Forex Fundamental analysis for beginners

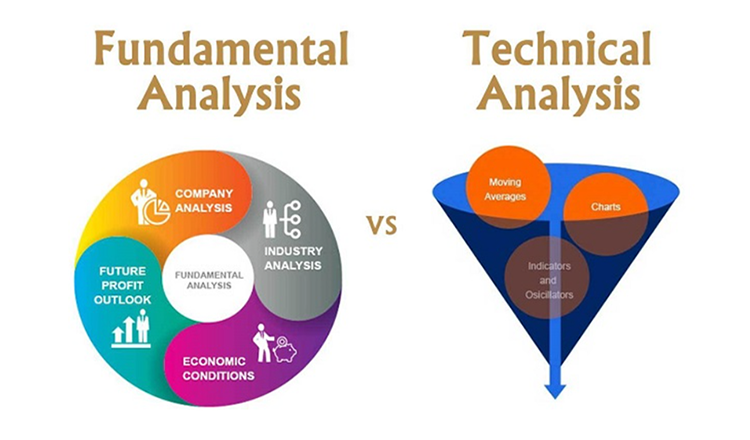

Those who trade in the foreign exchange market utilize the same two types of analysis as those who deal in the stock market: Fundamental and Technical analysis. Technical analysis is used in Forex in a way where the price is supposed to represent all news, and the charts are analyzed. But, unlike corporations, countries do not have balance sheets, so how can a currency be subjected to basic analysis?

Because Fundamental analysis is based on determining the intrinsic value of assets, its application in Forex requires determining the economic elements that affect the value of a country’s currency. With our expert team, we’ll take a look at some of the most important underlying elements that influence a currency’s movement.

What is Fundamental analysis in Forex?

While Technical and price movement analysis is concerned with the “what”, Fundamental analysis is interested in the “why”.

Fundamental analysis in Forex is both complex and essential for determining the true value of any investment or trading instrument (In case of Forex – currency pairs). It is a technique for analyzing financial markets in order to forecast prices.

Fundamental analysis in Forex focuses on the general state of the economy and evaluates a variety of factors such as interest rates, unemployment, GDP, international trade, manufacturing, global geopolitical and financial news, as well as their impact on the value of the national currency in question. Fundamental analysis should be viewed as an umbrella term that encompasses all of the important elements that influence a financial market’s price swings. The art of Forex fundamental analysis is in understanding the elements, how they interact, and how they affect the entire market.

Fundamental analysis in Forex, as well as other financial markets, is based on the idea that an asset’s price may deviate from its true value. As a result, numerous markets may occasionally misprice an asset in the short term. Fundamentalists believe that even if assets are mispriced in the short term, they will eventually recover to their right value. Fundamental analysis’ ultimate purpose is to determine an asset’s true value, compare it to its present price, and identify a trading opportunity.

This also exemplifies the key distinction between Fundamental and Technical analysis. Fundamental analysis studies everything but the current price, whereas Forex Technical analysis rarely pays attention to anything but the present price. While Fundamental analysis may not be the ideal tool for a day-to-day trader in the Forex market, it is the fundamental Forex aspects and how they are analyzed that determine what occurs in the long run.

Indicators of Fundamental analysis in the Forex market

Economic indicators are reports that detail a country’s economic performance and are provided by the government or a private entity. Economic reports are the primary instrument for evaluating a country’s financial strength but keep in mind that a country’s economic performance is influenced by a variety of circumstances and policies.

These reports are produced on a regular basis and provide market participants with information on whether a country’s economy has improved or deteriorated. The consequences of these reports are similar to how earnings reports, SEC filings, and other public announcements can affect stock prices. Any variation from the norm can create huge price and volume changes in Forex, just as it can in the stock market.

Interest rates in the FX market

Interest rates are one of the key indicators in Forex’s Fundamental analysis. They come in a variety of forms, but we’ll focus on the nominal or base interest rates set by a country’s central bank.

Money is printed by central banks, which is then borrowed by private banks. A base or nominal interest rate is the percentage of principle that private banks pay central banks for borrowing currencies. When you hear the term ‘interest rates,’ most people are referring to this notion. One of the primary functions of central banks is to manage interest rates, which is an important aspect of national monetary or fiscal policy. This is due to the fact that interest rates act as a tremendous leveler for the economy.

Interest rates have a greater influence on currency values than any other factor as inflation, investment, trade, manufacturing, and unemployment can all be impacted.

The following is how it works:

In general, central banks want to stimulate economic growth and meet a government-set inflation target, thus they lower interest rates. This encourages private banks and individuals to borrow, as well as consumption, production, and the economy as a whole. Low interest rates can achieve the purpose, but they aren’t always the best strategy.

Low interest rates, in the long run, can over-inflate the economy with cash and generate economic bubbles, which, as we all know, can set off a domino effect across the economy.

To avoid this, central banks can raise interest rates, reducing borrowing and leaving less money available for banks, firms, and individuals to play with. The ideal place to start looking for trading possibilities in Forex Fundamental analysis is with shifting interest rates.

Gross domestic product (GDP) in the FX market

The total market value of all products and services produced in a country over a given year is represented by GDP, which is the broadest measure of a country’s economy. Because the GDP statistic is frequently regarded as a lagging indicator, most traders concentrate on the advance report and preliminary report, which are released in the months leading up to the final GDP figures. Significant changes between these reports can result in a lot of volatility. In that, they are both indices of internal growth, the GDP and the gross profit margin of a publicly traded corporation are similar.

Consumer Price Index (CPI) in the FX market

The CPI tracks price changes in over 200 distinct categories of consumer goods. When compared to a country’s exports, this report can be used to determine if a country is profiting or losing money on its goods and services. However, keep an eye on exports – it’s a main interest among traders because export prices are typically affected by the strength or weakness of a currency.

The Purchasing Managers’ Index (PMI), The Producer Price Index (PPI), the Durable Goods Report, The Employment Cost Index (ECI), and new housing establishments are all important statistics. Not to mention the several privately published reports, the most well-known of which is the Michigan Consumer Confidence Survey. If used correctly, all of these can be significant resources for traders.

Inflation in the FX market

The volatility in the cost of goods over time is reported in news releases on the level of inflation. It’s worth noting that every economy has a level of ‘healthy inflation’ (usually around 2%). Inflation is defined as the increase in the amount of money in circulation over a long period of time as the economy grows. The difficulty is for governments and central banks to achieve self-sufficiency at that level.

When there is too much inflation, the supply-demand balance shifts in favor of supply, and the currency depreciates because there is just more of it than there is demand for it. Deflation is the flip side of the inflation coin. Deflation raises the worth of money while lowering the cost of goods and services.

It may be beneficial in the short term, but it may be destructive to the economy in the long run: the economy runs on money and when there’s less gasoline, there’s less movement. At some point, deflation may have such a severe impact on a country’s economy that there will be hardly enough money to keep the economy afloat, let alone propel it ahead.

Retail Sales in the FX market

The total receipts of all retail outlets in a given country are measured in the retail-sales report. This figure is based on data collected from a wide range of retail outlets around the country. The report is especially useful as a timely estimate of overall consumer spending trends that has been adjusted for seasonal factors. It can be used to forecast the performance of more important lagging indicators as well as gauge an economy’s immediate trajectory. Revisions to advanced retail sales data can cause a lot of volatility. The retail sales report can be compared to a publicly traded company’s sales activity.

How to interpret economic indicators for Forex trading

As economic indicators are used to assess a country’s economic health, changes in their respective conditions will have a direct impact on the currency’s price and volume. It’s important to keep in mind, though, that the signs highlighted above aren’t the only factors that influence the price of a currency. Third-party reports, technical requirements, and a variety of other factors can all have a significant impact on a currency’s value.

When conducting a Fundamental analysis of the Forex market, keep the following in mind:

- Keep up with financial news and have an economic calendar on hand with a list of indicators and their updated release dates. Also, keep an eye on the future: markets frequently move in anticipation of the release of a specific indicator or report at a later date.

- Be aware of the economic indicators that are attracting the most attention from the market at any particular time. Such indicators act as catalysts for the most significant price and volume changes.

- Know what the market expects from the data, and then monitor to see if those expectations are met: that matters significantly more than the data itself. Occasionally, there is a significant disparity between expectations and actual outcomes. If that’s the case, be aware of the reasons behind the discrepancy.

- Don’t respond to the news too hastily. Numbers are frequently released and then changed, and things can swiftly shift. Pay attention to these changes, as they may prove to be a useful tool for identifying trends and responding more effectively to future reports.

Summary of Fundamental Forex analysis

The three basic economic indicators studied in Forex fundamental analysis are interest rates, inflation, and GDP. When compared to other macroeconomic and geopolitical indicators, such as retail sales, capital flow, trading balance, bond prices, and several other macroeconomic and geopolitical factors, they have an unrivaled economic impact. Furthermore, economic indicators are not only compared over time, but some of them also have cross-discipline and cross-border correlations.

It’s essential to consider that there’s a lot of economic data released that has a big impact on the Forex market. You have got to learn how to incorporate Forex fundamental research into your trading strategy, in order to forecast market movements.

Top Forex brokers for currency pairs trading

Traders search for the finest trading circumstances and the best likelihood of profit when deciding which market to trade. Millions of traders throughout the world believe the Forex market meets these criteria for a variety of reasons, including convenient trading hours, strong liquidity, the option to trade on leverage, and the presence of some of the world’s most well-known and respected brokers to administer the trade.

These Forex brokers comply with the rules of the strictest financial regulators around the world and serve their clients through decades. Though some of them impose geographical restrictions, with free VPS or VPN services you can safely open an account with these trusted brokers wherever you are. They provide the best choice of currency pairs along with other financial instruments including Cryptocurrencies and some of the most favorable trading conditions, Forex bonuses of up to $5000 even on initial deposit (subject to geographical availability), Social trading, or negative balance protection.

Plus500 currencies CFDs trading

Plus500 is a reliable broker that offers CFDs trading in over 60 currency pairs, as well as commodities, equities, Indices, and Crypto (availability subject to regulations) with “stop-loss” and “stop-limit” features. The first is designed to prevent transaction losses, while the second instructs the broker to sell assets if their quotations fall below a certain level defined by the trader.

Plus500 trading platform that is available to clients as a web terminal for PCs and laptops, as well as a mobile app for Android and iOS.

Plus500 is fully licensed and authorized to operate around the world, complying with the requirements of regulatory agencies like CySEC, FCA, ASIC, etc.

Plus500 demo account and educational resources are suitable for beginners, while the real trading account is for experienced traders. Open whichever one suits you the most, depositing funds through bank and credit/debit card transfers through Visa and MasterCard, Paypal, Bank Transfers, BPay, Skrill, and other methods.

79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Plus500EE AS is authorised and regulated by the Estonian Financial Supervision and Resolution Authority (Licence No. 4.1-1/18).

OANDA currencies trading

OANDA is a well-known broker for traders all around the globe. Over 100 financial instruments are available for trading, including currency pairs, Cryptocurrencies, indices, commodities, bonds, and metals. EUR, GBP, CHF, USD, CAD, AUD, JPY, HKD, and SGD are the broker’s nine basic currencies.

OANDA is regarded as one of the most reliable Forex brokers. It has operating licenses in various countries and is a member of the following regulatory bodies: IIROC, FCA, and ASIC.

Also, the broker offers three account categories worldwide: demo, Standard, and Advanced Trader, making it a good fit for both beginners and experienced traders. Moreover, OANDA welcomes traders to put their skills into practice by using a demo account with an unlimited amount of virtual cash and an infinite term of use.

eToro currencies trading

eToro is one of the most well-known brokers in the world when it comes to online trading. With the best conditions: low Forex and trading fees and minimum deposits you can trade and invest in over 2000 different assets. Since 2017, the selection has grown to include new digital currencies like Bitcoin, Ethereum, and others. Popular currency pairs, stocks, cryptocurrencies, commodities, ETFs, and indices are on display to choose from for your deals.

There are two sorts of accounts available at eToro: Retail Client and Professional Client. The first is safeguarded against negative balance and includes a CopyTrader feature, while the second will stand out for its unlimited leverage. In addition, newbies can always use a demo account to experiment and test new strategies.

The broker is extremely trustworthy, as it has millions of clients worldwide, and is backed up by licenses that allow eToro to operate in different countries around the world, being under the regulations of the FCA, ASIC, and CySEC.

NAGA Markets currencies trading

NAGA Markets is a top-rated broker that offers trading in a variety of asset classes, including currency pairs (majors, minors, and exotics) equities, exchange-traded funds (ETFs), futures, commodities, and metals. There are several trading platforms available, including MetaTrader 4 and 5, as well as the broker’s original platform, NAGA Webtrader with respective mobile versions.

NAGA is more than just a great trading platform; it’s also a social trading network where clients of all levels of experience can trade, share, and duplicate assets on over 950 different trading instruments. Tight spreads, minimal costs, quick trade execution speeds, and a number of customizable account funding methods distinguish the broker’s trading circumstances.

NAGA’s mission is to make trading simple and accessible to anyone, so the broker complies with many regulatory rules around the world, including the FCA, CySEC, MiFID II, and MiFIR, to make investment services available to clients in various jurisdictions.

XM Group currencies trading

XM Group is an international online Forex broker that provides over 1000 trading instruments, including more than 55 currency pairings, including cross rates, metals, commodities, and equities, all of which may be traded on the MT4/MT5 platforms. The broker also has a mobile app that allows you to trade on foreign markets with only one login on a demo or live account.

In addition, the broker offers a virtual private server (VPS) service, which allows clients to fully enjoy all of the benefits of trading with XM without having to worry about other factors that can slow down or disrupt high-quality transactions, such as Internet connection speed or power outages.

One of the numerous advantages of XM Group is that deposits and withdrawals are free: the broker bears the entire expense of payment system commissions. Micro, Standard, XM Ultra Low, and Shares are the most profitable trading accounts on unique terms with negative balance protection, good leverage, and tight spreads. A broker also holds licenses from regulators such as CySEC, IFSC, DFSA, and ASIC.