What is forwards trading?

Like futures trading, forwards are an alternative to buying and selling assets at spot price in which a trader buys and owns an item at its value with the goal of selling it later. When deciding whether to acquire an item at a present rate or through a forward contract, traders can rely on the results of their Fundamental or Technical analysis to determine if the future delivery price will be less or more than the current spot price. If it is higher, they may employ a forward contract.

Cash settlement occurs at the end of a forward contract period with an expiry date. A forward hedging method is frequently employed to reduce the risk of losses in a financial market when price changes are highly turbulent, as traders can close out their positions before the underlying asset’s delivery date in exchange for cash. This is especially true for Forex risk management, in which cross-currency swaps use forward contracts to mitigate the risk of shifting exchange rates between international currencies.

How is Forwards trading done?

A forward contract is commonly entered into by two parties that have opposite opinions on the future price of a specific asset. One party believes that the price of a specific asset will rise in the future and hence intends to purchase it at a lower, specified rate in order to profit from the price difference. As a result, this party proposes to be the buyer. The other party, on the other hand, feels that the asset’s price will fall in the near future and wishes to hedge their bets by locking in a fixed price. As a result, this party agrees to sell.

The actual outcome of the forward contract can often go one of three ways, depending on how the market performs and the price of the asset changes:

The asset price rises in the future

In this case, the buyer’s estimate is correct, and they are able to sell the item at a higher price. They take delivery of the asset and sell it on the open market by paying the lower specified price of the forward contract. In this scenario, the buyer’s profit is the difference between the asset’s actual current price and the locked-in price at which the buyer purchased it.

The asset price falls in the future

In this case, the seller’s prognosis is right, resulting in gains from the forward contract sale. Despite the fact that the asset’s worth has declined, the seller is able to sell it at a higher price than its present value. In this scenario, the seller’s profit is the difference between the price at which the asset is sold and its current market value.

The asset price will not alter in the future

In this case, neither the buyer’s nor the seller’s prediction is proven right. As a result, no party makes a profit or suffers a loss as a result of the transaction.

Example: Assume a farmer expects to harvest 20 tonnes of corn next year. To profit from his harvest, he must sell it for at least $150 per tonne. If the farmer decides to sell his harvest next year, he may or may not be able to earn a profit on the sale. This is due to the fact that no one knows what the price per tonne will be next year.

However, the farmer’s risk is reduced if he enters into a forward contract with a food manufacturing company that commits to paying him his desired price in exchange for his produce the following year. As a result, even if maize prices fall next year, he will be safeguarded by the forward contract’s requirement and the knowledge that he will receive a higher price based on the lock-in price.

Features of the Forward contracts

Some of the most essential features of a forward contract include:

- Forwards contracts are not standardized and are not traded on exchanges. As a result, they are more customizable and allow for specific changes in the agreements with regard to the asset traded, amount, and date of delivery;

- The parties can settle forward derivatives in one of the two ways. One is where the seller makes physical delivery of the assets and receives the agreed-upon payment by the buyer. The other is where cash settlement occurs, and there is no actual physical delivery of the asset in question. Instead, one of the two parties settles the contract by paying the other an appropriate differential in cash;

- Forward contracts are some of the most commonly employed tools for corporations to minimize and hedge interest rate-related risks. By entering into a forward contract, traders won’t have to purchase an asset at a higher price in the future;

Forex trading in forwards contracts

A currency forward is a contract that locks in an exchange rate for the future purchase or selling of a currency, essentially being a hedging product that does not require an initial margin payment.

The other significant advantage of a currency forward is that, unlike exchange-traded currency futures, its conditions are not standardized and can be tailored to a specific amount and for any maturity or delivery date.

A currency forward is a legal obligation, which means that the contract buyer or seller cannot walk away if the “locked-in” rate eventually proves to be unfavorable. As a result, financial institutions that deal in currency forwards may request a deposit from a retail trader or smaller enterprises with whom they do not have a commercial relationship to compensate for the risk of non-delivery or non-settlement.

Currency forward settlement can be done in cash or in delivery, as long as the alternative is mutually accepted and stipulated in advance in the contract. Moreover, currency futures, commonly known as “outright forwards,” are over-the-counter (OTC) instruments because they do not trade on a controlled exchange.

Futures VS Forwards contracts trading

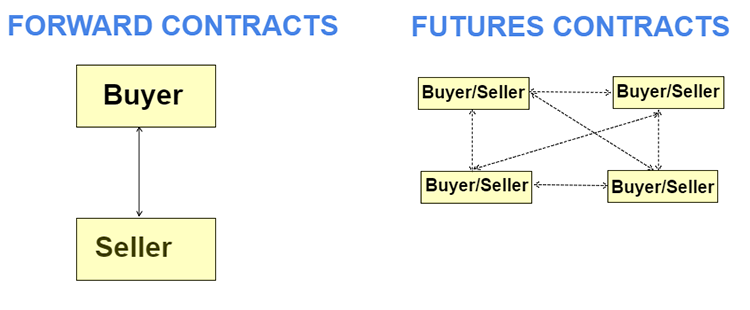

People sometimes confuse these two types of contracts since they are both given at a predetermined point in the future. However, if you dig a bit deeper, you will learn that these two have clear differences.

First, the buyer and seller agree on the conditions of the forward contract. As a result, it is adaptive and customizable. In contrast, a futures contract has a common market framework in terms of quantity, date, and delivery.

A forward contract is a contract between two parties to buy and sell the underlying asset at a predetermined price at a later date. A futures contract is a legally binding agreement in which the parties agree to buy and sell an asset at a certain price and on a predetermined date in the future.

As a result, because the agreement is confidential, there is a comparatively higher chance of a side defaulting on a forward contract. Unlike a futures contract, which incorporates clearing institutions and transaction insurance, the possibility of default is essentially non-existent.

Forward contracts are traded over the counter (OTC), which implies they do not have a secondary market. In contrast, a futures contract is traded on regulated securities exchanges and can be purchased and sold like a financial asset.

To summarize, forward contracts can be used for both hedging and trading, but they are better for the former as they are custom-made. Futures contracts, on the other hand, are better suitable for trading as an asset in their own right.

Top Forex brokers for contracts trading

Forward contracts can empower traders of a specific asset with a more solid investment: as market volatility is an unavoidable element of trade, forward trading can help to hedge against potentially unfavorable price changes and variations while also providing contracts that are private and tailored to your specific needs.

And while Forward contracts do not openly trade on exchanges, futures do. Futures contract characterizes by standardized terms, transferability, ease of entering and exiting a position, and the elimination of counterparty risk have all attracted numerous market participants and established the futures exchange as an integral component of the global economy.

Use free demo accounts from trusted brokers to test your trading approach with popular exchange pairings or other instruments, where you may access current market quotes and trading indicators. You’ll also learn real-time market dynamics, trading tools, and terminology.

The Forex brokers listed below have served their clients for decades and adhere to the world’s most credible financial regulators, allowing traders to trade currency pairs, stocks, commodities, indices, and other financial instruments such as Cryptocurrency under some of the best trading conditions available (including various Forex bonuses, Copy trading, demo accounts, or free VPS services for extra-secure trading).

OANDA contracts trading

OANDA, a reputable US-originated broker with millions of clients worldwide and a long history of operations, has created a superb reputation among users over more than two decades while also complying with a slew of global regulators.

The broker is an excellent choice for new traders as it provides demo accounts, numerous teaching tools, and market data with no minimum deposit requirement. There are frequent Forex bonus promotional campaigns, as well as low trading costs and spreads, a wide choice of trading derivatives for products such as Forex, Indices, Commodities, and Crypto including Bitcoin and Ether, innovative trading platforms, and the broker’s own mobile app.

AvaTrade contracts trading

AvaTrade is a broker known for providing competitive rates on a diverse variety of assets including currency pairings (both spot and futures), commodities, indices, stocks, CFDs, Cryptocurrencies, and many others. MT4, MT5, Proprietary, AvaSocial, AvaTradeGo, AvaOptions, and WebTrader are among the trading platforms accessible. AvaTrade mobile trading is for you if you are a consistent trader who does not want to be tied to a computer.

AvaTrade, in particular, provides a diverse range of automated trading platforms and tools that beginner traders can use to increase the profitability of their trades. One of them is AvaSocial, Ava’s first Copy Trading tool that allows you to imitate the performance of successful traders you choose and benefit in the same way they do.

AvaTrade has offices in almost every country and provides cross-continent regulatory coverage: MiFID, ASIC, the FSA and FFA, the FSB, IIROC, and the FSCA all have jurisdiction over it.

XM Group contracts trading

XM Group is a global online Forex broker that offers over 1000 trading products on the MT4/MT5 platforms, including over 55 currency pairs (on the spot or in futures), metals, commodities, and stocks. The broker also provides a mobile app that allows you to trade in foreign markets with a single login, regardless of whether you are using a demo or a real account.

Furthermore, the broker offers a virtual private server (VPS) service, allowing clients to fully enjoy all of the benefits of trading with XM without worrying about other factors that can delay or disrupt high-quality transactions, such as Internet connection speed or power outages.

Deposits and withdrawals are free at the XM Group since the broker covers all payment system commissions. Micro, Standard, XM Ultra Low, and Shares are the most successful trading accounts with negative balance protection, good leverage, Forex bonuses (the precise amount depends on the client’s area), and tight spreads. The broker is regulated by CySEC, IFSC, DFSA, and ASIC to ensure the safety of traders worldwide.

HF Markets contracts trading

HF Markets (previously HotForex in some countries) is a well-known broker that offers a wide range of accounts and trading instruments, including Micro, Premium, Fixed, VIP, and Zero Spread accounts. The broker provides the most competitive spreads and no hidden commissions for gold trading, allowing you to trade the metal in an ultimately favorable environment.

The well-known financial terminals MT4 and MT5 are now accessible in desktop, online, and mobile versions for Windows, iOS, MacOS, and Android, with the inclusion of a VPS service and the HFcopy – the original Social trading feature. The latter will help novice traders by imitating pros, while experienced traders will be rewarded for their efforts.

HF Markets is regulated in the EU and fully compliant with CySEC, as well as in the United Kingdom under the supervision of the FCA and in Dubai under a DFSA license.

eToro contracts trading

eToro is without a doubt one of the most popular brokers in the world, particularly in Europe. You can trade and invest in over 2000 different assets under the best possible terms, including cheap minimum deposits and minimal Forex and trading fees. Since 2017, additional digital currencies such as Bitcoin, Ethereum, and others have been introduced to the mix, making it possible to trade all popular currency pairs, equities, commodities, ETFs, indices, and digital assets.

eToro has two kinds of accounts: retail and professional. The first is impervious to negative balance and includes a CopyTrader feature, whereas the second is famous for its infinite leverage. Furthermore, newbies can always test alternative trading strategies on a trial account.

Because it has millions of clients globally, the broker is highly dependable and backed by licenses that allow eToro to operate in a variety of countries while conforming to FCA, ASIC, and CySEC criteria.

Forwards trading explained - FAQ