eToro: your ultimate FX broker for trading triumph

eToro FX Trading is a revolutionary platform that combines the power of social trading with the dynamic world of forex trading. Unlike traditional forex brokers, eToro provides a unique experience that allows traders to connect, interact, and learn from each other. Through eToro’s innovative features, traders have the opportunity to follow and copy the trades of successful traders, making it an ideal platform for both beginners and experienced traders.

eToro offers a user-friendly interface that is designed to cater to traders of all skill levels. Whether you are new to forex trading or have years of experience, eToro provides the tools and resources necessary to succeed in the forex market. With a wide range of currency pairs, real-time market data, and advanced charting capabilities, eToro equips traders with the necessary tools to make informed trading decisions.

FX Trading with eToro

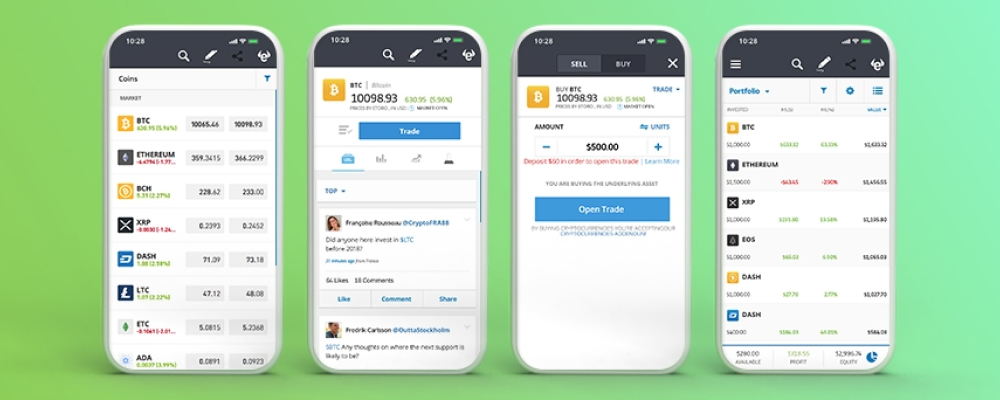

While trading, eToro operates on the principles of Social trading, which is centered around the concept of sharing and collaboration. The platform allows traders to connect with each other, follow successful traders, and even copy their trades. This means that even if you are a beginner with little to no knowledge of forex trading, you can still participate in the market and potentially profit by copying the trades of experienced traders.

When you join eToro, you have the option to create your own trading portfolio and share your trades with the community. This presents a unique opportunity to showcase your trading skills and potentially attract followers who wish to copy your trades. Additionally, eToro provides various tools and features to help you analyze the market, set risk management parameters, and monitor the performance of your trades.

The CopyTrading feature is one of the highlights of eToro FX Trading. It allows you to browse through a vast selection of traders and select the ones whose trading strategies align with your goals and risk tolerance. Once you have chosen traders to copy, the platform automatically executes their trades in your account, proportionally to the amount you allocate for copying. This way, you can benefit from the success of these traders, even if you don’t have the time or expertise to actively trade yourself.

Overall, eToro FX Trading offers a unique and inclusive approach to forex trading. It eliminates the need for extensive market knowledge and allows traders of all skill levels to participate and potentially profit from the forex market. Whether you choose to trade independently or copy the trades of successful traders, eToro provides a platform that empowers you to succeed in the exciting world of FX trading.

Getting into Forex trading with eToro

Creating an eToro account</3>

To begin your eToro FX Trading journey, you need to create an account on the platform. The process is straightforward and user-friendly, ensuring that traders of all skill levels can easily get started. Simply follow the link below.

During the account creation process, you will be required to provide some personal information, including your name, email address, and preferred username. You will also need to set a secure password to ensure the safety of your eToro account. Additionally, eToro may require you to complete a verification process to comply with regulatory requirements and enhance the security of your account.

Depositing funds into your eToro account

Once your eToro account is set up, the next step is to deposit funds into it. eToro provides various deposit methods, making it convenient for traders from different regions to fund their trading accounts. Some of the common deposit options include credit/debit cards, bank transfers, and e-wallets.

When depositing funds into your eToro account, it is essential to consider the minimum deposit requirements and any associated fees. eToro strives to provide a transparent fee structure, ensuring that traders are aware of any charges beforehand. The processing times for deposits may vary depending on the chosen deposit method, so it’s important to take this into account when planning your trading activities.

To manage your trading capital effectively, it is advisable to start with an amount that you are comfortable with and can afford to lose. It is also recommended to diversify your funds across different trades and not to allocate your entire capital to a single trade. This way, you can minimize the risk and protect your trading account from significant losses.

eToro takes the security of your funds seriously, employing industry-standard security measures to ensure the safety of your deposits. However, it is always a good practice to take additional precautions, such as enabling two-factor authentication and regularly monitoring your account for any suspicious activities.

As you embark on your eToro FX Trading journey, remember to manage your funds responsibly and trade within your risk tolerance. Depositing funds into your eToro account is just the first step towards unlocking the potential of Forex trading on this innovative platform.

Mastering Forex trading with eToro

eToro trading platform

The eToro trading platform is designed to provide a seamless and intuitive experience for traders of all levels. It offers a range of features and tools that can enhance your trading journey and help you make informed decisions. Understanding the various components of the eToro trading interface is essential to maximize your trading potential.

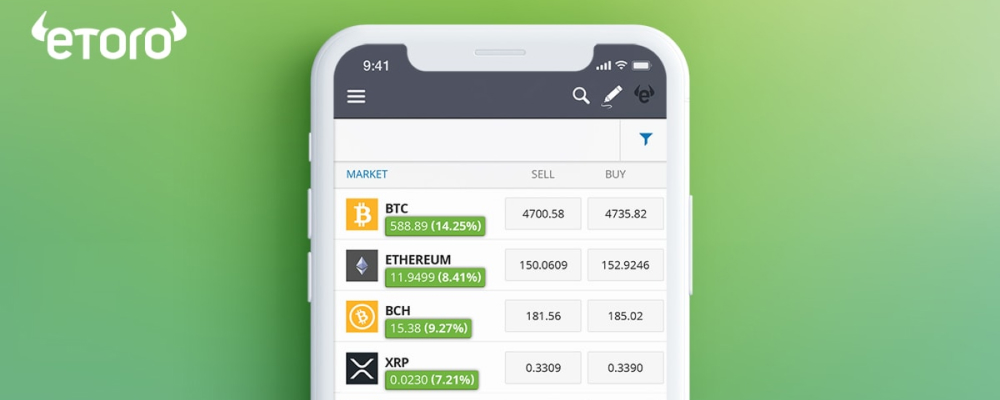

Upon logging into your eToro account, you will be greeted with a user-friendly interface that displays real-time market data, including currency pairs, prices, and charts. The platform allows you to easily navigate between different markets and instruments, enabling you to explore various trading opportunities.

The order placement process on eToro is straightforward. You can execute market orders, limit orders, and stop-loss orders, depending on your trading strategy and risk tolerance. By utilizing these order types effectively, you can enter and exit trades at desired price levels and manage your risk efficiently.

eToro also provides a range of advanced trading tools and indicators to help you analyze the market. These tools include technical analysis indicators, charting capabilities, and real-time news feeds. By utilizing these resources, you can gain insights into market trends, identify potential trading opportunities, and make well-informed decisions.

eToro Copy trading feature

One of the standout features of eToro is the CopyTrader, which allows you to follow and automatically replicate the trades of successful traders. This feature is particularly beneficial for novice traders who are looking to learn from experienced traders or those who may not have the time to actively trade themselves.

When exploring the Copy trading feature, you have the option to browse through a vast selection of traders on eToro and assess their trading performance, risk level, and trading style. You can review their historical trades, portfolio allocation, and other relevant metrics to make an informed decision about whom to copy.

It’s important to note that while CopyTrader can be a valuable tool, it is crucial to conduct thorough research and due diligence before selecting traders to copy. Past performance is not indicative of future results, and it’s important to consider factors such as risk management strategies, market conditions, and the trader’s overall trading approach.

Once you have chosen traders to copy, eToro will automatically replicate their trades in your account proportionally to the amount you allocate for copying. This means that whenever the trader you are copying executes a trade, it will be executed in your account at the same relative size. This allows you to potentially benefit from their successful trades and navigate the market with the guidance of experienced traders.

Managing your copied trades is also a crucial aspect of the CopyTrader. eToro provides tools to set risk management parameters, such as stop-loss levels and copy allocation limits, to ensure that your trading portfolio remains balanced and aligned with your risk appetite.

Developing a FX trading strategy on eToro

While CopyTrading is a valuable feature, it is equally important to develop your own trading strategy on eToro. Having a well-defined strategy tailored to your goals and risk tolerance will set the foundation for a successful trading journey.

When developing a trading strategy, it’s essential to consider factors such as the time horizon of your trades, the types of currency pairs you will focus on, and the risk management techniques you will employ. eToro provides a range of educational resources, including webinars, tutorials, and market analysis, to help you enhance your trading skills and develop a robust strategy.

Technical analysis is a key component of many trading strategies, and eToro provides a variety of technical indicators and charting tools to assist you in analyzing price patterns, trends, and market sentiment. Additionally, Fundamental analysis tools can help you stay informed about economic events and news that may impact the forex market.

When developing your strategy, it’s important to set realistic goals and expectations. Forex trading is a highly volatile market, and losses are inevitable. By establishing risk management techniques, such as setting stop-loss orders and diversifying your portfolio, you can mitigate potential losses and protect your trading capital.

Continuously evaluating and adjusting your trading strategy is also crucial for long-term success. Monitor your trades, analyze your performance, and identify areas for improvement. eToro’s analytics tools can provide valuable insights into your trading history, allowing you to identify patterns and make data-driven decisions to refine your strategy.

By mastering the eToro trading platform, exploring the CopyTrading feature, and developing a well-defined strategy, you can position yourself for success in the forex market. With dedication, discipline, and continuous learning, you can navigate the complexities of eToro FX Trading and unlock your full trading potential.

Maximizing profits and minimizing risks on eToro

Risk management techniques

In the fast-paced and volatile world of Forex trading, effective risk management is crucial for long-term success. While the potential for high profits exists, it is equally important to protect your trading capital from significant losses. Implementing sound risk management techniques can help you navigate the market with confidence and minimize potential risks.

One key risk management strategy is setting stop-loss and take-profit levels for your trades. A stop-loss order is an instruction to close a trade when it reaches a specific price level, limiting your potential losses. On the other hand, a take-profit order allows you to secure your profits by closing a trade when it reaches a predetermined price level. By setting these levels, you can protect your capital and ensure that losses are kept within acceptable limits.

Another critical aspect of risk management is diversifying your trading portfolio. The Forex market consists of various currency pairs, each with its own unique characteristics and levels of volatility. By diversifying your trades across different currency pairs, you can spread out your risk and avoid overexposure to a single market or currency. This approach helps protect your capital from significant losses that may occur in a particular currency pair.

Position sizing is also a key component of risk management. By carefully determining the appropriate position size for each trade, you can control the amount of risk you take. It is generally recommended to risk only a small percentage of your trading capital on any single trade. This ensures that even if a trade goes against you, the impact on your overall account is limited.

Lastly, it is important to stay disciplined and adhere to your risk management plan. Emotions can often cloud judgment, leading to impulsive decisions and potentially harmful trading actions. By maintaining discipline and following your risk management guidelines, you can mitigate the impact of emotional trading and make rational decisions based on your predetermined strategy.

Analyzing market trends and news

To make informed trading decisions, it is crucial to analyze market trends and stay updated with relevant news events. The forex market is influenced by a wide range of factors, including economic indicators, political developments, and global events. By staying informed, you can adjust your trading strategy accordingly and potentially capitalize on emerging opportunities.

Fundamental analysis is a key tool for understanding the underlying factors that drive currency movements. Economic indicators, such as GDP, inflation rates, and employment data, provide insights into the health and strength of an economy. By monitoring these indicators, you can identify trends and anticipate potential market movements.

Technical analysis is another valuable tool for analyzing market trends. By studying price charts, patterns, and indicators, you can identify potential entry and exit points for your trades. Technical analysis helps traders identify support and resistance levels, trend lines, and other patterns that can provide valuable insights into future price movements.

In addition to technical and fundamental analysis, staying updated with news events is crucial. Significant news, such as central bank announcements, geopolitical developments, and economic data releases, can have a profound impact on currency markets. By keeping track of these events, you can adjust your trading strategy and manage your risk effectively.

eToro: Evaluating your FX trading

Continuous monitoring and evaluation of your trading performance are essential for growth and improvement. eToro provides a range of analytics tools that enable you to track and analyze your trades, identify strengths and weaknesses, and make data-driven decisions.

eToro’s analytics tools allow you to review your trading history, including past trades, profits, and losses. By analyzing this data, you can identify patterns and trends, learn from your successes and mistakes, and make adjustments to your trading strategy. Understanding your strengths can help you capitalize on them while identifying weaknesses can guide you in areas that require improvement.

In addition to self-analysis, eToro also provides a platform for social interaction and learning. Engaging with other traders in the eToro community can provide valuable insights and perspectives. By sharing ideas, discussing trading strategies, and learning from experienced traders, you can expand your knowledge and improve your trading skills.

Continuous learning and adaptation are crucial in the dynamic world of forex trading. As you gain experience, it is important to stay open to new ideas and adjust your strategy as market conditions evolve. By embracing a growth mindset and seeking continuous improvement, you can strive for consistent profitability and long-term success on eToro.

In conclusion, maximizing profits and minimizing risks on eToro FX Trading requires the implementation of effective risk management techniques, analyzing market trends and news, and continuously monitoring and evaluating your performance. By adopting these practices, you can navigate the forex market with confidence and increase your chances of success.

eToro: your pathway to FX trading excellence

eToro FX Trading has revolutionized the way traders approach the forex market. With its social trading features, user-friendly interface, and vast community of traders, eToro provides a platform that caters to traders of all levels of experience. Whether you choose to trade independently or utilize the CopyTrading feature, eToro offers the tools and resources necessary to succeed in the exciting world of forex trading.

By leveraging the power of social trading, traders on eToro can learn from each other, share insights, and potentially replicate the success of experienced traders. The CopyTrading feature allows beginners to participate in the market and benefit from the expertise of others, while experienced traders can showcase their skills and attract followers.

However, it’s important to remember that forex trading entails risks, and success cannot be guaranteed. It is crucial to develop a well-defined trading strategy, implement effective risk management techniques, and continuously monitor and evaluate your performance. Forex trading requires discipline, dedication, and a commitment to ongoing learning.

Related articles:

A detailed overview of eToro trading markets: direct investing in stocks, ETFs and Crypto assets, CFDs on currency pairs, indices, and commodities. Trading with leverage, minimal commissions, low spreads, and a wide range of instruments and risk management tools.

Review of eToro mobile trading app and platform, a comprehensive solution for traders on the go. Learn about its features, security measures, and tips for successful mobile trading. Explore advanced tools, social features, and Social trading options. Stay informed with real-time market data. Enhance your trading experience with eToro’s user-friendly mobile app.

Discover the world of eToro Social trading and leverage the success of traders worldwide. With the option to choose a strategy or portfolio, it’s easy to invest and earn from top-performing trades. Dive deeper with an expert review on eToro Social and Copy trading, including features like copying new trades, Stop Copy, and Pause Copy, as well as trading conditions and commission rates.

eToro: transform your FX Trading - FAQ