet easy-to-understand Forex trading tactics that actually work.

Trend trading strategy

Identifying trade opportunities in the direction of the trend is a key component of trend trading. The theory behind it is that the financial instrument will continue to trend in the same direction as it is now (up or down).

We’re talking about an uptrend when prices are continually rising (making higher highs). A downtrend will be indicated by falling prices (the trading instrument making lower lows).

Traders can employ supporting tools to detect the trend, except when looking at price movement. One of the most popular is moving averages as traders can employ MA crossovers or simply look at whether the price is trading above or below a moving average (the 200 DMA is a prominent and often monitored one).

You’ll need to select a fast MA and a slow MA to employ moving average crossovers (which can also be used as entry signals). The 50 DMA and the 200 DMA are two popular examples. The crossover of the 50-day moving average over the 200-day moving average could signal the start of an uptrend, and vice versa.

Range trading strategy

As it is one of the simplest strategies, range trading is very popular among beginners. A market is said to be in a ‘range’ when it continuously moves between two price levels. You might then discover certain upward or downward trends within that range.

When adopting this approach, you’ll go long or short depending on the price’s position inside that range — long in a rising trend and short in a declining trend. This can occur at any point in time, both short and long.

Within this range, you may either manually place trades or set stop losses and limit orders. Below there will be two lines that reflect the range (support and resistance), as well as probable stop and limit levels.

For example, if you identified 1.17 as a key resistance level, but the price frequently stalls at 1.1690 or 1.1695, you can highlight that area (1.1690 – 1.17) and begin looking for selling opportunities within it. However, if you only focus on that level, you may miss out on potential trading opportunities, as the price can often reverse before it reaches there.

Breakout trading strategy

Many Forex traders prefer breakout trading because it allows them to enter a position at the commencement of a chaotic phase as increased volatility provides additional trading chances.

A ‘breakout’ occurs when the price of a currency pair moves out of a consolidated range (out of levels of support and resistance). This method entails entering an FX position relatively early in a new trend and setting your stop-loss at the market’s breakout point.

Scalping trading strategy

Traders who scalp are looking to profit from minor intraday price changes. Some traders have a trading aim of only 5 pips, and the deal time might range from seconds to minutes. Scalpers must be able to work with data and make quick decisions, even under duress. They also spend more time in front of the computer and tend to specialize in one or a few markets (for example, just scalping EUR/USD or only S&P 500 futures).

Being a scalper has the advantage of allowing you to focus on a specific timeframe of the market, without having to worry about holding your positions overnight or analyzing long-term fundamentals. At the same time, scalping requires you to be completely concentrated during your trading session: while your transactions are only open for a few minutes, it is simpler to react emotionally and make impulsive trading decisions.

Day trading strategy

Day traders, unlike scalpers, do not normally hold trades for only a few seconds. Their trading day, on the other hand, tends to be centered on a certain session or time of day, when they try to take advantage of opportunities. While scalpers may trade on an M1 chart, day traders typically trade on anything from the M15 to the H1 chart.

Scalpers typically open more than 10 trades each day (some of the most active traders may even open more than 100), whereas day traders take it a little slower and aim to identify 2-3 solid opportunities per day.

If you want to terminate your positions before the trading day ends but don’t want the extreme degree of pressure that comes with scalping, day trading may be for you.

Momentum trading strategy

The focus of momentum trading is on the intensity of a trend rather than the trend itself. The idea behind this strategy is that if a trend is strong enough, it will continue in the same direction (either upward or downward).

If you intend to apply this approach, you’ll open your trade when the trend starts to gather momentum and close it when the trend begins to wane. Volume, volatility, and periods must all be considered when determining momentum.

The momentum indicator, RSI, MAs, and the stochastic oscillator are all prominent indicators for this technique.

Finally, market sentiment has a significant impact on momentum. The impact of news and economic events, such as interest rate announcements, on currency prices can be significant. When a trend becomes stronger, a significant number of traders often enter the market, adding to the momentum.

Position trading

Position trading aims to profit from long-term trend moves while ignoring the short-term volatility that occurs on a daily basis. Traders that use this type of trading strategy may leave positions open for weeks, months, and even years.

It is one of the more difficult trading styles, along with scalping. It necessitates a trader’s extreme discipline, the ability to ignore the noise and remains cool even when a position swings against them by hundreds of pips.

Carry trade strategy

This approach is designed to assist you in profiting from the interest rate disparity between two currencies in a currency pair. Positive and negative currency carry trading strategies are available. The first involves borrowing a low-interest currency and then purchasing a high-interest currency. A negative currency carries trade is the polar opposite of a positive currency carry transaction.

Positive and negative carry trades will have different outcomes since you will pay interest on the position until the interest rate on the base exceeds the interest rate on the quote. Positive carry trades produce an initial net gain with the possibility of a net loss, while negative carry trades produce an initial net loss with the possibility of a net gain.

News trading strategy

News trading involves trying to profit from a market shift caused by a major news event. It might be a central bank meeting, economic statistics, or an unforeseen incident (natural disaster or geopolitical tensions escalating).

News trading is risky because the market is volatile: the impacted instruments’ spreads may also widen. Due to dwindling liquidity, you risk slippage, which means your transaction could be executed at a worse price than planned, or you may have trouble exiting at the level you wanted.

You’re better to decide which event to trade and which currency pair(s) it will affect most. The Euro is primarily affected by ECB meetings. Which currency pair to choose? If you expect a hawkish ECB to raise rates, use a low-yielding currency like the Japanese Yen, so EUR/JPY may be best.

News trading can be done with or without bias, leaving you to predict how the market will react to the occurrence. Without bias, you aim to record the huge move regardless of its direction.

How to develop the right Forex trading strategy?

You should indeed build a trading strategy that works for you as a rookie. Here are a few pointers to help you create your own step-by-step plan:

- Understand the fundamentals

As a newcomer, it is critical to understand the principles of currency trading as a Forex market is a broad area of finance. As a result, before entering the trade, you’re better first to get a general principle of how things work there.

- Define your time frame

Many Forex trading techniques are based on a time frame. Some demand time limits range from short to long, so it would be great for you to decide whether you trade every day, week, month, or even year.

- Determine your risk tolerance

The trading strategy you choose will be determined by your tolerance for risk and loss. You can use high-risk tactics for high returns if you can control your emotions and deal with high-tension moments. If it’s not about you, then you can go for more steady, low-risk solutions.

- Select indicators capable of detecting and validating trends

Technical indicators are useful for identifying market trends and signals. After you’ve decided on your trading approach, you should look for good indicators. Traders commonly use MACD, RSI, and stochastic indicators to identify and confirm trends.

- Determine your entry and exit points

To maximize profit and reduce loss, determine the ideal time and price limits for entering and quitting a trade.

How to trade Forex without your own strategy?

The Forex market gives multiple opportunities to make a passive income, making it a very lucrative place for beginners. The options below might assist newbies in earning and learning while trading with limited experience:

- PAMM accounts

Percentage allocation money management abbreviated as PAMM is the procedure through which two or more investors allocate funds to a skilled trader(s)/money manager in a defined proportion(s). The trader or money manager disbursed the transaction profit to the investors at the conclusion of the trade.

The acronym RAMM stands for Risk Allocation Management Model. It’s a hybrid model that incorporates aspects of both Copy trading and PAMM. RAMM enables novice traders to trade more effectively and profitably by allowing them to employ tried-and-true tactics.

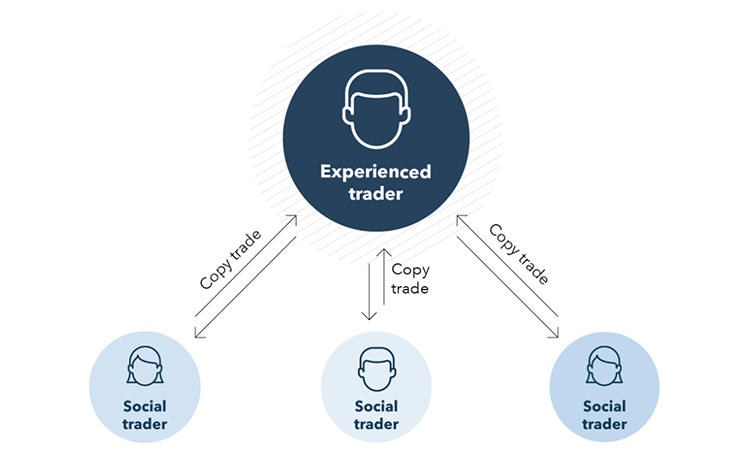

- Copy trading

For those who are new to Forex trading, Copy trading is an excellent choice. This strategy involves automating your trading by replicating the actions of other professional traders, boosting your chances of making a profit as you follow their deals. You bear losses in proportion to your funds, and all profits are yours to keep. Professional traders also gain a chance for additional monetary rewards if their successful deals are duplicated.

- Forex signal providers

Forex signal providers are computer programs that assist you in detecting trading opportunities at specific times. They are a great fit for beginners as they direct you on how to make the best trading decisions.

The best Forex brokers for beginners

Forex trading could be risky, but also rewarding if you use the right strategies: with these practical step-by-step plans, you may minimize avoidable losses as a newbie.

At first, beginner traders may find foreign currency trading intimidating and confusing. Buying and selling national currencies, on the other hand, is a pretty simple operation. Large corporations, hedge funds, and governments controlled the foreign currency market decades ago. However, nowadays, anyone may become a trader: with a simple mouse click or an account with a reliable Forex broker, the market is easily accessible.

Our recommended and reviewed forex brokers have been servicing customers for decades and meet the demanding criteria of the world’s strictest financial agencies. Despite the fact that some of them have geographical restrictions, you may still open an account with these reputable brokers from anywhere by using free VPS or VPN services. They have the best selection of currency pairs as well as other financial instruments such as stocks, commodities like gold, and Cryptocurrencies, as well as some of the best trading conditions, Forex bonuses of up to $5000 even on initial deposits (subject to geographic availability), Copy trading, detailed educational materials for beginners, latest financial market news for relevant trading decisions and negative balance protection.

AvaTrade Forex trading

AvaTrade is a Forex and CFD online broker with a powerful trading platform and equipment for newbies that use technical analysis as their trading approach. In general, the broker focuses on Cryptocurrencies, commodities, equities, exchange-traded funds (ETFs), bonds, and market indices. Six financial authorities regulate AvaTrade’s operations, including ASIC, the FCA, and CySEC.

The broker’s benefits include the absence of commissions, guaranteed tight spreads, and the possibility to open a free demo account to evaluate your trading skills and check out the potential of your strategies. Also, there is an AvaSocial – together with everything else, it’s a Copy trading feature that allows you to make a passive income.

HF Markets Forex trading

HF Markets – formerly known as HotForex – is a broker that offers a diverse range of financial products like currency pairings, indices, derivatives on energy and metals, stocks, and CFDs. Traders can select a trading account that meets their requirements as the broker provides both traditional ones and accounts with premium trading conditions for more demanding traders.

In terms of regulation, the broker is controlled by the Financial Services Commission (FSC), with some of the best commodity trading conditions. Another thing to mention is the CopyTrading function, which allows you to automatically copy transactions from multiple traders at the same time. Moreover, with geographical differences, HF Markets offers its traders a range of attractive bonuses that can earn them up to $50000 in total, a cash rebate of up to $8000, and a bonus on the initial deposit of up to $5000.

XM Group Forex trading

XM Group has a high level of trust among traders worldwide and is licensed by four financial regulators, including the FCA, ASIC, CySEC, and IFSC. XM Group places a premium on trader education, offering a variety of training and instructional materials like as video market analysis, Forex news, an economic calendar, and so on. These insights will be beneficial to all traders, from novice to seasoned.

It only takes a few minutes to open an account with XM broker. You can begin trading on the world’s most liquid exchanges immediately after your account has been verified. The firm provides 75 tradable products for trade, each with tight spreads and the same trading circumstances regardless of the client’s funding level. As part of this promotion, new traders earn an immediate bonus equal to 100% of their deposit, up to $5000.

You can also manage risk by diversifying your strategy and opening accounts with several of the finest brokers. You can not only compare trading platforms to choose the best one for you, but you can also optimize the bonuses you earn. You can use them to fund your market research: use this money to put your trading strategies to the test.

You can also trade on your own with some brokers while using the Copy Trading tool with others. It will motivate you to continue trading and boost your chances of earning passive income.

Forex trading strategies for beginners - FAQ