A comprehensive guide to trading accounts offered by popular Forex brokers

The Forex market is the largest and most liquid financial market in the world, with trillions of dollars traded daily. It involves buying and selling currencies to take advantage of fluctuations in exchange rates, and it requires a specialized trading account to access the market. Besides, there is also CFDs trading, which allows employ price fluctuations of assets like stocks and shares, commodities, indices, ETFs, Cryptocurrencies, and other instruments to potentially profit from it without actually owning a real thing.

As online trading has gained popularity among retail traders, many Forex and CFDs brokers have emerged, offering different types of trading accounts to cater to the diverse needs of traders. These trading account types often come with various features, such as different minimum deposit requirements, leverage options, spreads, and trading platforms, among others.

In this comprehensive guide, we will take a closer look at the trading account types offered by popular Forex brokers. From well-established names to newer players in the market, we will explore the account types, their features, and what traders should consider when starting to trade with a broker. Below are accounts offered by HF Markets, eToro, AvaTrade, Plus500, Exness, XM, and OANDA, all reputable and regulated market players with a global clientele.

Whether you are a beginner or an experienced trader, understanding the different trading account types can help you make an informed decision and choose the one that best aligns with your trading goals, risk tolerance, and trading strategy.

Let’s dive into the world of Forex trading account types and explore the options offered by popular Forex brokers to help you navigate the Forex market with confidence.

Please note that regulations and compliance requirements may vary depending on the jurisdiction, which may impact the availability of certain account types, features, or services for traders from different countries.

HF Markets – Diversify your portfolio with a true multi-asset broker

HF Markets, also known as HotForex, is a well-established forex and CFD broker that has been in operation since 2010. It offers a wide range of financial instruments for trading, including currencies, commodities, indices, metals, energies, and Cryptocurrencies.

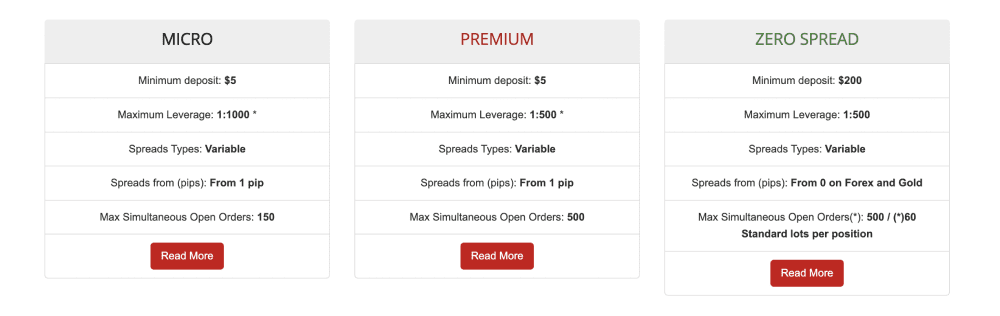

HF Markets offers a variety of trading accounts, catering to different trader preferences and strategies, including Micro, Premium, Zero Spread, Auto, HFCopy, and Islamic accounts. This allows traders to choose an account type best suits their trading style and capital requirements.

HF Markets provides competitive variable spreads on its trading accounts, which can start from low levels depending on the account type and market conditions. Also, there are flexible leverage options, allowing traders to choose leverage levels that suit their risk tolerance and trading strategy, ranging from 1:1 to 1:1000, depending on the account type and jurisdiction.

HF Markets offers a variety of trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and their proprietary HF App, which is widely used and well-regarded in the industry. They also provide a range of trading tools and features, such as advanced charting, Technical analysis, and market analysis tools.

The broker provides multilingual customer support through various channels, including live chat, email, and phone, providing assistance to traders in different regions and time zones. Also, there is a wide range of educational resources, including webinars, video tutorials, educational articles, and market analysis, which can be beneficial for traders of different skill levels to enhance their trading knowledge.

HF Markets is regulated by multiple reputable regulatory bodies, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, and others.

HF Markets account types

HF Markets Micro account

Micro account is designed for beginner traders or those who prefer to trade with smaller trade sizes. The minimum deposit requirement is only $5, which is lower compared to other account types, making it accessible to traders with limited capital. The leverage offered may vary depending on the jurisdiction, but it generally ranges from 1:1 to 1:1000. Spreads are typically variable, starting from low levels.

HF Markets Premium account

HF Market’s Premium account is suitable for more experienced traders who require additional features and benefits compared to the Micro Account. It requires a minimum deposit of $100 but offers tighter spreads (from 1 pip), faster execution speeds, and additional trading tools. Leverage also varies from product to product, but it is generally lower than the Micro Account, typically ranging from 1:1 to 1:500.

HF Markets Zero Spread account

Zero Spread account is best for traders who prioritize low spreads and fast execution speeds. Taking from the name, spreads are typically zero or close to zero, but there may be a commission charged on each trade. A minimum deposit of $200 is required to start trading, and leverage may vary from 1:1 to 1:500.

HF Markets Auto account

Auto account is specifically designed for traders who prefer automated trading strategies. It offers access to various trading signals and allows traders to use Expert Advisors (EAs) or other automated trading tools. Minimum deposit requirements and leverage may vary depending on the jurisdiction.

HF Markets HFCopy account

This is a Social trading account that allows traders to follow and copy the trades of successful traders. It is suitable for traders who prefer to follow and replicate the trading strategies of experienced traders. Spreads start from 1 pip. Minimum deposit requirements and leverage may vary depending on the jurisdiction.

HF Markets Islamic account

HF Markets also offers Forex Islamic account, which is designed for traders who follow Islamic principles and require swap-free trading. These accounts comply with Shariah law and do not charge or pay interest on overnight positions.

XM Group: trade Forex, Crypto CFDs, stocks, metals, and more

XM is a regulated Forex and CFD broker known for its diverse range of trading instruments, competitive trading conditions, multiple FX bonus programs, and customer-centric approach. With a global presence and a strong reputation in the industry, XM offers a unique trading experience to its clients.

At XM, traders can choose from a wide variety of financial instruments, including currencies, commodities, indices, metals, energies, and Cryptocurrencies, providing ample trading opportunities. The broker offers multiple account types to cater to different trader preferences and strategies, ranging from Micro and Standard accounts with low minimum deposit requirements to Zero and Ultra-Low accounts with tight spreads and low commissions.

XM stands out for its competitive trading conditions, including low spreads, high leverage options up to 1:888, and fast execution speeds, providing traders with optimal trading conditions. The broker also offers a range of trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and XM WebTrader, which are known for their advanced features, user-friendly interfaces, and reliable performance.

Customer satisfaction is a top priority for XM, and the broker provides excellent customer service through various channels, including live chat, email, and phone, with multilingual support available. Additionally, XM offers a wide range of educational resources, including webinars, video tutorials, educational articles, and market analysis, to empower traders with knowledge and tools to enhance their trading skills.

With its strong regulatory standing, diverse range of trading instruments, competitive trading conditions, and customer-centric approach, XM is a unique broker that caters to the needs of traders of all levels, from beginners to experienced traders, seeking a reliable and feature-rich trading experience.

XM Forex trading account types

XM offers a variety of trading account types designed to cater to different traders’ preferences and strategies. Here’s an overview of the XM account types:

XM Micro account

XM Micro account is a beginner-friendly type that allows traders to start with a low minimum deposit of $5 and trade with smaller contract sizes, where 1 lot is equal to 1000. The Micro Account offers flexible leverage options (up to 1:1000 depending on the instrument), 1 pip spreads, and no commissions, making it suitable for traders who are new to trading or prefer to trade smaller volumes since the minimum volume is only 0.01 lots on MT4 and MT5. The maximum number of open/pending orders per client is 300.

Base currency options: USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, SGD, ZAR

XM Standard account

With a minimum deposit of $5, XM Standard accounts offer competitive trading conditions (contract size of 1 lot is 100000, minimum trading volume is 0.01 lots with allowed swaps and hedging), no commissions, and standard leverage options. It is suitable for traders who prefer to trade with standard contract sizes and have a moderate level of trading experience. The maximum number of open/pending orders per client is 300.

Base currency options: USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, SGD, ZAR

XM Ultra Low account

XM Ultra Low account is designed for traders who require ultra-tight spreads and low commissions. The Ultra-Low account offers some of the lowest spreads available (as low as 0.6 pips), making it ideal for traders who prioritize cost-effective trading. The minimum deposit is also $5 and the maximum open/pending orders per client are 300 positions with allowed hedging.

Base currency options: EUR, USD, GBP, AUD, ZAR, SGD

XM Shares account

XM Shares account allows traders to trade shares of popular companies listed on major stock exchanges around the world. The Shares Account offers competitive leverage options and allows traders to diversify their trading portfolio by including shares in their trading strategies.

The contract size is 1 share traded with no leverage, spreads depend on the underlying exchange, and the minimum deposit required to open an account is $10000.

Base currency options: USD

XM Islamic account

XM offers Islamic accounts that comply with Shariah law for traders who follow Islamic principles of finance. The Islamic Account is swap-free and does not charge or pay any interest on overnight positions, making it suitable for traders who require a Shariah-compliant trading option.

Yet, these numbers and requirements may vary as XM is ready to create custom-tailored Forex account solutions for every client. Also, please note that the availability of account types, features, and trading conditions may vary depending on the jurisdiction and regulatory framework.

Exness: Online trading with better-than-market conditions

Exness offers a reliable and feature-rich Forex trading experience to traders around the world and is known for its competitive trading conditions, including tight spreads, high leverage options up to 1:2000, and fast execution speeds, providing traders with optimal trading conditions. The broker offers a wide range of financial instruments, including currencies, CFDs for multiple instruments, and Cryptocurrencies, allowing traders to diversify their trading portfolio.

One of the notable features of Exness is its transparency, as the broker provides real-time market execution data and publishes its trading performance statistics on its website, allowing traders to make informed trading decisions. Exness also offers a variety of trading accounts, including Standard, Pro, and Zero accounts, with different trading conditions to suit the needs of different traders.

Exness prioritizes customer satisfaction and provides excellent customer service through various channels, including live chat, email, and phone, with multilingual support available. The broker also offers a range of educational resources, including webinars, video tutorials, educational articles, and market analysis, to empower traders with knowledge and tools to enhance their trading skills.

Exness is regulated by reputable financial authorities, including the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA) in the UK, which adds to its reliability and trustworthiness as a broker.

With its transparent and client-centric approach, competitive trading conditions, and strong regulatory standing, Exness is a popular choice for traders seeking a reliable and trustworthy broker for their Forex and CFD trading needs.

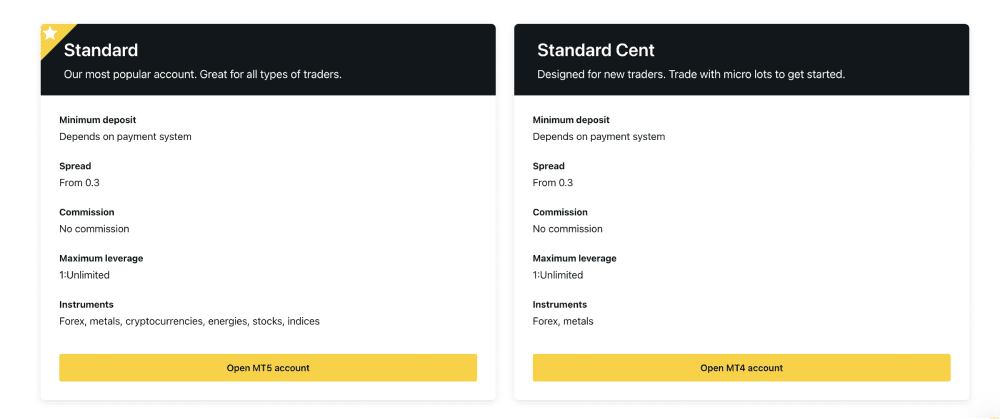

Exness FX trading account types

Exness offers different types of trading accounts to cater to the diverse needs of traders. Here are your options:

Exness Standard account

This is a classic trading account that offers variable spreads, no commissions, and standard leverage options. The Standard Account is suitable for traders who prefer a straightforward trading experience with standard trading conditions.

Exness Standard Cent account

Exness offers a unique account type known as the Standard Cent Account, which is specifically designed for traders who are new to trading or prefer to trade with smaller volumes. The Standard Cent account is denominated in cents, which means that the base currency of the account is in cents rather than the standard base currencies like USD, EUR, or GBP. This allows traders to trade with smaller contract sizes and lower margin requirements. It also offers high-leverage options of up to 1:1000, allowing traders to potentially amplify their trading positions.

Exness Pro account

The Pro Account is designed for more experienced traders who require tighter spreads and lower trading costs. This account type offers variable spreads, no commissions, and higher leverage options compared to the Standard account, making it suitable for traders with a higher trading volume. The minimum deposit is $200, spreads start at 0.1, and leverage is unlimited.

Exness Zero account

Exness Zero Account is a popular choice for traders who require tight spreads with no markups and low commissions. This account type offers raw spreads with zero markups, and traders pay a small commission per trade. The Zero Account is suitable for traders who prioritize precise pricing and fast execution. The minimum deposit is also $200; spreads start at zero, and leverage is unlimited.

Exness ECN account

The ECN (Electronic Communication Network) Account is designed for advanced traders who require direct market access and deep liquidity. This account type offers raw spreads from multiple liquidity providers, and traders pay a commission per trade. The ECN Account is suitable for traders who demand high-speed execution and competitive pricing.

Plus500: CFDs trading on global markets

Plus500 is a popular online broker that specializes in CFDs trading (derivative products that allow traders to speculate on the price movements of various financial instruments without actually owning the underlying assets).

The broker offers a wide range of CFDs on various financial instruments, including stocks, indices, currencies, commodities, Cryptocurrencies (availability subject to regulations), options, and ETFs providing traders with a diverse set of trading opportunities to capitalize on price movements in different markets.

The trading platform of Plus500 is web-based and accessible on multiple devices, including desktop, web, and mobile. It is known for its user-friendly interface, intuitive navigation, and comprehensive charting tools that allow traders to analyze price movements and make informed trading decisions.

Plus500 offers competitive spreads, which are the differences between the buy and sell prices, and allows traders to trade with leverage. Leverage allows traders to control larger positions with a smaller initial investment, but it also amplifies the potential risks. The leverage offered by Plus500 varies depending on the financial instrument and regulatory requirements.

The broker offers a free and unlimited demo account that allows traders to practice their trading skills and strategies without risking real money. This is a valuable feature for beginner traders to get familiar with the platform and test their trading strategies in a risk-free environment.

Plus500 is a regulated broker and operates under the supervision of multiple regulatory authorities, including the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC) in Australia, and the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, among others. This provides traders with a certain level of regulatory protection and ensures that Plus500 follows industry standards and regulations.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Plus500 CFDs trading account types

Besides a free, unlimited demo account, Plus500 offers a single account type for trading, which is their standard trading account with a minimum required deposit of $100.

It is accessible to traders in over 50 countries worldwide, including the UK, Europe, Australia, and Asia. It allows traders to trade a wide range of CFDs on various financial instruments, including stocks, indices, Forex, commodities, Cryptocurrencies, options, and ETFs.

This trading account offers competitive spreads and allows traders to trade with leverage. The leverage offered by Plus500 varies depending on the financial instrument and regulatory requirements, with the maximum one being 1:30. However, it’s important to note that leverage amplifies the potential risks of trading and should be used with caution.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

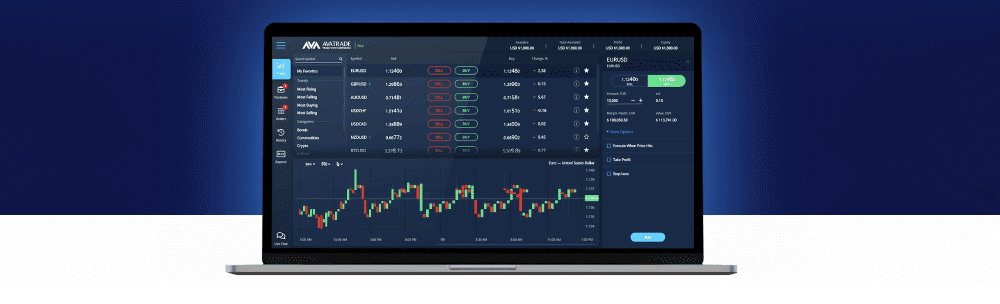

AvaTrade: world-class CFDs and FX trading experience

AvaTrade is a leading online Forex and CFD broker that was established in 2006 that offers a wide range of financial instruments, including Forex, commodities, indices, stocks, bonds, Cryptocurrencies, and ETFs, providing traders with diverse trading options.

AvaTrade offers competitive spreads, leverage options, and a variety of order types, allowing traders to customize their trading strategies. They also offer free educational resources, webinars, and market analysis tools to help traders make informed trading decisions.

There are different account types to cater to the needs of different traders, including a Standard account, a Pro account, a Retail account, and an Islamic account for Muslim traders. Each account type has its own features, such as different leverage options and minimum deposit requirements.

AvaTrade is regulated by multiple regulatory authorities globally, including the Central Bank of Ireland, the Financial Services Commission (FSC) in the British Virgin Islands, the Financial Sector Conduct Authority (FSCA) in South Africa, and the Australian Securities and Investments Commission (ASIC), among others. This ensures that AvaTrade adheres to industry standards and regulations, providing traders with a certain level of regulatory protection.

AvaTrade FX trading account types

AvaTrade Standard trading account

The Standard account is designed for beginner and intermediate traders. It offers competitive spreads, leverage options, and access to a wide range of financial instruments, including Forex, commodities, indices, stocks, and Cryptocurrencies. The minimum initial deposit requirement for the Standard Account varies depending on the trader’s region and regulatory requirements, so follow the link below to find your rates.

AvaTrade Pro trading account

AvaTrade Pro account is designed for experienced and professional traders who require higher leverage and lower spreads. It offers tighter spreads compared to the Standard Account but may have higher minimum deposit requirements. The Pro Account is suitable for traders who have a higher level of trading knowledge and experience.

AvaTrade Retail Account

AvaTrade’s Retail account is designed for traders based in Europe and is compliant with the regulations set forth by the European Securities and Markets Authority (ESMA). It offers limited leverage options due to regulatory restrictions but provides access to a wide range of financial instruments, including forex, commodities, indices, stocks, and Cryptocurrencies.

eToro: trade and invest in top markets

eToro is a leading social trading platform and multi-asset brokerage firm that provides a unique approach to online trading. It was founded in 2007 and has grown to become a popular choice among traders and investors worldwide. eToro is known for its user-friendly platform that allows traders to access a wide range of financial instruments, including stocks, cryptocurrencies, commodities, forex, and more.

One of the key features that set eToro apart is its Social trading platform, which allows users to follow and copy the trading activities of other successful traders. This makes eToro particularly appealing to beginner traders who can learn from experienced traders and benefit from their trading strategies. eToro also offers a range of innovative features, such as the ability to invest in fractional shares, automatic Copy trading, and a virtual trading account for practice.

eToro offers multiple account types, including a free demo account for practice, as well as live trading accounts with various features and minimum deposit requirements. The platform is accessible via a user-friendly web-based interface and a mobile app, making it convenient for traders to trade on the go.

eToro is regulated by reputable financial authorities, such as the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, and the Australian Securities and Investments Commission (ASIC) in Australia, providing traders with a sense of security and trust.

Overall, eToro is known for its innovative social trading platform, user-friendly interface, and wide range of financial instruments, making it a popular choice for traders and investors looking for a unique and intuitive trading experience.

eToro trading account types review

eToro offers several live trading account types, each designed to cater to different types of traders. Here’s a review of the main live trading account types offered by eToro:

eToro Retail trading account

The Retail account is the standard live trading account on eToro and is suitable for most individual traders. It allows traders to trade a wide range of financial instruments, including stocks, Cryptocurrencies, commodities, Forex pairs, and more. The minimum initial deposit for a retail account is $50, though the minimum deposit amount may vary depending on the trader’s location (for example, for the UK it’s $100).

Key features of the retail account include:

- Access to eToro’s extensive range of financial instruments;

- User-friendly web-based trading platform and mobile app;

- Social trading features, allow users to follow and copy the trading activities of other successful traders;

- Various order types, including market orders, limit orders, and stop orders;

- Access to eToro’s educational resources and customer support;

eToro Professional account

The Professional account of eToro is designed for experienced traders who meet certain eligibility criteria, such as a minimum trading experience and a certain level of trading activity. The professional account offers higher leverage options and other additional benefits, but it also comes with increased risks. The eligibility criteria may vary depending on the trader’s location but typically include requirements such as a minimum trading experience of 2 years and a significant trading volume.

Key features of the professional account include:

- Higher leverage options, allowing traders to amplify their trading positions;

- All features of the retail account, including access to eToro’s extensive range of financial; instruments, social trading features, and educational resources;

- Customized pricing and premium customer support;

Your personal conditions to open a Professional account with eToro you can find here.

eToro Corporate Account

eToro also offers a Corporate account for businesses and organizations that want to trade on the eToro platform. The corporate account is designed to cater to the specific needs of corporate clients, and it offers features such as multi-user access, customizable reporting, and dedicated account managers.

Key features of the corporate account include:

- Customized pricing and trading conditions;

- Multi-user access for multiple employees to manage the account;

- Customizable reporting for tracking and analysis;

- Dedicated account managers to provide personalized support;

It’s important to note that leveraged trading carries risks, and traders should carefully consider their trading goals, risk tolerance, and trading experience before choosing a live trading account type on eToro. Additionally, eToro also charges spreads, overnight fees, and other fees that traders should be aware of when trading on the platform. Traders should thoroughly review the account types, trading conditions, and fees on eToro’s website before opening a live trading account.

OANDA: Global FX broker for over 25 years

OANDA is a well-established and reputable forex broker that has been operating in the industry for over 25 years, offering a wide range of financial instruments for trading, including Forex, commodities, indices, bonds, and precious metals. This provides traders with diverse options to trade based on their trading strategies and preferences.

The broker has its own proprietary trading platform called OANDA Trade, which is available in desktop, web, and mobile versions. The platform is user-friendly, and customizable, and offers a variety of advanced charting and technical analysis tools for traders. Also, there is a range of trading tools and resources to assist traders in their trading decisions. This includes market analysis, economic calendar, and access to OANDA’s proprietary trading signals tool called “Autochartist” which helps identify potential trading opportunities.

OANDA is known for its innovation in the Forex industry, being one of the early pioneers of online trading. The broker has introduced various technological advancements, such as its proprietary “fxTrade” trading platform, and it continues to strive for innovation in the ever-evolving Forex market.

Moreover, OANDA is a well-regulated broker, authorized and regulated by multiple reputable financial authorities, including the U.S. Commodity Futures Trading Commission (CFTC), the National Futures Association (NFA), the Financial Conduct Authority (FCA) in the UK, and the Australian Securities and Investments Commission (ASIC). OANDA also holds client funds in segregated accounts to ensure their safety.

Guide on OANDA trading accounts

OANDA offers two main types of live trading accounts: the Standard Account and the Premium Account. Both of them offer access to OANDA’s range of trading tools and resources, including market analysis, economic calendar, and OANDA’s proprietary trading signals tool “Autochartist.”

h3 id=”oanda-standard-trading-accounts”>OANDA Standard trading account

The Standard account is OANDA’s basic account type, requiring no minimum deposit. It offers competitive spreads, starting from 1.0 pip for major currency pairs, and provides access to a wide range of financial instruments, including forex, commodities, indices, bonds, and precious metals. Traders can trade on OANDA’s proprietary trading platform, OANDA Trade, which is available in desktop, web, and mobile versions. The Standard Account is suitable for traders who are just starting out or who prefer to trade with smaller volumes.

OANDA Premium trading account

OANDA’s Premium account is there for more experienced and high-volume traders. It requires a higher minimum deposit compared to the Standard Account and offers additional benefits, including lower spreads starting from 0.6 pips for major currency pairs, priority customer support, and access to exclusive events and promotions. The Premium Account is suitable for traders who have a higher trading volume and require enhanced features and priority support.

Pro tip: By registering and verifying an account with several regulated brokers, you can not only compare different trading platforms to find the most suitable one but also maximize the Forex bonuses you receive. This will allow you to test multiple trading strategies, try diverse instruments and set the way to becoming a true professional trader without risking your hard-earned money.

Related articles:

Forex trading with leverage and margin: definitions of terms, trading benefits, margin calls, and risk-management strategies. Top Forex brokers offering Social trading, demo, and swap-free Islamic accounts with the best leverage and margin parameters for trading currency pairs, stocks, commodities, indices, ETFs, Cryptocurrencies, and other instruments.

-

FX and CFDs brokers with a welcome bonus and no minimum deposit requirements: benefits, terms, conditions, and more

Overview of Top 3 Forex and CFD brokers with zero minimum deposits and no deposit bonuses: the benefits of such offers, terms, and conditions of receiving them, step-by-step instructions for registration, and application process.

An expert guide on Forex demo accounts offered by trusted brokers, their features, and using benefits. Top 5 popular FX brokers with free demo accounts providing a virtual balance of up to $100000, all types of trading instruments, and convenient terminals.

Trading accounts types of popular FX brokers - FAQ