Artificial Intelligence in Forex trading: how AI tools from regulated brokers and Chat GPT can enhance your performance

Forex trading, also known as “foreign exchange trading,” is the buying and selling of currencies (and actually other instruments and derivatives) with the aim of making a profit from the fluctuations in their exchange rates. It is one of the largest and most liquid financial markets in the world, with an average daily trading volume of around $6.6 trillion.

The use of Artificial Intelligence (AI) in Forex trading has become increasingly popular in recent years. AI is a branch of computer science that focuses on the development of intelligent machines that can perform tasks that typically require human intelligence, such as visual perception, speech recognition, decision-making, and language translation.

AI is particularly well-suited for Forex trading due to its ability to analyze large amounts of data quickly and accurately. By using machine learning algorithms, AI can identify patterns in market data and make predictions about future price movements, which can help traders make more informed decisions about when to buy and sell currencies.

There are various types of AI applications used in Forex trading, including:

- Expert advisors (EAs) – EAs are automated trading systems that use AI algorithms to analyze market data and execute trades automatically. They can be customized to the trader’s specific trading strategy and can operate 24/7 without the need for human intervention.

- Signal providers – Signal providers use AI algorithms to analyze market data and provide traders with signals indicating when to enter or exit a trade. These signals can be sent via email, SMS, or through a trading platform.

- Data analysis – AI can analyze large amounts of market data, such as economic indicators, news articles, and social media posts, to identify trends and patterns that can help traders make more informed decisions.

Overall, the use of AI in Forex trading has the potential to improve the accuracy of trading decisions, reduce risk, and increase profitability. However, it is important to note that AI is not a replacement for human expertise and should be used to complement a trader’s knowledge and experience.

What are expert advisors, and how to use them in Forex trading

Expert advisors (EAs) are automated trading systems that use AI algorithms to analyze market data and execute trades automatically based on predetermined criteria. EAs are commonly used in Forex trading to help traders analyze market data, identify trading opportunities, and execute trades without the need for manual intervention. Sounds nice, right?

More than that, EAs can offer several other benefits for traders in Forex trading, including:

- Increased efficiency: EAs can monitor the markets 24/7 and execute trades automatically based on pre-programmed rules and criteria. This eliminates the need for manual analysis and execution of trades, which can save time and increase efficiency.

- Consistency: EAs follow a set of rules and criteria consistently, which can help eliminate emotional biases and ensure trades are executed according to the trader’s strategy.

- Backtesting: EAs can be backtested using historical market data to assess their performance and make adjustments if necessary. This allows traders to optimize their EAs and ensure they are performing as intended before deploying them in live trading.

- Risk management: EAs can be programmed to include risk management tools, such as stop-loss and take-profit orders, to help traders manage their risk exposure.

- Scalability: EAs can handle large volumes of trades simultaneously, which can be particularly beneficial for traders who want to trade multiple currency pairs or even instruments or execute high-frequency trading strategies.

How Expert Advisors work in Forex trading

Traders develop a trading strategy and set criteria for entry and exit points, stop-loss levels, and take-profit targets. These criteria are programmed into the EA, which later executes trades automatically based on the strategy.

After that, the EA starts running and continuously analyzes market data, including price movements, technical indicators, and other relevant factors, to identify potential trading opportunities that meet the criteria set by the trading strategy.

When the EA identifies a potential trading opportunity, it executes a trade automatically according to the criteria set by the trading strategy.

The EA also includes risk management tools, such as stop-loss orders and position sizing strategies, that help manage risk and minimize losses in the event of adverse market movements.

Traders monitor the performance of the EA, analyze trading metrics, and make adjustments to the trading strategy or criteria as needed to optimize performance and achieve better results.

How to set up an expert advisor with a Forex broker

As we mentioned before, expert advisors are a helpful tool commonly provided by some reliable FX brokers to assist their clients on their trading journey. They run smoothly on MT4, MT5, or brokers’ original platforms and are usually available even on “basic” account types.

AvaTrade is a well-known online Forex and CFD broker that offers trading services to clients around the world. The Central Bank of Ireland, the Australian Securities and Investments Commission (ASIC), and the Financial Sector Conduct Authority (FSCA) in South Africa are just a few of the financial organizations that oversee the 2006-established company.

AvaTrade offers a range of trading platforms, including the popular MetaTrader 4 and 5 platforms as well as its proprietary AvaTradeGO platform. The broker provides access to a wide range of trading instruments, including Forex currency pairs, commodities, indices, and Cryptocurrencies.

One of the key benefits of trading with AvaTrade is its reputation as a reliable and regulated broker. The company is committed to maintaining a high level of security and transparency and offers multiple measures to protect client funds, including segregated accounts and negative balance protection.

AvaTrade also provides a range of educational resources and trading tools, including a free demo account, trading signals, and a comprehensive education center. This can help traders develop their skills and improve their trading performance.

Moreover, AvaTrade offers a range of expert advisors for traders who prefer automated trading. These EAs can be used with the MetaTrader 4 and 5 platforms, as well as the AvaTradeGO platform.

Some of the key features of AvaTrade’s EAs include:

- Customizable parameters: AvaTrade’s EAs are fully customizable, allowing traders to adjust parameters such as stop-loss levels, take-profit targets, and trade sizes to fit their individual trading strategies.

- Built-in risk management tools: AvaTrade’s EAs come with built-in risk management tools, such as stop-loss orders and position sizing strategies, which can help traders manage risk and minimize losses.

- Multiple trading strategies: AvaTrade offers a range of EAs with different trading strategies, including trend-following, scalping, and grid trading strategies. This can provide traders with a variety of options to choose from based on their preferences and risk tolerance.

- Backtesting and optimization: AvaTrade’s EAs can be backtested and optimized using historical data to evaluate their performance and make adjustments to the trading strategy as needed.

How to set up an expert advisor with AvaTrade

To set up an expert advisor with AvaTrade, you’ll need to follow these steps:

- Open an account by following the link below this instruction.

- Download and install the trading platform: once you’ve opened an account, you’ll need to download and install the platform on your computer. AvaTrade offers several trading platforms, including MetaTrader 4 and 5, which are popular platforms for EAs.

- Choose an EA: There are many EAs available on the market, each with its own unique trading strategy. Traders need to choose an EA that aligns with their trading style and objectives.

- Install the EA on the platform: Once you’ve chosen an EA, you’ll need to install it on the trading platform. To do this, simply follow the instructions provided on the screen by AvaTrade.

- Configure the EA: Traders need to configure the EA according to their trading preferences and risk management strategy. This includes setting parameters such as stop-loss and take-profit levels as well as the size of each trade.

- Test the EA: Before using the EA in live trading, it’s important to test it thoroughly using historical market data. This can help identify any issues or potential problems with the EA as well as optimize its performance.

- Monitor the EA: While EAs operate automatically, traders need to monitor their performance regularly to ensure they are operating as intended. This includes checking trade history, analyzing performance metrics, and adjusting settings if necessary.

As mentioned in the review above, AvaTrade also offers a range of educational resources and tools to help traders optimize their EAs. These include webinars, articles, and videos on topics such as EA optimization, risk management, and backtesting. You can access this knowledge base and set up an account with AvaTrade here:

What are Forex AI trading signals?

Forex AI trading signals are generated by automated trading systems that use machine learning and advanced algorithms to analyze large amounts of data and identify trading opportunities in the market. These systems can analyze a variety of factors, including technical indicators, economic data, and news events, to generate trading signals.

Forex AI trading signals can be generated in real-time and customized based on a trader’s preferences and risk tolerance. These signals can be sent to traders via email, SMS, or through a trading platform and can include information such as the currency pair, entry price, stop-loss level, and take-profit target.

One of the key benefits of AI trading signals is that they can help traders make more informed trading decisions based on objective and data-driven analysis rather than relying on subjective analysis or emotions. This can be particularly useful for traders who are new to the market or who may not have the time or expertise to analyze large amounts of data on their own.

Other benefits of AI trading signals include:

- Increased speed and efficiency: AI systems can analyze large amounts of data much faster than humans, allowing traders to take advantage of trading opportunities in real-time.

- Reduced emotional bias: AI systems can make trading decisions based on objective analysis, reducing the impact of emotional biases such as fear or greed.

- Customizable parameters: Traders can customize their trades based on their risk tolerance and preferences, allowing them to optimize their trading strategies.

Overall, AI trading signals can be a useful tool for traders looking to improve their trading performance and take advantage of the benefits of algorithmic trading. However, it’s important to note that AI trading signals are not a guarantee of profits, and traders should still exercise caution and use proper risk management techniques when using them.

Data analysis for Forex trading with AI

Data analysis is an important part of Forex trading that involves the use of statistical and quantitative techniques to identify patterns and trends in market data. The goal of data analysis in Forex trading is to gain insights into market movements and make more informed trading decisions.

There are several types of data that are commonly analyzed in Forex trading, including:

- Technical data: This includes market data such as price and volume, which can be analyzed using Technical analysis tools to identify patterns and trends.

- Fundamental data: This includes economic indicators such as GDP, inflation, and employment data, which can be used to gain insights into the health of the economy and potential market movements.

- Sentiment data: This includes FX market sentiment, which can be analyzed using sentiment analysis tools to gain insights into how traders are feeling about the market.

- News data: This includes news articles and press releases, which can be analyzed using natural language processing (NLP) algorithms to identify relevant information and potential market movements.

In recent years, the use of AI and machine learning has become increasingly popular in Forex trading data analysis. These tools can analyze vast amounts of data and identify patterns and trends that may not be immediately apparent to human traders. This can help traders make more informed trading decisions and improve their overall trading performance.

How to use AI to analyze data for FX trading decisions

Using AI to analyze data for trading decisions can provide several benefits, such as:

- Improved accuracy: AI algorithms can examine a large amount of data and spot patterns that human traders might overlook. This can help traders make more accurate predictions and improve their trading performance.

- Faster decision-making: AI algorithms can analyze data in real time, allowing traders to make faster decisions based on market conditions.

- Reduced human error: Using AI to analyze data can help reduce the risk of human error, which can lead to costly trading mistakes.

AI tools for Forex data analysis

As you can see, by analyzing a range of different data sources and using a variety of analysis tools, traders can gain a more complete picture of the market and potentially improve their trading performance. So let’s talk about particular tools you can employ to help with your trading decisions:

Machine Learning Algorithms, such as neural networks, decision trees, and random forests, can be used to analyze large amounts of data and identify patterns and trends in the forex market.

Natural Language Processing (NLP) can be used to analyze news articles, social media posts, and other text-based data to identify sentiment and other factors that may impact the forex market.

Deep learning algorithms, such as convolutional neural networks (CNNs) and recurrent neural networks (RNNs), can be used to analyze time-series data, such as price charts and other market data.

Data visualization tools, such as Tableau and Power BI, can be used to create visualizations that help traders identify patterns and trends in the data.

Cloud computing platforms, such as Amazon Web Services (AWS) and Microsoft Azure, can be used to store and process large amounts of data and run AI algorithms at scale.

Automated trading systems, like the expert advisors discussed above and trading robots, use AI algorithms to analyze market data and make trading decisions automatically.

Forex market AI data analysis with FX and CFDs brokers

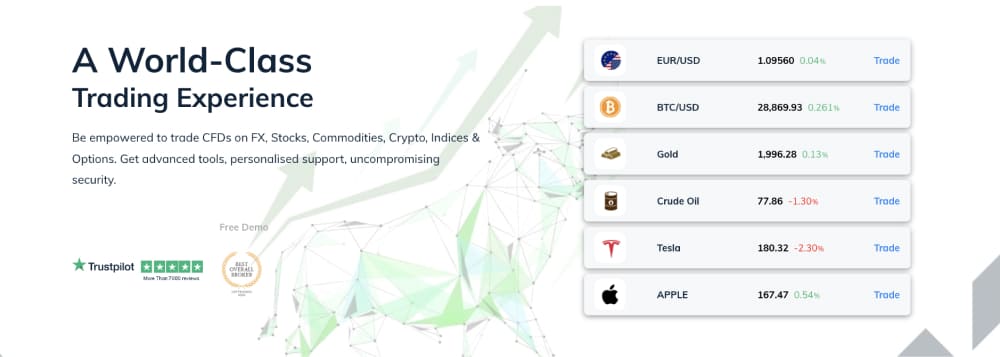

Plus500 is a CFD (Contracts for Difference) trading platform that allows users to trade on a range of financial instruments, including stocks, currencies, commodities, Cryptocurrencies, and more. It is regulated by several financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC).

Plus500 offers a trading platform that is accessible via desktop and mobile devices. The platform includes a range of features, including real-time quotes, risk management tools, technical analysis indicators, and more. Plus500 also offers a free demo account for users to practice trading before committing real funds.

One of the key benefits of Plus500 is its commission-free trading model, which means users do not pay any commission fees on their trades. However, the company generates revenue through the spread (the difference between the buy and sell price of an instrument), which can vary depending on market conditions.

In terms of advanced AI technology, Plus500 offers an AI-powered trading platform with several market analysis tools. These tools are designed to help traders make more informed trading decisions by analyzing market data in real time and identifying trading opportunities.

Here are some of the key features of Plus500’s AI market analysis tools:

- Sentiment analysis: Plus500’s AI-powered platform uses natural language processing algorithms to analyze news articles and social media posts to identify market sentiment. This information is then used to provide traders with insights into market trends and sentiment.

- Price alerts: Traders can set up price alerts for specific instruments to receive notifications when the price reaches a certain level. This helps traders stay up-to-date with market movements and identify potential trading opportunities.

- Economic calendar: Plus500’s economic calendar provides traders with a schedule of upcoming economic events, such as interest rate decisions and employment reports. This information can help traders anticipate market movements and adjust their trading strategies accordingly.

- Technical analysis tools: Plus500’s platform includes a range of technical analysis tools, such as trend lines, moving averages, and stochastic oscillators. These tools can be used to identify key levels of support and resistance and potential trading opportunities.

- Risk Management: Plus500’s platform includes several risk management tools, such as stop-loss and take-profit orders, to help traders manage their risk and minimize potential losses.

Overall, Plus500’s AI-powered platform provides traders with a range of market analysis tools that can help them make more informed trading decisions. You can start your journey with this reliable CFDs broker here:

79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Plus500EE AS is authorised and regulated by the Estonian Financial Supervision and Resolution Authority (Licence No. 4.1-1/18).

How to use Chat GPT in Forex trading?

As an AI language model, Chat GPT can assist in Forex trading by providing information and answering questions related to trading strategies, market trends, economic indicators, and more.

Traders can use Chat GPT to ask questions and get instant answers related to their trading activities. For example, they can ask for market analysis, the latest news affecting currency pairs, or tips on developing a successful trading strategy.

Furthermore, Chat GPT can also provide insights on how to use trading tools such as expert advisors and how to set them up. Additionally, traders can ask for information on regulated Forex brokers and their features, such as the availability of AI tools, trading signals, and other analytical tools.

The full list of GPT abilities when it comes to assisting in Forex trading looks like this:

- Providing information and education

Chat GPT can provide traders with up-to-date information and educational resources on Forex trading, including market analysis, trading strategies, and risk management techniques. This can help traders stay informed and make informed trading decisions.

- Answering questions and providing guidance

Traders can ask questions about Forex trading to get guidance based on AI knowledge and expertise. This can help traders clarify any doubts or confusion they may have about the market or their trading strategies.

- Analyzing market data

GPT can help traders analyze market data and identify trends, patterns, and potential trading opportunities. This can potentially help traders improve their overall trading performance.

- Providing automated trading tools

This AI Chat can assist in developing or using automated trading tools, such as expert advisors or trading algorithms, that can execute trades automatically based on predetermined criteria. This can help traders save time and potentially improve their trading performance.

- Offering risk management tools

Chat GPT can provide traders with risk management tools and techniques, such as stop-loss orders or position sizing strategies, which can help minimize losses and manage risk in their trades.

How to use AI in Forex trading: a quick guide

Forex trading has evolved over the years with the integration of AI tools. AI tools such as expert advisors, AI trading signals, and market analysis tools have been developed to help traders make informed decisions, increase efficiency and speed, and improve accuracy and consistency.

Additionally, regulated Forex brokers provide these AI tools, which allow traders to manage their risk exposure and optimize their trading performance. By using AI tools provided by regulated Forex brokers, traders can improve their trading strategies, make better trading decisions, and achieve their financial goals in the Forex market with higher probability.

In the section above, we covered popular AI tools you can employ to boost your trading, and the best strategy here is to use all the help you can get. Learn how to combine different AI mechanisms to make your trading decisions more efficient. For example:

- Use AI trading signals in conjunction with expert advisors

AI trading signals can provide valuable insights into market trends and potential trading opportunities, which can be used in conjunction with expert advisors to execute trades automatically.

- Use Chat GPT to get insights on market analysis

Chat GPT can help traders get insights into market trends and analysis, which can be used to make more informed trading decisions. This information can be used to develop trading strategies and optimize trading performance.

- Use AI tools for risk management

AI tools can be used to manage risk by setting stop-loss and take-profit orders. Expert advisors can be used to automate this process, while AI trading signals can provide alerts on potential risks and opportunities.

- Use AI tools to optimize trading performance

AI tools can be used to backtest trading strategies, identify patterns, and optimize trading performance. This can be done using historical data and simulation tools to test the performance of trading strategies under different market conditions.

All in all, these tools can analyze large amounts of data from various sources to identify patterns and trends that can help traders predict market movements and make profitable trades. As a result, traders can benefit from increased accuracy, efficiency, and a chance of profitability. By using the right AI tools provided by regulated Forex brokers, traders can stay ahead of the game and take advantage of the opportunities presented by this rapidly evolving market.

Related articles:

Everything you should know about AvaTrade’s advanced trading features: risk management with AvaProtect, Trading Central analytics, the free Guardian Angel feedback and support system, Expert Advisors, auto deals with ZuluTrade, DupliTrade, and Capitalise.ai, as well as various in-house developments like AvaSocial.

An expert review of the basics of trading with risk management tools in the Forex market: key order concepts, distinctive features, and their usage examples. Following the professionals with Social and Copy trading and comparison of the best Forex brokers with advanced trading platforms, bonuses up to 100% on the initial deposit, and free VPS service.

An expert review of the Plus500 demo account: popular CFD trading instruments, risk management tools, and indicators, the virtual balance of up to $40000 as well as step-by-step registration instructions.

Forex trading with AI - FAQ