Mastering gold futures: essential indicators and charting techniques for effective analysis

Analyzing gold futures is a crucial skill for traders looking to capitalize on the movements of one of the most valuable commodities in the market. Gold futures provide a way to hedge against inflation, diversify portfolios, and speculate on future price changes. To effectively navigate the gold futures market, traders rely on various technical indicators, predictions, and a well-thought-out trading plan. This article aims to guide you through the key indicators used in gold futures analysis, offer insights into price predictions, and outline a robust trading plan. Additionally, we will highlight some of the top FX brokers to consider for executing your trades efficiently and securely. Whether you’re a beginner or a seasoned trader, this comprehensive guide will provide valuable insights to enhance your trading strategies and decision-making processes.

Analyzing gold futures: key indicators, predictions, and trading plan

The real chart is taken from the Investing.com website. The following is not a recommendation but a guide for beginners on analyzing charts.

Gold futures chart analysis

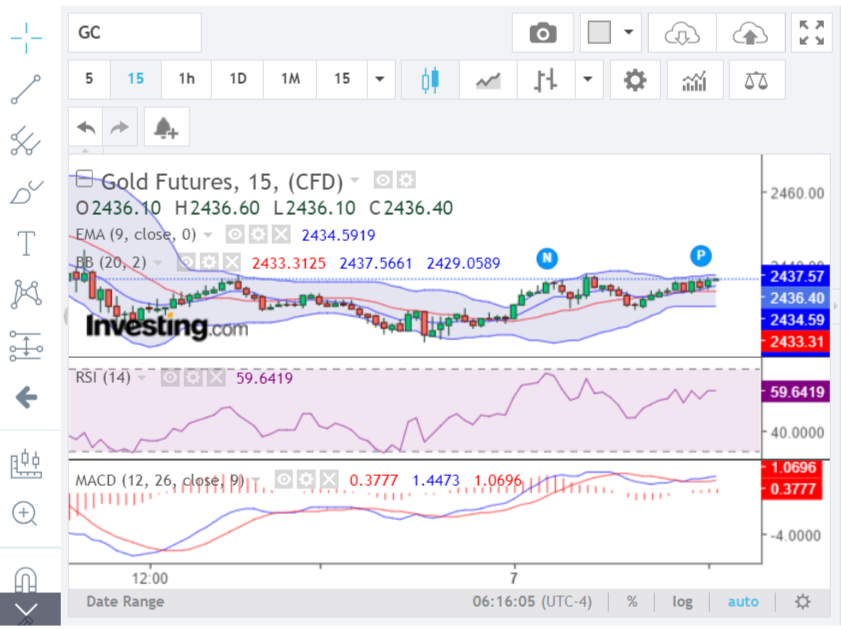

The chart provided is for gold futures (15-minute intervals) and includes several technical indicators: EMA (9), Bollinger Bands, RSI (14), and MACD (12, 26, 9). Here’s a breakdown of each indicator and what it suggests:

EMA (9) – Exponential Moving Average (blue line)

- What is it? The EMA (9) is a short-term moving average that reacts more quickly to price changes than a simple moving average.

- Current value: 2434.59

- Interpretation: The price (2436.40) is above the EMA (9), suggesting a short-term bullish trend. This indicates that the recent price action is relatively strong, and traders may look for buying opportunities.

Bollinger Bands (20, 2)

- What are they? Bollinger Bands consist of a middle band (simple moving average), and an upper and lower band, which are standard deviations away from the middle band.

- Current values: Upper band: 2437.57, middle band: 2433.31, lower band: 2429.06

- Interpretation: The price is near the upper Bollinger Band, indicating potential overbought conditions. This could suggest a possible price pullback in the near term. Traders often use this information to prepare for a potential reversal or to tighten their stops if they are in long positions.

RSI (14) – Relative Strength Index (purple line)

- What is it? The RSI measures the speed and change of price movements, oscillating between 0 and 100.

- Current Value: 59.64

- Interpretation: An RSI above 70 is typically considered overbought, while below 30 is oversold. A value around 59.64 suggests that the market is in the neutral to slightly overbought range, indicating there may be room for further upward movement but also cautioning that it is getting closer to overbought territory.

MACD (12, 26, 9) – Moving Average Convergence Divergence (Below the RSI)

- What is it? The MACD is a trend-following momentum indicator that shows the relationship between two moving averages (12-day and 26-day).

- Current values: MACD line: 0.3777, signal line: 1.0696, histogram: -0.6919

- Interpretation: The MACD line is below the Signal line, which is generally a bearish signal. However, the histogram shows the difference between the MACD line and the Signal line is decreasing, which could indicate an upcoming bullish crossover. This suggests that bearish momentum is weakening, and a potential reversal to a bullish trend could be on the horizon.

Gold futures predictions and trading plan

Price prediction:

Considering the indicators:

- The price is above the EMA (9), suggesting short-term bullishness.

- The position near the upper Bollinger Band indicates potential overbought conditions.

- RSI is moderately high but not yet in the overbought range.

- MACD shows bearish momentum but with signs of potential bullish reversal.

Trading plan:

Short-term (next few hours):

- Monitor the price closely as it approaches the upper Bollinger Band and the EMA (9).

- If the price moves significantly above the upper Bollinger Band with increased volume, it might indicate a strong bullish breakout. Consider a short-term long position with a close stop-loss just below the EMA (9).

- If the price starts to pull back from the upper Bollinger Band, it might be wise to wait for a better entry point or consider a short-term short position with a target near the middle Bollinger Band (2433.31).

Medium-term (next few days):

- Watch for the MACD crossover.

- If the MACD line crosses above the Signal line, it could indicate a stronger bullish trend. A confirmed crossover could be a good entry point for a medium-term long position.

Pay attention to the RSI approaching 70. - If it crosses into overbought territory, it may signal an upcoming correction. This could be a time to tighten stop-loss levels or consider taking profits.

Note: Always use stop-loss orders to manage risk and avoid significant losses. Continuously monitor the chart for any changes in trend or momentum.

Check out Forex risk management tools: automatic trading with popular market orders

Top Forex brokers to trade gold futures

Choosing the right Forex broker is a crucial step for traders looking to venture into gold futures trading. The right broker can provide a secure, efficient, and cost-effective platform for executing trades, along with essential tools and resources to help you make informed trading decisions. With a multitude of brokers available in the market, finding one that meets your specific needs and preferences can be challenging. This list of top Forex brokers has been carefully curated to highlight those that offer exceptional services, competitive fees, robust trading platforms, and excellent customer support.

BlackBull FX trading

BlackBull Markets is a dependable Forex broker offering an extensive array of trading options, including commodities, currency pairs, stocks, futures, indices, and cryptocurrencies, with the added advantage of trading gold futures.

Based in Seychelles and adhering to rigorous safety regulations, BlackBull provides a variety of account types, including standard, prime, institutional, and Islamic (swap-free) accounts, as well as a demo account for practice.

Traders can access several popular platforms, such as MT4, MT5, cTrader, Web Trader, and TradingView. BlackBull also features specialized tools like BlackBull CopyTrader and BlackBull Shares, along with mobile apps for trading on the move.

In addition to these resources, BlackBull offers educational materials including webinars and tutorials to support traders in enhancing their skills and strategies.

Exness FX trading

Exness is a well-regarded Forex broker known for its wide range of trading options, including currency pairs, commodities, indices, and cryptocurrencies.

With a strong focus on regulatory compliance, Exness is regulated by leading authorities such as the FCA in the UK and CySEC in Cyprus, ensuring a secure trading environment.

The broker offers competitive spreads that vary depending on the account type. Traders can choose between Standard and Professional accounts, each with its own set of advantages and conditions.

Customer support is available through email, live chat, and phone, assisting whenever needed. Exness supports popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are celebrated for their user-friendly interfaces and advanced charting tools, ensuring an efficient and seamless trading experience.

HF Markets FX trading

HF Markets is an excellent choice for traders seeking a diverse selection of asset trading options. With access to over 1,200 financial instruments, including currency pairs, energies, indices, commodities, ETFs, stocks, and bonds, HF Markets meets a broad spectrum of trading needs.

The broker offers several trading platforms, such as MT4 and MT5, which are available on desktop, web, and mobile devices. Their dedicated trading app provides added convenience, while their VPS service further enhances trading performance.

HF Markets features a range of account types, including Premium, Pro, Zero, and Cent accounts, each with varying minimum deposits, leverage options, and spreads. Notably, HF Markets also provides special conditions for gold trading, catering to traders who focus on this precious metal.

Beginners can utilize a demo account to practice their strategies and get acquainted with different instruments before investing in real capital.

OANDA FX trading

OANDA is a well-established online broker with a history dating back to 1996. Renowned for its reliability and commitment to customer service, OANDA provides a secure and trustworthy trading environment.

The broker offers competitive spreads and flexible leverage options, enabling traders to customize their positions according to their strategies and risk preferences. Traders can choose between popular platforms like MetaTrader 4 or OANDA’s proprietary platform, OANDA Trade, which boasts advanced charting tools and expert advisors to facilitate technical analysis and algorithmic trading.

Additionally, OANDA is recognized for its comprehensive range of tools and features that enhance the trading experience. This includes daily and weekly market analysis, up-to-date forex news, and insightful commentary.

NAGA Markets FX trading

NAGA Markets is a highly regarded global brokerage offering a diverse range of over 1,000 instruments, including currency pairs, stocks, indices, commodities, and ETFs, which facilitates portfolio diversification and growth.

For both beginners and those interested in automated trading, NAGA provides the NAGA Autocopy tool, enabling traders to replicate the strategies of successful peers, thereby enhancing their trading skills and insights.

The broker also offers a variety of trading aids and educational resources designed to boost trading efficiency and security, helping traders make well-informed decisions.

Regulated by CySEC in Cyprus and compliant with MiFID regulations in the European Economic Area, NAGA ensures full regulatory adherence as an authorized broker.

NAGA supports popular trading platforms such as MT4 and MT5, as well as its own NAGA Web app and mobile applications, providing versatile and accessible options for engaging with the markets.

Related articles:

Analyzing gold futures - FAQ