Exness review: trading platforms, account types, and how to start trading

Exness has emerged as a prominent player in the competitive landscape of online trading, particularly in the realm of Forex markets. With a commitment to transparency, advanced technology, and a client-centric approach, the broker has gained recognition for its comprehensive trading conditions.

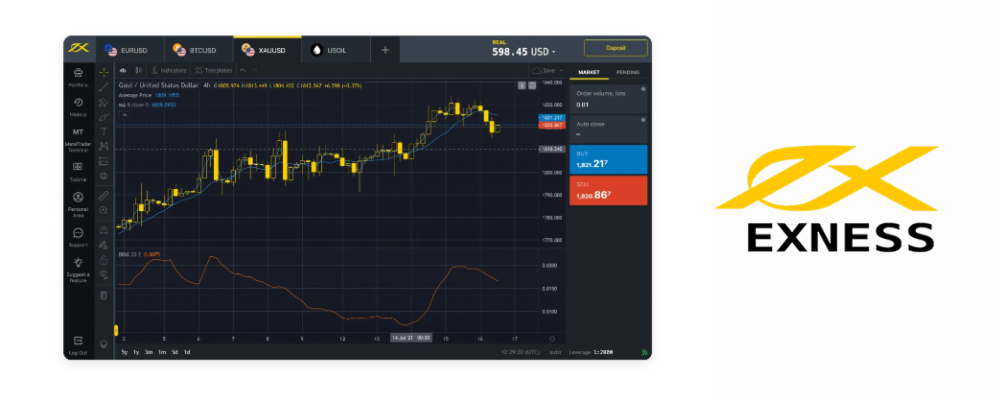

Exness offers a user-friendly trading platform that caters to novice and experienced traders. The MetaTrader 4 and MetaTrader 5 platforms are available, providing a range of tools for technical analysis, charting, and order execution. These platforms are renowned for their stability, ease of use, and customization options.

Traders on Exness gain access to a diverse array of financial instruments, with a primary focus on FX pairs. Additionally, the broker offers opportunities to trade precious metals, Cryptocurrencies, indices, and energies, allowing traders to diversify their portfolios and explore different market dynamics.

Exness provides multiple account types, each catering to varying trader needs. One of the noteworthy aspects of the broker is its flexible leverage offerings. While high leverage can amplify profits, it also increases risk. Traders must exercise caution and adhere to responsible trading practices.

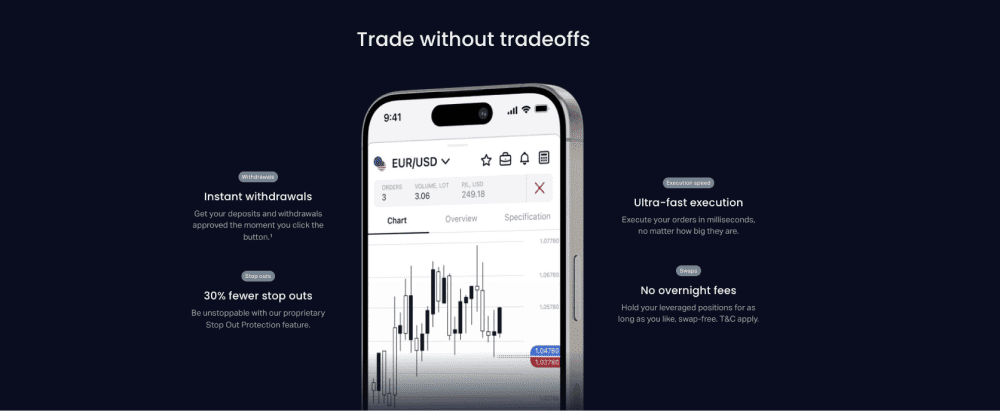

Exness prides itself on its competitive trading conditions, including tight spreads and rapid order execution. These factors are crucial for traders looking to optimize their trading strategies and capitalize on market movements efficiently.

Exness has established itself as a reputable broker in the competitive FX trading landscape. Its commitment to transparency, advanced technology, and client satisfaction sets it apart. Traders seeking a platform with diverse instruments, competitive trading conditions, and a focus on responsible trading would find Exness worth considering.

Exness account types and minimum deposit requirements

Exness provides a range of account types designed to cater to the diverse needs of traders. Let’s explore some of the key account types offered by Exness and their associated minimum deposit requirements.

Exness Standard account

The Standard Account is a popular choice for beginner and intermediate traders. It offers competitive spreads, flexible leverage options, and no commission charges. The minimum deposit requirement for the Standard Account is $1, making it accessible to traders with different budget sizes. This account type provides a solid foundation for traders to develop their skills and explore the forex market.

Exness Pro account

The Pro Account is tailored for experienced traders who require enhanced trading conditions. This account type offers tighter spreads, lower slippage, and faster order execution. It is suitable for traders who engage in high-volume trading and require advanced trading tools and features. The minimum deposit requirement for the Pro Account is $200, reflecting the higher trading capabilities and benefits provided.

Exness Raw Spread account

The Raw Spread Account is designed for traders who prioritize tight spreads and low trading costs. This account type offers raw spreads directly from liquidity providers, resulting in lower trading costs compared to other account types. The Raw Spread Account requires a minimum deposit of $500, reflecting the advanced trading conditions and cost structure associated with this account.

Exness Zero account

The Zero Account is ideal for traders who prefer commission-based trading. With this account type, traders enjoy ultra-low spreads combined with a fixed commission per trade. This structure ensures transparency and allows traders to optimize their trading costs. The minimum deposit requirement for the Zero Account is $200, making it accessible to traders seeking competitive trading conditions and cost-efficient trading.

It is important to note that Exness also offers Islamic accounts, known as swap-free accounts, which comply with Shariah principles. These accounts are available for traders who adhere to Islamic beliefs and do not participate in swap or interest-based activities.

Check out our article on Exness demo account: instruments, platforms, and a $10,000 balance in a secure learning environment

Selecting the appropriate account type depends on various factors, including your trading experience, investment capital, and trading preferences. It is crucial to assess your individual requirements and consider the trading conditions, features, and benefits associated with each account type before making a decision.

Exness leverage and margin requirements

Leverage is essentially a loan provided by the broker to amplify your trading position. It allows you to control a larger position size than your initial investment, magnifying both potential profits and losses. For example, with a leverage ratio of 1:100, you can control a position of $10,000 with a margin requirement of only $100.

Exness offers a range of leverage options to accommodate different trading styles and risk preferences. The leverage ratios available may vary depending on the regulatory jurisdiction and the specific account type you choose. Let’s explore some of the leverage options commonly offered by Exness:

Flexible Leverage: Exness provides flexible leverage options, allowing traders to select a leverage level that suits their trading strategy and risk tolerance. With flexible leverage, you have the freedom to adjust your leverage ratio according to your trading needs. It is important to note that higher leverage ratios carry a higher level of risk, as they amplify both potential profits and losses.

Maximum leverage: The maximum leverage offered by Exness may vary depending on the regulatory requirements in your jurisdiction and the account type you choose. The maximum leverage ratio available for retail traders is often lower than the ratio available for professional or institutional traders. It is crucial to be aware of the specific maximum leverage offered to ensure compliance with regulatory guidelines.

When selecting an appropriate leverage level, it is essential to consider your trading experience, risk tolerance, and specific market conditions. While higher leverage ratios can potentially amplify profits, they also increase the risk of significant losses. It is advisable to start with lower leverage ratios, especially if you are a beginner or have a conservative risk appetite. As you gain experience and confidence in your trading abilities, you may gradually increase your leverage level if it aligns with your trading strategy.

Exness spreads and commissions

Spreads refer to the difference between the bid and ask prices of a currency pair. It represents the cost of executing a trade and is measured in pips. A narrower spread indicates lower trading costs, making it more favorable for traders.

Exness offers variable spreads, meaning that the spread may fluctuate based on market conditions. This allows traders to benefit from tighter spreads during periods of high liquidity and volatility. However, it is important to note that spreads may widen during times of low liquidity or significant market events. Traders should consider these factors when planning their trading activities.

Exness is known for its competitive spreads, particularly for major currency pairs such as EUR/USD, GBP/USD, and USD/JPY. However, it is advisable to compare spreads across different currency pairs and account types to ensure that they align with your trading strategy.

Exness offers commission-based accounts, known as the Zero Account, which provides traders with ultra-low spreads and a fixed commission per trade. This account type is suitable for traders who prioritize tight spreads and want to optimize their trading costs. The fixed commission charged allows for greater transparency in calculating trading expenses.

Exness execution and order types

Exness market orders

A market order is the most common type of order used in forex trading. It involves buying or selling a currency pair at the current market price. Market orders are executed immediately, ensuring quick trade execution but providing no guarantee of the exact price at which the order will be filled.

Exness limit orders

A limit order allows traders to specify the price at which they want to buy or sell a currency pair. The order is executed only if the market reaches the specified price or better. Limit orders provide control over the entry or exit price, but there is a risk that the order may not be filled if the market does not reach the specified price.

Exness stop orders

Stop orders are used to enter or exit trades once the market reaches a specific price level. There are two types of stop orders: stop-loss orders, which are used to limit potential losses, and take-profit orders, which are used to secure profits. Stop orders help manage risk and automate trade execution based on predetermined levels.

Exness trailing stop orders

Trailing stop orders are stop orders that are adjusted automatically as the market price moves in the trader’s favor. This type of order allows traders to lock in profits while allowing for potential further gains. Trailing stop orders are particularly useful in trending markets where price momentum can lead to extended price movements.

Also, Exness offers two main order execution methods: instant execution and market execution.

Instant execution

With instant execution, the order is executed at the price displayed on the trading platform. This method ensures that the trade is executed immediately at the specified price or a better price. However, there is a possibility of slippage, which occurs when the execution price differs from the requested price due to market volatility or delays in order processing.

Market execution

Market execution involves executing the order at the best available market price. This method ensures that the order is filled without requotes or slippage. Market execution is particularly beneficial during periods of high market volatility when prices can change rapidly.

Each order execution method has its advantages and disadvantages:

Instant execution advantages:

- Immediate order execution at the requested price or better.

- Suitable for traders who require precise control over trade entry and exit levels.

Instant execution disadvantages:

- Possibility of slippage during periods of high market volatility.

- Potential for requotes, especially when market conditions change rapidly.

Market execution advantages:

- Order execution at the best available market price without requotes.

- Suitable for traders who prioritize speed and accuracy of trade execution.

Market execution disadvantages:

- Possibility of slight price variations due to market volatility.

- Potential for price changes between order placement and execution.

When selecting the most suitable execution method, traders should consider the following factors:

- Trading style: Scalpers and high-frequency traders may prefer instant execution to ensure quick trade entry and exit. In contrast, long-term traders may prioritize market execution for accuracy and minimal slippage.

- Market conditions: During periods of high market volatility, instant execution may result in more requotes and slippage. Market execution may be more suitable during such times.

- Trade size: Large trade sizes may be more prone to slippage with instant execution. Market execution may provide better execution for larger orders.

Understanding execution and order types is crucial for effective forex trading. Exness offers a range of order types, including market, limit, stop, and trailing stop orders, allowing traders to execute their trades based on their specific strategies. With instant execution and market execution methods, Exness ensures efficient trade execution, albeit with slight differences in terms of speed and potential slippage. By considering your trading style, market conditions, and trade size, you can select the most appropriate order execution method to optimize your trading experience and achieve your trading goals.

Exness trading instruments and asset classes

Major currency pairs

Exness provides traders with a comprehensive selection of major currency pairs, which include some of the most widely traded currencies in the world. Major currency pairs typically involve the US dollar (USD) paired with other major currencies such as the Euro (EUR), British Pound (GBP), Japanese Yen (JPY), Swiss Franc (CHF), Canadian Dollar (CAD), and Australian Dollar (AUD). Examples of major currency pairs include EUR/USD, GBP/USD, and USD/JPY. These pairs offer high liquidity, and tight spreads, and are generally less volatile compared to other currency pairs.

Minor currency pairs

Exness also offers a range of minor currency pairs, also known as cross-currency pairs. These pairs do not include the US dollar as one of the currencies. Examples of minor currency pairs include EUR/GBP, GBP/JPY, and AUD/CAD. Minor currency pairs can offer unique trading opportunities for traders looking to diversify their portfolios and capitalize on specific currency movements.

Exotic currency pairs

Exness provides traders with access to various exotic currency pairs. Exotic currency pairs involve currencies from emerging or less frequently traded economies. Examples include USD/ZAR (US Dollar/South African Rand), USD/TRY (US Dollar/Turkish Lira), and EUR/TRY (Euro/Turkish Lira). Exotic currency pairs tend to have wider spreads and higher volatility compared to major and minor pairs. They can offer potential opportunities for traders with a higher risk appetite and an understanding of the specific economic factors that influence these currencies.

In addition to currency pairs, Exness offers traders the opportunity to trade other asset classes, allowing for further diversification and trading opportunities. These asset classes include:

- Commodities: Traders can access a variety of commodities such as gold, silver, oil, natural gas, and agricultural products like corn and wheat. Trading commodities can be attractive for those looking to diversify their portfolios and take advantage of price movements in these markets.

- Indices: Exness provides traders with the ability to trade indices, which represent a basket of stocks from a particular market or sector. Examples of indices include the S&P 500, FTSE 100, and Nikkei 225. Trading indices allow traders to speculate on the overall performance of a specific market or sector.

- Cryptocurrencies: Exness offers traders the opportunity to trade popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP). Trading cryptocurrencies has gained significant popularity in recent years, offering traders the potential for high volatility and substantial profit opportunities.

It is important to note that each asset class may have its own unique characteristics, including liquidity, volatility, and trading hours. Traders should consider these factors when selecting the asset classes they wish to trade and tailor their strategies accordingly.

Pros and cons of trading with Exness

Exness is well-regarded for its trading conditions, but it is important to assess the pros and cons before making a decision. In this section, we will explore the advantages and potential drawbacks of trading with Exness. By understanding these factors, traders can make an informed decision about whether Exness is the right forex broker for their trading needs.

Pros of Exness Trading Conditions

- Competitive spreads: Exness offers competitive spreads, particularly for major currency pairs. Traders can benefit from tight spreads, reducing their trading costs and potentially maximizing their profits.

- Flexible leverage: Exness provides flexible leverage options, allowing traders to select a leverage level that suits their trading strategy and risk tolerance. This flexibility empowers traders to have more control over their trading positions.

- Range of account types: Exness offers various account types to cater to different trading needs. From the Standard Account for beginners to the Pro Account for more experienced traders, there are options available for traders of all levels.

- A diverse range of trading instruments: Exness provides a comprehensive selection of trading instruments, including major, minor, and exotic currency pairs, as well as commodities, indices, and cryptocurrencies. This diversity allows traders to explore different markets and diversify their portfolios.

- Advanced trading platforms: Exness offers advanced trading platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are widely recognized and appreciated by traders for their robust features, user-friendly interface, and extensive customization options.

Cons of Exness trading conditions

- Limited educational resources: While Exness provides some educational resources such as tutorials and articles, the availability of comprehensive educational materials could be further enhanced. Traders who rely heavily on educational resources may need to seek additional learning materials through other sources.

- Limited customer support time: Exness offers customer support through live chat, email, and phone. However, the availability of customer support may be limited during non-trading hours or in different time zones.

- Market volatility and potential slippage: Like any online broker, Exness is subject to market volatility, which can result in wider spreads and potential slippage during volatile market conditions. Traders should be aware of these risks and consider appropriate risk management strategies our team prepared below.

It is important to note that the advantages and disadvantages of Exness trading conditions may vary depending on individual trading preferences, strategies, and risk tolerance. Traders should carefully assess their own needs and compare them with the offerings of Exness to determine if they align with their trading goals.

Case study: trading scenario with Exness trading conditions

To provide a practical illustration of how Exness’ trading conditions can be applied in a real trading scenario, let’s consider a hypothetical case study. This case study will showcase a trading scenario using Exness’ trading conditions, analyzing the potential outcomes and profitability of the trade.

Scenario: John, an experienced forex trader, decides to take advantage of a potential bullish trend in the EUR/USD currency pair. Based on his analysis, he believes that the euro will strengthen against the US dollar in the coming days. John opened a Standard Account with Exness, which offers competitive spreads and flexible leverage options.

John sets his entry point at 1.1800, just above the current market price. He places a limited order to buy EUR/USD at this level. Considering the potential volatility of the market, John decides to set his stop-loss order at 1.1750 to limit potential losses and his take-profit order at 1.1900 to secure profits.

Exness’ instant execution method ensures that John’s order is executed promptly at the specified price. The trade is opened, and John’s position is now live in the market.

Over the next few days, the EUR/USD pair will experience the anticipated bullish movement. The price reaches John’s take-profit level of 1.1900, and his trade automatically closes, securing his profits. Exness’ reliable order execution and efficient trade monitoring allow John to capture the desired profit opportunity.

By analyzing this hypothetical trading scenario, we can highlight the ways in which Exness’ trading conditions positively impact John’s trading experience:

- Competitive spreads: Exness’ competitive spreads contribute to reducing John’s trading costs. The tight spreads allow him to enter the trade at a favorable price, maximizing his potential profits.

- Flexible leverage: With Exness’ flexible leverage options, John can adjust his leverage level based on his risk appetite and trading strategy. This flexibility enables him to optimize his trading position and manage his risk effectively.

- Instant execution: Exness’ instant execution method ensures that John’s order is executed promptly at the specified price. This feature allows him to enter the trade at the desired level without delays or rejections.

- Efficient trade monitoring: Exness’ advanced trading platforms provide real-time monitoring of John’s trade. He can track the progress of his position, monitor the market conditions, and make timely adjustments if necessary.

It is important to note that this case study is purely hypothetical and does not guarantee similar results in real trading. The outcome of any trade depends on various factors, including market conditions, individual trading strategies, and risk management techniques.

In conclusion, the case study demonstrates how Exness’ trading conditions can be applied in a real trading scenario. The competitive spreads, flexible leverage, instant execution, and efficient trade monitoring contribute to enhancing the trading experience and potentially maximizing profitability. Traders should always conduct a thorough analysis, apply appropriate risk management strategies, and adapt their trading decisions based on market conditions and their individual trading goals and preferences.

Exness FX trading conditions - FAQ