Forex trading with economic calendar: how does it work?

One of the most powerful tools for traders (especially day traders), is an economic calendar. It includes a timeline of data releases and breaking news related to different industries and economies.

When performing Fundamental analysis, a trader’s economic calendar is a necessary element as it helps traders to reduce the possibility of making hasty decisions that could cause significant losses. Trusted Forex brokers TopForex.trade experts review here are aware that the economic calendar is one of the key resources for successful trading. Due to this, the majority of them provide the resource integrated into their systems for free. Or, you can always refer to third-party websites like Bloomberg to access the latest economic data.

Most important economic indicators for FX trading

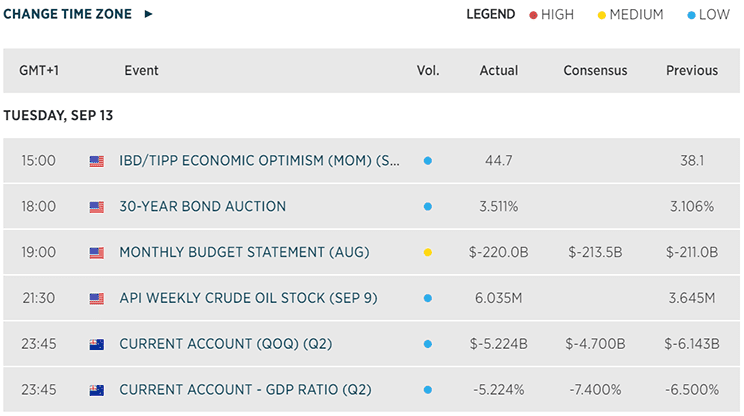

An economic calendar is a list of upcoming economic events for the upcoming day, week, month, or quarter. Using an economic calendar, you can find out the time of a release.

There are two different types of indicators when it comes to the time dimension they reflect: lagging indicators, which reflect the performance of the economy in the past, and changes to these indicators are only noticeable after an economic tendency or pattern has already formed, and leading indicators, which frequently change prior to significant economic adjustments and can be used to predict future trends.

There are a number of highly significant economic indicators that affect the market. For instance, the employment data for the nation with the largest economy in the world – Non-Farm Payrolls (NFP) – will invariably cause volatility. The Consumer Price Index (CPI) and Producer Price Index (PPI), which track inflation in the industrialized nations of the United States, Europe, Japan, and others, offer information on price fluctuations and may influence interest rates and currency exchange rates.

An economic report called the Gross Domestic Product (GDP) shows growth. Market volatility is mostly caused by changes in monetary policy made by central banks, such as the Federal Reserve, the European Central Bank, the Bank of England, and the Bank of Japan.

The Purchasing Manager’s Index (PMI), which tracks manufacturing activity, is also thought to be a sign of greater influence. Initial Jobless Claims, Unemployment Rate, Consumer Confidence Index, Home Sales, Durable Goods Orders, and more are among the indicators that are frequently observed. In the following chapter of our guide, we’ll go through each one in detail.

Indicators like housing starts, business inventories, factory orders, average hourly earnings, the federal budget balance, etc. give less important but nonetheless significant data.

Commodities and other financial instruments are related to trading economic events and the economic calendar. You should closely monitor the Energy Information Administration (EIA) weekly petroleum report, which is released on Wednesday, if you trade crude or Brent oil, for example. Additionally, if you trade any grains or soft commodities, the United States Department of Agriculture (USDA) grains report, which is released once a month, creates a lot of volatility (corn, wheat, soybeans, coffee, cotton, etc.).

You can bet there will be volatility if an economic release surprises the market. This occurs, although it is more of an exception to a rule. Globally renowned analysts report their predictions, which are averaged out with analyst highs and lows indicated. The markets will adjust to reflect the new information if the actual release is unexpected. Furthermore, market fluctuations brought on by fresh knowledge might cause high market turbulence. If you keep an eye on these whipsaws in the stocks or currency pairs you trade, you will notice that they frequently lead to a breakout in the trend’s direction.

How to use economic data for Forex trading

Traders typically compare the results for the current period to those for the previous period while also taking into account analyst projections for the particular data. By combining these three numbers, traders can decide whether new data meets or exceeds expectations, which will influence their next market move.

Political and economic statements can also cause a change in a currency pair’s direction, sometimes even in a matter of seconds. A trader can move more quickly than other market players by using the economic calendar to identify potential changes earlier.

The first thing a trader should consider when a certain report is about to be released is whether or not it will cause volatility and whether that volatility will be considerable. The way they position themselves and where their protection stops are put greatly influences how they’d react to financial news. This explains why decisions seem to be so dependent on leading indicators: when traders have advanced knowledge, they can earn since it allows them to forecast the potential course of a currency pair they are interested in.

In other words, you will be equipped to advance to the next level and comprehend in depth each of the most crucial economic data released each trading day after you have a better understanding of the fundamentals of Forex trading.

Best Forex trading strategies to combine with the economic calendar

A variety of trading tactics can be enhanced by using an economic calendar. According to the opinion of TopForex.trade experts, the strategies listed below are the best to match with an announcement schedule of major financial decisions:

Scalping trading strategy

Scalping is a trading strategy in which deals are opened and closed quickly. As a result, you can employ this strategy whenever significant data is released. As the volatility increases, the goal is to open and go through multiple trades.

Pre-data release FX trading

This approach is created to trade before the new data comes out. In some cases, you will find that some assets behave in certain ways before the data comes out. Knowing these patterns, you can take advantage of these movements.

Forex trading with pending orders

Moreover, you can trade the economic calendar using pending orders. The intention is to profit from the volatility that follows the release of the data. You may set a buy-stop at 1.1230 and a sell-stop at 1.1180. For instance, if the EUR/USD is trading at 1.1200, then, use a take-profit and stop-loss to safeguard these trades. Therefore, your pending order will be activated once the data is released.

Benefits of using the economic calendar for Forex trading

The advantages of an economic calendar are numerous. Generally speaking, it prevents people from being taken off guard when new information is revealed: if there were no calendar, when significant events like the NFP and Fed decision occur, many traders would be taken by surprise.

Secondly, it aids in trading strategy development. Having a calendar will assist you to choose which technique to adopt, or mix many to suit current market trends. For instance, you might utilize the scalping approach occasionally if some major economic data was released or use the swing trading strategy if there is nothing of sorts upcoming.

Third, it can aid in data analysis: you can use the economic calendar’s data to comprehend the pattern of market movements.

You will have the chance to profit from this situation since volatility will come after an economic release. Economic reports are typically released every month at a predetermined time like clockwork. The majority of important releases are issued once a month, and they often represent the state of the economy from the previous month. For instance, the United States’ May unemployment statistics will be made public at the start of June. Weekly economic updates include the Department of Energy’s inventory report and the number of claims for unemployment benefits. Once you choose a reputable broker with an advanced trading platform and tools, it will be easier for you to regularly monitor the economic calendar.

How to secure your Forex trading

The greatest solution would be to employ Top VPN services for Forex trading if you wanted to stay anonymous and feel absolutely secure when it comes to your market activity. You can trade CFDs, options, futures, or other financial derivatives, watch market movements, and stay anonymous from other users and the authorities by using a VPN to purchase and sell assets.

Additionally, robust encryption algorithms and data transfer protocols of VPN services will shield crucial information about the trading account from fraudsters in situations where a direct connection to the network via public Wi-Fi.

Click the button below to register with one of the best VPNs for Forex trading:

Furthermore, the VPN service will simply get beyond any geographical limits placed by different brokers’ websites, enabling you to attempt trading any financial products in total security.

Trading with top Forex brokers and the economic calendar

The majority of market players think that the price of a share or exchange rate reflects all the information that is currently available as capital markets are kind of efficient marketplaces. When new information like economic data or a change in the monetary policy becomes available, prices typically start to fluctuate. Small price changes brought on the market noise will increase volatility. Using a financial calendar, where the time and date of the majority of economic releases will be listed, you can keep track of changes in economic releases, predict their influence on the price level of your assets, and profit from suitable trading actions.

An economic calendar is a necessary instrument no matter what market you choose to trade in. If you are still looking for a suitable option, you can consider one popular option – The Forex market. When deciding which market to trade in, traders look for the best trading conditions and one with the greatest chances of profit. For a variety of reasons, including convenient trading hours, high liquidity, the ability to trade using leverage, and the presence of some of the most well-known and reputable brokers in the world to manage the trade, millions of traders around the world believe the Forex market meets these criteria.

These Forex brokers have been providing their consumers with services for decades while abiding by the strictest financial regulations in the globe. Even if on some of them location limitations are imposed, you may register an account with these reputable brokers without risk by using VPS services provided by some brokers for free or VPN services for Forex trading. Also, these brokers provide the best choice of currency pairs along with other financial instruments including Cryptocurrencies and some of the most favorable trading conditions, Forex bonuses of up to 100% on initial deposit (subject to geographical availability), Social trading, or negative balance protection.

Plus500 CFDs trading

Plus500 has been in business for over a decade, offering CFDs for currency pairings, commodities, stocks, Indices, and Crypto, as well as a trading guide and all the tools necessary to make trading more efficient and secure.

Plus500’s customers have access to a web terminal for PCs and laptops, as well as a mobile app for Android and iOS. There are two sorts of accounts available: real and demo. The second will provide an excellent opportunity for new brokers to practice, test their trading techniques, and get valuable experience in real market situations while remaining fully risk-free.

Plus500 is regulated by the UK Financial Conduct Authority, the Australian Securities and Investments Commission, the Cyprus Securities and Exchange Commission, and the Financial Markets Authority in New Zealand, making it one of the most well-known players in the Forex market. It is also a licensed financial services provider in South Africa, holding a license from the Financial Sector Conduct Authority.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

eToro Forex trading

eToro is one of the most well-known brokerage firms in the world when it comes to online trading. You can invest in over 2000 different assets and markets with the best possible terms: minimal Forex trading fees and low minimum deposits. Since 2017, the selection has grown to include new digital currencies such as Bitcoin, Ethereum, and others. Stocks, cryptocurrencies, commodities, currencies, and ETF indices are the six categories in which all instruments fall.

eToro has two account types: Retail Client and Professional Client. The first is shielded from negative balance and has a Copy Trading feature, while the second will stand out for its limitless leverage. In addition, newbies can always use a demo account to experiment and test new tactics.

eToro is a highly credible broker: it has millions of clients all over the world and is backed up by the fact that it has licenses to operate in many countries and is a member of the following regulators: FCA, ASIC, and CySEC.

NAGA Markets Forex trading

NAGA Markets is a fully licensed and regulated broker that offers more than 950 trading products and assets. Its clients can trade commodities, Cryptos, Forex, and conduct trades on futures, precious metals, ETFs, indices, and CFDs.

NAGA is licensed by several of the world’s most authoritative regulators and doctrines, including the FCA, CySEC, MiFID II, and MiFIR, allowing users to trade with little risk, even if they are novices in trading.

It is now possible to trade it on desktop and mobile versions of MT4, as well as on the broker’s own NAGA Trader platforms (Mobile app and web version). Overall, a great combination of platform features enables clients to trade, copy trades and communicate – this is a modern social trading platform offered by NAGA.

HF Markets Forex trading

HF Markets (former Hot Forex) is a broker with representative brunches around the world that offers the most diverse range of trading instruments, including currency pairs, commodities, cryptocurrency, stocks, indices, metals, energies, bonds, and CFDs, and most notably – Forex Gold trading with competitive low spreads and no hidden fees.

Clients of HF Markets can select a trading account that meets their needs, such as Micro, Premium, Zero Spread, Demo, or Islamic. There is also a significant feature accessible – the Copy Trading HFcopy which allows you to mirror transactions from multiple traders at the same time.

All transactions take place across multiple platforms. You can use MT4, MetaTrader 4 Web Terminal, or dedicated mobile trading apps for Apple and iOS devices.

In terms of regulation, the broker is governed by CySEC and the FCA (Europe), the FSCA (South Africa), the DIFC (Dubai), and the SFSA (South Africa).

AvaTrade Forex trading

AvaTrade is a broker noted for offering advantageous terms for all types of assets such as currency pairs, commodities, indices, stocks, CFDs, Cryptocurrencies, and many others. Trading platforms available include MT4, MT5, Proprietary, AvaSocial, AvaTradeGo, AvaOptions, and WebTrader. If you are a frequent trader who does not want to be tethered to a computer, Avatrade mobile trading is for you.

AvaTrade, in particular, offers a wide choice of automated trading platforms and tools that novice traders can utilize to boost the profitability of their transactions. One of them is Ava Replicate Trading – AvaSocial, which allows you to copy the performance of successful traders you select and profit in the same way they do.

A comprehensive regulatory framework can be added to AvaTrade’s benefits. It holds MiFID, ASIC, FSA and FFA, FSB, IIROC, and FSCA licenses. AvaTrade has various offices in most regions of the world, in addition to its cross-continent regulatory coverage.

XM Group Forex trading

XM Group is a regulated online broker offering over 1000 trading instruments, including more than 55 currency pairings, cross rates, metals, commodities, and equities, all of which may be traded on the MT4/MT5 platforms. The broker also provides a user-friendly mobile app through which you can trade on worldwide markets with a single login on a demo or live account.

Furthermore, XM offers clients a VPS service, allowing them to fully enjoy all of the benefits of trading without having to worry about other issues that can impede rapid and high-quality transactions, such as Internet connection speed, computer problems, and power outages.

One of the several benefits of XM Group is that there are no fees for deposits or withdrawals: the broker bears the entire expense of payment system commissions. Clients can select the most profitable trading account with negative balance protection, good leverage, and tight spreads from the following options: Micro, Standard, XM Ultra Low, and Shares.

XG Group accepts clients from more than 150 countries around the world thanks to being credited by such reputable regulators as CySEC, IFSC, DFSA, and ASIC.

Forex trading with economic calendar - FAQ