AvaTrade Social trading: unlocking the power of collective wisdom

Social trading is a revolutionary approach to online trading that enables traders to connect, share insights, and even replicate the trades and strategies of successful traders. It leverages the power of social networks and technology to create an interactive and collaborative trading environment. Instead of relying solely on their knowledge and experience, traders can now tap into the expertise of others and make informed trading decisions based on the collective intelligence of the community.

AvaTrade, a leading online trading platform, has embraced this trend and introduced AvaTrade Social Trading, a powerful feature that allows traders to connect, interact, and learn from each other. In this section, we will dive deeper into the concept of social trading, provide an overview of AvaTrade as a platform, AvaSocial, and explore the benefits of AvaTrade Social Trading for both experienced and novice traders.

AvaTrade Social Trading

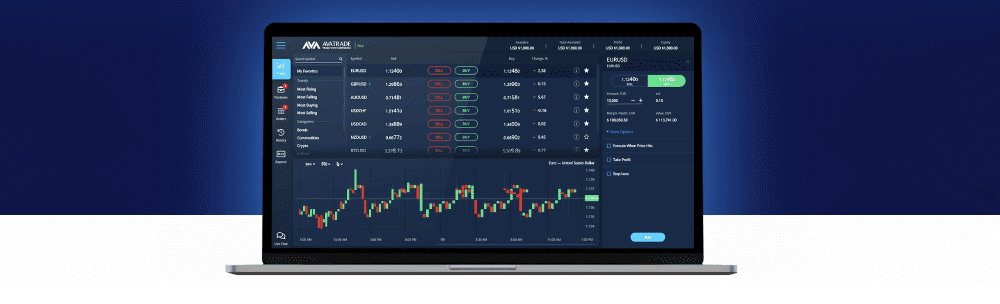

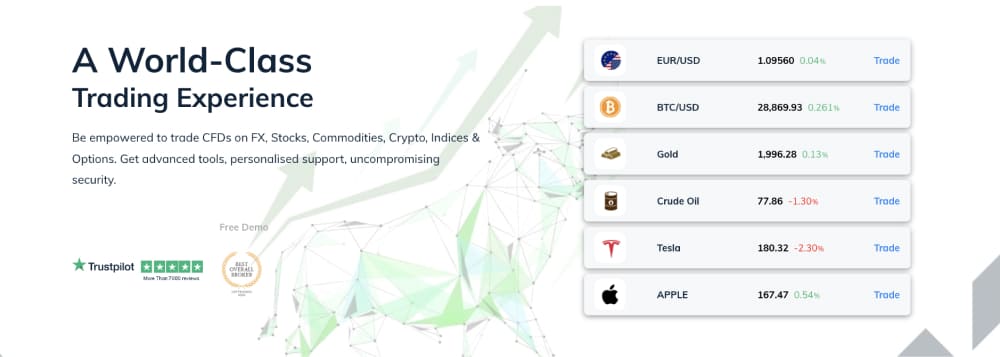

AvaTrade is a well-established online trading platform that has been serving traders worldwide since 2006. It has earned a strong reputation for its user-friendly interface, advanced trading tools, and a wide range of financial instruments available for trading. With a presence in over 150 countries, AvaTrade has become a trusted name in the industry, offering a secure and regulated platform for traders of all levels.

AvaTrade has taken social trading to the next level by integrating it seamlessly into its platform. AvaTrade Social Trading allows users to connect with other traders, follow their trades, and even automatically copy their strategies. This innovative feature empowers traders to learn from successful investors and replicate their trading actions in real time. By leveraging the collective knowledge and expertise of the AvaTrade community, traders can potentially improve their trading performance and achieve better results.

Benefits of Social Trading with AvaTrade

The benefits of Social trading on AvaSocial are numerous. For experienced traders, social trading provides an opportunity to diversify their investment portfolio, discover new trading strategies, and gain insights from other successful traders. It allows experienced traders to showcase their skills and potentially earn additional income through the platform’s Copy-trading feature.

Novice traders, on the other hand, can benefit from social trading by learning from more experienced traders, gaining exposure to different trading styles, and gradually building their trading knowledge and skills. The ability to copy trades from successful traders provides a valuable learning experience, allowing novice traders to understand the rationale behind trading decisions and observe the execution of successful strategies.

In conclusion, AvaTrade Social Trading is a game-changer in the world of online trading. By connecting traders around the globe and facilitating the sharing of knowledge and expertise, AvaTrade has created a vibrant and collaborative community.

How to start Social trading with AvaTrade

Getting started with AvaTrade Social Trading is a straightforward process that allows traders to quickly tap into the power of the community. In this section, we will guide you through the steps of creating an account on AvaTrade, familiarize you with the platform’s social trading features, and show you how to connect with successful traders.

Create AvaTrade account

To begin your journey with AvaTrade Social Trading, you need to create an account on the platform by clicking on the button below. You will be prompted to provide your personal information, including your name, email address, and contact details. It is important to ensure that the information you provide is accurate and up-to-date, as it will be used for account verification and communication purposes.

Once you have filled in the necessary details, you will need to choose a username and password for your account. It is recommended to select a strong and unique password to ensure the security of your account. After completing the registration process, you may be required to verify your email address or provide additional documentation to comply with regulatory requirements.

Navigate the AvaTrade platform and Social trading features

Once you have successfully registered an account on AvaTrade, you can log in to the platform and explore its user-friendly interface. The AvaTrade platform provides a seamless and intuitive trading experience, with a variety of features and tools at your disposal. Take some time to familiarize yourself with the platform’s layout, navigation menus, and trading dashboard.

Within the platform, you will find dedicated sections for social trading. These sections may include a “Social” or “Copy Trading” tab, which will allow you to access the various social trading features and functionalities. AvaTrade provides a comprehensive set of tools to help you discover and connect with successful traders, analyze their performance, and copy their trades.

Connect and follow successful traders on AvaTrade

One of the key advantages of AvaTrade Social Trading is the ability to connect with successful traders and follow their trading activities. Within the AvaTrade platform, you will find a vast community of traders from around the world, each with their unique trading strategies and performance records. To connect with traders, you can browse through their profiles, explore their trading history and statistics, and decide whether to follow them.

When selecting traders to follow, it is important to consider various factors, such as their trading style, risk tolerance, and track record. AvaTrade provides detailed trader profiles, which typically include information about their trading experience, performance metrics, risk levels, and preferred trading instruments. Take the time to review these profiles and analyze the data to make informed decisions about who to follow.

Review and analyze trader profiles, statistics, and performance

To make the most of AvaTrade Social Trading, it is essential to review and analyze trader profiles thoroughly. The trader profiles on AvaTrade provide valuable insights into their trading strategies, performance metrics, and risk management approaches. By carefully examining this information, you can gain a better understanding of a trader’s track record, consistency, and risk-reward ratio.

Pay attention to key performance indicators such as the trader’s win rate, average profit/loss per trade, and maximum drawdown. These metrics can help you assess the trader’s profitability, risk management skills, and overall trading competence.

Additionally, consider the trader’s trading style, timeframes, and preferred assets to ensure compatibility with your own trading goals and preferences.

In conclusion, getting started with AvaTrade Social Trading is a simple process that involves creating an account, exploring the platform’s features, connecting with successful traders, and analyzing their profiles and performance. By following these steps, you can embark on a journey of collaborative trading, learning from experienced traders, and potentially enhancing your trading performance.

Master Forex trading on AvaSocial

Understanding the mechanics of AvaSocial is crucial to making informed trading decisions and maximizing the benefits of this innovative feature. In this section, we will delve into the process of copying trades and strategies from successful traders, explore the different copy trading options available on AvaTrade, and discuss important aspects such as risk management and trade monitoring.

Copy trades and strategies from successful traders

AvaTrade Social Trading provides you with the opportunity to replicate the trades and strategies of successful traders. This feature allows you to automatically mirror the actions of traders you follow, ensuring that you can benefit from their expertise and potential profitability. When you choose to copy a trader, your account will automatically execute the same trades as the selected trader, in proportion to your chosen investment amount.

Copying trades can be done in two main ways: “AutoTrading” and “Manual Copying”. AutoTrading is a fully automated process where your trades are executed automatically based on the actions of the trader you are copying. On the other hand, manual copying allows you to review each trade before deciding whether to replicate it in your account. AvaTrade offers flexibility in choosing the copying method that suits your preferences and risk appetite.

Explore different Copy trading options

AvaTrade provides a range of copy trading options to cater to different trading styles and preferences. One popular option is the “CopyTrader” feature, which allows you to copy entire portfolios of successful traders. This means that you can replicate not only individual trades but also the overall investment strategy and asset allocation of the trader you are copying. By diversifying your investments across multiple successful traders, you can spread your risk and potentially increase your chances of success.

Another option available on AvaTrade is the “CopyPortfolio” feature, which is a curated portfolio of top-performing traders or assets. These portfolios are carefully selected and managed by AvaTrade’s team of experts, providing you with the opportunity to invest in a diversified portfolio without the need for manual selection and monitoring. CopyPortfolios can be based on different themes, such as sector-specific strategies, geographical regions, or asset classes.

Manage risk and set appropriate trade parameters

While AvaTrade Social Trading offers the potential for significant gains, it is essential to manage your risk effectively. Copying trades from successful traders does not guarantee profits, and it is important to set appropriate trade parameters to align with your risk tolerance and investment goals. Before copying a trader, carefully analyze their risk management approach, maximum drawdown, and overall risk profile.

AvaTrade provides various risk management tools and features to help you maintain control over your investments. These include setting stop-loss orders to limit potential losses, adjusting trade size to align with your risk appetite, and diversifying your portfolio by copying multiple traders with different trading strategies. It is also recommended to regularly review and assess the performance of the traders you are copying, making adjustments or ceasing to copy them if necessary.

Monitor and track the performance of copied trades

Monitoring and tracking the performance of the trades you have copied is crucial to evaluating the success of your social trading strategy. AvaTrade offers comprehensive performance tracking tools that allow you to analyze the results of your copied trades. You can assess the profitability, risk-reward ratio, and overall performance of the traders you are following.

By regularly monitoring the performance of your copied trades, you can identify patterns, make informed decisions on which traders to continue following, and adjust your overall social trading strategy. It is important to maintain a disciplined approach, evaluate your own trading goals, and make necessary adjustments to optimize your portfolio’s performance.

Pro tips for successful AvaSocial trading

Maximizing success with AvaTrade Social Trading requires a strategic approach and a deep understanding of the platform’s features. In this section, we will explore how to identify and select the right traders to follow and copy, utilize AvaTrade’s social trading tools and resources, implement proper risk management strategies, and continuously improve your trading skills.

- Identify and select the right traders to follow and copy

One of the key factors in maximizing success with AvaTrade Social Trading is selecting the right traders to follow and copy. While there are numerous traders to choose from, it is important to conduct thorough research and analysis before making your decision.

Start by reviewing the trader profiles available on AvaTrade. Pay attention to performance metrics such as average monthly returns, drawdowns, and risk levels. Look for traders who have demonstrated consistent profitability over a significant period, as this indicates a higher likelihood of sustained success.

Consider the trading style and strategy of each trader. Some traders may focus on short-term scalping, while others may adopt a long-term trend-following approach. Align your own trading goals and risk tolerance with the strategies of the traders you are considering to follow.

Additionally, take advantage of AvaTrade’s social trading community by exploring user reviews and ratings. Read feedback and testimonials from other users who have followed and copied the traders you are interested in. This can provide valuable insights and help you make an informed decision.

- Utilizing AvaTrade’s Social trading tools and resources

AvaTrade provides a range of social trading tools and resources to enhance your trading experience. Take advantage of these features to gain valuable insights and make informed decisions.

The AvaTrade platform offers comprehensive trader statistics and performance data. Analyze these metrics to identify patterns and trends. Look for traders with a solid track record in terms of consistent profitability, risk management, and low drawdowns.

Utilize the social trading forums and communities available on AvaTrade. Engage in discussions, seek advice, and learn from the experiences of other traders. These forums can provide valuable insights and help you stay updated with the latest market trends and trading strategies.

AvaTrade also provides educational resources, including webinars, tutorials, and analysis tools. Take advantage of these resources to enhance your trading knowledge and skills. Continuous learning is key to staying ahead in the dynamic world of social trading.

- Implement proper risk management strategies

Managing risk is of utmost importance when engaging in social trading. While copying successful traders can be profitable, it also carries inherent risks. To mitigate these risks, it is crucial to implement proper risk management strategies.

Set a realistic risk tolerance level based on your financial situation and investment goals. Allocate an appropriate portion of your capital for social trading and avoid overexposing yourself to a single trader or strategy.

Implement stop-loss orders to limit potential losses. This allows you to automatically exit a trade if it reaches a predetermined level of loss. Consider setting stop-loss levels based on the individual trader’s risk profile and your risk appetite.

Diversify your portfolio by copying multiple traders with different trading strategies. By spreading your investments across various traders, you reduce the risk of being heavily reliant on a single trader’s performance.

Regularly monitor the performance of the traders you are copying. If a trader’s performance consistently underperforms or demonstrates increased risk, consider discontinuing copying their trades to protect your capital.

- Learn from mistakes and continuously improve trading skills

Social trading on AvaTrade is not a guaranteed path to success. It is essential to approach it as a learning experience and continuously strive to improve your trading skills.

Review your trading history and analyze the outcomes of your copied trades. Identify patterns and trends to understand what works and what doesn’t. Learn from any mistakes and adjust your approach accordingly.

Take advantage of the feedback and insights provided by the AvaTrade community. Engage in discussions, ask questions, and seek advice from other traders. This collaborative environment can provide valuable feedback and help you identify areas for improvement.

Invest in your trading education by attending webinars, workshops, and seminars. Stay updated with the latest market trends and trading strategies. Continuously expanding your knowledge and skills will give you an edge in the competitive world of social trading.

In conclusion, maximizing success with AvaTrade Social Trading requires a careful selection of traders to follow and copy, utilizing the platform’s tools and resources, implementing proper risk management strategies, and continuously improving your trading skills. By following these guidelines, you can enhance your chances of achieving profitable results.

FX trading strategies for Social trading with AvaTrade

AvaTrade Social Trading presents traders with a plethora of opportunities to enhance their trading performance. In this section, we will explore advanced strategies and provide valuable tips to take your AvaTrade Social Trading experience to the next level. By implementing these strategies and utilizing the available resources, you can further maximize your success and potentially achieve superior trading results.

- Diversifying investment portfolios through social trading

Diversification is a fundamental principle in investment that helps spread risk and minimize potential losses. AvaTrade Social Trading offers an excellent opportunity to diversify your investment portfolio by copying trades from multiple successful traders. By spreading your investments across different traders with varying strategies and trading instruments, you can reduce the impact of any single trader’s performance on your overall portfolio.

Consider diversifying not only across different traders but also across different asset classes. AvaTrade provides access to a wide range of financial instruments, including stocks, commodities, forex, and cryptocurrencies. By diversifying your investments across various asset classes, you can potentially benefit from different market conditions and increase the overall stability of your portfolio.

- Utilizing Technical analysis tools to enhance trading decisions

Technical analysis is a widely used approach to analyzing financial markets and making trading decisions based on price patterns, trends, and indicators. AvaTrade offers a range of technical analysis tools and indicators that can be utilized to enhance your trading decisions when engaging in social trading.

Take advantage of charting tools provided by AvaTrade to analyze the historical price movements of assets and identify patterns or trends. Use popular technical indicators such as moving averages, oscillators, and support/resistance levels to gain insights into potential entry and exit points for your trades.

Combine technical analysis with the information available on the trader profiles. Look for traders who demonstrate a solid understanding of technical analysis and incorporate it into their trading strategies. By following and copying traders who utilize technical analysis effectively, you can benefit from their expertise and potentially improve your own trading decisions.

- Exploring social trading communities and forums for insights

Social trading communities and forums can be a valuable resource for gaining insights and staying updated with the latest market trends. AvaTrade provides a platform where traders can interact, share ideas, and discuss trading strategies with each other.

Engage in discussions on the AvaTrade social trading forums to exchange ideas and learn from the experiences of other traders. Participate in conversations related to specific trading instruments or strategies that you are interested in. These communities can provide valuable insights, alternative perspectives, and trading ideas that can enhance your decision-making process.

Additionally, AvaTrade may organize webinars, workshops, or educational events for its users. Take advantage of these opportunities to learn from industry experts, gain valuable insights, and expand your knowledge base. The more engaged you are within the social trading community, the more you can benefit from collective wisdom and potentially improve your trading performance.

- Leverage the power of Social trading data and analytics

AvaTrade provides a wealth of data and analytics that can be leveraged to gain a deeper understanding of the social trading landscape. Analyzing this data can help you make informed decisions and refine your social trading strategy.

Explore the performance statistics and historical data of the traders you are following. Identify patterns and trends in their trading performance, such as seasonal trends or specific market conditions that favor their strategies. This analysis can provide valuable insights into the optimal times to increase or decrease your exposure to specific traders.

Utilize the analytical tools provided by AvaTrade, such as performance graphs and risk metrics, to assess the performance of your portfolio. Regularly review and analyze your copied trades to identify areas for improvement and adjust your strategy accordingly.

In conclusion, implementing advanced strategies and tips can elevate your AvaTrade Social Trading experience and potentially lead to enhanced trading results. By diversifying your portfolio, utilizing technical analysis tools, engaging in social trading communities, and leveraging data and analytics, you can optimize your trading decisions and increase your chances of success.

AvaTrade: Unlocking the Power of Social Trading

AvaTrade Social Trading offers a unique and powerful opportunity for traders to connect, learn, and potentially increase their profits. By embracing the principles of social trading, utilizing the features and tools provided by AvaTrade, and continuously improving trading skills, traders can unlock the power of collective wisdom and embark on a journey toward enhanced trading success.

Related articles:

TopForex.trade review of AvaTrade’s trading platforms: AvaSocial, AvaOption, AvaTradeGO, WebTrader, and MT4 and MT5 terminals. In-depth analysis of their technical capabilities and Social trading opportunities provided by the broker, as well as a step-by-step guide on how to set up an AvaTrade account and enjoy all the benefits of trading with a regulated, award-winning broker.

TopForex.trade expert review of AvaTradeGo: a mobile trading app from one of the global online brokers. Everything you need to know about its advanced features that are there to enhance your trading experience and manage your positions on the go.

Everything you should know about AvaTrade’s advanced trading features: risk management with AvaProtect, Trading Central analytics, the free Guardian Angel feedback and support system, Expert Advisors, auto deals with ZuluTrade, DupliTrade, and Capitalise.ai, as well as various in-house developments like AvaSocial.

AvaTrade Social trading - FAQ