Your first Forex deal in 10 simple steps

Entering the world of Forex trading can seem daunting for beginners. However, with the accessibility and convenience offered by online brokers, anyone can participate in the excitement of the Forex market. Online brokers provide individuals with the tools and platforms necessary to trade currency pairs, stocks, and other financial instruments from the comfort of their homes.

If you’re considering taking your first steps into the world of trading, this guide will walk you through the basic steps to make your first trade using an online broker. By following these steps, you’ll gain a better understanding of how to navigate the Forex market and enter trades with confidence.

From selecting a reputable online broker to conducting research, placing trades, and managing your portfolio, we’ll cover the fundamental aspects that will help you get started.

Whether you’re interested in long-term investing or exploring shorter-term trading opportunities, this guide aims to equip you with the knowledge and tools necessary to embark on your trading journey. So let’s dive in and discover the basic steps that will enable you to execute your first trade and enter the exciting world of online trading.

Step 1. Find a regulated Forex broker

Look for reputable online brokers that offer the features and services you need. When researching and selecting an online broker, several factors should be taken into account. These factors include regulation, user interface, customer support, available markets, educational resources, and welcome bonuses to start trading without losing your own money. Some popular online brokers include XTB, Exness, eToro, AvaTrade, and XM Group.

XTB, recognized for its competitive fees and advanced trading tools, appeals to traders seeking a comprehensive and professional trading experience. It offers a wide range of instruments including currency pairs, indices, commodities, shares, ETFs, and Cryptocurrencies, and is regulated by such reputable authorities as the Financial Conduct Authority (FCA) in the UK, the Polish Financial Supervision Authority (KNF), and the Cyprus Securities and Exchange Commission (CySEC).

Exness, on the other hand, boasts a user-friendly interface and a strong focus on customer support, catering to traders who prioritize simplicity and assistance throughout their trading journey. The company operates under the regulation of the FCA, CySEC, FSCA, FSC, and FSA.

If you’re interested in Social trading and gaining insights from a vibrant community, eToro stands out with its innovative copy trading feature, allowing you to mimic the trades of successful traders. The company is licensed by reputable regulatory bodies such as FCA (UK), ASIC (Australia), and CySEC (Cyprus/Europe).

Moreover, AvaTrade offers a diverse range of educational resources, making it an attractive choice for traders looking to expand their knowledge and skills. The Abu Dhabi Securities and Commodities Authority, the British Virgin Islands Financial Services Commission and the Australian Securities and Investments Commission (ASIC) have all licensed AvaTrde as a secure trading company.

XM Group, in turn, offers attractive promotional offers to its new clients, including a $50 XM no-deposit bonus to enter the market without risking your own money. Operating in multiple countries, XM Group adheres to regulatory standards set by organizations such as CySEC, IFSC, DFSA, and ASIC.

Step 2. Open an account with a Forex broker

When exploring online brokers, it’s worth noting that you have the option to open multiple accounts with different brokers. This strategy can be beneficial as it allows you to take advantage of various promotional bonuses, compare different trading platforms, and build diverse investment portfolios.

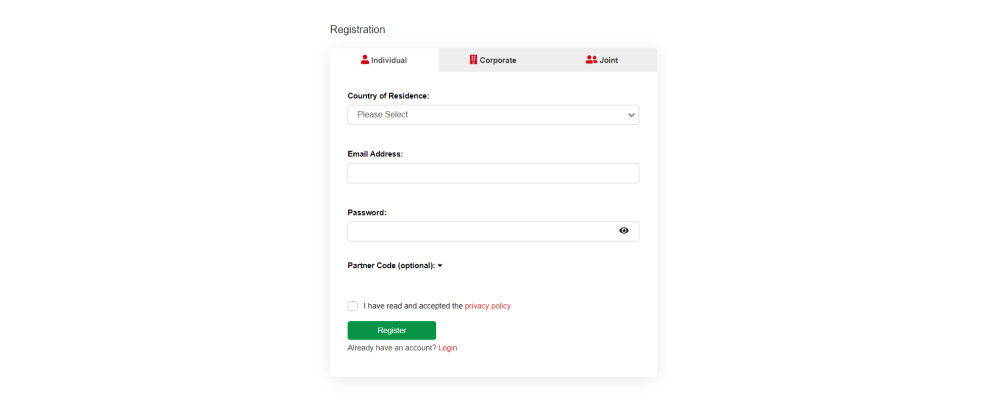

To begin, click our special buttons to visit the website of the selected online broker and initiate the account opening process. Typically, you will be required to provide personal information, including your name, address, Social Security number (or equivalent identification number), and details about your employment. Additionally, you may need to furnish identification documents as part of the verification process.

By opening multiple accounts with different brokers, you gain the opportunity to explore a wider range of features, benefits, and incentives offered by each platform. Furthermore, you can take advantage of any promotional bonuses, such as cash rewards or commission-free trades, that brokers may offer to attract new clients.

HF Markets is a reputable choice for trading a wide range of financial instruments, including numerous securities that have a simple sign-up process. The broker holds licenses from FCA (UK), FSCA (South Africa), DIFC (Dubai), and SFSA (Seychelles), further ensuring a secure trading environment.

Click the button to access the registration page and a special offer from TopForex.trade.

Step 3. Deposit trading funds

Once your account is open, you’ll need to deposit funds to start trading. Online brokers offer various funding options, including bank transfers, debit or credit card payments, and electronic payment services. You just need to simply follow the instructions provided by your broker to fund your account.

OANDA stands out by not charging fees for depositing or withdrawing funds. The broker also offers the flexibility of unlimited deposit and withdrawal amounts. The platform supports deposit methods via bank transfers, cheques, FAST, PayPal, and more.

Step 4. Explore the trading platform

Familiarize yourself with the trading platform provided by the online broker. Most brokers offer web-based platforms, mobile apps, or both. Take some time to explore the platform’s features, order types, market research tools, and any other available resources.

Check out the article about popular trading terminals and choose the best options such as Plus500, one of the largest CFD trading companies on various assets including stocks, ETFs, Cryptocurrencies, currency pairs, options, indices, and commodities, that provide its clients with a trading terminal, developed by the company’s specialists. The trading program is available in several versions, such as a web terminal for PCs and laptops and a mobile application for Android and iOS. The web version requires no download or installation, so you can easily access this platform from anywhere in the world.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Step 5. Choose instruments and conduct market research

In online trading, one crucial step is to choose instruments and conduct market research. This step involves selecting the financial instruments you wish to trade and gaining a thorough understanding of the market conditions and trends that may impact your trading decisions. Here’s a closer look at these two components:

1. Choosing instruments

Financial instruments refer to the various assets available for trading, such as stocks, bonds, commodities, currencies, and derivatives. The choice of instruments depends on your investment goals, risk tolerance, and trading strategy.

When selecting instruments, consider factors such as liquidity, volatility, and historical performance. Liquidity refers to how easily an instrument can be bought or sold without significantly affecting its price. Volatility measures the price fluctuations of an instrument over time, which can impact potential profits or losses. Examining historical performance helps you understand how an instrument has behaved in different market conditions.

Diversification is also a key consideration. By choosing instruments from different asset classes, industries, or regions, you can spread your risk and potentially mitigate losses.

Usually, brokers like NAGA offer a wide range of instruments to cater to the diverse needs and preferences of traders. These instruments may include stocks, indices, commodities, Cryptocurrencies, forex pairs, and more.

Additionally, one of the advantages of online trading platforms like NAGA is that they often offer accessible account options. It means that you can start trading with just a small amount of capital, sometimes as little as a couple of bucks. This feature is especially beneficial for beginner traders who want to dip their toes into the world of trading without committing significant funds upfront. It provides an opportunity for individuals with limited resources to participate in the financial markets and learn about trading dynamics.

2. Conducting market research

Market research is essential to make informed trading decisions. It involves analyzing various aspects of the market to understand trends, factors affecting prices, and potential trading opportunities. Here are some key aspects to consider during market research:

This involves evaluating the underlying factors that influence an instrument’s value, such as financial statements, economic indicators, industry trends, and news events. Fundamental analysis helps assess the intrinsic value of an instrument and its potential for growth or decline.

This approach involves studying price patterns, trends, and chart indicators to predict future price movements. Technical analysts use tools like moving averages, support and resistance levels, and oscillators to identify entry and exit points.

Stay updated with financial news, economic data releases, company earnings reports, and geopolitical developments that can impact the markets. Such information can provide insights into potential market movements.

- Sentiment analysis

Assessing market sentiment involves gauging the overall mood or attitude of traders and investors toward an instrument or the market as a whole. This can be done by analyzing social media trends, surveys, and sentiment indicators. Sentiment analysis can help identify potential market reversals or overbought/oversold conditions.

Remember, market research is an ongoing process. Continuously monitor your selected instruments and stay informed about market dynamics, as they can change rapidly. Online trading platforms often provide access to research tools, real-time data, and expert analysis, which can assist you in conducting comprehensive market research.

Step 6. Choose a trading strategy

Once you have gained a solid understanding of the fundamental principles of online trading, it is crucial to learn and choose a trading strategy that aligns with your goals and risk tolerance. A trading strategy provides a systematic approach to making investment decisions, helping you navigate the complexities of the financial markets with a clear plan in mind. Check out the article Forex trading strategies for beginners: top of profitable tactics and learn more about trend trading, day trading, scalping, and more.

Step 7. Practice on demo accounts and try out Social trading

Once you have acquired some basic knowledge about online trading and have a clear understanding of the strategies and tools involved, it is time to put your skills to the test. One effective way to gain practical experience without risking your real money is to practice on demo accounts offered by various online trading platforms. Additionally, you can explore the concept of Social trading to learn from and emulate successful traders.

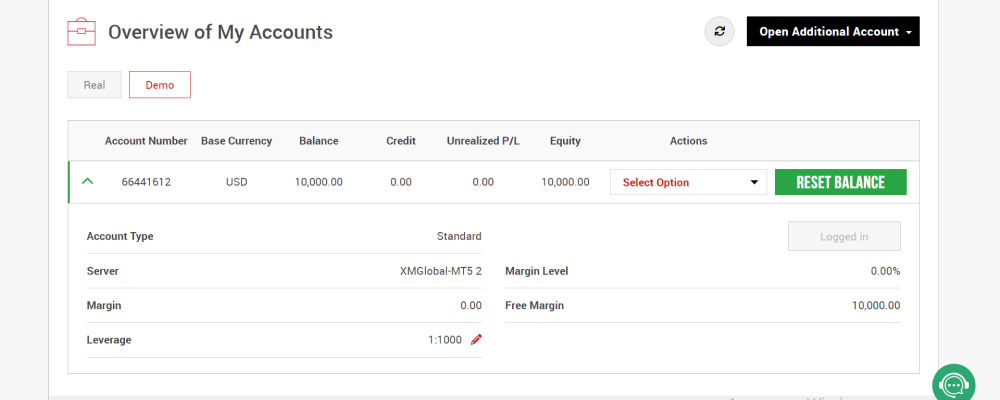

Demo accounts are simulated trading platforms that allow you to execute trades using virtual money. These accounts replicate the real trading environment, providing you with access to real-time market data and a range of financial instruments. XM Group offers an unlimited in-time demo account with a virtual balance of $100000. To get a demo account you need to click our button and go to the XM website and click the “open demo account” button, then fill out a form with the required information. After that, just like in a real account, you choose a trading platform, currency, leverage, and other important details.

With the XM demo account, you can trade using the full functionality of the real-time charts, graphs, and market situations to accurately predict results and make your strategies as close as possible to live trading but without losing real money.

Social trading is a relatively new concept that allows traders to interact, share ideas, and automatically copy the trades of successful traders. It combines the power of online trading with social networking. Social trading platforms provide access to a community of experienced traders. By following and observing their strategies, trade ideas, and market insights, you can learn valuable lessons and gain a deeper understanding of the markets. This shared knowledge can help you identify new opportunities and improve your trading skills.

Social trading platforms often offer a feature called copy trading, where you can automatically replicate the trades of successful traders in your own trading account. This allows you to leverage the expertise of seasoned professionals and potentially benefit from their profitable trades.

eToro stands out as the world’s most renowned Social trading network, boasting an impressive user base exceeding 17 million individuals. With a wide array of Social trading tools and features, eToro primarily operates as a CFD and Forex broker, offering users access to innovative social trading software. Pioneering the online social trading platform concept in 2006, eToro remains the first brokerage firm to introduce this revolutionary service.

Additionally, prominent Forex brokers like AvaTrade have developed mobile Social trading apps, enabling users to engage with fellow members of the AvaTrade trading community. These apps offer opportunities to connect with mentors, pose inquiries, and, of course, replicate the trades of top-performing traders, all without the constraints of being tied to a computer. The AvaSocial platform particularly appeals to beginners desiring connections with more experienced traders. Simultaneously, it serves as a lucrative avenue for skilled traders with a proven track record who seek to augment their earnings by sharing their trading activities.

Step 8. Place your first trade

Once you’ve chosen the instrument you want to trade and the strategy you want to follow, navigate to the order placement section of your broker’s platform. Select the appropriate order type, such as a market order (buy or sell at the current market price) or a limit order (set a specific price at which you want to buy or sell). Enter the amount you wish to trade and review the details before submitting the order.

After placing the trade, keep an eye on the market to track the stock’s performance. You can use the online broker’s platform to monitor your open positions, view real-time market data, set price alerts, and manage your portfolio. Consider implementing stop-loss orders or take-profit orders to automatically exit trades if the stock reaches a certain price.

Step 9. Close your trade

The outcome of your gains or losses is determined when you finalize your trade. There are two ways to accomplish this: you can patiently wait for the price to reach a pre-established Take Profit or Stop Loss order, or you can manually close the position if your market perspective shifts.

By adhering to this step, you ensure that the results of your trade are settled and accounted for.

Step 10. Review and learn from your trades

Once the trade is executed, take the time to review its outcome. Assess your decision-making process, evaluate the trade’s success or failure, and learn from the experience. This reflection can help you refine your trading strategies and improve your future trades.

Top Forex brokers to start Forex trading

Entering the world of Forex trading can be an exciting endeavor, offering immense potential for financial growth and independence. However, with a plethora of Forex brokers available in the market, choosing the right one can be a daunting task. A reliable and reputable Forex broker is essential to ensure a smooth trading experience, with access to robust trading platforms, competitive spreads, secure transactions, and comprehensive educational resources.

In this review, we present a curated list of the top Forex brokers, renowned for their exceptional services and commitment to client satisfaction. These brokers have established themselves as industry leaders, consistently delivering a high-quality trading environment that caters to both novice and experienced traders alike.

By partnering with one of these trusted Forex brokers, you can embark on your Forex trading journey with confidence, knowing that you have a solid foundation and the necessary tools to succeed. Whether you are a beginner seeking educational resources, a seasoned trader requiring advanced charting tools, or a demanding investor looking for low transaction costs, our list has you covered.

Related articles:

How to start Forex trading - FAQ