Elliott Waves theory: basics you should know

Over the last decade, Forex trading has grown in popularity as many people have discovered it to be a profitable pastime or even a career.

Most Forex traders are day traders, who typically use Technical analysis in their trading to better understand how to make a profit trading in the market. As a result, many Forex traders are interested in Technical analysis and the tools and theories available to help them improve.

You’ve likely heard of the Elliott Wave theory, which is commonly mentioned alongside Fibonacci patterns. Ralph Nelson Elliott, an American accountant, and author developed the Elliott Wave theory in the 1920s (hence the name). He came to believe that stock markets moved in predictable cycles. It was a revolutionary way of thinking at the time because the stock market was regarded as chaotic by 1920s traders. Since then, the Elliott Wave theory has gained popularity as a market analysis method for traders around the world.

The internet boom of the last ten years or so has revealed a whole new generation of Elliott Wave practitioners, and some, for whatever reason, have taken a more hybrid route in its application, for example, using Elliott Wave in Cryptocurrency trading, departing from the core-essence and principles of what R.N. Elliott discovered.

In this article, we’ll talk about the Elliott Wave theory’s history and the ways you can use it to predict market swings in Forex trading.

The core concept of Elliott Waves theory for Forex trading

The Elliott Wave theory proposed that market cycles were caused by traders’ reactions to outside influences (for example, macro factors, studied by Fundamental analysis) or the psychology of the masses. Elliott discovered that the downward and upward swings of mass psychology had a recurring pattern, which he dubbed “waves.” This theory is based on the Dow theory, which implies that the market shifts in waves as well.

However, due to their fractal nature, Elliott was able to break down and analyze markets in far greater detail than Dow. Fractals are formations that endlessly repeat themselves as they get smaller, and Elliott found that stock trading patterns worked in the same way.

Also, fractions are never-ending patterns that repeat themselves over and over, becoming similar on different scales. And after discovering these patterns (or waves) in the market, Elliott developed a method for forecasting the market itself.

How to trade Forex with Elliott Waves theory

The goal of applying Elliott Wave theory guidelines is to determine where the market is now in terms of the overall structure and cycle, and what portion of that motion is likely to come next, so you form your future Forex trading strategy. Traders who use waves are identified by having a preferred wave pattern, or “sweet spot,” which frees them from having to keep a full account of the waves in all time frames.

Although the variability of forms is a real challenge for any Elliott’s understudy, distinguishing between impulsive and corrective waves is critical. Another important lesson from Elliott is to recognize that the market spends far more time in corrective mode than in impulse and sentiment mode, and those periods of correction can be extremely complex in terms of price action.

It is common for traders’ patience to run out during a corrective pattern while waiting for confirmation of a trend change. So it’s a bit of common expert advice to wait for corrective patterns to emerge before entering the market. This necessitates discipline and a thorough understanding of the various ways in which corrective patterns can be applied.

Patterns of Elliott Waves theory in Forex trading

Also, the Elliott Wave theory can be explained as follows:

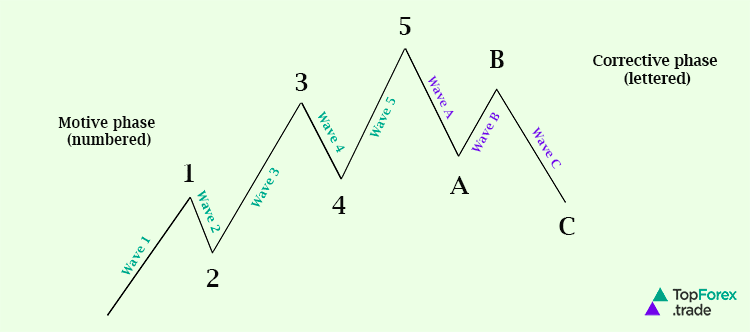

Five waves move in the main trend’s direction, followed by three waves in a correction (totaling a 5-3 move). Then, this 5-3 move is divided into two subdivisions of the following higher wave move. Though the time span of each wave varies, the underlying 5-3 pattern remains constant.

Consider the chart above, which is made up of eight waves (five net up and three net down) marked 1, 2, 3, 4, 5, A, B, and C.

Waves 1, 2, 3, 4, and 5 make up an impulse, while waves A, B, and C compensate for a correction. Wave 1 is formed by the five-wave impulse, and wave 2 is formed by the three-wave correction.

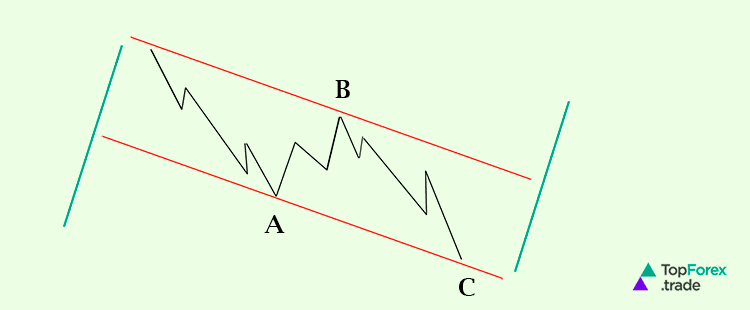

Normally, the corrective wave has three distinct price movements: two in the direction of the main correction (A and C) and one against it (B). Waves 2 and 4 in the diagram above are corrections. The structure of these waves is typical as follows:

In this image, waves A and C move in the direction of the trend at one-larger degree, indicating that they are impulsive and composed of five waves. Wave B, on the other hand, is counter-trend and thus corrective, and it consists of three waves.

An Elliott wave degree consists of trends and counter-trends formed by an impulse wave followed by a corrective wave.

As the patterns show, five waves do not always travel net upward, and three waves do not always travel net downward. When the larger-degree trend is down, the five-wave sequence is down as well.

Elliott identified nine different types of waves, which he identified from largest to smallest:

- Grand Super Cycle;

- Super Cycle;

- Cycle;

- Primary;

- Intermediate;

- Minor;

- Minute;

- Minuette;

- Sub-Minuette;

Since Elliott waves are fractals, wave degrees can theoretically expand and contract beyond those mentioned above. In practice, a trader might recognize an upward-trending impulse wave, go long, and then sell or short as the pattern fulfills five waves and a reversal is inevitable.

Again, to summarize briefly: According to the Elliott Wave theory, markets changes in five patterns: A five-way rise will be followed by a three-way fall in an upward trend. A five-way fall will be followed by a three-way rise in a downward trend. The five-way patterns are known as “impulse waves,” while the three-way patterns are known as “corrective waves.”

The price rise in the ‘impulsive wave’ is in phase one of the uptrend. This is the point at which traders expect the trend to reverse. This results in a negative denominator for the prices. Prices do not fall significantly in wave two. The trend rises in wave three, bringing positive news into the market. On wave four, prices fall due to profit booking, leading to an optimistic outlook from traders who receive positive market news.

Forex trading indicators to use with Elliot Waves theory

As with any other indicator or chart pattern, The Elliott Wave theory is not completely sufficient as a solitary point of reference when spotting trading opportunities. The Elliott Wave theory’s analysis results are better utilized in conjunction with other types of analysis, such as global economic news and other technical indications that could support or refute them.

Frequently utilized indicators with the Elliott Wave theory are as follows:

Simple moving average (SMA) trading indicator

A price decrease may be more likely to occur if a negative Elliott Wave indicator is found at the same time the 50-day SMA indicates downward momentum. On the other hand, a bullish Elliott Wave along with a rising 50-day SMA may be urging traders to take a long position on traded currency pairs or other instruments.

Trading Relative Strength Index (RSI)

A trader’s confidence in initiating a position may increase when overbought or oversold conditions coincide with wave indications and both indicators are pointing in the direction of an expected price swing.

Moving Average Convergence-Divergence (MACD)

The third wave of a five-wave structure, which is typically the longest and strongest wave, can be identified using the MACD line when looking for the setup of the structure. This makes it easier for traders to spot a five-wave structure as it forms rather than after the pattern has finished.

Benefits of using Elliott Waves theory for Forex trading

The Elliott Wave theory adds value as a diagnostic tool for identifying potential trade opportunities by offering a framework for organizing price movement information into simple, graphical representations. With a broad knowledge of the principles of this theory, even beginner traders can begin employing it to inform their strategies.

At the same time, Elliott Wave trading’s popularity works in its favor: because it is based on consumer psychology, its relevance to Forex trading is enhanced when a large group of traders observes these patterns and trades based on this information.

Elliott Wave theory analysis is essential for any Forex trader who wants to maximize their profits. It is used to predict the direction of the market trend, as well as the rise and fall of currency prices, based on psychological factors of brokers and trade participants.

Profitably applying the Elliott Wave Forex theory is a good starting point for learning the tricks of the trade in the Foreign Exchange market. It is an excellent tool for enhancing and enriching your trading strategy that can be used to identify stop-losses and predict the strength of potential market moves.

Yet, it works the best in combination with other Forex trading indicators discussed above. Moreover, trusted brokers that are regulated by the strictest global financial authorities offer their clients in-platform advanced trading tools that would definitely work to your benefit; another important point is to practice on a Forex demo account, making deals with virtual money without risking your own capital to create your perfect combination of trading indicators and theories.

Save Forex trading with VPN providers

Without arguments, it’s much easier to focus on theories and patterns to predict the market when you don’t have to worry about the general safety of your trading account. Top VPN services for Forex trading allow you to reroute your traffic at will through one or more locations, so you will always be protected from government surveillance or intruders. In addition, state-of-the-art military-grade encryption algorithms will prevent your personal information from leaking onto the Internet.

Click the button below to secure your Forex trade with one of the best VPNs:

Using a VPN also makes it possible for you to maintain your anonymity, which prevents third parties from monitoring, collecting, or storing information about your online activities and data; it enhances your feeling of security and comfort because it lowers your risk of falling victim to cybercriminals, hackers, and other cyberattacks that could compromise your password and other sensitive information.

Top brokers for Forex trading

Elliott Waves theory is one of the most widely known parts of Technical analysis, created as any other trading concept to aid one goal: to help traders predict the market movements and get positive returns from their deals. Try your hand at interpreting the results of your analysis in a demo or real account of regulated Forex brokers listed below to see which ones you prefer.

These Forex brokers have a long history of providing excellent customer service while satisfying the high standards of the most stringent financial regulators in the world. You can register an account with these trustworthy brokers without risk by using free VPS or VPN services; these brokers provide some of the most advantageous trading conditions, including Forex bonuses of up to 100% on initial deposits (subject to geographic availability), Copy trading, and negative balance protection. They also offer the best selection of currency pairs as well as other financial instruments like stocks, indices, ETFs, and Cryptocurrencies.

Another good news is that you are not limited to choosing just one broker. All regulated Forex brokers reviewed below provide demo accounts, so you can test them out and determine if their platforms are right for you. It will allow you to experiment with different trading strategies, make use of advanced features that are currently available on the market, and collect offered Forex bonuses.

It could also be an important part of your portfolio diversification strategy: you can trade freely with one broker while supporting Social trading with another, generating some passive money as you use the third one for hedging your trading risks.

Plus500 CFDs trading

Plus500 is a reliable broker that offers CFDs trading in more than 60 currency pairings, commodities, stocks, indices, and cryptocurrency with “stop-loss” and “stop-limit” features. The first is meant to guard against transaction losses, while the second instructs the broker to sell assets if their quotes drop below a predetermined level that the trader has selected.

Opening an account just takes a few minutes. Additionally, you can practice trading strategies on a free, limitless demo account before moving on to the next level. You can use PayPal, bank transfers, BPay, Skrill, Visa, MasterCard, and other methods to deposit and withdraw money from your account.

Traders can use a web interface for PCs and laptops to access the Plus500 trading platform as well as a mobile app for Android and iOS.

Plus500 is fully licensed and authorized to operate globally, adhering to the regulations of regulatory bodies such as CySEC, FCA, ASIC, and MAS to ensure safe trading.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

eToro FX trading

eToro is one of the most well-known brokers in the world when it comes to online trading. With the best terms, including low Forex and trading expenses and low minimum deposits, you can trade and invest in more than 2000 different assets. Since 2017, additional digital currencies have been added to the list, including Bitcoin, Ethereum, and others. You can choose from popular currency pairs, stocks, indices, Cryptocurrencies, and commodities for your trading transactions.

For both retail and professional clients, eToro offers two different types of accounts. The first offers a CopyTrader feature and protection against negative balance, while the second stands out for having infinite leverage. Additionally, beginners can always use a demo account to play around with and try out various methods.

eToro has millions of clients worldwide and is backed up by licenses that allow it to operate all around the world, as it is regulated by the FCA, ASIC, and CySEC.

NAGA Markets FX trading

NAGA Markets is a highly regarded broker that enables you to trade major, minor, and exotic currency pairings as well as stocks, ETFs, commodities, metals, and other instruments. It is possible to access a number of trading platforms, including MetaTrader 4 and 5 and NAGA Webtrader, the broker’s own platform, which includes mobile versions.

Additionally, NAGA is a social trading network that enables users of all skill levels to trade, share, and duplicate assets using more than 950 different trading instruments. The broker’s trading conditions are defined by narrow spreads, low costs, quick trade execution, and a choice of customizable account funding options.

NAGA’s goal is to make trading easy and accessible for everyone, thus the broker complies with several regulatory standards around the globe, such as the FCA, CySEC, MiFID II, and MiFIR.

AvaTrade FX trading

AvaTrade brings together more than 20000 private traders from 150 countries. The broker now operates regional offices in France, Australia, Japan, and Italy, with its headquarters in Dublin, Ireland. All rules are followed by the broker, who is regulated by MiFID, ASIC, Japan FSA and FFA, FSB, IIROC, and FSCA.

Traders can purchase and sell 1250 instruments across multiple trading platforms, including MT4, MT5, Proprietary, AvaSocial, AvaTradeGo, AvaOptions, and WebTrader. AvaTrade mobile trading is for you if you are an active trader who does not want to be tied to a computer.

Elliott Waves theory in Forex trading - FAQ