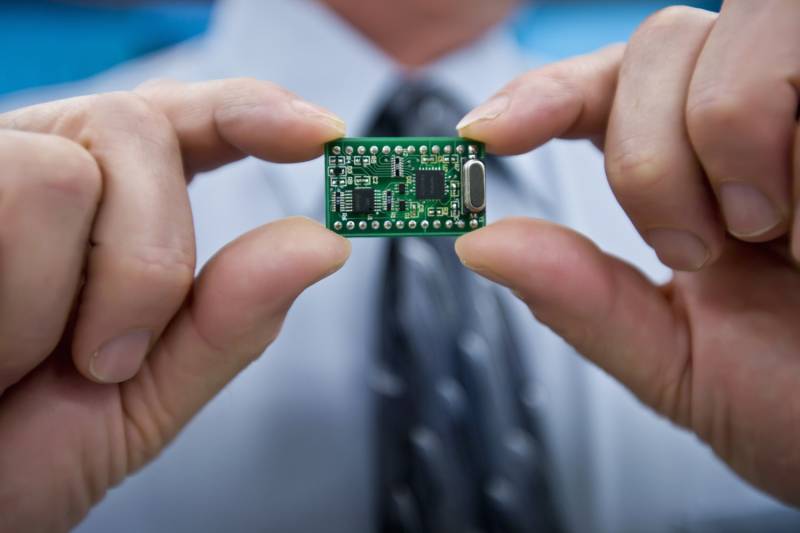

Asian semiconductor stocks edged higher, beating the worst forecast from Intel Corp., as traders and investors hope for a recovery.

The Bloomberg Asia Pacific Semiconductors Index added 0.6%, led by South Korean memory maker Samsung Electronics Co., which jumped more than 1%.

Intel’s poor expectations were due to weak demand for PCs, but demand from industries including automobiles is strong and prices for cloud computing chips are on the rise.

Intel’s forecasts were among the most unfavorable.

Among Intel importers, case substrate maker Ibiden Co cut the drop from 3% to less than 1%. At the same time, Tokyo Electron Ltd. slipped as Japan and the Netherlands were poised to join US sanctions on China.

Learn how to trade stocks with Top Forex and CFD brokers

Shares of Asian chips have risen this month. Samsung shares are rising despite a strong decline in profits.

Intel’s own shares lost nearly 10% after hours after the current period sales guidance. Intel has suffered from falling demand from PC buyers and fierce competition in the server hardware market.

Taiwan Semiconductor Manufacturing Co., one of the world’s most important chip makers, sees weak sales in the short term but expects modest gains throughout the year as demand for server chips recovers.

Subscribe for our newsletter

Get Forex brokers reviews, market insights, expert analytics and education material right into your inbox for free!