A comprehensive guide to opening an account with XM

Opening an account with a reputable forex broker is the first step towards engaging in the dynamic world of online trading. XM, a well-established broker, offers a user-friendly platform and a range of features that make it a popular choice among traders. In this guide, we’ll explore general information about XM, delve into its special features, and provide a step-by-step guide to help you seamlessly open an account.

XM broker expert review

XM, founded in 2009, is a globally recognized online trading broker that provides access to forex, commodities, indices, and stocks. With a commitment to transparency and client satisfaction, XM has earned a solid reputation in the financial markets.

XM operates under strict regulatory guidelines, ensuring a secure and trustworthy trading environment. It is regulated by renowned authorities, such as the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA) in the United Kingdom.

To accommodate the varied preferences of traders, XM offers multiple account types, each tailored to specific trading styles. Whether you opt for the Micro, Standard, or XM Ultra Low account, you gain access to a range of features and trading conditions designed to suit your individual needs.

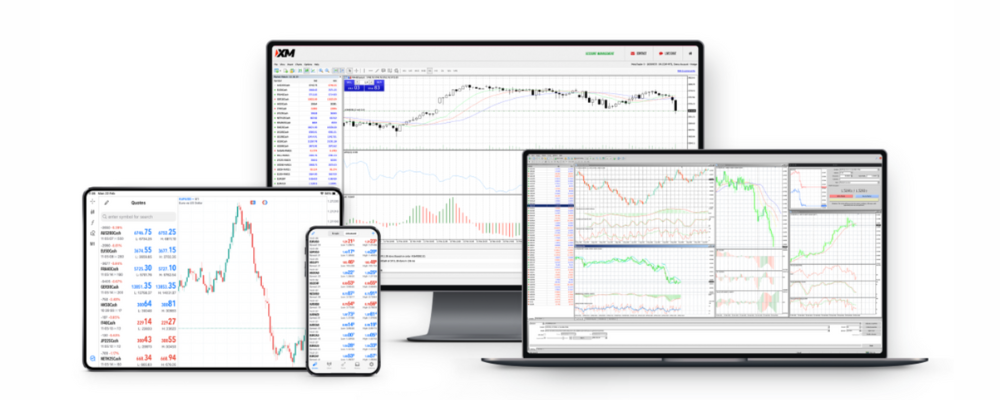

XM places a strong emphasis on technology and security, providing a robust and user-friendly trading platform. Traders can execute transactions with confidence, knowing that their data and financial information are safeguarded by advanced security measures.

With a commitment to inclusivity, XM has expanded its services globally. Its multilingual support ensures that traders from different linguistic backgrounds can access assistance and navigate the platform seamlessly. This global presence further solidifies XM’s status as a broker accessible to a diverse clientele.

XM special FX trading features review

As we dive into the second part of our guide, let’s explore the distinctive features that set XM apart in the world of online trading. From flexible leverage options and negative balance protection to an extensive array of educational resources, XM is not just a platform; it’s a comprehensive ecosystem designed to empower traders at every level.

XM flexible leverage

XM offers flexible leverage options, allowing traders to magnify their exposure to the markets. Leverage can be adjusted based on individual preferences, but it’s crucial to exercise caution and use leverage responsibly. The availability of high leverage enables traders to potentially amplify their profits, but it also comes with increased risk. XM provides clear information and educational resources to help traders understand the implications of leverage on their positions.

XM negative balance protection

One of the standout features of XM is its commitment to client protection through Negative Balance Protection. This means that traders cannot lose more than their initial investment, even in highly volatile market conditions. This safeguard ensures that traders’ account balances will not go into negative territory, providing an additional layer of risk management.

Educational resources

XM distinguishes itself by placing a strong emphasis on trader education. The broker offers an extensive range of educational resources, including video tutorials, webinars, and market analysis. Traders can access these materials to enhance their understanding of fundamental and technical analysis, risk management, and trading strategies. This commitment to education is particularly beneficial for both novice and experienced traders looking to refine their skills.

A vast range of tradable instruments

XM stands out for its diverse range of tradable instruments, including forex pairs, commodities, indices, and stocks. This allows traders to create a well-diversified portfolio and explore different market opportunities. The availability of a wide range of instruments ensures that traders can capitalize on various market trends and make informed investment decisions across different asset classes.

Competitive spreads and execution speed

XM is known for offering competitive spreads and fast execution speeds. Tight spreads contribute to cost-effective trading, while rapid order execution ensures that traders can enter and exit positions swiftly. These factors are crucial for optimizing trading strategies and taking advantage of short-term market opportunities.

By understanding and leveraging these special features, traders can make the most of their experience with XM, whether they are just starting or looking to enhance their existing trading strategies.

A step-by-step guide to opening an account with XM

- Visit the dedicated XM account opening link: To initiate the process, click on our dedicated XM account opening link. This ensures that you not only gain access to the official XM registration page but also qualify for any exclusive XM bonuses or promotions available through our partnership.

- Click on “Open an Account”: Once you land on the XM website through the dedicated link, navigate to the homepage and locate the “Open an Account” button. This will redirect you to the registration page, where you can begin the account creation process.

- Complete the registration form: Fill in the required information accurately on the registration form. This includes personal details such as your name, address, contact information, and financial information. Take the time to ensure that all details are correct, as this information is crucial for the account verification process.

- Select your XM account type: XM offers various account types, each catering to different trading preferences. Choose the account type that aligns with your trading goals, whether it’s the Micro, Standard, or XM Ultra Low account. Each account type comes with its own set of features and trading conditions, so select the one that best suits your needs.

- Verify your identity: As part of the regulatory requirements, XM requires identity verification to ensure the security of your account. Upload clear copies of your identification documents, such as a passport or driver’s license, and any additional documents requested for proof of address. This step is crucial for complying with regulatory standards and safeguarding your account.

- Fund your account: Once your account is successfully registered and verified, it’s time to fund it. XM provides a variety of secure payment methods, including bank wire transfers, credit/debit cards, and e-wallets. Choose the method that suits you best and follow the instructions to deposit funds into your trading account. Keep in mind that the initial deposit amount may vary depending on the chosen account type.

- Claim bonuses (if geographically applicable): Depending on ongoing promotions or special offers, XM may provide bonuses for new accounts. Check for any available bonuses during the registration process and follow the specified steps to claim them. Be sure to review the terms and conditions associated with any bonuses offered.

- Download and set up the trading platform: After successfully funding your account, download the XM trading platform compatible with your device. XM supports popular platforms like MetaTrader 4 and MetaTrader 5. Follow the installation instructions and log in using your account credentials.

- Start trading: With your account funded and the trading platform set up, you are now ready to explore the financial markets. Familiarize yourself with the platform features, utilize the educational resources provided by XM, and start implementing your trading strategies.

Congratulations! You’ve successfully opened an account with XM and are now equipped to navigate the exciting world of online trading. By following these step-by-step instructions, you’ve ensured a smooth onboarding process, and with XM’s special features at your disposal, you’re well-positioned to make informed and strategic trading decisions. If you haven’t already, use our dedicated link [Insert Your Affiliate Link Here] to open your XM account and embark on your trading journey with confidence.

Related articles:

Opening a trading account with XM - FAQ