AvaTrade trading instruments: a comprehensive guide to diverse investment opportunities

AvaTrade, a globally recognized online trading platform, has emerged as a beacon for both novice and seasoned traders seeking to harness the potential of these instruments. With a commitment to transparency, innovation, and client-centric services, AvaTrade provides a robust ecosystem that caters to a wide spectrum of trading preferences.

This article aims to illuminate the multifaceted world of trading instruments offered by AvaTrade, offering an in-depth exploration of the tools and assets that form the backbone of trading on this platform. From Forex and commodities to stocks, Cryptocurrencies, and indices, each instrument carries its own unique dynamics and opportunities. By understanding the nuances of these instruments, traders can make informed decisions, optimize their portfolios, and pursue their financial goals with confidence.

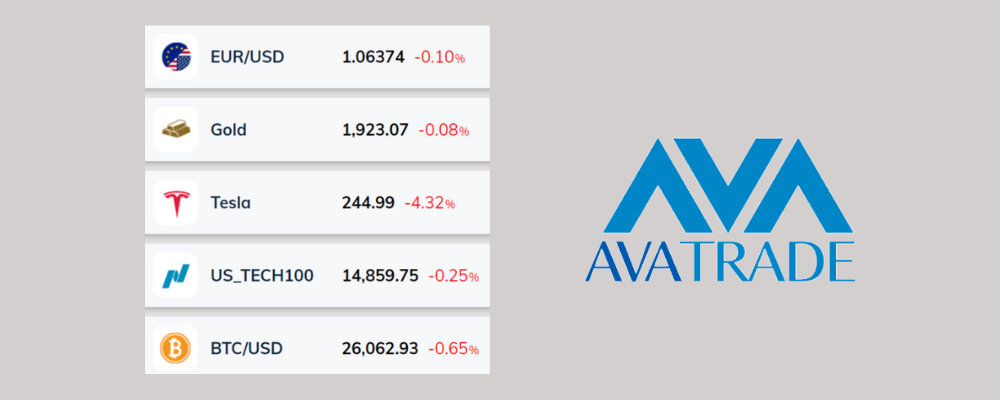

AvaTrade trading instruments

AvaTrade provides its clients with a range of trading options, including currency pairs, CFDs on commodities, indices, ETFs, bonds, and stocks, along with the possibility of engaging in options and Crypto trading. Each tool offers distinct opportunities for investors to explore and potentially profit from the market.

AvaTrade currency pairs trading

AvaTrade presents a versatile array of 50+ currency pairs with exceptional spreads. Traders can engage in majors, minors, and exotics seamlessly, commission-free, 24/5. Leverage, up to 400:1 (subject to jurisdiction and asset class), further enhances trading potential. This dynamic platform equips traders to navigate the forex market with precision, though prudent risk management remains paramount.

AvaTrade CFD trading: commodities, indices, ETFs, stocks, bonds, and Crypto

AvaTrade’s CFD (Contract for Difference) trading offer is a versatile gateway to a wide range of financial instruments, providing traders with the opportunity to engage in various markets. From commodities and indices to ETFs, stocks, bonds, and cryptocurrencies, AvaTrade offers a diverse array of options for traders seeking to capitalize on market opportunities.

- Trade bonds & treasuries CFDs

AvaTrade enables traders to access both Japanese and European government bonds through CFDs. With competitive spreads and leverage of up to 5:1, traders have the flexibility to engage in bond markets according to their preferences. Whether going long (BUY) or short (SELL), AvaTrade empowers traders to navigate the bond market with ease and confidence.

- ETF CFDs

AvaTrade provides a platform for trading ETFs (Exchange-Traded Funds) with spreads starting as low as 0.0013. With leverage options of up to 5:1, traders can amplify their potential returns in this diverse market. ETF CFDs present an excellent opportunity to diversify portfolios and capitalize on market trends.

- Stock CFDs

With leverage of up to 5:1, traders on AvaTrade can access a wide array of stocks, including those listed on major exchanges like NYSE, US TECH100, and FTSE. This offers traders the flexibility to engage in global stock markets with a smaller capital outlay.

- Commodities CFDs

AvaTrade’s platform facilitates trading in various commodities, including energies, precious metals, and agricultural products. Traders can start with a modest investment and leverage up to 10:1, allowing for exposure to a diverse range of commodities. Additionally, AvaTrade offers features like auto trading and expert advisors to enhance the trading experience.

- Indices CFDs

Popular indices such as Dow Jones and DAX100 are accessible through AvaTrade’s CFD platform. Traders can employ leverage of up to 10:1 on index trading, offering an efficient way to speculate on global financial markets and stay informed about top stock market movements.

- Crypto CFDs

Regulated in five continents, AvaTrade offers a secure way to access crypto markets. They provide a wide range of digital currencies, with very tight spreads and 1:2 leverage (Not available in Canada). Get leverage of up to 2:1 (for EU residents) and 25:1 (for non-EU residents), and increase your trade value and exposure to the markets. Through CFDs, traders can speculate on the price movements of popular cryptocurrencies like Bitcoin, Ethereum, and more, without the need for direct ownership. This offers traders the opportunity to potentially profit from both rising and falling crypto prices.

AvaTrade options trading

One standout feature of AvaTrade’s options trading is the AvaOptions platform. This specialized platform is designed to provide traders with an advanced and intuitive interface for trading options. It offers a range of tools, analytics, and risk management features to enhance the trading experience, making it an invaluable resource for both novice and experienced options traders.

AvaTrade provides access to a wide variety of options, allowing traders to choose from an extensive selection of contracts based on different underlying assets. This includes options on stocks, indices, commodities, and currency pairs. The diversity of options available enables traders to implement a range of strategies to meet their specific trading objectives.

Options trading with AvaTrade allows for the implementation of a multitude of strategies. Traders can employ strategies like covered calls, protective puts, straddles, and spreads, among others. This flexibility in trading strategies offers traders the ability to customize their approach to market conditions and their risk tolerance.

Options trading provides unique opportunities for risk management and hedging strategies. Through options contracts, traders can protect their portfolios from adverse market movements or capitalize on potential price swings. This additional layer of risk management is a valuable tool for preserving capital and optimizing trading outcomes.

AvaTrade recognizes the importance of education in options trading. The platform offers a wealth of educational resources, including webinars, tutorials, and market analysis. This ensures that traders have access to the knowledge and information needed to make informed decisions in the options market.

Start trading with AvaTrade

AvaTrade, a distinguished online trading platform, stands ready to be your trusted companion on this exciting venture. With a comprehensive range of trading instruments and a commitment to client-centric services, AvaTrade provides an environment where both novice and seasoned traders can thrive.

To begin your trading journey with AvaTrade, simply click the button below. This action opens the door to a world of possibilities, from currency pairs and commodities to indices, stocks, and options trading.

Related articles:

Explore the comprehensive examination of AvaTradeGo, a mobile trading application offered by a leading international online brokerage. This evaluation spotlights its cutting-edge functionalities meticulously crafted to elevate your trading venture and seamlessly oversee positions while on the move.

Discover AvaTrade’s array of trading platforms, including AvaSocial, AvaOption, AvaTradeGO, WebTrader, and MT4 and MT5 terminals. Gain insights into the broker’s technical and social trading capabilities, along with a detailed, step-by-step guide on how to establish an AvaTrade account.

Dive into the complexities of AvaTrade’s advanced trading capabilities, meticulously crafted to equip traders with exceptional tools and insights. Immerse yourself in the realm of risk management with AvaProtect, harness the analytical power of Trading Central, embrace the Guardian Angel feedback system, utilize Expert Advisors, and embark on automated transactions with ZuluTrade, DupliTrade, and Capitalise.ai. Furthermore, explore proprietary innovations like AvaSocial, designed to elevate your trading experience.

AvaTrade trading instruments - FAQ