CFDs trading: basics you should know

A contract for difference (CFD) is a deal between a buyer and a seller, where the buyer agrees to pay the seller the difference between the current value of an asset and its worth at the time of the contract. CFDs enable traders and investors to profit from price movements without having to own the underlying assets. The value of a CFD contract is determined solely by the price difference between trade entry and exit.

This is executed through a contract between the client and the broker, and no currency trading, stock, commodity, or futures exchange is used. Trading CFDs brings several substantial advantages that have strengthened the instrument’s immense popularity over the last decade.

Also, all CFDs are leveraged, which means that you only need a relatively small deposit (called margin) to open a larger position. However, as your final profit or loss is dependent on the size of your position, either could greatly exceed your margin amount. When trading CFDs, you should always apply suitable trading risk control measures.

CFDs trading explained

CFDs have created a quite sophisticated trading strategy that gained more and more popularity as time went by.

As we briefly mentioned in the intro, CFD is a contract between a trader and a CFD broker to exchange the difference in the value of a financial asset (securities or derivatives) between the times the contract opens and closes. CFDs can be traded in shares, currency pairs, commodities, bonds, stocks, or indices and are an attractive opportunity to trade global markets without a direct deal with a particular asset.

CFDs do not include the delivery of tangible items or securities and a buyer never truly owns the underlying asset, but rather earns compensation based on the asset’s price fluctuation. Instead of purchasing or selling physical gold, a trader might merely speculate on whether the price of gold will rise or fall.

Essentially, CFDs allow traders to speculate on whether the price of the underlying asset or security will rise or decline; they try to predict either up or down movement. If the trader who purchased a CFD notices that the asset’s price rises, they will offer their position for sale. The net difference between the buy and sale prices is added together. The trader’s brokerage account settles the net difference, representing the gain from the deals.

Leveraged trading of CFDs

As we explored before, CFDs are financial instruments in the form of derivatives that allow retail traders to possibly profit from changes in an asset’s price without really owning the asset; another distinguishing aspect of CFDs is that they are always traded on margin, which adds leverage. Trading using leverage allows you to open a large position without putting up the full cost.

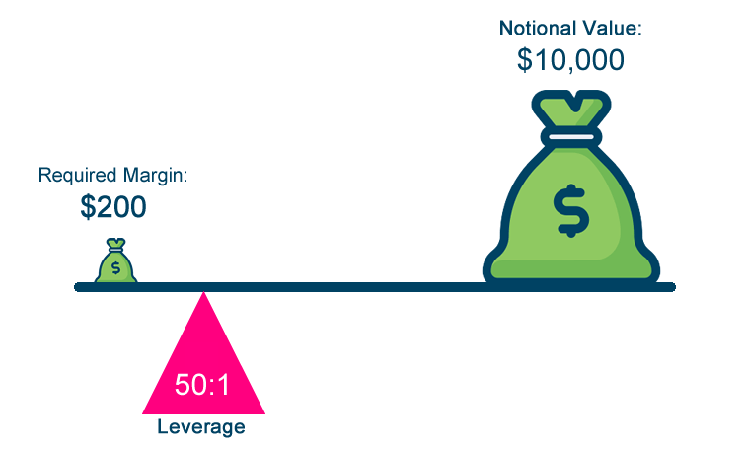

Let’s assume that you decided to open a GBP/USD stake equal to one standard lot (100,000 units). Without leverage, you would have to pay the entire cost upfront. However, with a leveraged product like CFD and a leverage ratio of 50:1, or a margin requirement of 2%, you would only need to deposit $200 to obtain exposure to $10000 worth of GBP/USD, effectively “borrowing” nearly 98% of the whole value.

This means that you can start a CFD position with only a tiny percentage of the entire position size as a deposit. The amount of money necessary to start and maintain a leveraged position is known as the “margin,” and it indicates a fraction of the entire value or size of the position.

There are two types of margins when trading CFDs:

- The initial margin is the deposit made to open a position;

- The maintenance margin is the extra margin required if your position is on the verge of suffering losses that the initial margin (and any additional funds in your account) cannot cover;

However, as CFDs are leveraged, retail traders may incur losses above the funds on their trading balance. The pace and volume of losses can be weighty depending on the leverage utilized and the volatility of the underlying asset.

For Forex CFDs, leverage rates of up to 1:30 are common among brokers registered in Europe. A retail trader with this leverage ratio can open a CFD position worth $60000 with a $2000 initial deposit. Yet, CFDs with such high leverage ratios are highly price-sensitive, as prices can gap and losses can exceed the initial deposit in fast-moving markets.

If you fail to meet the margin requirement for your trade, your CFD provider will contact you, asking you to deposit extra funds into your account. If you do not, the position will be closed immediately, realizing all the losses.

Currency pairs trading via CFDs

As with any other financial instrument, CFD in Forex trading is an agreement to exchange the difference in the price of a specific currency pair between the time the contract is opened and the time it is closed.

When the contract is concluded, you will receive or pay the difference between the CFD’s closing and opening prices; if the difference is positive, the CFD provider will compensate you, or you will pay him if the difference is negative.

Moreover, with CFDs, you can speculate on price changes in either direction initiating “long” or “short” trading positions.

- Purchase the CFD at the ask price provided (“go long”).

- Sell the CFD at the offer price mentioned (“go short”).

The decision you make here will reflect your expectations for the underlying asset’s price movement.

A long position entails entering into a CFD contract with the assumption that the underlying asset’s price will go up, as you expect the price to rise “from now on.”. A short position is when you enter a CFD contract with the assumption that the underlying asset’s price will fall in value.

When you close your CFD position, your profit or loss is the difference between the closing price and the opening price of your CFD position in both situations, calculated by multiplying the difference by the size (number of units) of the position you traded, plus any fees and other expenditures.

For example, if you believe the price of GBP/USD will fall, you would sell a CFD on GBP/USD. You will still exchange the price difference between when your position is opened and when it is closed, but you will make a profit if the GBP/USD falls in value and a loss if the pair value goes up.

Trading Gold CFDs

When it comes to CFD trading, Gold is usually matched with USD, creating the pair known as XAUUSD. It means that while looking for a solid gold CFD trade opportunity, keeping a close check on the USD and developments in the US economy is essential. The functioning principles of Gold CFDs are no different from any other CFD, yet trading gold has its own set of special characteristics.

For trading Gold CFDs, the best strategy is to use a balanced mixture of Forex Fundamental and Technical analysis with a sprinkling of intuition and market sense to find the most lucrative position-opening opportunities. The information gleaned from these assessments will assist you in calculating the likelihood of market movements in your favor.

When the currency and stock markets are volatile, traders and investors gravitate toward more traditional assets like gold, possibly leading to a spike in gold prices. However, because we are trading CFDs for gold rather than actual gold, there is no reason why you can not profit from falling gold prices as well.

Typically, the best time to trade gold is when market sessions overlap and market volatility is at its peak. As liquidity goes up during market overlaps, you will be able to identify nice trade entry points. Also, don’t forget to keep an eye out for economic news that may have an impact on the USD, as gold is linked to the US dollar.

Factors that affect gold prices:

- Demand and supply

Since the 1970s, demand for gold has been steadily increasing, despite occasional price drops, frequently outweighing the supply. There were times when gold lost value, such as in 2016, when the ounce price fell to $1060 before regaining. However, never-ending demand commonly results in greater gold prices, allowing gold to restore its worth.

- The rate of inflation

Traders who lose faith in their currency tend to acquire gold or other precious metals. As a result, a straightforward cause-and-effect relationship emerges: the commodity price typically climbs up during periods of strong inflation.

- Dollar/US Economy

Gold and the US dollar have an adverse connection: gold prices tend to rise when the USD falls, as traders and investors frequently view gold as a “safe haven” during recessions or volatile periods rather than currencies. When the US dollar strengthens, demand for gold falls, bringing the price down as well.

However, in the world of finance, things are rarely that straightforward: extraordinary circumstances may confound the equation, causing politics to take precedence over the outcome.

Throughout history, gold has been a popular investment option. Yet, when purchasing actual gold, your only alternative is to hope that gold prices rise. CFD trading allows you to benefit regardless of the direction of gold prices by allowing you to go long or short. Furthermore, physical gold prices do not reflect the true worth of gold because prices are marked up at the point of sale.

Gold has higher volatility in CFD markets than traditional currency pairs and can be more rewarding for good trade in both the long and short term.

Another advantage of gold CFDs is that they are excellent for portfolio diversification, as it is one of the “golden rules” of risk control in trading. Even if you favor trading currency pairings, it is always a good idea to diversify your holdings to mitigate risk.

Where you can trade CFDs

Many major financial hubs allow CFDs in listed, over-the-counter (OTC) markets, including the United Kingdom, Germany, Singapore, France, South Africa, Hong Kong, Sweden, Norway, Italy, Thailand, Denmark, the Netherlands, Switzerland, Spain, Canada, and New Zealand.

The Australian Securities and Investment Commission (ASIC) has announced several adjustments in the issuing and distribution of CFDs to retail clients in Australia, where CFD contracts are currently permitted. ASIC’s purpose is to increase consumer safeguards by limiting retail clients’ access to CFD leverage and targeting CFD product features and sales practices that amplify retail clients’ CFD losses. The product intervention order issued by ASIC went into effect on March 29, 2021.

The Securities and Exchange Commission (SEC) controls CFD trading in the United States, but non-residents can use them freely.

Benefits of trading CFDs

With access to a wide range of markets, leverage, and flexible short trades, it’s easy to see why CFDs have grown in popularity in recent years. However, if you’re still uncertain about what trading instrument to choose, here are six reasons to trade CFDs.

- Higher Leverage

CFDs offer more leverage than traditional trading, still being regulated by global market authorities. It used to be as low as a 2% maintenance margin (1:50 leverage), but it is now limited to 3% (1:30 leverage) and may go up to 50% (1:2 leverage). Lower margin requirements imply less capital outlay and higher potential rewards for the trader.

Don’t forget, that leverage in trading comes with the risk of losing more than you invest.

- Access to the global market from a single platform

Many CFD brokers provide financial products in all of the world’s major markets, allowing for 24-hour access. CFDs can be part of deals in a variety of global markets by traders.

- No shorting rules or borrowing stock

Certain markets restrict shorting, require traders to borrow the instrument before selling short or have varying margin requirements for short and long positions. Because the trader does not own the underlying asset, CFD instruments can be shorted at any time without incurring borrowing charges.

- Profit from falling markets

Again, the fundamental distinction between CFDs and regular trading is that you never own the underlying market with CFDs, bringing various advantages, including the potential to go both short and long.

To open a short CFD position, you sell the number of contracts you want rather than buying them. When you want to close your trade, you must purchase the same number of CFDs. It allows you to profit when markets decline in price, adding a whole new dimension to your trading.

- No day trading requirements

Some markets require a certain amount of capital to day trade or limit the number of day trades that can be made in a given account. The CFD market is not constrained by these limitations, and all account holders can day trade if they so desire. Accounts can frequently be started for as little as $1000, while minimum deposit requirements of $2000 and $5000 are usual.

- Various Trading Possibilities

CFDs on stocks, indices, shares, currencies, bonds, and commodities are currently available from brokers. Speculators interested in various financial vehicles can now trade CFDs as an alternative to traditional exchanges.

Top Forex brokers for CFD trading

Market newcomers may be puzzled as to how Forex traders can purchase and sell currencies they do not possess, also being frequently perplexed by the concept of selling something even before purchasing it. The key to the solution is that the trader is trading a derivative rather than the actual currencies themselves.

There is no requirement to “own” anything before selling because you and your Forex broker are exchanging agreements rather than the real underlying assets. Contracts for differences, or CFDs, are the name given to these derivatives.

Brokers suggested and reviewed by TopForex.trade brokers have been serving consumers for decades and meet the high standards of the world’s most stringent financial institutions. You may register an account with these reliable brokers from almost any country by using free VPS or VPN services. They have the best selection of CFDs on currency pairs as well as other financial instruments such as stocks, bonds, indices, and commodities, as well as some of the best trading conditions, various Forex bonuses even on initial deposits (subject to geographic availability), Copy trading, comprehensive educational materials for beginners, the latest financial market news for relevant trading decisions, and negative balance protection.

eToro CFDs trading

eToro is one of the most well-known brokerage firms in the world. With the best available terms: minimal Forex trading costs and cheap minimum deposits, you can invest in over 2000 different assets, including CFDs on currencies, commodities, indices, equities, and Cryptocurrencies. Since 2017, new digital currencies such as Bitcoin, Ethereum, and others have been added to the trading instruments list.

eToro offers two types of accounts: Retail Client and Professional Client. The first is protected from negative balance and offers a Copy Trading feature, whereas the second is distinguished by its unlimited leverage. Furthermore, newcomers can always use a demo account to experiment with and try new strategies.

eToro is a very reliable broker with millions of clients worldwide, as well as licenses to operate in numerous countries and membership in the following regulators: FCA, ASIC, and CySEC.

OANDA CFDs trading

OANDA, a reputable US-based broker with millions of clients worldwide and a long history of operations, has earned a stellar reputation among users over more than two decades, while also complying with a slew of global regulators.

The broker is an excellent alternative for new traders because it provides demo accounts, extensive educational tools, and market information, and there is no minimum deposit requirement. There are frequent promo campaigns the broker holds giving various Forex bonuses as well as low commissions and spreads, a diverse range of trading instruments such as CFDs on over 70 currency pairs, Indices, Commodities, and Crypto including Bitcoin and Ether.

XM Group CFDs trading

XM Group is a regulated online broker that offers over 1000 trading instruments, including CFDs for Crypto (Bitcoin, Ethereum, Ripple), indices, commodities, metals, energy, and stocks (other 600 companies) on the MT4/MT5 platforms. The broker also offers an easy-to-use mobile app that allows you to trade on global markets with a single login on a demo or live account.

Furthermore, XM provides clients with a VPS service, allowing them to completely experience all of the benefits of trading without worrying about other concerns that can impede fast and high-quality transactions, such as Internet connection speed, computer problems, and power outages.

One of XM Group’s many advantages is that there are no fees for deposits or withdrawals: the broker covers the complete cost of payment system commissions. From the following alternatives, clients can choose the most profitable trading account with negative balance protection, good leverage, and tight spreads: Micro, Standard, XM Ultra Low, and Shares.

XG Group accepts clients from over 150 countries thanks to accreditation from recognized regulators such as CySEC, IFSC, DFSA, and ASIC.

HF Markets CFDs trading

HF Markets – formerly known in some regions like HotForex – is a broker with offices all over the world that provides the most diverse range of trading instruments, including CFDs for more than 1000 instruments like currency pairs, commodities, Cryptocurrency, stocks, indices, metals, energies, bonds, and, most notably, Forex Gold trading with competitive low spreads and no hidden fees.

Clients of HF Markets can choose from Micro, Premium, Zero Spread, Demo, and Islamic trading accounts. A crucial feature is also available – Copy Trading HFcopy, which allows you to mirror transactions from many traders at the same time.

All transactions are carried out over multiple platforms. MT4, MetaTrader 4 Web Terminal, or specific mobile trading apps for Apple and iOS devices are all options.

The broker is governed by CySEC and the FCA (Europe), the FSCA (South Africa), and the DIFC (Dubai).

Forex trading of CFDs - FAQ