Forex trading in Egypt: market review and top online brokers

Egypt is a developing country located in North Africa and the Middle East. It has a population of over 100 million people and is the third-largest economy in Africa, after Nigeria and South Africa.

Egypt’s economy has undergone significant reforms in recent years, with the government implementing measures aimed at reducing the budget deficit, improving infrastructure, and attracting foreign investment. These efforts have helped to stabilize the economy and promote economic growth.

One of the key drivers of Egypt’s economy is the service sector, which accounts for around 47% of the country’s GDP. The sector includes industries such as tourism, transportation, and financial services. Tourism is particularly important, as Egypt is home to numerous historical and cultural sites that attract millions of visitors each year.

The agricultural sector is also an important contributor to the economy, employing around 25% of the workforce and accounting for about 11% of GDP. Egypt is a major producer of cotton, fruits, and vegetables, and is the world’s largest exporter of dates.

In recent years, Egypt has made significant investments in infrastructure, including the construction of new highways, bridges, and airports. The government has also introduced reforms aimed at improving the business climate and attracting foreign investment, such as streamlining the process of starting a business and reducing bureaucracy.

Despite these positive developments, Egypt faces several challenges. High levels of poverty and unemployment remain significant issues, particularly among young people. The country also faces ongoing security concerns, including terrorism and political instability. In addition, Egypt’s economy is vulnerable to external shocks, such as fluctuations in global commodity prices and changes in international trade policies.

Forex market and online trading in Egypt

The foreign exchange (Forex) market in Egypt has undergone significant development in recent years, driven by a combination of regulatory reforms and technological advancements. Online trading has also become increasingly popular, providing greater access to the FX market for individual traders.

In 2016, the Central Bank of Egypt (CBE) introduced a series of measures aimed at liberalizing the Forex market and reducing the country’s reliance on foreign currency reserves. These measures included the introduction of a new auction system for allocating foreign exchange, which helped to reduce the black market exchange rate and improve transparency in the market.

In addition to these regulatory reforms, advances in technology have made it easier for individual investors to participate in the Forex market through online trading platforms. These platforms provide access to real-time market data, analysis tools, and trading software, allowing investors to trade currencies from anywhere with an internet connection.

Several global reputable Forex brokers operate in Egypt, offering a range of services to individual traders and investors. These brokers are regulated by the Egyptian Financial Supervisory Authority (EFSA), which was established in 2009 to oversee and regulate the non-banking financial sector, including Forex trading.

Moreover, the Forex market in Egypt has a couple of particularities that traders should be aware of:

- Limited currency pairs: The Forex market in Egypt has a limited number of currency pairs available for trading. The most commonly traded pairs are the USD/EGP, EUR/EGP, and GBP/EGP.

- Exchange rate volatility: The value of the Egyptian pound (EGP) is subject to fluctuations due to various economic and political factors, such as inflation, interest rates, and political instability. This can make trading Forex in Egypt more volatile than in other countries.

How to choose a reliable FX broker for online trading in Egypt?

Choosing a reliable FX broker is an important step for online traders in Egypt, as it can greatly affect their trading experience and outcomes. Here are some factors to consider when choosing a reliable FX broker for online trading in Egypt:

- Financial regulations: Look for a broker that is regulated by a reputable regulatory body, such as the Egyptian Financial Supervisory Authority (EFSA) or a foreign regulatory body like the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). Regulated brokers are required to follow strict rules and guidelines, providing traders with greater protection against fraud and other forms of malpractice.

- Reputation: Research the broker’s reputation by reading reviews from other traders and checking its regulatory history. Look for a broker with a solid reputation for providing quality services, fair trading conditions, and reliable customer support.

- Trading Platforms: Choose a broker that offers a user-friendly trading platform with advanced trading tools and features. Look for a platform that is easy to navigate, has fast execution speeds, and provides real-time market data.

- Account Types: Look for a broker that offers a variety of account types to suit your trading needs, such as standard accounts, mini accounts, and Islamic accounts. Make sure the broker offers a demo account for practicing trading strategies and getting familiar with the platform.

- Customer Support: Choose a broker that provides reliable customer support, such as 24/7 support through email, phone, or live chat. Test the broker’s customer support before opening an account to ensure that they are responsive and helpful.

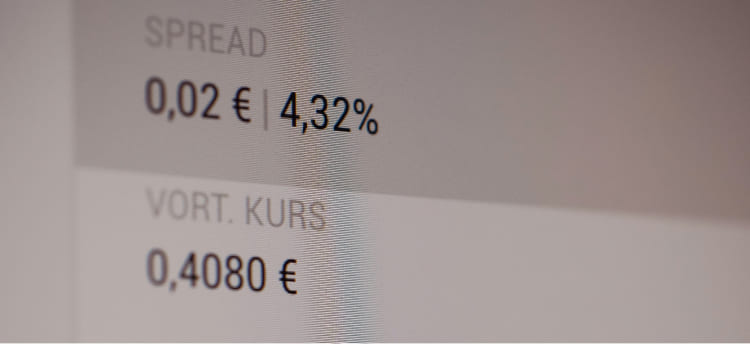

- Trading Costs: Consider the trading costs, such as spreads and commissions, when choosing a broker. Look for a broker that offers competitive spreads and low commission fees.

- Payment Methods: Choose a broker that offers a variety of payment methods for deposits and withdrawals, such as credit cards, bank transfers, and e-wallets. Make sure the payment methods are convenient and secure.

Overall, it is important to do your due diligence when choosing a reliable FX broker for online trading in Egypt. By considering these factors, you can find a broker that provides a safe and reliable trading environment, allowing you to focus on your trading strategies and goals.

Popular FX trading instruments in Egypt

Online traders in Egypt have access to a variety of financial instruments through online trading platforms. Some of the most popular trading instruments among online traders in Egypt include:

- Forex pairs

Currency trading is one of the most popular trading instruments among online traders in Egypt. This is because Forex trading offers high liquidity and the ability to trade 24 hours a day, five days a week. Traders can trade major currency pairs such as EUR/USD, USD/JPY, GBP/USD, and USD/CHF, as well as exotic currency pairs.

- Stocks

Online traders in Egypt can also trade stocks from international markets such as the US, Europe, and Asia. Popular stocks among traders include tech stocks like Apple, Amazon, and Microsoft, as well as financial stocks like JPMorgan Chase and Goldman Sachs.

- Commodities

Trading commodities such as gold, silver, crude oil, and natural gas is also popular among online traders in Egypt. These commodities are traded based on their market prices and can offer a hedge against inflation and economic instability.

- Cryptocurrencies

Cryptocurrency trading has also gained popularity among online traders in Egypt. Popular coins include Bitcoin, Ethereum, Litecoin, and Ripple. Trading Cryptocurrencies offers high volatility and the potential for high returns, but also carries high risks.

- Indices

Online traders in Egypt can also trade indices such as the Dow Jones, S&P 500, and NASDAQ. These indices represent a basket of stocks and offer exposure to the broader market movement.

It is important for online traders in Egypt to have a clear understanding of the risks and benefits associated with each trading instrument before making any investment decisions. It is also important to choose a reputable online broker and to develop a sound trading strategy.

Exness is one of the world’s leading financial brokers with clients from over 100 countries that provide trading in many popular instruments such as currency pairs, stocks, indices, metals, energies, and popular Cryptocurrencies. The broker is licensed by such regulatory bodies as FCA, CySEC, FSCA, FSC, FSA, and others.

The MetaTrader 1, MetaTrader 4, MetaTrader 5, and MetaTrader WebTerminal trading platforms are all available to the traders. In addition, Exness has made it possible to keep tabs on the markets without being tethered to a desktop computer by creating an iOS and Android app. Exness also offers a Virtual Private Server (VPS) solution for traders who want a faster and more secure connection.

Clients can sign up for a variety of accounts on the broker’s website, including a demo where they can test the waters without risking any of their own money.

Participants in the market are able to deposit and withdraw funds using a wide variety of local currencies, e – wallets, and Crypto wallets.

Popular currency pairs for FX trading in Egypt

Some of the most popular currency pairs for online trading in Egypt include:

- EUR/USD: The EUR/USD is the most traded currency pair in the world, and is popular among online traders in Egypt due to its high liquidity and relatively low volatility. It represents the exchange rate between the euro and the US dollar.

- USD/JPY: The USD/JPY is another popular currency pair among online traders in Egypt, representing the exchange rate between the US dollar and the Japanese yen. It is known for its high liquidity and volatility, and is popular among traders who seek to take advantage of price fluctuations in the Japanese economy.

- GBP/USD: The GBP/USD is another highly traded currency pair among online traders in Egypt, representing the exchange rate between the British pound and the US dollar. It is known for its high volatility, and is popular among traders who seek to take advantage of political and economic developments in the UK and the US.

- USD/CHF: The USD/CHF is a less popular currency pair among online traders in Egypt, but it still sees significant trading volume. It represents the exchange rate between the US dollar and the Swiss franc, and is known for its low volatility and safe-haven status.

- EUR/GBP: The EUR/GBP is a popular currency pair among online traders in Egypt, representing the exchange rate between the euro and the British pound. It is known for its high volatility, and is popular among traders who seek to take advantage of political and economic developments in the EU and the UK.

- USD/CAD: The USD/CAD is another popular currency pair among online traders in Egypt, representing the exchange rate between the US dollar and the Canadian dollar. It is known for its high liquidity and volatility, and is popular among traders who seek to take advantage of price fluctuations in the Canadian economy.

XM Group is an international broker that provides access to a variety of financial instruments including more than 50 currency pairs. The broker serves its clients in almost 200 countries, being licensed by such reputable regulators as ASIC, CySEC, IFSC, and DFSA, which indicates its reliability.

In addition to a demo account where traders can practice their skills and knowledge, the broker offers four types of accounts with negative balance protection, good leverage, and tight spreads: Micro, Standard, XM Ultra Low, and Shares.

When it comes to bonuses, XM Group offers different ones: a 100% entry bonus up to $5000 on your initial deposit, a client referral bonus of $35 per friend and other occasional bonuses.

Popular CFD instruments for trading in Egypt

CFD (Contracts for Difference) trading is a popular form of online trading in Egypt, allowing traders to speculate on the price movements of various financial instruments without actually owning the underlying assets. CFDs offer several advantages to traders, such as:

- Flexibility

CFDs are traded on margin, which means that traders can take positions in the market with a smaller capital investment than would be required to purchase the underlying assets.

- Diversification

CFDs offer exposure to a wide range of financial instruments, including stocks, indices, commodities, Forex, and Cryptocurrencies, allowing traders to diversify their portfolios and mitigate risk.

- Leveraged trading

CFDs allow traders to trade on margin, which means that they can amplify their potential profits (and losses) by using leverage. However, it is important to note that leverage can also increase the risks associated with trading.

- Short selling

CFDs allow traders to take short positions in the market, meaning that they can profit from price decreases in the underlying assets.

The most popular CFD instruments among traders in Egypt can vary, depending on market conditions and individual trading preferences. However, Here are some popular CFD instruments for online trading in Egypt:

- Stock CFDs: Traders can speculate on the price movements of individual stocks without owning the underlying assets by trading stock CFDs. This allows traders to take advantage of short-term price fluctuations in the stock market, without the need for a large capital investment.

- Index CFDs: Index CFDs allow traders to speculate on the performance of an entire stock market or sector, rather than individual stocks. Popular index CFDs include the S&P 500, FTSE 100, and DAX.

- Commodity CFDs: Commodity CFDs allow traders to speculate on the price movements of commodities such as gold, silver, oil, and natural gas. These CFDs can provide traders with exposure to commodity markets, without the need for physical ownership of the assets.

- Forex CFDs: Forex CFDs allow traders to speculate on the price movements of currency pairs, such as EUR/USD or USD/JPY, without actually owning the currencies. This allows traders to profit from fluctuations in the foreign exchange market.

- Cryptocurrency CFDs: Cryptocurrency CFDs allow traders to speculate on the price movements of popular coins like Bitcoin, Ethereum, and Litecoin. These CFDs can provide traders with exposure to Crypto markets, without the need for a digital wallet or exchange account.

Cryptocurrency trading and its regulations in Egypt

Cryptocurrency trading is still relatively new in Egypt, and as such, the regulatory framework for its operations is still developing. In 2018, the Egyptian government issued a statement warning citizens about the risks associated with Cryptocurrencies and cautioning them against investing in them. However, the statement did not ban these digital assets outright, and individuals are still able to trade Cryptocurrencies online.

The Central Bank of Egypt (CBE) has taken steps to regulate Cryptocurrency trading in the country. In January 2021, the CBE issued a draft law that would require all Cryptocurrency transactions to be conducted through licensed banks and registered companies. The law also includes measures to prevent money laundering and terrorist financing.

In addition to the CBE’s proposed regulations, the Financial Regulatory Authority (FRA) has also stated its intention to regulate the Cryptocurrency market in Egypt. The FRA is expected to issue a new law that would require exchanges and other service providers to obtain licenses and adhere to certain regulatory requirements.

Despite the lack of clear regulations in Egypt, Cryptocurrency trading is still popular among Egyptian traders. Many traders use online Crypto exchanges and trading platforms to buy and sell coins like Bitcoin and Ethereum. However, it is important for traders to exercise caution and to carefully research the risks and potential benefits of Crypto trading before investing their capital. Additionally, traders should use reputable and secure online platforms for their Cryptocurrency transactions and keep their accounts and personal information secure to avoid potential fraud or hacking attempts.

OANDA is a multi-regulated online broker offering clients worldwide a wide range of trading instruments including fiat currency pairs and popular Cryptocurrencies on a friendly and easy-to-use trading platform. Low spreads, low fees, and rapid deal execution make OANDA attractive to traders. The broker offers a variety of convenient funding options and requires just a $1 deposit to open a real account.

OANDA’s trading platforms support mobile trading through iOS and Android apps, making trading even more convenient.

How to earn online passive income in Egypt

Passive income through online trading in Egypt is possible, but it requires a well-thought-out strategy and careful risk management. Here are some ways to potentially earn passive income through online trading:

- Dividend stocks

Traders can invest in stocks that pay dividends, which are regular payments made to shareholders from the company’s profits. By holding onto these stocks over the long term, traders can earn a steady stream of passive income.

- Copy trading

Some online trading platforms offer Copy trading (also known as Social trading), where you can automatically Copy the trades of successful traders. By following and copying the strategies of experienced traders, you can potentially earn passive income without having to actively trade yourself.

- Automated trading

Some online trading platforms offer automated trading systems that can trade on behalf of the trader, even when they are not actively monitoring the markets. These systems use algorithms to identify trading opportunities and execute trades automatically.

- Investing in ETFs

Exchange-traded funds (ETFs) are a type of investment fund that can be bought and sold on stock exchanges. They typically hold a basket of stocks or other assets, and their value fluctuates with the underlying assets. By investing in ETFs that track markets or sectors that are expected to perform well over the long term, traders can earn passive income through capital gains.

- Forex carry trades

Carry trades involve borrowing money in a currency with a low interest rate and investing it in a currency with a higher interest rate. If done correctly, traders can earn passive income through the interest rate differential between the two currencies.

It’s important to note that these methods of earning passive income through online trading require careful research, planning, and risk management. Always ensure that you thoroughly understand the risks involved and seek professional advice if necessary.

Forex trading with islamic accounts in Egypt

Forex trading with Islamic accounts in Egypt follows the principles of Islamic finance, which prohibit the charging or paying of interest (riba) and require all transactions to be backed by underlying assets. Islamic Forex accounts in Egypt, also known as Sharia-compliant Forex accounts, offer traders the opportunity to participate in the Forex market while adhering to these principles.

In Egypt, Forex brokers that offer Islamic accounts to traders typically charge a commission rather than interest on trades, and they also ensure that all trades are backed by underlying assets.

To open an Islamic Forex account in Egypt, traders need to provide the necessary documentation and meet the broker’s eligibility criteria. They will also need to agree to adhere to the Islamic finance principles and abide by the terms and conditions of the Islamic account.

Traders in Egypt need to do their research and choose a reputable Islamic Forex broker that is regulated by a relevant authority such as the Egyptian Financial Supervisory Authority (EFSA) to ensure the safety of their funds.

Overall, Forex trading with Islamic accounts in Egypt is a viable option for Muslim traders who want to participate in the Forex market while following the principles of Islamic finance.

HF Markets, a reputable Forex broker with a global clientele that spans Africa, Asia, Latin America, and the Middle East, exempts Muslims from swaps on four of its six account types (the Micro, Premium, Currenex, VIP, and Fix accounts). The other features of the account type you’ve selected also apply to Islamic accounts, with the exception that open positions in Islamic accounts go without swap for 7 days.

It is possible to convert any of the four HF Markets MT4 account types into a swap-free account compliant with Islamic principles.

Costs for trading CFDs and FX are included in the tight spread offered by HF Markets. HF Markets provides a number of services, including Zero Spread trading, and cumulative rebate Forex bonuses up to $8000, all while maintaining the highest standards of safety as befits a broker that is fully registered in several jurisdictions.

In addition, HF Markets offers some of the greatest market conditions for Forex Gold trading, including adjustable leverage, minimal spreads, and no hidden costs. Read this article in its entirety to learn about the many advantages of trading gold with HF Markets.

Safe Forex trading with VPN in Egypt

Using a VPN (Virtual Private Network) can help ensure safer Forex trading in Egypt by providing a secure and private connection to the internet. Here are some of the ways that using a VPN can help protect your online trading activities:

- Enhanced security: A VPN encrypts your internet traffic, making it more difficult for hackers and other malicious actors to intercept and access your data. This can help prevent unauthorized access to your trading account and keep your personal and financial information safe.

- Anonymous browsing: A VPN can also help protect your privacy by hiding your IP address and online activities from your internet service provider (ISP) and other third parties. This can help prevent unwanted tracking and surveillance, as well as protect you from potential censorship or government surveillance.

- Access to restricted content: In some cases, Forex trading platforms or brokers may be restricted in certain countries or regions. Using a VPN can help bypass these restrictions and provide access to the platform or broker from any location.

When choosing a VPN for Forex trading in Egypt, it’s important to choose a reputable provider that offers strong encryption, a large server network, and fast connection speeds. It’s also important to ensure that the VPN provider has a strict no-logs policy and is not subject to data retention laws in any jurisdiction. By taking these steps, traders can help ensure a safer and more secure online trading experience.

NordVPN is one of the VPN providers that reliably protect Forex trading using the most powerful encryption algorithms, Double VPN, VPN + TOR, and other technologies for complete confidentiality.

Click the button below to get the best VPNs deal for Forex trading:

Top of reliable Forex and CFDs brokers in Egypt

Overall, Forex trading offers Egyptians an accessible, liquid, and potentially profitable investment and trading option, which may explain its popularity in the country.

Yet, to secure yourself, it is essential to conduct thorough research and choose a reputable Forex broker that offers competitive spreads, fast execution, and reliable customer support. Additionally, traders should have a sound understanding of Forex trading, including Technical and Fundamental analysis, risk management, and trading psychology, to increase their chances of success in the highly volatile Forex market.

Egyptian traders can trade with multinational online brokers, the best of which have excellent reputations based on licenses from the strictest global regulators, advantageous trading conditions, social trading, and free VPS hosting. By fulfilling all the above conditions, here is a list of top brokers in Egypt:

Exness in Egypt

Exness is a well-established FX and CFD broker that has been operating since 2008. The broker is regulated by multiple regulatory bodies, including the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). Exness offers a range of trading instruments, including currency pairs, metals, energies, indices, and Cryptocurrencies.

Exness provides access to multiple trading platforms, including MetaTrader 4 and 5. The broker also offers a range of educational resources and trading tools to help traders improve their trading skills and strategies.

Exness provides customer support in multiple languages, including Arabic, and offers various deposit and withdrawal options, including credit/debit cards, bank wire transfer, and electronic payment methods like Neteller and Skrill. The broker also offers fast and reliable trade execution and tight spreads.

XM broker in Egypt

XM is a well-known Forex and CFD broker that has been in operation since 2009. The company is licensed and regulated by several financial authorities, including CySEC, ASIC, and the IFSC, which ensures that it operates in a transparent and secure manner.

One of the key features of XM is its broad range of trading instruments, which include over 1000 financial instruments such as Forex, multiple CFDs, stocks, and commodities. The broker also offers a variety of account types to suit the needs of different traders, from beginner to advanced, including demo accounts for those who want to practice trading.

XM offers competitive spreads and provides access to various trading platforms, including MetaTrader 4 and 5. The broker also offers educational resources and trading tools to help traders improve their trading skills and strategies. Moreover, there are multiple FX bonus offerings which you can use to fund your market practice.

The broker provides customer support in multiple languages, including Arabic, and offers various deposit and withdrawal options, including credit/debit cards, bank wire transfer, and electronic payment methods such as Neteller and Skrill.

Overall, XM is a reputable and reliable broker with a wide range of trading instruments, multiple account types, and platforms, and excellent customer support.

HF Markets in Egypt

HF Markets, also known as HotForex, is a well-established Forex and CFD broker that is regulated by multiple regulatory bodies, including the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA) in the UK.

The broker offers a range of trading instruments, including Forex, metals, energies, indices, and Cryptocurrencies, and provides access to multiple trading platforms, including MetaTrader 4 and 5. The broker also offers various account types, including Islamic accounts, and provides customer support in multiple languages, including Arabic.

Overall, HF Markets is a reputable and reliable broker with a wide range of trading instruments, competitive spreads, multiple account types, and platforms, and excellent customer support.

OANDA in Egypt

OANDA is a well-established FX and CFD broker that has been operating since 1996. The broker is regulated by multiple regulatory bodies, including the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the US National Futures Association (NFA). OANDA offers a range of trading instruments, including currencies, metals, energies, indices, and commodities.

OANDA provides access to multiple trading platforms, including its proprietary platform, OANDA Trade, as well as MetaTrader 4 and 5. The broker also offers a range of educational resources and trading tools to help traders improve their trading skills and strategies.

OANDA provides customer support in multiple languages, including Arabic, and offers various deposit and withdrawal options, including credit/debit cards, bank wire transfer, and electronic payment methods such as PayPal and Skrill.

Forex market and online trading in Egypt - FAQ