Review of Exness cutting-edge AI tools for traders

Exness is a globally recognized online trading broker known for its commitment to regulatory compliance and transparency. The company operates under the oversight of reputable regulatory bodies, including the Financial Conduct Authority (FCA) in the United Kingdom, the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, and the Financial Services Authority (FSA) in the Seychelles.

These regulatory authorities ensure that Exness adheres to strict standards of conduct, client fund segregation, and operational transparency, providing traders with confidence in the safety and security of their investments.

Exness offers a diverse range of trading instruments across multiple asset classes, catering to its clients’ varied preferences and trading strategies. These instruments include:

- Forex: major, minor, and exotic currency pairs.

- Metals: gold, silver, platinum, and palladium.

- Energies: crude oil and natural gas.

- Indices: major global indices such as the S&P 500, NASDAQ, FTSE 100, and more.

- Cryptocurrencies: popular cryptocurrencies like Bitcoin, Ethereum, Litecoin, Ripple, and others.

To accommodate different trading needs, Exness provides a range of account types designed to suit the needs of both beginners and experienced professionals.

The broker holds a variety of advanced trading features aimed at enhancing the trading experience for its clients. Some notable features include:

- Negative balance protection: Safeguards clients from incurring losses greater than their account balance.

- High leverage options: Flexible leverage offerings allow traders to optimize their trading strategies according to their risk appetite.

- Multi-lingual support: Customer support is available in multiple languages to assist traders from diverse backgrounds.

- Educational resources: Comprehensive educational materials, including webinars, tutorials, and market analysis, to empower traders with knowledge and skills.

- VPS hosting: Virtual Private Server (VPS) hosting services for traders who require uninterrupted trading access and enhanced performance.

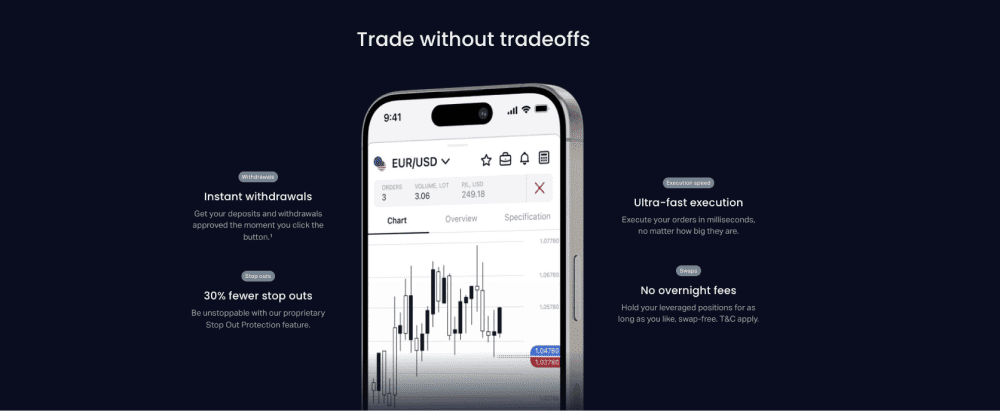

Exness offers a user-friendly mobile trading app available for both iOS and Android devices, allowing traders to access the markets anytime, anywhere. The mobile app provides full account management capabilities, real-time market quotes, interactive charts, and seamless trade execution on the go.

Overall, Exness stands out as a reputable and innovative brokerage firm, providing traders with a secure and feature-rich trading environment supported by advanced technology, diverse trading instruments, and regulatory compliance.

Exness Smart Stop-Out technology

Smart Stop-Out technology represents a significant advancement in trading risk management. This innovative tool is designed to protect traders from excessive losses by automatically closing out positions when their account balance approaches a predefined threshold, known as the stop-out level.

One of the key features of Smart Stop-Out technology is its ability to intelligently assess and manage risk in real time. By continuously monitoring account balances and market conditions, the system can swiftly identify situations where a trader’s margin level is at risk of falling below the stop-out level. In such cases, the technology takes proactive measures to mitigate potential losses by automatically closing out positions in a systematic and controlled manner.

This tool plays a crucial role in helping traders avoid margin calls, which occur when their account equity falls below the required margin level to maintain open positions. Margin calls can lead to the forced liquidation of positions at unfavorable prices, resulting in significant losses for traders. Smart Stop-Out technology acts as a preemptive safeguard against margin calls by closing out positions before the account balance reaches critical levels, thus minimizing the risk of further losses.

Furthermore, Smart Stop-Out technology provides traders with peace of mind and confidence in their risk management strategies. By automating the process of closing out positions during periods of heightened risk, traders can focus on analyzing markets and executing trades without the constant worry of potential margin calls and associated losses. This allows for greater clarity and discipline in trading decisions, ultimately contributing to improved trading outcomes over the long term.

Example:

A trader opens multiple leveraged positions in volatile market conditions without closely monitoring their account balance. As market fluctuations occur, the trader’s margin level gradually decreases, approaching the stop-out level. Without Smart Stop-Out technology, the trader may fail to recognize the impending risk until it is too late, leading to a margin call and substantial losses.

With Smart Stop-Out technology implemented, the system proactively detects the deteriorating margin level and automatically closes out positions before reaching critical levels, thereby protecting the trader from excessive losses.

In summary, Smart Stop-Out technology represents a powerful risk management tool that empowers traders to navigate volatile markets with confidence and discipline. By leveraging advanced algorithms to monitor account balances and manage risk in real time, this innovative tool helps traders avoid margin calls and mitigate potential losses, thereby enhancing overall trading performance and stability.

Exness advanced analytical indicators

Exness offers traders a comprehensive suite of advanced and AI-powered analytical tools and indicators designed to empower them with valuable insights and enhance their trading decisions. These tools encompass a range of features, including advanced charting capabilities, a diverse selection of technical indicators, and comprehensive market analysis resources.

At the heart of Exness’ analytical toolkit is its advanced charting platform, which provides traders with intuitive and customizable charting functionalities. From simple line charts to advanced candlestick patterns, traders have access to a variety of chart types and timeframes to suit their analysis preferences. The platform also offers advanced drawing tools, allowing traders to annotate charts with trendlines, Fibonacci retracements, and other technical analysis tools to identify potential entry and exit points.

In addition to charting capabilities, Exness provides a wide array of technical indicators that enable traders to analyze market trends, identify patterns, and make informed trading decisions. These indicators cover a diverse range of technical analysis methods, including oscillators, moving averages, trend-following indicators, and volatility measures. Traders can customize indicator settings and overlay multiple indicators on charts to gain deeper insights into market dynamics and potential price movements.

Moreover, Exness equips traders with comprehensive market analysis features, including daily market updates, economic calendars, and expert insights from seasoned analysts. These resources provide traders with valuable information on market trends, upcoming events, and potential trading opportunities, helping them stay informed and ahead of market developments.

The benefits of using Exness’ advanced analytical tools and indicators are manifold. Firstly, these tools enable traders to conduct thorough market analysis and identify high-probability trading opportunities with greater precision. By leveraging advanced charting and technical indicators, traders can accurately assess market trends, gauge market sentiment, and anticipate potential price movements.

Furthermore, these tools empower traders to make informed trading decisions based on objective data and analysis rather than relying solely on intuition or guesswork. By combining technical analysis with fundamental insights and market research, traders can develop robust trading strategies and risk management plans that align with their investment goals and risk tolerance.

Exness AI-powered trading algorithms

Exness leverages state-of-the-art AI-powered trading algorithms to provide traders with a competitive edge in the financial markets. These sophisticated algorithms harness the power of artificial intelligence and machine learning to analyze vast amounts of market data, identify patterns, and execute trades autonomously with speed and precision.

AI algorithms employed by Exness utilize advanced mathematical models and algorithms to process and interpret complex market data in real time. By analyzing historical price movements, market trends, and other relevant indicators, these algorithms can identify patterns and correlations that may not be apparent to human traders. This enables them to make data-driven trading decisions based on objective analysis and statistical probabilities.

One of the key advantages of AI-driven trading is its ability to operate with speed and efficiency. Unlike human traders, AI algorithms can process and analyze vast amounts of market data within milliseconds, enabling them to identify trading opportunities and execute trades with lightning-fast speed. This high-speed execution capability allows traders to capitalize on fleeting market opportunities and react to changing market conditions in real time.

Moreover, AI-powered trading algorithms offer a high degree of accuracy and consistency in decision-making. By eliminating human emotions and biases from the trading process, AI algorithms can make objective and rational decisions based on predefined criteria and mathematical models. This helps to minimize the impact of human error and subjective judgment, leading to more reliable and consistent trading outcomes over time.

Another significant advantage of AI-driven trading is its adaptability to evolving market conditions. AI algorithms can continuously learn and evolve from new data and market experiences, allowing them to adapt their strategies and parameters to changing market dynamics. This adaptability enables AI-powered trading systems to remain effective and competitive in diverse market environments, including volatile and unpredictable conditions.

Furthermore, AI-powered trading algorithms can operate around the clock without the need for breaks or rest, providing traders with 24/7 access to the markets. This allows traders to take advantage of global market opportunities and respond to market developments at any time, enhancing flexibility and accessibility in trading activities.

How to start trading with Exness

In conclusion, with Exness at your side, you have the opportunity to unlock a world of possibilities in the financial markets. By harnessing cutting-edge technology, innovative tools, and a commitment to excellence, Exness empowers traders to navigate the complexities of trading with confidence and precision.

From the Smart Stop-Out technology that safeguards your investments to the advanced analytical tools and indicators that provide valuable insights, and the AI-powered trading algorithms that offer speed, accuracy, and adaptability, Exness equips you with everything you need to succeed.

Now is the time to take the next step in your trading journey. Open an account with Exness today and experience the benefits of trading multiple assets with a broker that prioritizes your success.

Don’t miss out on the opportunity to maximize your trading potential. Start trading with Exness now:

Related articles:

Exness AI trading tools - FAQ